cagkansayin

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 2nd 2022.

I last covered the SPDR Blackstone / GSO Senior Loan ETF (SRLN), the largest, highest-yielding senior loan ETF in the market, one year ago. In that article, I argued that SRLN’s high expense ratio and credit risk outweighed its low interest rate risk. The fund seemed destined to underperform, barring aggressive interest rate hikes from the Federal Reserve. Since then, the Federal Reserve has aggressively hiked rates, leading to reasonably good returns and dividend growth for SRLN. Not the scenario I envisioned, at least not at this level of intensity, but the fund did perform as one would expect under current conditions.

Although SRLN has performed relatively well these past few months, it still suffers from a high expense ratio and credit risk. Barring further significant, unprecedented interest rate hikes the fund should underperform from here on out. As such, I would not be investing in the fund at the present time.

Senior Secured Loan Basics

SRLN is an actively-managed fund investing in senior secured loans. These securities have specific characteristics which are key to understanding the fund and its expected performance during specific economic scenarios.

Senior secured loans are senior to most/all other company loans and liabilities, meaning they are the first to be repaid in the event of bankruptcy.

Senior secured loans are secured with company assets, meaning investors are pledged to receive real assets in the event of a bankruptcy.

Due to the above, senior secured loans tend to have comparatively strong recovery rates, reducing risk and losses during downturns.

Senior secured loans are effectively always variable rate loans, and so see higher coupon/interest rate payments when the Federal Reserve hikes rates.

Senior secured loans are generally non-investment grade loans, issued by smaller, less mature, riskier companies.

The characteristics above are common to all variable rate loans, including funds focusing on these securities like SRLN. With this in mind, let’s have a look at SRLN itself.

SRLN – Overview and Benefits

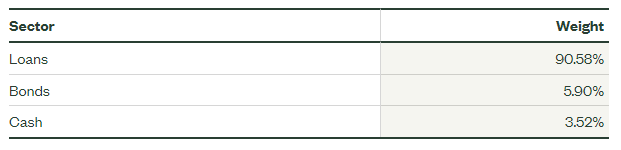

SRLN is an actively-managed fund, focusing on senior loans, with smaller investments in fixed-rate bonds and cash.

SRLN

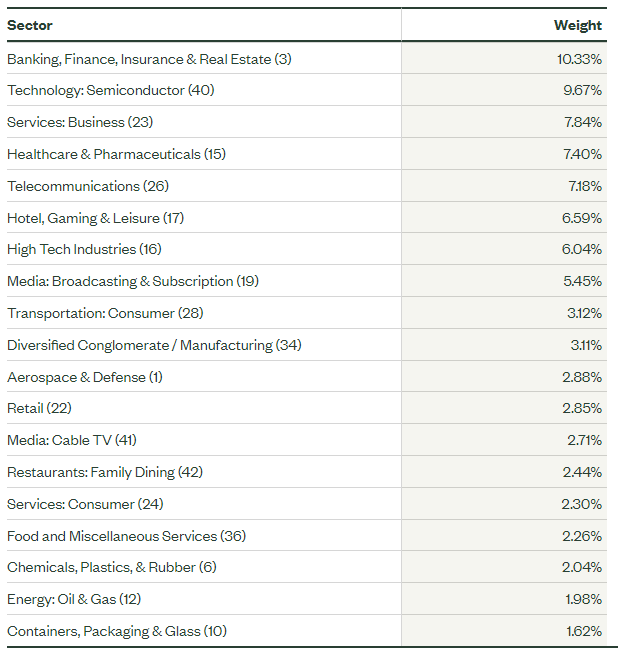

SRLN’s portfolio is quite diversified, with investments in over 500 securities from all relevant industry segments.

SRLN

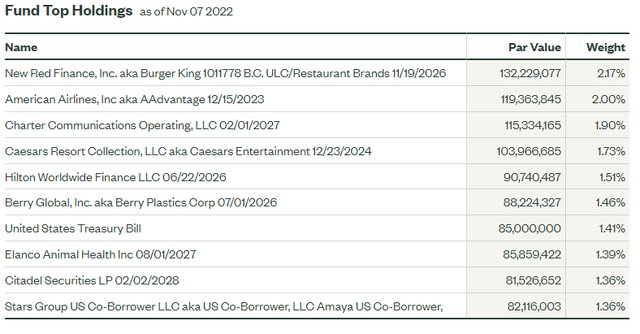

Concentration is somewhat above average, with the fund’s top ten holdings accounting for over 16% of its value, but not excessively so.

