relif/iStock via Getty Images

Thesis

The iShares MBS ETF (MBB) tracks the results of an index composed of mortgage pass-through securities guaranteed by U.S government agencies. The index at hand is the Bloomberg US MBS Index Total Return Value Unhedged USD index. It tracks fixed-rate agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC). The construction of the index involves grouping individual TBA-deliverable MBS pools into aggregates or generics based on program, coupon and vintage. Agency MBS are mortgage-backed securities issued by government-sponsored enterprises in order to keep mortgage rates low and homeownership accessible. Ultimately they have an implicit guarantee from the US government in addition to the collateral that backs the transaction, hence they are rated AAA and their main risk reside with interest rate movements. As it engaged in quantitative easing the Fed purchased MBSs for its balance sheet in addition to US Treasuries. It is estimated that the Fed currently has 30% of all outstanding MBS securities on its books. As rates rise and the Fed looks to unwind its balance sheet MBS bond are going to underperform driven by several factors: i) loss in value due to rising rates, ii) loss in market demand for the bonds without the Fed bid (spread widening basically). MBB has a 4.6 years duration and is already down -3% year to date. Just like its long Treasuries counterpart, the iShares 7-10 Year Treasury Bond ETF (IEF), MBB is going to keep losing value until there is a rates stabilization and a clear picture of the Fed hiking end game. MBB has the additional wrinkle of the MBS to Treasuries spread which we believe is going to widen as the Fed bid goes away and it will act as another drag on performance. We anticipate a further price loss of -6% this year from rates and spread widening, which will be partially mitigated by the fund’s dividend yield. We have a Sell rating on MBB. A retail investor would be best suited to divest all MBB holdings and revisit at the end of the year for a better entry point.

Holdings

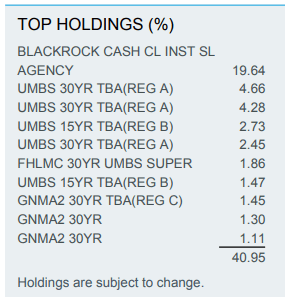

The fund holds MBS securities either outright or via TBAs:

Top Holdings (Fund Fact sheet)

To be announced, or TBA in bond trading, serves as a contract to purchase or sell an MBS on a specific date, but it does not include information regarding the pool number, number of pools, or the exact amount that will be included in the transaction. In effect TBAs are a cash efficient way of gaining access to the MBS market.

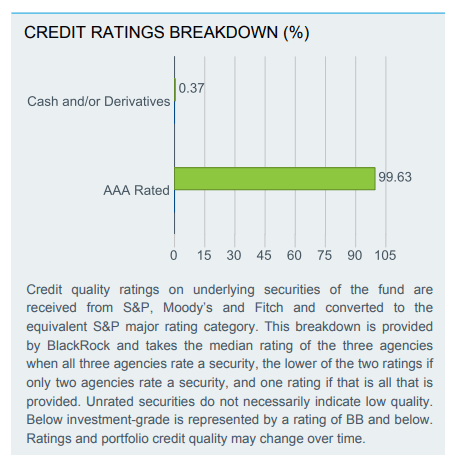

All securities are rated AAA given their collateral and implicit government guarantee:

Credit Rating (Fund Fact Sheet)

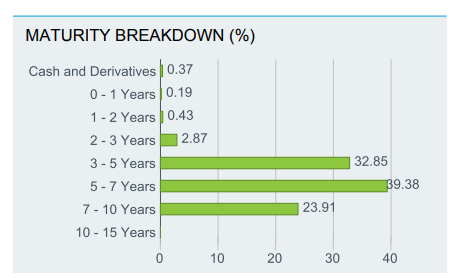

The fund generally purchases shorter maturity securities:

Maturity Breakdown (Fund Fact Sheet)

This maturity profile yields a 4.62 years fund duration

Interest Rate Risk

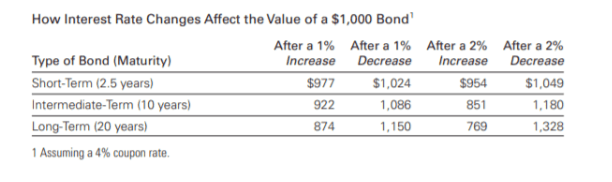

The fund has an 4.6 years duration and a slightly higher WAL of 5.72. This makes it fall in the intermediate bond duration bucket. The general move in prices given a 1% increase in rates for the duration bucket is as follows per Vanguard:

Duration Implications (Vanguard)

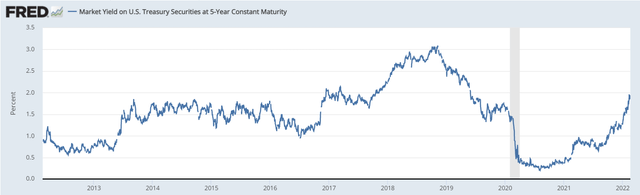

The best proxy given the fund duration is constituted by 5-year Treasury rates:

5-Year Treasury Rates (The Fed)

5 year rates have gone up significantly recently reaching the 2% threshold. Given the current high inflation and aggressive anticipated Fed path we believe 5-year rates are going to test the 2.5% – 3% range this year. Based on our duration matrix this implies another 5-6% move down in the MBB bond price.

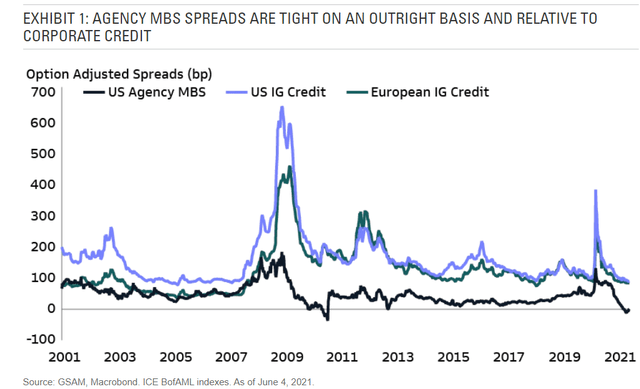

Spread to Treasuries

Mortgage backed securities are rated AAA and generally take advantage of an implicit government guarantee in addition to the collateral they reference (housing stock) hence an objective investor would expect them to trade fairly closely to US Treasuries. This in fact does happen and there are entire trading teams dedicated to the spread between mortgages and treasuries. As the Fed engaged in quantitative easing and purchased MBSs, the spread tightened to historic low levels:

As rates rise, the Fed starts unwinding its balance sheet and investors generally shy away from longer duration fixed income securities we expect this spread to normalize or even widen. The net effect will be a headwind to MBB and further underperformance.

Performance

The fund has robust 5- and 10-year total returns:

5-Year Total Return (Seeking Alpha) 10-Year Total Return (Seeking Alpha)

We can see a very good correlation between the MBB and IEF vehicles that only started to diverge in late 2019 as the mortgage / treasuries basis changed. MBB has proven to be a good buy-and-hold diversification tool, albeit with modest yearly returns given its asset class.

As the Fed became more hawkish MBB has started to lose value:

Conclusion

MBB is an ETF that tracks a mortgage backed securities index. The instrument is a good buy-and-hold vehicle for the asset class, benchmarking favorably with its Treasuries counterpart IEF. A savvy investor needs to recognize nonetheless that we have now entered a monetary tightening environment hence holding MBB will only result in negative total returns in the next twelve months. We anticipate a further price loss of -6% this year from rates and spread widening, which will be partially mitigated by the fund’s dividend yield. We have a Sell rating on MBB. A retail investor would be best suited to divest all MBB holdings and revisit at the end of the year for a better entry point.

Be the first to comment