Kameleon007

The second look at Q3 GDP data released this week showed the U.S. grew at an impressive 2.9% annualized rate, even stronger than the 2.7% consensus. Compared to the more challenging macro backdrop from the first half of the year, lower energy prices and slowing inflation helped support a rebound in consumer spending as the main growth driver this quarter. The biggest takeaway for us is that the economy remains resilient, brushing aside fears of a deepening recession.

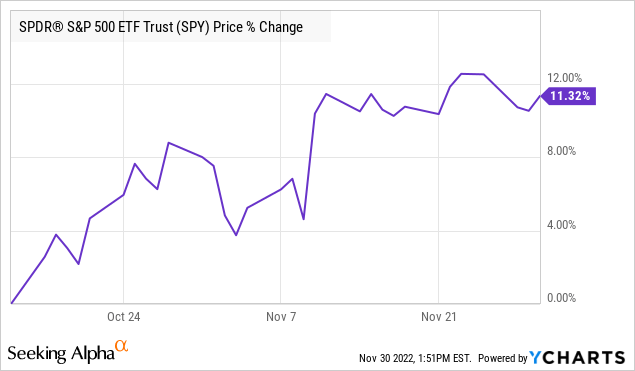

The other development was the latest Fed speech, with Chairman Powell strongly suggesting a slowdown in the pace of rate hikes at the next FOMC meeting. Stocks are rallying and that’s the setup heading into the final stretch of 2022 with the S&P 500 (NYSEARCA:SPY) up more than 11% from its lows. Our message here is that we see more upside with several reasons to look forward to a year-end rally.

The Bullish Case For Stocks

In our view, all the pieces are in place for an emerging “soft landing” scenario which could be very bullish for stocks going forward. Simply put, despite the Fed’s hawkish monetary policy that has lifted interest rates to a decade high, the GDP report highlights an underlying level of economic resiliency that can continue. The following points are the TLDR version:

- Room for better-than-expected macro data into 2023

- Inflation trending lower

- Low gasoline prices a windfall for consumer spending

- A steady labor market with subdued wage growth

- Positive corporate earnings momentum

- Stabilizing interest rates/ pullback in the Dollar strength

We haven’t seen the surge in unemployment or a collapse in corporate earnings that would be necessary for the market to really take a leg lower. Bears have been calling for this development for a long-time and simply pushing that view into next year looks a lot like moving the goalposts.

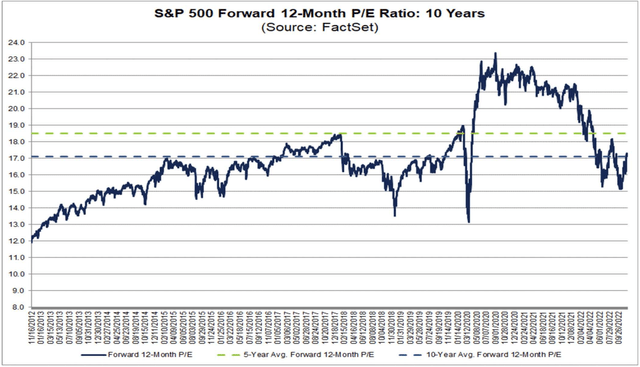

On this point, earnings have been strong, with the S&P 500 EPS on track to climb 6% this year on top of a record 2021. The data were looking at from FactSet shows that 69% of S&P 500 companies beat EPS expectations in Q3. The consensus is for average EPS to climb another 5% in 2023.

In our view, there is likely an upside to these estimates in the bullish case as confidence returns to the economy. The market is trading at a forward P/E of 17x and this is particularly compelling at the tail end of a tightening cycle with room for some multiples expansion by the time the Fed stops hiking. If macro outperforms, stronger earnings will make stocks appear even more attractive.

source: FactSet

The path here is that the Fed’s strategy ends up working with inflation trending lower- and possibly even surprising to the downside, even as macro indicators outperform. The October inflation data surprised to the downside and the upcoming November CPI report in a few weeks can work as the next catalyst to push stocks higher.

The drop in oil and gasoline prices has helped, but the bigger picture considers a normalization of global supply chains compared to the headline-making disruptions back in Q1. The other important inflation components like housing and even car prices that have responded are moving in the right direction.

The series of rate hikes this year are still working their way through the economy and from a technical perspective, the base effect of tough year-over-year comparisons into Q1 and Q2 2023 means that the headline inflation rate will be pressured lower.

From there, the big question is where the terminal fed funds rate will end up in 2023. Whether its 5% or a bit higher as implied by current estimates, the mistake some investors are making is to assume this must crash the economy. Again, the bullish case for risk assets including equities is that the final rate hike in the cycle is coming sooner rather than later, not because the economy is collapsing, but because the inflation trajectory can justify it.

