gorodenkoff

Shares of Charles River Laboratories International, Inc. (NYSE:CRL) have fallen dramatically over the past year, as this one-time growth stock has struggled from operational missteps and higher interest rates, “busting” its growth story. Despite setbacks, the company is operating in a high-growth space with drug investment rising in a fairly secular fashion. At 18-19x earnings, shares are caught in a no man’s land, particularly as there is some further downside risk guidance. I view shares as rangebound and would wait until $180 to add a position.

In the company’s second quarter, revenue rose 6.4% (9.5% organic growth before a 3.4% FX headwind) to $973 million. Non-GAAP operating margins widened 100bp to 21.8%, and non-GAAP EPS rose 6.1% to $2.77. This is a company that is still growing to be sure, but it is not growing as quickly as expected as foreign exchange, higher interest rates, and its CDMO (contract development and manufacturing organization) business create headwinds. Headwinds. CDMO’s challenges are taking 150-175bp off revenue growth while FX and interest expense represented a $0.40 EPS headwind just from June to August. Those challenges have subsequently worsened and will be discussed more below.

Starting with the bad part of its business, CRL has done several acquisitions to add manufacturing capabilities, but this business has simply not delivered as expected. CDMO has been hit by delays from retraining staff and retooling its UK site since its UK COVID vaccine work ended. This vaccine site does not have an “immediate backlog” as it pivots to plasma. Management conceded it will take a few quarters to fix, essentially writing off the second half of the year before a promised acceleration in 2023.

The other challenge has been that cell and gene therapy is technically very complex work. Accordingly, it is proving to have a longer sales lead time. Consequently, manufacturing revenue fell 1.5% (up 1% organic) as CDMO revenue fell. The company did also face challenging comps for biologics (up 26.6% last year), and it expects biologics to rebound in H2. On the positive side, subsequent to Q2 results, Charles River’s Memphis CDMO facility was the first to get European regulatory approval. That should add confidence that this is a viable business but getting to double-digit growth is going to be more of a marathon than a sprint.

The rest of the business is actually doing fairly well as biotech activity has been resilient. Discovery and Safety Assessment (DSA) organic revenue grew 12.9%, a 340bp sequential acceleration. There is a growing backlog in safety assessment. In fact, demand has been so strong it has been signing up clients on a take-or-pay basis through next year, locking in material revenue growth. The Discovery side is taking longer to get clients to commit and will slow in H2. Thanks to strong pricing power from a large backlog, operating margins were up 180bp to 25.3%.

Research Models and Services (RMS) revenues was up 8.5% to $186.4million, less than hoped as China did not rebound. The Shanghai lockdown was a 200bp drag on the segment. Management believes this is a case of revenue deferred rather than lost as it expects a catch up in H2. While I have been worried that ongoing COVID-zero policies in China are likely to reduce economic activity, due to the scarring effect on consumers and businesses, this is likely a less pronounced issue for pharmaceutical research. While it may not get back all of its revenue, I do generally agree there should be some catch-up. Operating margins fell 290bp to 21.2% due to higher costs and loss of operating leverage from the lockdown.

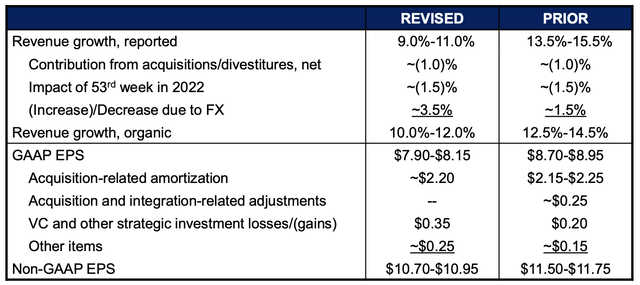

Given these headwinds, Charles River slashed expectations across the board with organic revenue growth now expected to be 10-12% from 12.5-14.5%. Non-GAAP EPS was cut by $0.80 to $10.70-$10.95. During the first half, it earned $5.52, so this implies a sequential decline in EPS during H2. Again, these are not the results one hopes to see from a growth company. Unfortunately, I see a risk the guidance is revised lower when the company reports third quarter earnings on November 2nd.

