z1b

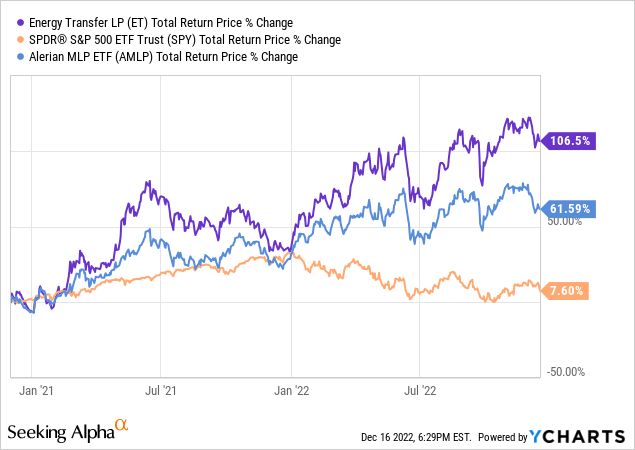

Energy midstream infrastructure giant Energy Transfer (NYSE:ET) has generated phenomenal total returns since we bought it in December 2020, including year-to-date, crushing both the broader midstream sector (AMLP) and the S&P 500 (SPY) over that span:

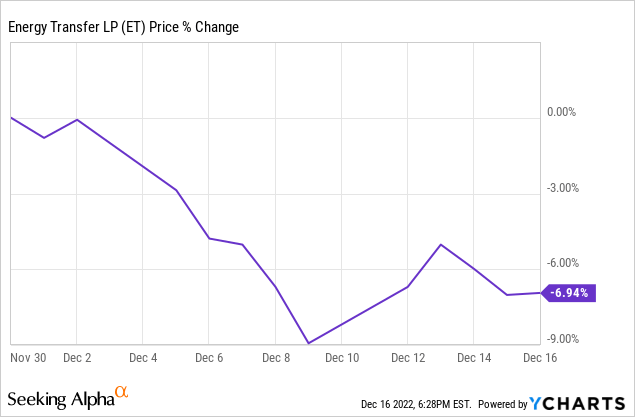

However, in recent weeks the ET unit price has pulled back somewhat with a mini dip in the unit price:

In this article, we share several reasons why investors will regret not buying this dip while it lasts.

#1. The Energy Bull Market Is Just Getting Started

While ET has obviously benefited from the strong energy bull market this year, we believe these macro tailwinds for ET’s total returns are just getting started. Oil supplies are tight and likely to remain so for the foreseeable future as years of underinvestment in production have led to a problem that will likely take years to correct itself. This situation is further exasperated by the facts that two of the world’s leading oil exporters – Russia and the Middle East – remain very geopolitically volatile and even Saudi Arabia is increasingly cozying up to American adversaries like China. On top of that, China is beginning to re-open from its tyrannical COVID-19 lockdowns, which will likely increase demand for energy as well.

Another major catalyst for ET in particular is the growing global demand for LNG. Thanks to Russia’s incursion into Ukraine, Europe is increasingly trying to free itself from dependency on Russian energy. As a result, there is growing demand for LNG from places like North America, a market that ET is well-positioned to fill.

Some concrete steps that it is taking to profit from this trend are completing its LNG export facility in addition to its Lake Charles LNG import and regasification plant. In addition, it has already signed numerous agreements to supply LNG to foreign buyers, and this trend seems likely to continue. All of this indicates that ET should enjoy some meaningful growth tailwinds for the foreseeable future which should continue to drive its total returns higher.

#2. The Distribution Yield Alone Provides Alpha

ET’s current distribution is $0.2650 quarterly ($1.06 annualized), good for a hefty 9.1% distribution yield. On top of that, management has repeatedly emphasized throughout this past year that restoring the quarterly distribution to the $0.305 quarterly level is a top priority and – with the analyst consensus estimating $2.63 in distributable cash flow in 2023 – they should be easily able to hit that quarterly payout level in the first quarter of 2023 and still have more than 2x coverage of the distribution for the full year. This would leave them with plenty of cash left over for fully funding CapEx and continuing to pay down debt as well.

Furthermore, their recent distribution growth trajectory has seen the quarterly payout rise from $0.1525 in each quarter in 2021 to $0.175, $0.20, $0.23, and $0.265 in 2022. This means they just need one more hike of $0.04 to reach their quarterly payout objective and this is a natural acceleration from their quarter increases of $0.0225, $0.025, $0.03, and $0.035. As a result, all signals point to their next distribution being $0.305. This would be a 10.5% distribution yield on current cost, which roughly equates to the average annualized return of the S&P 500 (SPY), is tax deferred, and does not even take into account the even larger amount of retained distributable cash flow that ET can use to pay down debt, invest in growth opportunities, and even buy back units.