SRLN’s diversified holdings reduce risk, volatility, and the potential for significant losses or underperformance from any one individual issuer bankruptcy or default.

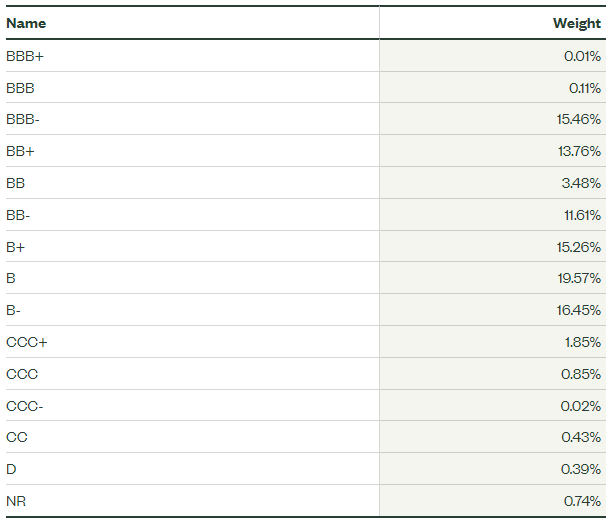

SRLN focuses on senior secured loans which, as previously mentioned, are generally non-investment grade securities, with these accounting for 85% of the value of the fund. Investment grade securities account for the remaining 15%, and include some of the fund’s bonds, cash investments, and, presumably, a small percentage of its loans.

SRLN

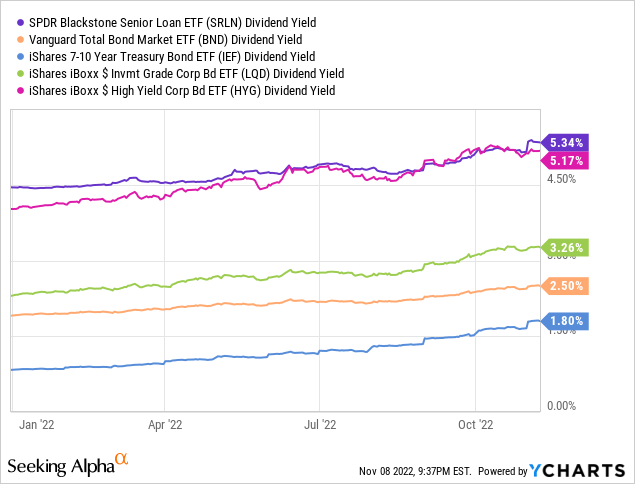

Non-investment grade securities are riskier than average, but sport relatively higher yields as compensation. SRLN itself yields 5.3%, quite a bit higher than average for a bond fund, but comparable to high-yield corporate bond funds.

SRLN’s above-average yield increases expected shareholder returns, a benefit for the same.

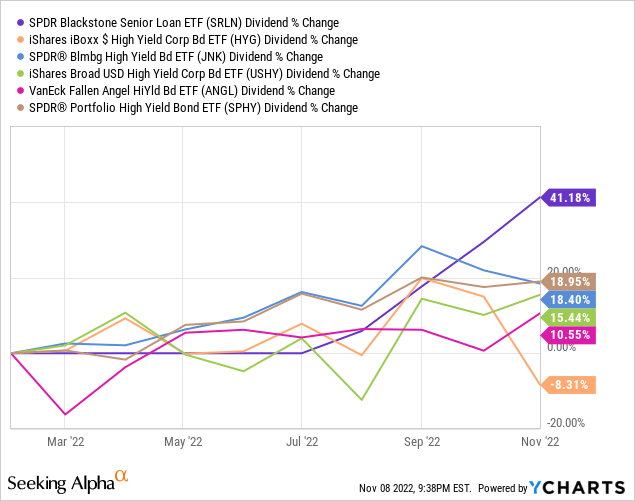

SRLN focuses on senior loans which, as previously mentioned, are generally variable rate loans. These loans see higher interest rate payments as the Federal Reserve hikes rates, leading to higher income for the fund, and higher dividends for shareholders. SRLN’s dividends have grown by over 40% YTD, or 2.0% percentage points. Growth has been significantly higher than average for a high-yield corporate bond ETF, but ETFs have somewhat volatile dividends, so differences in growth could simply be due to volatility, and might not persist into the future.