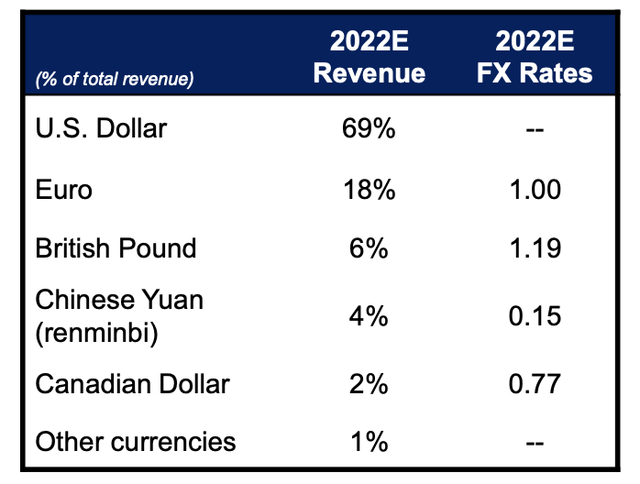

The first headwind is that the U.S. dollar has stayed strong with the British Pound weakening amid fiscal policy uncertainty. The company is already budgeting for a 3.5% FX headwind so it will not be dramatically different, but it may prove to be closer to 4-4.5%.

More troublingly, half of Charles River’s $3 billion debt is floating rate. This guidance assumed 100bp of hikes in Sept-Dec. Instead if the Fed dots play out, we will get 200bp of hikes during this time period. That higher rate outcome will be an additional $4 million impact in H2 or about $0.08. This will be a more meaningful headwind next year as interest expense could nearly double from $23 million to $40 million next year, taking $1 off of EPS. Essentially the company will need to grow its business by nearly 10% just to offset the headwind of rates.

Its decision to keep so much floating rate debt rather than term out debt last year and lock-in rates has proven to be a mistake. Accordingly even as its net leverage is reasonable at 2.7x, debt repayment is the “priority” for cash in an effort to mitigate this impact. Its revised 2022 guidance translates to about $360 million in free cash flow, $207 million of which was realized in H1. Repaying about $150 million in debt during H2 as well as continuing to do so in 2023 will help to reduce the EPS impact from $1 to $0.80-$0.90, still a meaningful drag.

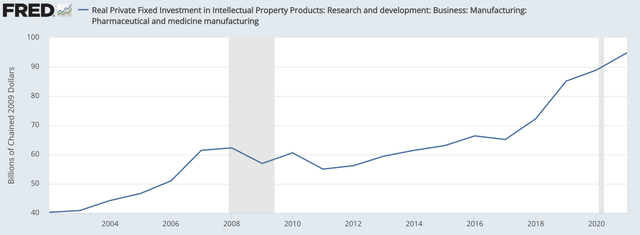

These challenges from rates, FX, and a slower than hoped for rollout of CDMO capabilities have clouded what should be a favorable growth picture. The company has 3,000 cell & gene therapy programs in the pipeline, which is up 20% annually the past three years. 70% are still pre-clinical and just 5% are in Phase 3 trials, meaning they should be driving more testing revenue for CRL in coming years. As you can see blow, R&D investment in pharmaceuticals has been steadily rising and is poised to eclipse $100 billion. There should be a growing pie of revenue opportunities for CRL once it works through its operational issues.

Now, there is a risk that the tightening from the Fed and associated drop in equity markets make R&D funding scarce as venture funds scale back and companies cost cut. Still, even during the financial crisis, spending did not fall materially. With CRL even able to secure take-or-pay contracts next year in the safety business, there are no signs I see that a significant retrenchment is coming.

With rates and FX strong headwinds, CRL looks poised to deliver toward the low-end of guidance with some risk of a cut. Even at the low-end, CRL will generate about $5.20 in H2 earnings or a $10.40 annualized run-rate. Relative to that figure, higher rates, just assuming the Fed dot plot plays out, will be about a $0.60 headwind (assuming some debt paydown). That leaves the company with $9.80 in earnings power. If we assume everything ex-CDMO can grow 10% and CDMO 5%, earnings would likely be $10.60-$11, barely higher than 2022’s numbers. That leaves shares with a 19x forward multiple.

Investors excited about the long-term prospects of more drug R&D spending and cell therapy may be willing to hold shares now given the hope that revenue growth reaccelerates sometime next year as it signs clients over. That is likely to be a multi-quarter process, and for the time being, I see shares as rangebound until we see better execution. At $180, shares would have a 17x P/E, close to the market multiple, and given the long-term potential, I would be a buyer despite the operational uncertainties. For now, I would avoid the stock unless one is willing to be extremely patient for performance.

Be the first to comment