Leonid Sorokin

The investment thesis

We are nearing 2023 and investors are looking for new investment ideas. In my opinion, American Tower Corporation (NYSE:AMT) is one of the best deals in the market right now. What I especially like about this company is the increasing exposure to Africa. Many people still consider Africa as a poor and weak continent that will never catch up with the ‘western world’. The opposite is true as the African middle class is expected to boom in the coming decades which means smartphone ownership and data usage will outgrow other markets. American Tower has taken advantage of this opportunity by acquiring and building cell towers in Africa at a rapid pace. This will help to drive future growth and continue the impressive growth track record from the past decade. And if you thought things could not get any better, the stock is currently trading at attractive valuations.

In this article I will outline American Tower’s business model, the company’s expansion into Africa, the financial results and future outlook, and explain why American Tower stock is very attractive at the current price levels.

Prologue

First things first: why writing a piece about American Tower and Africa?

I have recently finished reading a book called ‘Factfullness‘ from the Swedish academic Hans Rosling. For those of you who do not know this book: it uses data to show that the world, for all its imperfections, is in a much better state than most people think. Rosling addresses ten human instincts that make us worry about the wrong things instead of using hard facts for our world view.

One of the facts that stuck with me the most is that population growth will not continue at the high pace from the past century. According to projections from United Nations, worldwide population growth will slow down significantly and stabilize around the year 2100 in the 10 to 13 billion range.

So there is still some population growth ahead, but where will this come from? I initially thought that this would be Asia, but (surprise surprise) it is actually Africa that will be the main growth driver. According to the World Economic Forum, Africa will account for more than half of global population growth in the coming decades. Rosling sketches a simplified base scenario in which the share of total world population living in Africa will grow from 15% today to more than 35% by the year 2100. But it’s not only Africa’s population that will grow. Also GDP per capita is expected to increase. The Africa Development Bank Group estimates that GDP growth per capita will hover around 4% per annum through 2060. Even (potential) economic superpowers like China and India will not achieve such rates. Currently, people in most African countries can meet their basic needs. But, as their income continues to grow, people can afford to save money and buy things beyond their basic needs. This means that there are plenty of opportunities for companies to benefit from the increasing prosperity in this continent.

So, after having read the book, I immediately started my journey looking for companies in my stock watchlist with a relatively high and growing exposure to African markets. I have to admit that this was not easy – most companies I follow are from the U.S. and Europe and exposure to Africa is often negligible. But, after going through a whole lot of annual reports, I concluded that American Tower Corporation would be my main candidate.

