fotogaby/E+ via Getty Images

Back in August, I detailed how the situation at artificial intelligence lending marketplace Upstart Holdings (NASDAQ:UPST) was getting much worse. The company had already warned that revenues for its just ended quarter were going to fall short of previous guidance, and the future wasn’t looking any brighter. On Tuesday, the company reported its Q3 results, and this report was just as bad as we saw roughly three months ago.

For the third quarter of 2022, total revenue was $157 million, a decrease of 31% from the third quarter of 2021. Total fee revenue was $179 million, a decrease of 15% year-over-year. Analysts were looking just under $170 million in total revenue, so this was a clear disappointment. Don’t forget that when guidance was given back in August, the street was at more than $246 million for Q3, and that number itself had come down quite a bit after the Q2 pre-announcement, so missing here when analyst estimates come down that much is really bad.

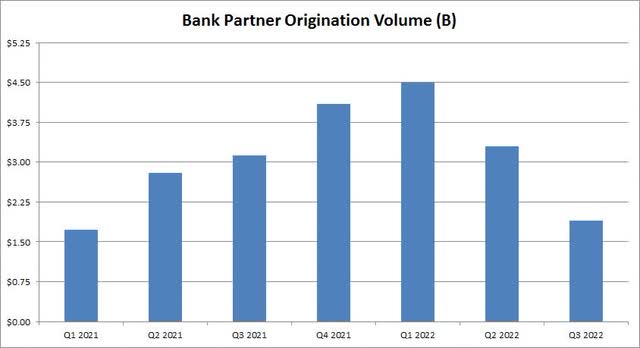

The problem for the company right now is that we’re in a very tight funding market. With interest rates soaring, the company’s bank partners originated 188,519 loans in the Q3 period, which was just over half as much as what was seen in Q3 2021. As the graphic below shows, origination volume was down almost 40% year over year to its lowest point in a year and a half. This key corporate figure is down almost 60% from its peak, which was seen not too long ago, in the first quarter of this year.

Quarterly Origination Volumes (Company Earnings Reports)

As I detailed previously, the company’s costs were rising at an alarming rate, which doesn’t mesh well when revenues suddenly fall flat. The company reported an operating loss of more than $58 million in Q3, whereas it had an operating profit of more than $28 million in the year-ago period. Both the operating and net losses that were reported were nearly double what was seen in Q2 of this year, so things trended significantly worse sequentially.

With losses piling up, so is the company’s cash burn. Operations used about $100 million in cash during Q3, as opposed to a nearly $44 million inflow a year earlier. Through the first nine months of 2022, cash used in operations was nearly $422 million, a swing of more than $600 million in the wrong direction as compared to the first three quarters of last year. Management still believes it has a healthy balance sheet, however, with about $684 million in cash. The company did spend $25 million on share repurchases in the quarter, although that was down from $125 million in Q2. With shares at new lows, however, those repurchases were obviously very poorly timed.

Unfortunately, just as we saw back at the August report, guidance was the worst part of the overall earnings release. For Q4 2022, management is calling for revenue of approximately $125 to $145 million, as compared to almost $305 million in the final quarter of last year. Not only is this less than half of what was seen in Q4 2021 but is also tremendously below the $185 million the street was looking for. Street estimates had called for a sequential rise of more than $15 million, and not only did Q3 miss, but even the top of this range still calls for a sequential decline of $12 million.

As noted above, estimates have continued lower, so the fact that guidance still missed by that much is a huge red flag. Just about 7 months ago, analysts were looking for $1.94 billion in revenue from the company next year. The average estimate has been halved since then, and it is likely to come down even more after this dismal guidance. With total revenues likely to be this low for the foreseeable future, it seems losses are going to pile up for at least a few more quarters now.

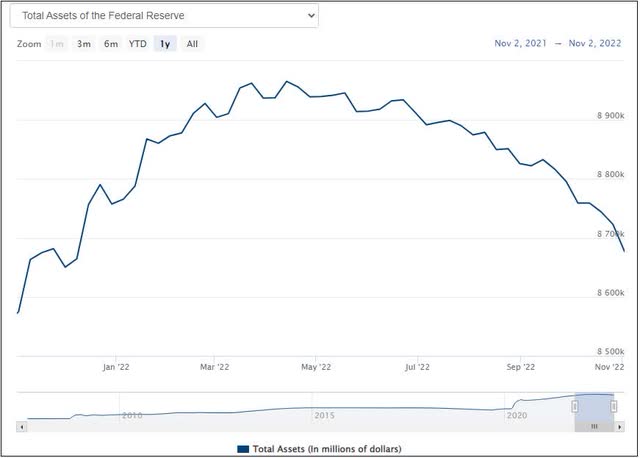

I just don’t see how conditions are going to get better anytime soon for Upstart. The Fed just raised rates last week, with at least one more rate hike expected to come in December. As the chart below shows, the Fed is starting to reduce its balance sheet by a meaningful amount, and this process should continue well into 2023 even if rate hikes stop. While year over year inflation numbers are starting to come down, consumers are still facing sharp increases in most prices, and now interest rates have soared which makes borrowing much more expensive.

Fed Balance Sheet Chart (Federal Reserve)

As for Upstart shares, they dropped more than 26% in Tuesday’s afterhours session. While they are already down about 95% from their all-time high at nearly $400, I still think they can go lower from here because I don’t see the business improving for at least another few quarters. Bulls might point to the average price target of more than $24 as having significant upside, but those targets will be cut on this guidance. Also, the street once saw this name as worth more than $305, and look where we are now.

In the end, Upstart announced another dismal set of quarterly results, making me think that single digits for the stock are not out of the question. Q3 revenues came in well short of dramatically reduced street estimates, and the company swung to a large quarterly loss. Q4 guidance was extremely bad, which will lead to another round of analyst estimate and price target cuts. With financial conditions only expected to get tighter in the coming months, I don’t see a positive setup for this name anytime soon.

Be the first to comment