Matt Winkelmeyer/Getty Images Entertainment

Investment Thesis

Spotify (NYSE:SPOT) is the world’s number one music streaming platform, and it has kept this position despite intense competition from the likes of Apple (AAPL). In fact, it has overtaken Apple Podcasts as the top podcast platform in the US, and across many other markets.

The company operates a freemium business model, and gives users the option to opt for either its Premium or Ad-Supported Service. The Premium service offers unlimited, ad-free streaming for a monthly subscription fee, whereas the Ad-Supported tier is free, but gives users limited on-demand access to Spotify & is interrupted with advertisements. It also serves as a great acquisition channel for the Premium Service, whilst substantially reducing the barriers for people who want to use Spotify but do not wish the pay the subscription fee.

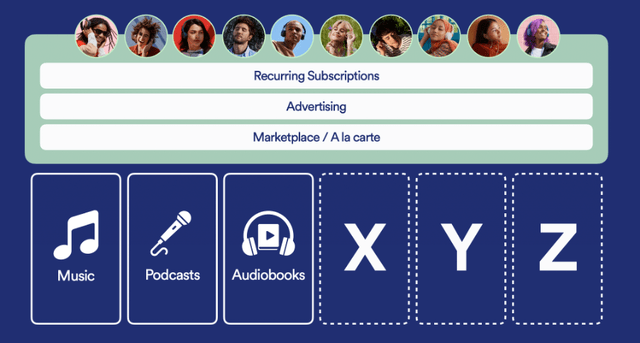

As I laid out in my previous article, my investment thesis for Spotify involves the platform evolving beyond music, since royalty fees eat up the bulk of revenue – this is just the nature of the industry. It has already become a global leader in the podcast space, with long-term gross margins from Podcasting expected to hit 40%-50% according to their latest Investor Day presentation – that’s compared with Music gross profits, which are only expected to hit 35% in the long term.

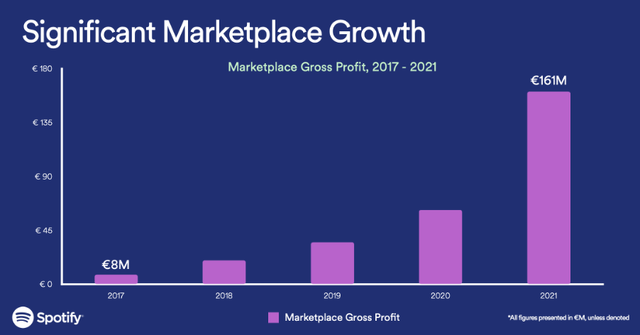

Spotify is also seeing substantial growth with Spotify for Artists, a new revenue stream which is basically an advertising platform that artists can use to have their songs recommended to Spotify listeners. It only made up 6% of Spotify’s gross profit in 2021, but it’s a fast-growing part of the company that should see 30% growth in 2022 according to the Investor Day presentation.

The company recently outlined its plan to enter the audiobooks market, as well as additional goals to dive into multiple new verticals over the upcoming decade.

Spotify 2022 Investor Day Presentation

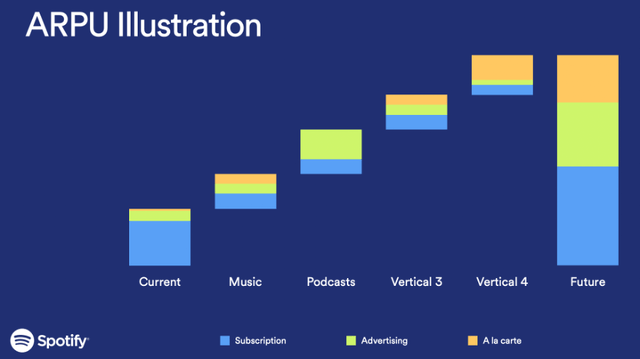

The heart of my investing thesis is the following: Spotify is a global audio leader, and has a huge existing and growing user base that it can monetize more effectively. Its Music segment is hampered by the royalty fees, so Spotify’s ability to offer new non-Music services to this existing base of listeners should boost both ARPU and margins.

Spotify 2022 Investor Presentation

Earnings Overview

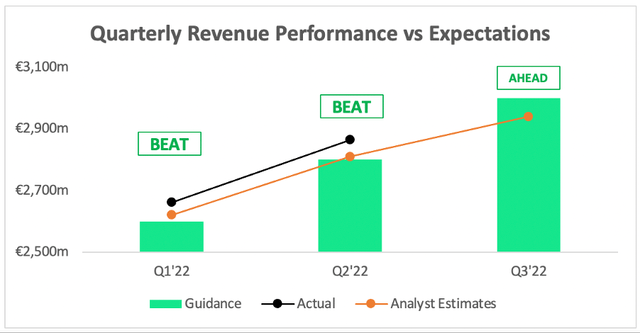

Spotify reported total revenue of €2,864m in Q2’22, up +23% YoY and an impressive +8% QoQ. This was ahead of their own €2.8b guidance, and also beat analysts’ estimates of €2.81b by a pretty good margin. Furthermore, their forward guidance for Q3’22 of €3.0b also came in ahead of estimates, with analysts expecting €2.94b.