American Tower business overview

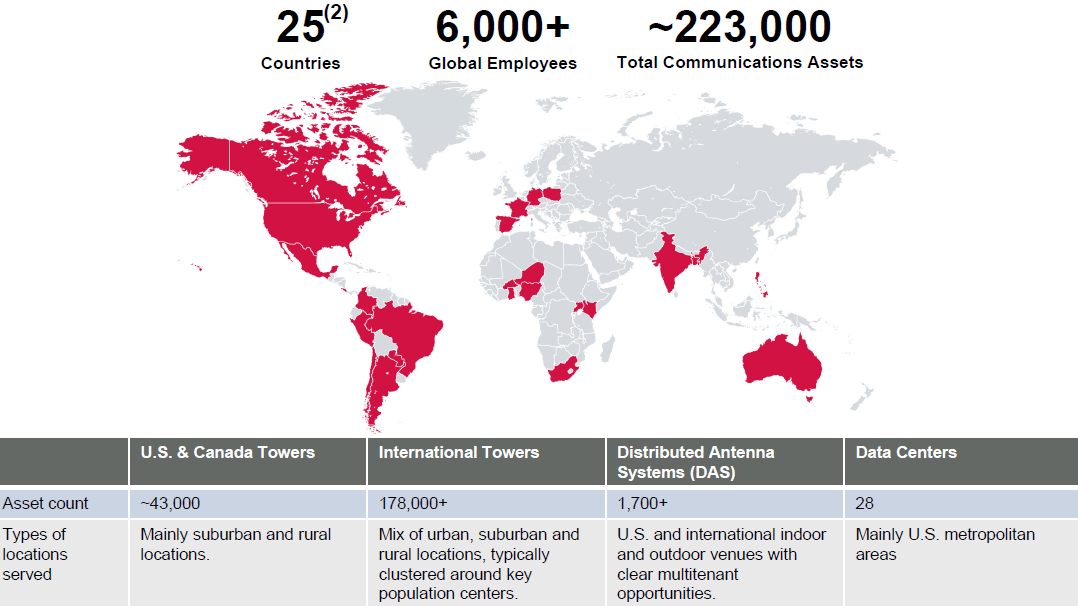

American Tower is one of the world’s largest REITs by market cap. It owns, operates and develops different types of communications real estate. The vast majority of revenue is generated by leasing space on communication sites to tenants, such as AT&T Inc. (T), Verizon Communications Inc. (VZ), and Telefónica S.A. (TEF). The company owned roughly 223,000 communication sites at the end of September this year (see figure below).

American Tower company overview (American Tower Investor Relations)

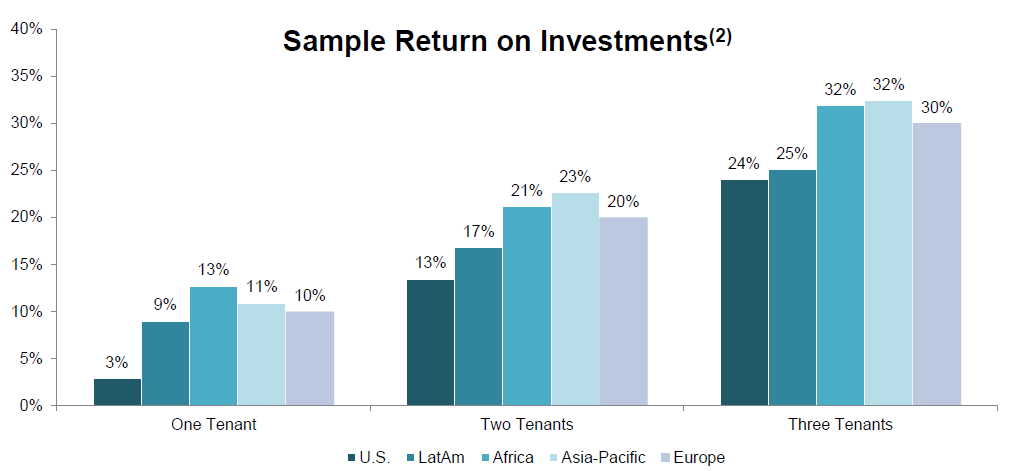

There is a reason why American Tower is such a huge company: cell towers are a very lucrative business. American Tower only owns/operates the tower structure and land parcel, while the rest of a tower site is owned by tenants. With one tenant leasing space on the tower structure, return on investment for towers in the U.S. is rather unimpressive at roughly 3%. But, it becomes interesting when more tenants start to lease space on the same tower site. While operating costs increase marginally, tenant revenue makes a huge leap per tenant added, resulting in ROI rates of 13% with two tenants and 24% with three tenants. Tenant contracts usually last between 5 and 10 years, and the churn rate has historically averaged 1% to 2% of tenant billings annually. This provides a steadily increasing stream of non-cancellable lease revenue.

