Khanchit Khirisutchalual/iStock via Getty Images

A little bit of good inflation news on Friday and the market (NYSEARCA:SPY) soared. You would think there was peace in the Ukraine or that the Fed was only going to raise rates 50 basis points instead of 75 basis points next time.

As a matter of fact, we set up the $384 Buy Signal alert before the Fed was scheduled to raise rates, just in case they did only 50 basis points. They did 75 and the market dived, but we still left the $384 Buy Signal in place, in case any other good news took the market higher. That good news happened on Friday and triggered our preset Buy Signal. So how high is the price going?

We are not in the prediction business, however we do have signals we watch, and when they click on, as happened Friday, they tell us that the SPY is moving higher. Now we are watching to see how high price will go and when price will turn down again to retest the bottom at $362.

We will wait for the signals to tell us. To do that, we have to look at the signals on the weekly chart for the short term and the monthly chart for the longer term signals. We do not guess about when the signals will change, but rather we just wait for the signals to change and tell us how the SPY is moving. Friday’s signal is telling us that the SPY is moving higher, targeting a test of the next resistance level ~$407.

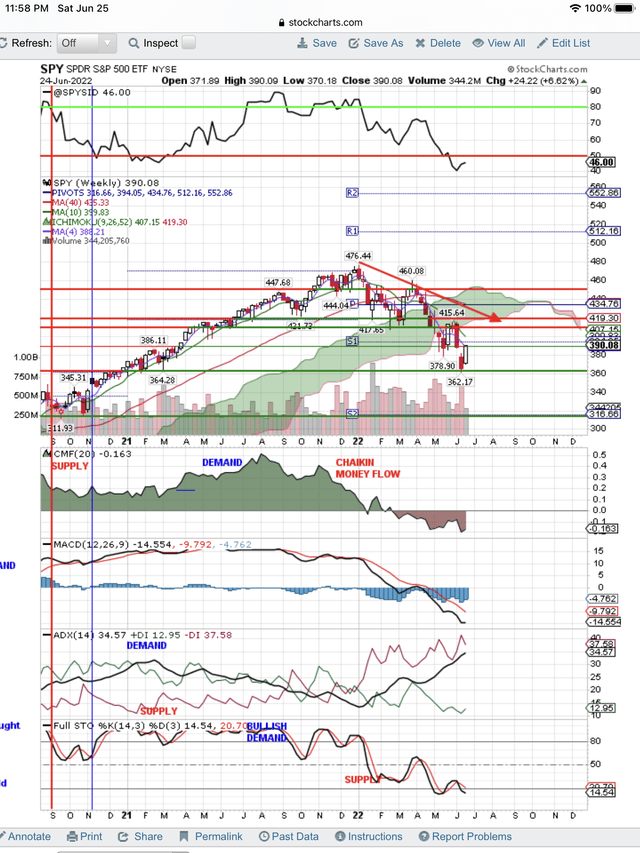

Here is our weekly chart, showing the shorter term signals turning up. You can see we have drawn the resistance line at ~$407 and that is target. The SPY could turn down before we get to that target, or it could break above that target. We will wait for the signals to tell us. Stay tuned or check out our free, live charts on StockCharts.com.

Weekly Chart Signals Improving (StockCharts.com)

At the top of the weekly chart shown above, is our most important fundamental and technical signal. You can see it is still below the red line, Sell Signal, but it has turned up.

You can see slight improvements in the other signals. If these signals continue to improve, we will have weeks of upside testing as the July earnings reports are announced. It looks as if the SPY wants to test the bear market downtrend line.

Since we don’t have a bottom in place yet, we expect the test to fail and see a retest of the bottom at $362. We won’t guess about this happening, but will let the signals tell us what is happening. Friday’s Buy Signal is telling us what is happening short term.

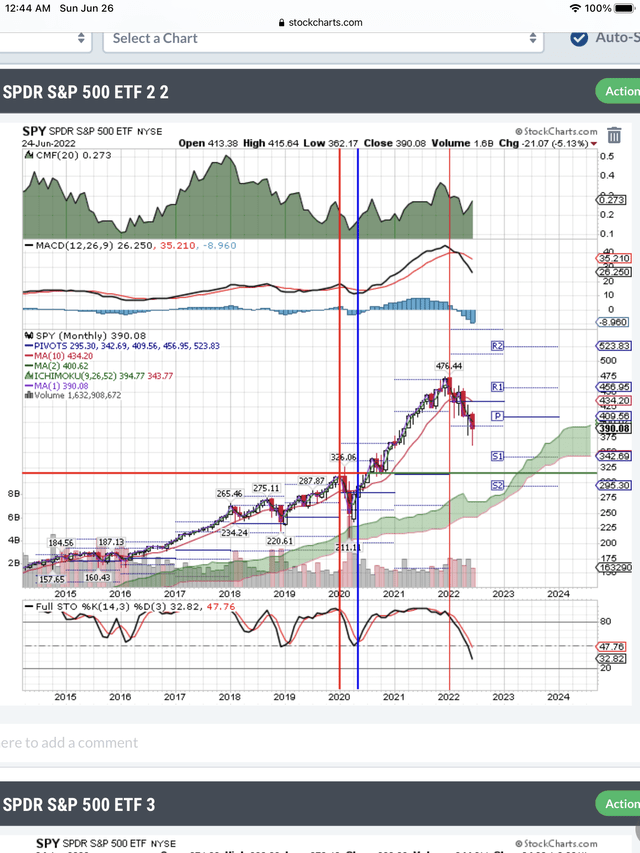

For the longer term view on this bear market, here is the monthly chart:

Monthly Chart Bearish Signals (StockCharts.com)

As you can see on the above chart, the signals are still dropping. There is no change in this bear market. First the signals have to stop diving and second, they have to turn up. The SPY has not even started the bottoming process, never mind seeing these signals turn up.

The weekly chart will lead the monthly chart. We just looked at the weekly chart and it is giving us no indication that the monthly chart is going to improve. In fact, we are not seeing a big improvement on the weekly chart. We are seeing a nice, short term technical bounce. It is just trying to reach up and test the downtrend of this bear market. There is no indication yet, that it can break above that bear market downtrend shown on the weekly chart.

Conclusion

The short term, technical bounce continues and will probably be fueled by July earnings reports. We expect the SPY bounce to stop at ~$407 and drop to retest $362. There is no improvement in the war, inflation, the stronger dollar and the Fed raising interest rates. The consumer is still spending. July earnings will reflect that. That is why we are having a technical bounce in a bear market. The reason the SPY does not have a bottom in place yet, is because the SPY is a leading indicator of the economy and is looking into the future. When it sees real improvements, it will put a bottom in place and we will see it on the charts. The SPY is not there yet. However, let’s make money on the technical bounce. Let’s rotate into stocks that are still beating the Index.

Be the first to comment