How We’re Reading The Fed

Anything the Fed says at this point must be taken in the context of the memory from 2021 when the group dropped the ball by not hiking rates sooner in the cycle. Facing a credibility crisis based on what was likely careless messaging on inflation projections from last year, it makes sense for the Fed to maintain an extra cautious approach. This has been reflected in some aggressively hawkish quotes giving fodder to bears waiting for the bottom to fall out.

The way we see it playing out is that the Fed is under promising now to later over-deliver. It would be easy to connect the dots and cite an expectation that peak inflation has passed, but the urgency is to appear stern and not declare victory too early.

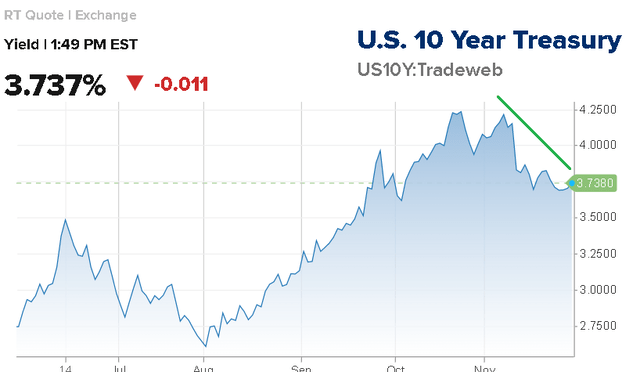

On the other hand, there are signs the narrative is shifting. Chairman Powell has strongly alluded that the next FOMC meeting will feature a 50 basis point rate hike. Depending on your definition, this is the long-awaited pivot compared to the string of 75 basis point hikes in recent months. Depending on how the CPI evolves into Q1 next year, a further rate hike may not be necessary.

All this is being translated in interest rates that have pulled back from highs evident by the 10-year treasury currently yielding 3.7% down from a high above 4.3% in early October. We believe the Fed when they say they are data dependent, and that data looks good right now for equity bulls.

source: CNBC

Humble Pie For the Bears

We’ll take this moment to have some fun at the expense of our good friends “the bears”, which are on the wrong side of the trade right now. We can bring up some of the celebrity investors like Michael Burry or even characters such as Robert Kiyosaki that are apparently convinced of a big leg lower. If the stocks break out higher from here, a lot of folks will be chewing on some humble pie during this holiday season.

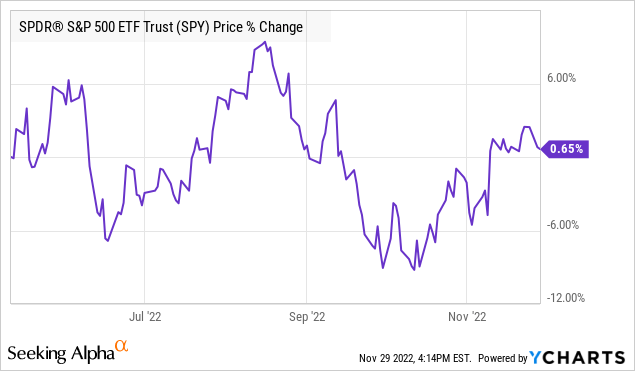

One of our favorite charts right now is simply the performance history of the S&P 500 since May as it has delivered a positive return over the period. For a market that is often hyper-focused on the daily headline, seven months is nearly an eternity waiting for the bottom to fall out that has not materialized. The bearish case rehashing the same talking points that may have worked as a short case in Q1 is past its expiration date in our opinion.

For all the prophecies of a looming stock market crash, it’s hard to see how the bears can sit on a high horse considering the chart above. Yes, it’s been a rough ride, and this same S&P 500 is still down 15% year-to-date with some individual stocks crushed even lower, but we’re also well above levels from early 2021.

Recognizing the performance here is relative, it’s fair to say that the bulls have been winning for much of the last several months. By this measure, the next leg higher in stocks will be particularly painful for anyone stuck on a doom-and-gloom narrative betting on more downside or even just sitting on the sidelines.

What’s Next For SPY?

We see the S&P 500 running towards 4,300 as a year-end or early January price target corresponding to approximately $430 in SPY. That’s a lofty 7% move higher from here but consider what would be an accelerating “short squeeze” with a lot of bears forced to flip long. Breaking out above 400 in the near term will place levels from September and August back in play with the theme of 2023 being a recovery.

We mentioned the November CPI report set to be released on December 12th as the potential next big catalyst. Even this Friday’s payroll update should be positive assuming continued job gains help to bury the hatchet that widespread layoffs are coming. Improving consumer sentiment globally with a pullback in the Dollar should also be a tailwind for risk assets. The areas of the market that we like include high-growth tech and beaten-down names.

On the downside, as long as SPY can hold ~$390, the bulls are in control in our opinion. The big risks to consider would be tail-risk events like the ever-volatile Russia-Ukraine situation. Data out of China is also a key monitoring point that could undermine the positive momentum here.

Seeking Alpha

Be the first to comment