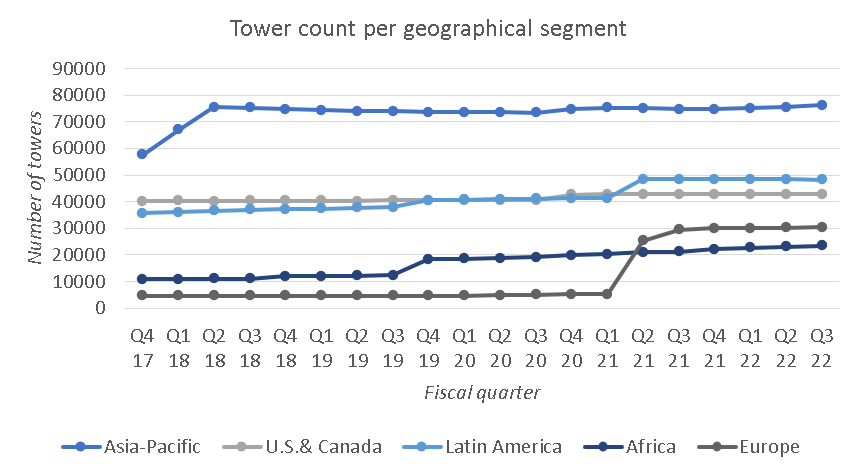

The following graph shows the tower count across all geographical business segments over the past five years. The number of towers has grown in all segments for the considered time period, but there are some significant differences in tower count growth rates between the geographical areas. Tower count in the largest segment Asia-Pacific has grown with 6.1% annually. This growth rate is only 1.3% for U.S. & Canada, 6.5% for Latin America, an impressive 17.4% for Africa, and a whopping 48.2% annually for Europe. Tower count is Europe has been mainly driven by the Telxius Towers acquisition in Q2 2021.

Number of towers per geographical segment (Author; American Tower Quarterly Reports)

Excluding this acquisition, Africa has been the geographical area with the highest tower count growth. In the most recent quarter, Africa was responsible for 11% of total tower count and 11.6% of total property revenues.

Considering the expected population and GDP per capita growth in Africa, I think American Tower will only increase exposure to this continent. Reason enough to further explore the Africa segment and future opportunities.

Why this U.S.-based business will keep expanding into Africa

I already mentioned that the vast majority of telecom towers from American Tower is located outside U.S. & Canada. But, this has not always been the case. Prior to 2011, there were more towers in U.S. & Canada than in the rest of the world. After 2011, international tower count overtook U.S. & Canada and kept growing at a rapid pace until today.

2011 was also the year that American Tower expanded its operations into Africa, starting in South Africa and Ghana. In the following years, more African countries followed. The company launched its operations in Uganda in 2012, Nigeria in 2015, Kenya in 2018, and Niger and Burkina Faso in 2019.

When at the end of 2010 American Tower announced that it would establish presence in Africa, former CEO Jim Taiclet talked about a compelling investment opportunity. And I think he is definitely right. In the following, I will go through three reasons why Africa was and will remain the most attractive opportunity for American Tower to further expand operations.

1: High return on investment

I explained in the business overview that the estimated return on investment for a tower site in the U.S. increases from 3% with one tenant to 24% with three tenants. The following figure shows that in the rest of the world sample return on investments are even higher. This is mainly caused by the tower construction costs. Typical towers construction costs in the U.S. are way higher compared to other markets, with Africa and Asia-Pacific being the cheapest. As a consequence, these regions (and also Europe) are most attractive from a return on investment perspective. I think that the company will mainly increase exposure to Africa in the coming years, because the largest portion of telecom towers is already located in Asia-Pacific and the company has recently done a very big acquisition in Europe.

Sample ROIs per geographical segment (American Tower Investor Relations)

2: Highest growth in mobile internet users

The International Market Overview Presentation on the company website nicely shows the five-year CAGR for wireless subscribers in all countries outside the U.S. This growth rate is in the low-single-digits for most ‘advanced wireless markets’, while it is in the mid-to high-single-digit range for most African countries. I think this is a result of 1) population growth, and 2) an increasing share of total population with access to mobile internet.

In the Prologue, I explained that Africa will be the region with highest population growth. According to a report from the Global System Mobile Association, penetration rate of mobile internet users in Sub-Saharan Africa is expected to grow from 26% in 2019 to 39% in 2025. It is highly likely that this trend will continue after 2025.

