sbayram

Earnings compression

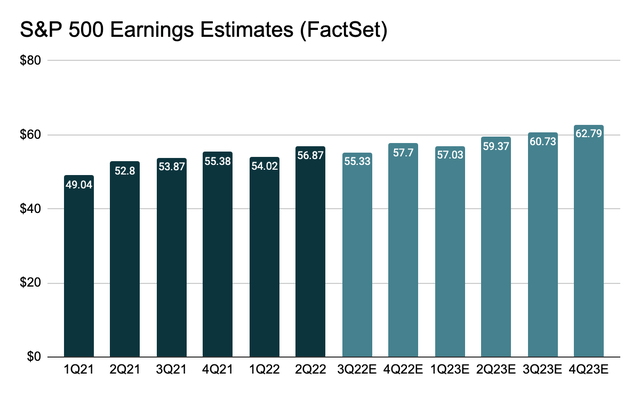

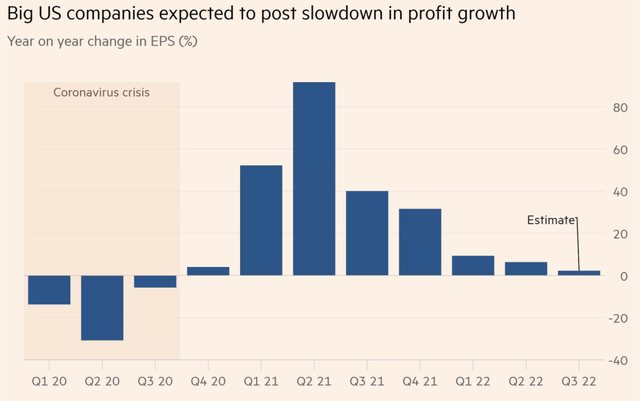

Markets continue to navigate a difficult environment where interest rates are rising and earnings are slowing. Per FactSet, Wall Street analysts have cut their earnings outlook for the S&P 500 (SPY) by $34 billion in the past 3 months and now expect just 2.4% EPS growth for 3Q22 vs. 9.8% previous estimate. This marks the slowest earnings growth since 3Q20, as key economic variables continue to pressure top and bottom-line growth.

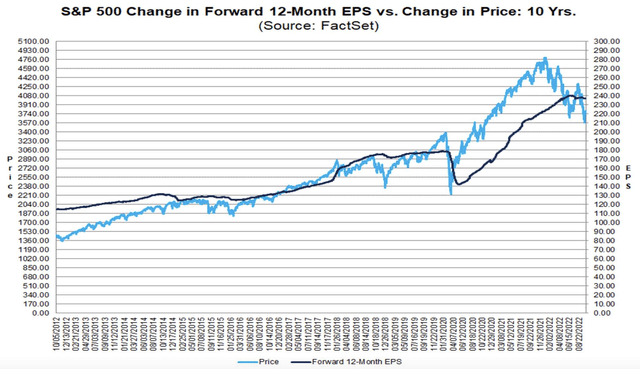

The interesting thing here is that while S&P 500 valuation has adjusted lower with a forward P/E of 15.6x vs. the 5/10-year average of 18.5x/17.1x, earnings estimates haven’t seen a material downward revision when the Fed is doing everything in its power to tame inflation by suppressing the demand side of the economy. Since June, CY2022 S&P 500 EPS has been revised down just ~3% to $224. CY2023 EPS has been cut by a little over 4%, to $240.

Key borrowing rates are now at record levels, with the average 30-year fixed mortgage rate at 6.66%, a level not seen since 2008. Per Bankrate.com, that number is even higher at 7.04%. Further, the average 72-year used/new car loan rate is easily above 7%/5% across most states in the U.S. With significantly higher borrowing rates, consumers will have no choice but to delay their major lifetime purchases. The U.S. 10-year yield has been flirting with the 4% mark and could easily exceed this level after a few more rate hikes. For the past 13 years, investors have been living in a TINA (there is no alternative) environment where stocks are the place to be. However, this concept may no longer apply should rates continue to trend higher.

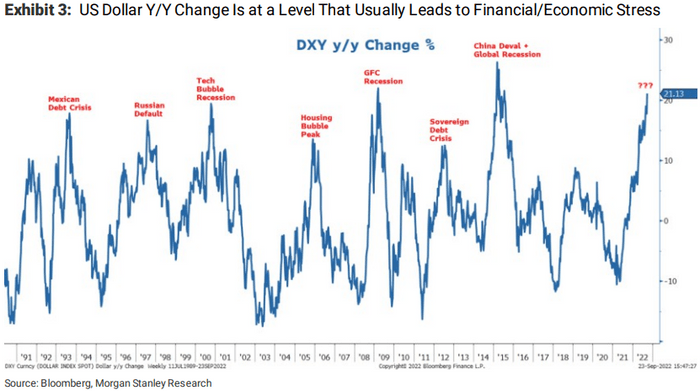

A strong dollar is also doing more harm than good on the earnings outlook. The U.S. Dollar Currency Index (DXY) is up 18% YTD, creating a 1:1 scenario against the euro that was last seen in 2002. The technology sector of the S&P 500 has the highest exposure to foreign exchange risks, where 58% of revenue comes from outside the U.S. For perspective, 50% of companies in the S&P 500 have discussed the FX impact on 3Q22 earnings. Recently, Mike Wilson of Morgan Stanley noted that every 1% increase in the U.S. Dollar Index will have a negative 0.5% hit on the bottom line. As long as the dollar remains at elevated levels, earnings headwinds will persist.

Bloomberg, Morgan Stanley Research

Corporate earnings are now in question as companies are feeling the pain and analysts are seeing the need to adjust their expectations. Recently, Advanced Micro Devices, Inc. (AMD) reported disappointing Q3 revenues, where PC-related sales dropped 40% YoY due to depressed consumer demand (analysis here). Apple Inc. (AAPL) is the latest name in big tech to attract skepticism on its earnings estimates, as BofA recently downgraded the stock on a slower demand outlook (here). Not too long ago, Nike, Inc. (NKE) reported mixed August quarter results with muted top-line growth with a 600 bp impact from FX and a giant inventory position of $9.7 billion (here). Amazon.com, Inc. (AMZN) is running a second Prime Day while Walmart (WMT) is countering with its own sales event to get rid of excess inventory. Per data from Adobe (ADBE), online holiday spending from November to December 2022 is expected to grow just 2.5%, which is the smallest increase since the company began tracking such data in 2015.

FactSet, Graphic by Albert Lin

Yet still, earnings estimates for the S&P 500 (FactSet) remain on the optimistic side despite slower consumer spending, elevated inventories, higher cost of living/borrowing and a strong dollar. Estimated 2023 EPS of $240 still suggests a 7% YoY increase from 2022E. In the last 10 years, S&P 500 earnings have beaten estimates by 6.5% on average, a number that was skewed to the high end because of the extraordinary earnings beat coming out of Covid. In Q1 and Q2 2022, however, S&P 500 actual earnings only beat estimates by 4% on average. As the macro conditions continue to take a turn for the worse, it’s difficult to think that companies will be able to meet such high expectations in 2023.

Overall, it’s conceivable that S&P 500 earnings may continue to face downward pressure and estimates haven’t quite adjusted to the current macro narrative. Whether the Fed can deliver a soft or hard landing, there will be a landing. With a recession being the wildcard for 2023, a 7% increase in EPS seems like a stretch. Per Michael Burry’s warning in June, an earnings compression is up next.

Be the first to comment