SRLN’s dividends should almost certainly see further growth, as the Federal Reserve has hiked rates by around 4.0% YTD, and further hikes are likely. Expect another +2.0% percentage point increases in dividends from here on out, although much will depend on future Federal Reserve interest rate policy.

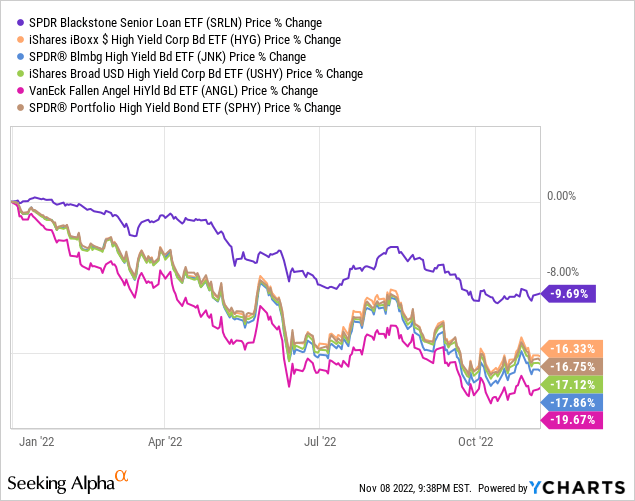

SRLN’s variable rate loans see higher dividends as interest rates rise, which also helps to protect their market value when rates rise. In most cases, investors sell older, lower-yielding bonds and loans when rates rise, to buy newer, higher-yielding alternatives. There is no need to do this for variable rate loans, as these securities pay higher interest rate payments when rates rise. As such, SRLN should see comparatively low capital losses when interest rates increase, as has been the case YTD.

SRLN’s above-average, growing 5.3% yield and low interest rate risk are important benefits for the fund and its shareholders, and make for a reasonably compelling investment thesis. The fund’s many risks and drawbacks seem to outweigh these benefits, in my opinion at least. Let’s have a look.

SRLN – Risks and Drawbacks

High Credit Risk

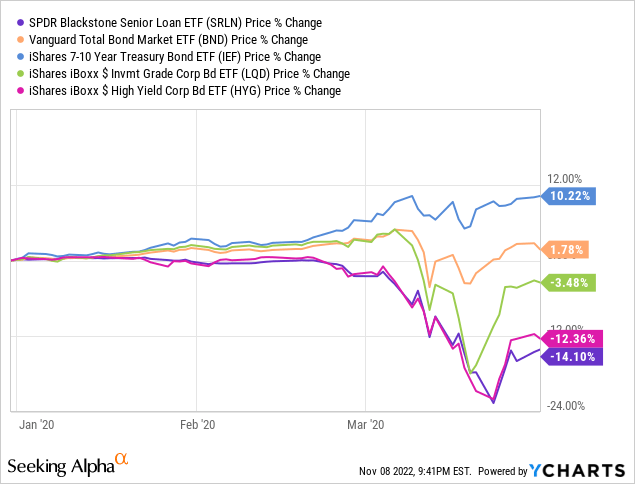

SRLN focuses on non-investment grade securities, issued by relatively weak counterparties, which might run into payment difficulties during downturns and recessions. Default rates should spike during these scenarios, leading to lower security prices, and hence capital losses for the fund and its investors. This was the case during 1Q2020, as expected.

As can be seen above, SRLN suffered relatively large, double-digit losses during the most recent recession. Losses were much greater than average for a bond fund, but comparable to those of high-yield corporate bond funds.

SRLN’s high credit risk has led to relatively large losses during prior downturns, and would almost certainly lead to similar losses during future downturns. Economic conditions are currently somewhat poor, and could worsen as the Federal Reserve continues to hike rates. More risk-averse investors concerned about these issues might find SRLN’s high credit risk to be a deal-breaker.

Moderately Ineffective Rate Hedge

SRLN’s variable rate loans technically have very little / zero interest rate risk, but the fund’s focus on non-investment grade securities somewhat blunts the impact of this.