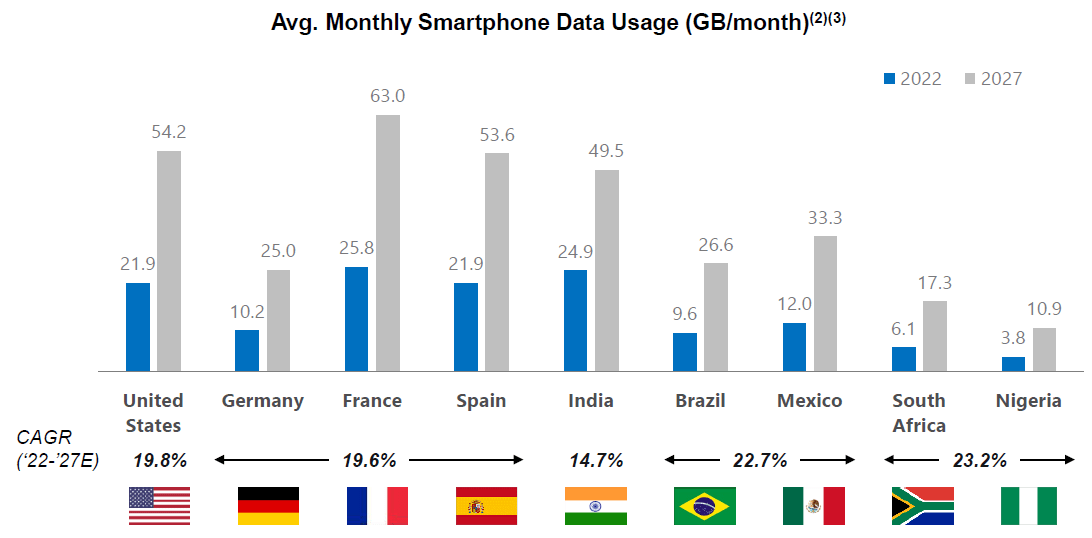

3: Highest growth in smartphone data usage per subscriber

American Tower currently estimates that the highest growth in monthly data usage per subscriber will occur in African countries through at least 2027. The growth rates are impressive in all countries, but if you are purely looking for the region with the highest growth potential in terms of data usage, Africa is the winner.

Smartphone data usage per month per country (American Tower Investor Relations)

All in all, there are plenty of reasons for American Tower to continue expanding into Africa, and I think that this geographical segment will show outsized growth in terms of tower count.

American Tower has built an excellent track record

Some of you might say that it is risky for American Tower to build so much exposure to emerging markets. But I think it is only logical as the growth opportunities and return on investment are just too attractive outside the U.S. Moreover, the company has shown that the international-focussed strategy works and translates into great financial results.

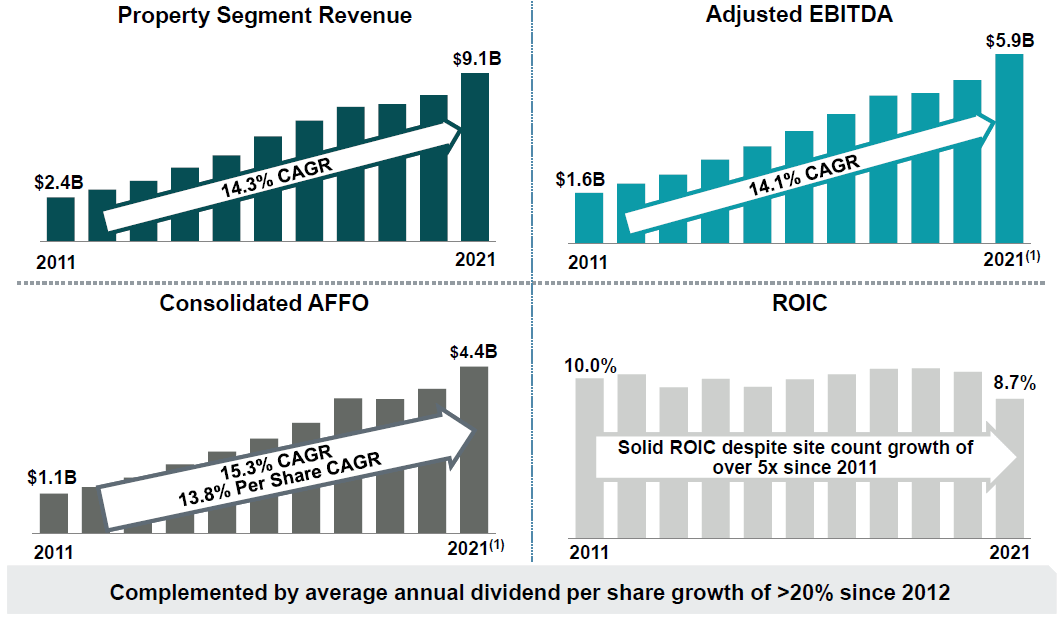

The figure below shows the CAGRs for property segment revenue, adjusted EBITDA, consolidated AFFO (per share), and return on invested capital. Both the top-line and bottom-line results have grown with a mid-teens CAGR, which has translated in a 13.8% CAGR for AFFO per share. Return on invested capital has been trending around 10%.

