da-kuk

I’ve written about nVent Electric PLC (NYSE:NVT) a few times over the years, and my articles have admittedly been, in the words of one reader, “all over the map.” This is a function of the fact that I’m willing to quickly change my mind on an investment if it either begins to, or no longer offers superior risk adjusted returns. When I last wrote about the business, we only had Q1s results to go on, which were not great. For that reason, I suggested that the stock had further to fall in an article with the terribly unoriginal title “nVent Electric has Further to Fall.” Fast forward to the present, and the company has reported excellent Q2 results, and the stock is up about 5.8% against a loss of about 5.75% for the S&P 500. The company is about to report earnings again, so I thought I’d offer my forecast based on what I’ve been able to glean is going on at the business. Based on this forecast I’ll buy (or not) ahead of earnings.

If you’re one of my regular readers you know what time it is. It’s “thesis statement” time, where I offer my readers the highlights of my thinking in a short, succinct paragraph. I do this for you so you won’t have to wander into the brambly maze of my writing. You’re welcome. Given the growth we’ve seen recently, the fact that input costs are starting to soften a bit, the sustainable backlog, and a few other factors, I forecast that the company is about to post a rather robust third quarter. Against this forecast, the valuation is fairly reasonable. For that reason, I’ll be buying some shares ahead of earnings, and will add to the stock on any post earnings weakness.

nVent Electric Financial Review And Forecast

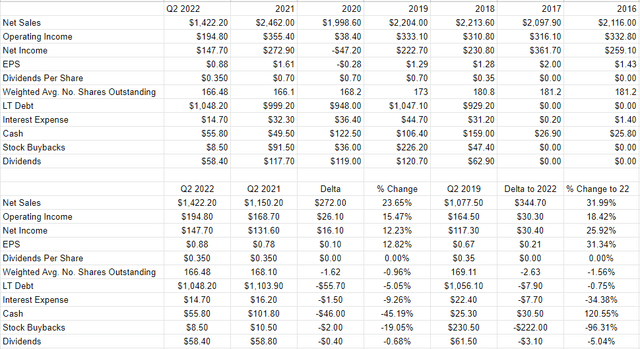

The company has posted financial results since I last reviewed the name, and I’ll admit that I think they were impressive. In my previous article on this name I “made a big stink” (as the young people say) about the fact that net income growth was relatively paltry. The most recent quarter was quite a bit different. Specifically, revenue for the first half of 2022 was up 23.65% relative to the same period a year ago, but net income was also up a healthy 12.2%. This was driven by a nice uptick in volumes and price. All of the company’s verticals grew at double digits, with “infrastructure” a particular standout. It seems there’s something to their “electrification of everything” strategy. Additionally, things look much better relative to the pre-pandemic period, with current revenue and net income higher than 2019 by 32% and 25.9% respectively.

Previously, I also clutched my proverbial “pearls” about the fact that the capital structure had deteriorated. In hindsight, I think that was a bit of a nitpick. The level of indebtedness certainly had increased relative to the end of 2021, but as of Q2 2022, long term debt had declined fully 5% from the same time in 2021, and was basically back to the same level it was in 2019. Although I’m not a fan of indebtedness, especially in the current rate environment, I don’t think it reasonable to lament it in this case. After all, interest expense has been declining for a few years now.

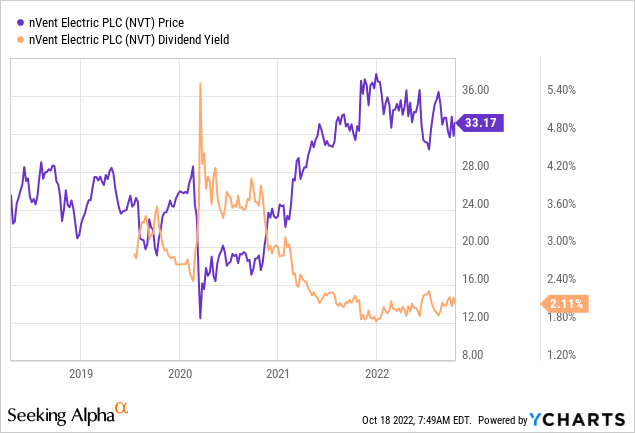

Also, I like the fact that the company returns a certain amount to owners, and, with the exception of a spike in 2019, most of that return comes in the form of dividends.

Although I’m interested in the past, most other investors are focused on the future for very obvious reasons, and so it falls to me now to take a stab at predicting how Q3 results will turn out. I derived some of my forecast from this webcast, hosted by the good people at Morgan Stanley, and if you’re interested in going deeper here, I would recommend checking it out.

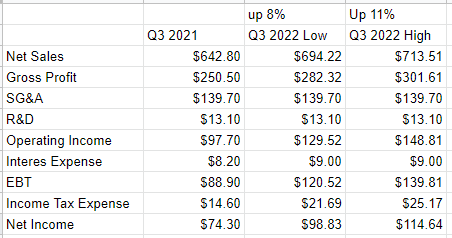

I’m going to assume the following with this forecast:

-

The momentum the company picked up in Q2 will continue apace in Q3, with sales growing by between 8% on the low end and 11% on the high end relative to the same period in 2021. This is net of a 4% FX headwind.

-

Although the price of steel has come down recently, I’m going to model a 5% increase in COGS relative to the same period a year ago.

-

I’m going to keep SG&A, and R&D the same from last year, and the interest expense is picking up slightly to $9 million.

-

Finally, I’m choosing a tax rate of 18%, which is on the high end of the company’s guidance. This is because I find it prudent to bet on the idea that every government needs to constantly wet their beaks. After all, as I acknowledge in my forecast, they need a taste.

I’m not known for my optimism, but I’m feeling fairly upbeat about the upcoming quarter here. Assuming that the valuation isn’t too stretched, I’d be very happy to buy just ahead of the earnings release.

nVent Q3 2022 Earnings Forecast (Author calculations, nVent Q3 2021 10-Q)

nVent Financials (nVent investor relations)

nVent Electric Stock

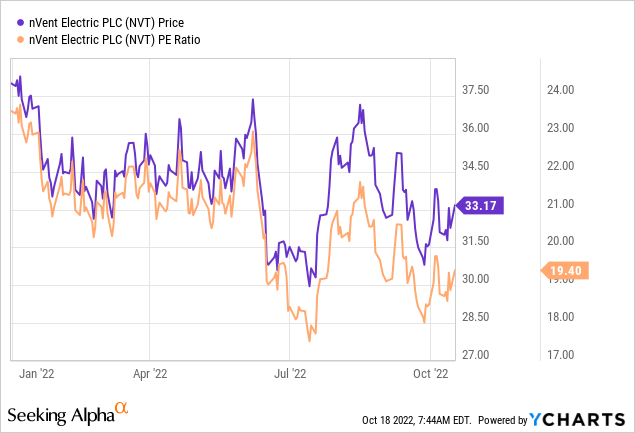

When I last reviewed this name, I recommended avoiding NVT stock because it was a low growth business, trading at a PE of about 18.2. Fast forward to the present and the valuation is slightly less attractive, and the yield is slightly lower, per the following:

Source: YCharts

Source: YCharts

Although the shares are slightly more richly priced today, I’m more comfortable with the valuation given the growth drivers that I’m finally seeing some evidence of. For that reason, I’m comfortable buying the stock at current prices. I’m glad I avoided the name in November of last year, but I think the evidence is fairly compelling that this stock now offers better risk adjusted returns. For that reason, I’ll be buying a few shares now, and will add on any weakness post earnings.

Be the first to comment