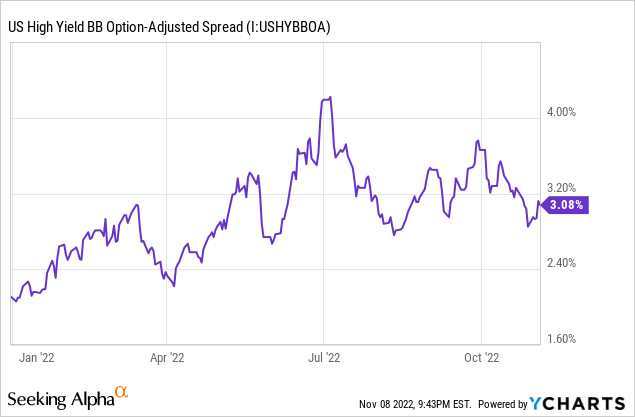

Non-investment grade security yields are dependent on Federal Reserve intervention rates, which act as a base rate, and credit spreads, which are dependent on economic and market conditions. Non-investment grade securities should see higher yields when Federal Reserve interest rates increase, as has been the case YTD, but also when economic conditions worsen, as investors grow weary of investing in relatively risky securities when times are tough. Spreads technically matter for more or less all fixed-income securities, but are particularly important for riskier ones, as these tend to have wider, more volatile spreads.

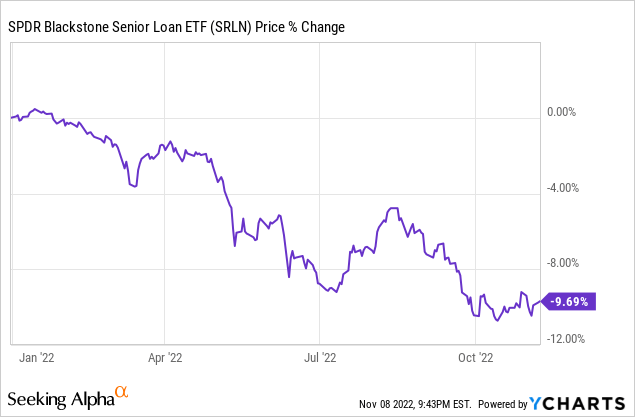

Due to the above, SRLN only moderately protects investors from Federal Reserve hikes. Spreads matter too, and the fund could see losses when rates rise if spreads increase too. This has been the case YTD, during which credit spreads have widened as economic conditions worsen.

Leading to some capital losses for SRLN.

Importantly, these losses were quite a bit lower than average for a bond fund, so the fund did offer some protection against rising rates, but only some.

In general terms, SRLN’s high credit risk significantly undercuts its investment thesis. Instead of seeing losses when rates rise, SRLN sees losses when spreads rise, a different, but equally as important, risk or negative.

High Expense Ratio

SRLN is a relatively expensive fund, with a 0.70% expense ratio. This is moderately higher than average for an actively-managed ETF, significantly higher than average for a bond fund. High expenses directly reduce shareholder returns, and, all else equal, should lead to long-term underperformance.

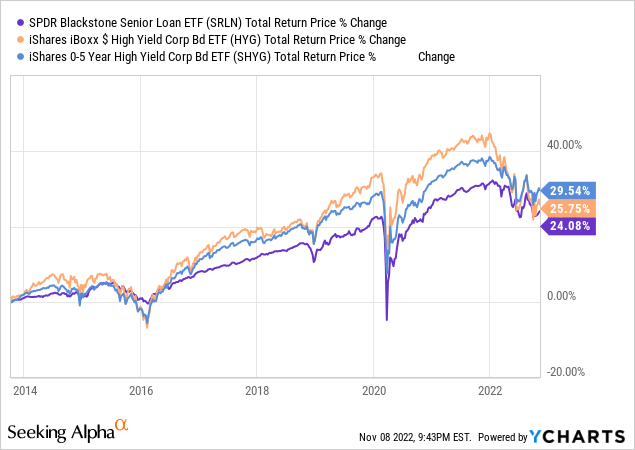

SRLN has underperformed relative to the high-yield corporate bond benchmark since inception, as expected. Underperformance was even greater relative to short-term high-yield corporate bonds, as these securities also have relatively low interest rate risk, and so have performed relatively well these past few months.

In my opinion, investors should always try to minimize fees and expenses, as doing so is one of the only sure-fire, risk-free ways to increase returns. The strongest funds might more than earn their expenses in higher yields, performance, or with other benefits, but SRLN’s benefits do not seem to be significant enough to warrant a 0.70% in fees. Remember, the fund’s most important benefit is its reduced interest rate risk, and the fund has still seen relatively large capital losses YTD.

Conclusion

SRLN offers investors an above-average, growing 5.3% dividend yield, and has relatively low interest rate risk. On the other hand, the fund is relatively expensive, and has high credit risk. In my opinion, the fund’s risks and negatives outweigh its benefits, so I would not be investing in the fund at the present time.

Be the first to comment