Financial track record over the past decade (American Tower Investor Relations)

American Tower is well known for its quarterly dividend raises. The most recent raise was announced on December 8th as the quarterly dividend payment was increased with 6.1% to $1.56 per share.

The company started with quarterly raises in Q1 2012. Between Q1 of 2012 and Q4 of 2022, the quarterly dividend has grown from $0.21 to $1.56 per share – a 20.5% CAGR! I think this growth rate will decline as the pay-out ratio is increasing, but with future AFFO growth there is plenty of room to continue the dividend growth streak.

Growth will continue in the future

So will growth continue in the coming decades? For me the answer is a definite yes. Geographically, I think the company will keep focussing on Asia-Pacific, Europe, and especially Africa for future acquisitions/constructions of new sites. In all regions growth will be driven by a combination of organic tenant billings growth at existing communication sites, and adding new communications sites through construction and/or acquisition.

Organic tenants billings growth

The long-term tenant lease contracts include rent escalations. This could be a fixed percentage (averaging approximately 3% in the U.S.), an inflationary index (applicable in most international markets), or a combination of both. Moreover, it is highly likely that tenants will continue to expand their equipment on existing towers. The increase in the number of mobile-connected devices and data usage per device drives the trend for more equipment per tower structure.

Communication site growth

The ongoing transition from 4G to 5G in American Tower’s ‘advanced markets’ (e.g. U.S., Canada, France, Germany) and some of the ‘evolving markets’ (e.g. Argentina, Brazil, Poland, South Africa), requires a densification of communication sites. 5G operates at a higher-frequency spectrum which covers shorter distances. To maintain adequate coverage of an area, new cell sites are required between original sites. Besides cell towers, there are more densification solutions such as indoor/outdoor distributed antenna systems and rooftop locations.

In American Tower’s ’emerging markets’ (e.g. Bangladesh, Burkina Faso, Paraguay) there is still a general demand for communication infrastructure to realize nation-wide wireless coverage.

While the drivers for new sites are very country-specific, it is safe to say that there is a general demand to build new communication sites in all regions.

Current growth outlook from management

Management briefly mentioned their multi-year targets during the Q4 2021 earnings call. They think that the company is on track to deliver at least 10% growth annually in AFFO per share through 2027. I think that this deceleration in growth is realistic as the company is growing bigger and bigger. Still, double-digit growth on average is very decent and I would be very pleased if the company can achieve that.

Valuation

There is a lot to like about American Tower, but the question is what share price would be attractive for investors to add some shares. In the following, I will use two methods to assess whether American Tower stock is currently overvalued or undervalued.

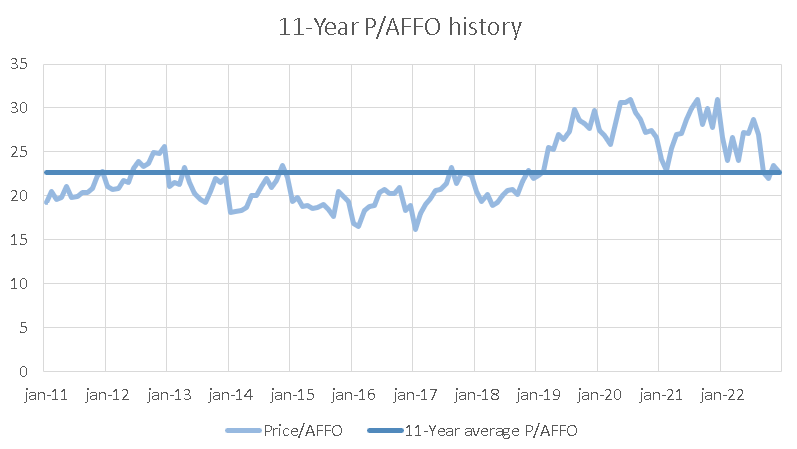

Let’s first take a look at the Price to AFFO ratio. I have plotted that P/AFFO history over the past eleven years in the graph below. The average P/AFFO ratio over the whole period is 22.7x. During the three most recent years, the valuation multiple was quite elevated. The share price of American Tower has been declining since September last year, and the P/AFFO ratio showed a similar trend. Currently, the stock is valued at a P/AFFO ratio of 19.5x for the next fiscal year 2023. This is significantly below the 11-year average multiple.

