CreativaImages

The recovery in the SPX off the June lows has taken valuations back to extreme levels, which should be reason enough to avoid being aggressively long. These expensive valuations are also joined by three other factors which suggests that downside risks dominate in the short term; widening credit spreads, widespread complacency in options markets (low Vix), and a deterioration in international stocks (both developed and emerging). As for Fed policy, while interest rates have shown little correlation with equity valuations across history, the Fed continues to tighten policy despite a surging dollar and a weakening global economy, which raises the risk of a credit crunch.

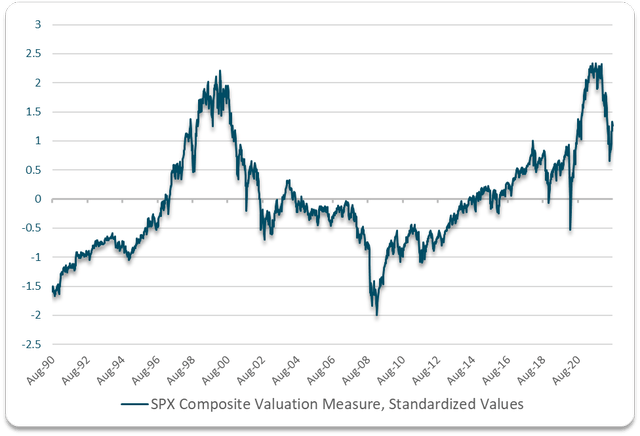

Valuations Are Back At Extreme Levels

Despite continued increases in earnings the recent recovery in the SPX has taken valuations back to extreme levels. The chart below shows a composite valuation metric based on an average of price/earnings, price/sales, price/book value, EV/EBITDA, and dividend yield, and the unit of measurement is in standard deviations based on data going back to 1990. While valuations have come down significantly from those seen in 2021, they remain more than a standard deviation above their long-term average. It is also worth noting that valuations during this 30+ year period have been significantly higher than previous decades.

Bloomberg, Author’s calculations

Another key point to keep in mind is that free cash flow growth has been significantly weaker than earnings growth over the past year. For the SPX ex-Financials index, the price/free cash flow ratio is at 26.8x, just modestly down from its 2021 peak. This is typical of high inflation periods, where earnings are artificially elevated as depreciation costs do not reflect the higher cost of capital expenditure caused by inflation.

SPX P/E and Price/Free Cash Flow (Bloomberg)

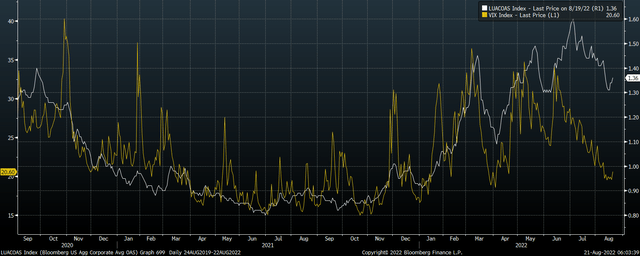

Credit Markets Suggest Equity Investors Should Be More Fearful

Tighter monetary policy and a deteriorating economy appear to be taking their toll on credit markets, with both high yield and investment grade credit spreads remaining a long way from their 2021 lows. Despite this, equity options markets as measured by the Vix show a high degree of complacency. It would be highly unusual for credit markets and the Vix to decouple for any significant length of time given the strong links between the two markets, which suggests there is potential for a rise in the Vix.

VIX vs Investment Grade Credit Spreads (Bloomberg)

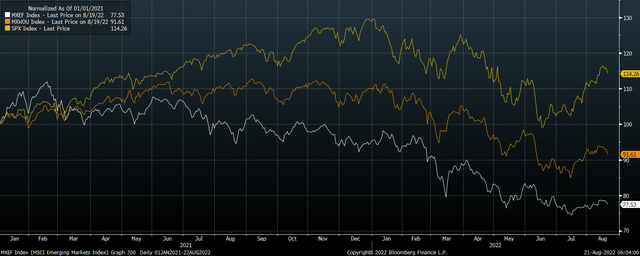

International Stocks Are Trending Lower

Both the MSCI World ex-U.S. and the MSCI Emerging Markets indices are on established downward trends after posting a series of lower highs. The strong dollar has undoubtedly hit these markets much more than the SPX, but we should also see SPX earnings expectations suffer from the impact of falling overseas profits as a result of the strong greenback.

SPX, MSCI EM, And MSCI World Ex-US (Bloomberg)

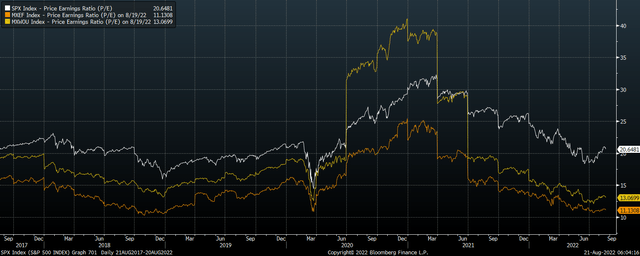

The outperformance of the SPX versus its international peers over the past few years has been largely down to the valuations that investors have been willing to pay for U.S. stocks, rather than any dramatic outperformance in company fundamentals. As a result, the SPX trades at record multiples of both international developed and emerging market benchmarks on almost every metric.

P/E Ratios: SPX, MSCI EM, and MSCI World Ex-US (Bloomberg)

Fed Policy Raises The Risk Of A Credit Crunch

Regular readers will be aware that I believe the importance of Federal Reserve policy in determining equity market valuations is wildly overstated (see ‘Stocks And The Fed: Setting The Record Straight‘). That said, the Fed’s insistence on driving up borrowing costs in an environment of rising credit spreads, weakening economic activity, and a surging dollar, raise the potential for a self-feeding liquidation episode where falling asset prices lead to tighter credit conditions which lead to further declines in asset prices. While such episodes are rare and nearly impossible to predict with any accuracy, the current combination of factors makes such an event much more likely than usual.

Be the first to comment