Last, but not least, keep in mind that forward returns for the SPY are expected to be below average given that economic growth is slowing, valuations are above historical norms, and interest rates are still rising, so ET’s distribution yield will very likely be more than enough to lead to outperformance for ET unitholders even without any additional unit price appreciation (though we expect that to kick in as well).

#3. Additional Multiple Expansion Is Highly Likely

Last, but not least, ET is poised to generate very strong total returns via multiple expansion in the coming months and years. The reasons for this are:

First and foremost, ET remains meaningfully undervalued relative to industry peers and its own history despite being at its strongest fundamentally in a long time. This valuation disconnect is quite evident from the following table:

| Investment Grade Midstream | EV/EBITDA | P/DCF |

| ET | 7.50x | 4.43x |

| ET (5-Yr Average) | 8.87x | |

| EPD | 8.94x | 6.84x |

| MMP | 10.41x | 8.72x |

| MPLX | 9.29x | 6.79x |

| ENB | 12.32x | 9.47x |

| KMI | 9.66x | 8.11x |

| OKE | 10.88x | 9.73x |

| PAA | 8.71x | 4.83x |

| WMB | 9.77x | 8.74x |

Second, interest rates are likely nearing their peak and odds are increasingly favoring a return to Fed easing in the not-too-distant future. Given that a recession is likely coming – if not already here – and that the last several months of CPI numbers reflect decelerating inflation, the Federal Reserve is likely to cease interest rate hikes next year and could very possibly pivot towards rate cuts shortly thereafter.

Third, as it continues to pay down debt rapidly, the equity portion of its enterprise value should increase accordingly leading to a higher P/DCF multiple. This is exactly what management intends to do as well, stating on their latest earnings call:

we’re clearly looking at paying down as much [debt] as we can…you nailed it when you said looking at trying to pay down as much as we can of [2023 debt maturities] if not moving some of it to the revolver only because when you look out over the remainder of the year and you see what the free cash flow continues throughout the year, we have a lot of financial flexibility right now is the way I’d like to leave that, and we’re going to play the best options we can of reaching all the targets that we’re going after.

Fourth, once its distribution yield reaches its pre-cut level – likely early next year – the market will probably reprice ET units higher given that it is widely viewed as an income instrument.

Last, but not least, if/when it earns a credit rating upgrade and the market increasingly believes in the new and improved ET capital allocation model, it will likely earn a higher valuation multiple. Management has already indicated that based on their conversations with credit ratings agencies, they expect to achieve a credit rating upgrade in the not-too-distant future as they continue to deleverage. On their Q3 earnings call they stated:

Pretty much all 3 agencies put out there that you get to that closer towards maybe the lower end of that range [of 4 to 4.5 times leverage], you’re now looking at upgrades and that is important to us. We really do want to continue to get into that 4, 4.5 and get into that next higher notch on the rating agencies. All the dialogue we had with them has been very constructive, by the way. We think that they hear us. We think we’ve got a lot of credibility with them. And we’re going to continue to have this dialogue with them.

Investor Takeaway

ET has been on a tremendous run over the past two years, helping our portfolio on its way to massively outperforming Mr. Market over that span. Moving forward, we expect ET to continue to deliver outperformance due to a combination of sustained bullish conditions in the energy market, a very attractive distribution with an expected double-digit yield on current cost, and meaningful valuation multiple expansion.

That said, no investment is risk-free and ET is no exception. The primary risk facing the company is that we go into a deep and prolonged global recession, causing demand for energy to decline sharply. This will obviously hurt ET’s growth prospects in the short-term and also weaken its re-contracting position and therefore its cash flows in the medium to longer term. Another risk still lingering over the company is that founder and Executive Chairman Kelcy Warren will resume his reckless trigger-happy investment and acquisition habits from before, potentially weakening the balance sheet and destroying unitholder value in the process. A warning sign that this could be on the horizon took place back on the Q2 earnings call. Management said that – once the leverage target is achieved – they would look at increasing growth spending:

I think it’s very important to note with all the projects we’re talking about right now that are very good, high-returning projects. We’re going to continue to look at that… and we’ll have a good, healthy discussion internally here with our Executive Chairman as well with our Board as we continue to focus on that… [We] expect our strong coverage and balance sheet strength to allow us to further prioritize growth within our capital allocation strategy… We also continue to evaluate opportunities in the petrochemical space, which would include developing a project along the Gulf Coast as well as potential M&A opportunities… Kelcy gave us the directive that we need to step in to petchem, we certainly are doing that… from an M&A perspective, anything that’s for sale, we’ll take a look at pretty much like anything in the industry.

That said, as already discussed in this article, we were reassured of management’s commitment to a credit rating upgrade in the not-too-distant future and are confident that they will stay on course for deleveraging and will be more disciplined with any future growth investments.

As a result, we remain very bullish on ET and hold it as one of our largest positions at the moment. We think that the latest dip in the unit price presents an attractive buying opportunity as one of our top energy sector picks.

Be the first to comment