P/AFFO history and average P/AFFO ratio (Author)

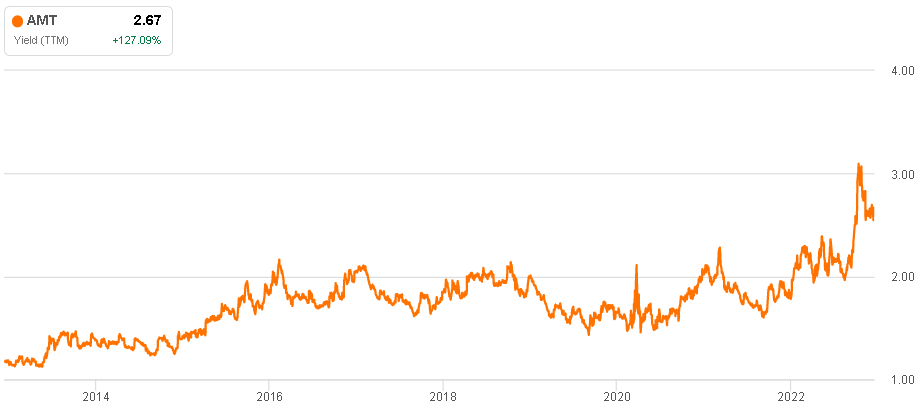

We can also consider the historical dividend yield. The following graph shows the dividend yield for American Tower since December 2012. Currently, investors can pick up shares of American Tower at a starting dividend yield of 2.9% (including the most recent dividend increase). This is well above the long-term average dividend yield.

Dividend yield history for American Tower (SeekingAlpha)

Both P/AFFO ratio and dividend yield suggest that shares of American Tower are attractively valued. It is true that a slowdown in growth and increasing interest rates justify a lower valuation multiple. But, the combination of a starting dividend yield around 2.9%, a quarterly growing dividend, and double-digit AFFO per share growth through FY2027 offers potential for double-digit total returns by buying the stock now.

Risks to consider

This article would not be complete without addressing the risks that could jeopardize the investment thesis. I will address four general risks for American Tower.

- Higher interest rates: American Tower has performed very well during the past ten years, but interest rates were pretty low during the majority of this period. Currently, interest rates are still on the rise and it remains uncertain if and/or when the FED will start lowering rates again. Higher interest rates affect REITs like American Tower as it becomes more expensive to fund investments, and thus further expand in growth regions such as Africa.

- Leverage has been increasing: Net debt has increased significantly over the past decade. I don’t think this is a big problem per se as the EBITDA has also increased strongly, but a higher leverage ratio offers less flexibility for new investments in emerging markets. Luckily, American Tower has been lowering net debt in the most recent quarters and net leverage has decreased from 6.8x in Q4 2021 to 5.5x in Q3 2022. I hope the company will continue to de-lever back into the 3-5x target range.

- The law of large numbers: I already mentioned that American Tower is growing bigger and bigger every year. To maintain a certain level of growth requires a larger number of revenue every year. As a result, it requires larger acquisitions to have a material impact on the financial results. It is not more than logical that growth will slow down and management acknowledges that. On the positive side, the tower market is far from saturated and there are plenty of opportunities for organic growth.

- Disruptive technologies: Communication sites are an essential part of today’s basic infrastructure. However, the role of telecom towers could change in the future. A much-discussed topic is the threat of satellites to the cell tower business. Currently, it does not seem that satellites could replace cell towers, but nobody knows how this or other potential disruptive technologies will develop in the future.

Final thoughts

American Tower is a perfect example of a simple business that generates outstanding financial results. The company has transformed from a U.S.-focussed business to a true international superpower in the communication sites sector. Shareholders have been rewarded with total returns well in the double-digits over the past decade.

I think that growth is likely to continue at a high-single-digit to low-double-digit rate through a combination of organic growth and new site constructions/acquisitions. From my perspective, Africa will remain the largest growth opportunity in the coming decades. Management has acknowledged that as property revenue exposure to Africa has grown to over 11%. This percentage will only continue to increase driven by demographic and economic trends in the region.

While investors should keep a close eye on the risks I addressed, I believe that now is a good moment to start adding shares. The stock is undervalued based on the historical P/AFFO ratio and dividend yield, so I rate American Tower stock a ‘buy’.

Happy investing!

Be the first to comment