Investing.com / Spotify / Excel

Investors should be undoubtedly pleased with these revenue beats across the board.

Spotify doesn’t give EPS guidance, but EPS of -€0.85 fell below analysts’ estimates of -€0.64. Whilst EPS isn’t that important to Spotify right now (it isn’t a company optimized for profitability), it is still worth highlighting the drivers behind this.

Operating expenses increased 38% YoY (or 28% in constant currency) driven by Spotify’s expansion of its global ad sales team, as well as the impact of acquisitions. We can see that exchange rates played a big part in the increase, accounting for almost 1,000 basis points, as the euro continues to weaken substantially against the US dollar.

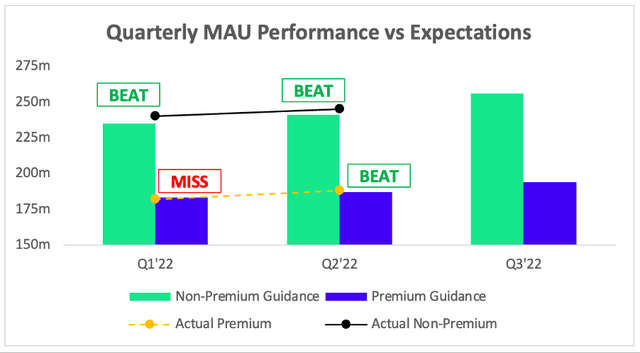

Some positive news came Spotify’s Ad-Supported MAUs and Premium Subscriber numbers, both of which came in ahead of expectations. The company added 19 million new MAUs in the quarter, representing its largest ever Q2 MAU growth in absolute terms.

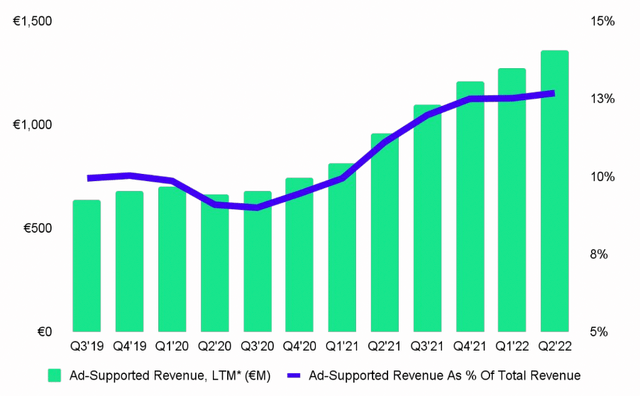

Revenue Growth Led by Advertising

As mentioned, my thesis for Spotify involves the company getting as far away as possible from its reliance on royalty income. If it can boost its ad-supported income and get users moving away from music, then this just might happen – and that’s what I can see here, with 31% YoY growth for advertising revenue being one of the biggest drivers of revenue growth this quarter. In fact, it continues to become a more and more substantial part of Spotify’s overall revenue, and now makes up ~13%.

Spotify Q2’22 Shareholder Deck

Revenue generated from its Premium Subscribers also grew 22% YoY, reflecting a combination of both subscriber growth and ARPU expansion. Excluding the impact of FX, ARPU was primarily boosted by price increases over the prior year.

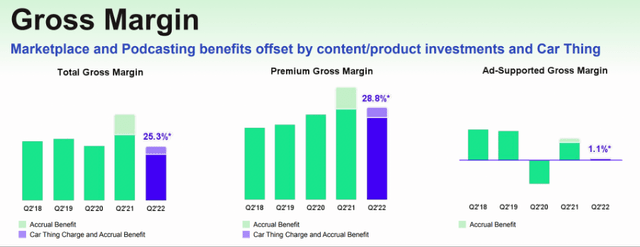

Perhaps the biggest concern for Spotify investors is the decrease in gross profit margins, which were at 24.6% vs 28.4% one year ago. Part of this is due to the decision to stop manufacturing Spotify Car Thing, resulting in a €31m charge – but even excluding that charge, adjusted gross profit was just 25.3%. This might appear to be an issue on the face of it, but I’m going to turn it into a positive (perhaps I’m just an optimist).

Spotify Q2’22 Shareholder Deck

The fall was driven by increased spend in non-music content and product enhancement, both of which are required for my Spotify thesis to succeed. It was also driven by increased publishing rates, which is less than ideal and I expect this to be addressed on the earnings call – now is a good time to highlight that the earnings call isn’t out yet, and I will add any additional takeaways from the earnings call to a pinned comment at the bottom of this article.

Some additional good news is that continued growth in its Spotify for Artists activities and a favorable revenue mix shift towards podcasting actually helped to boost gross profit margins, offsetting some of the additional costs incurred. Again, this move away from Music is exactly what I’m looking for.

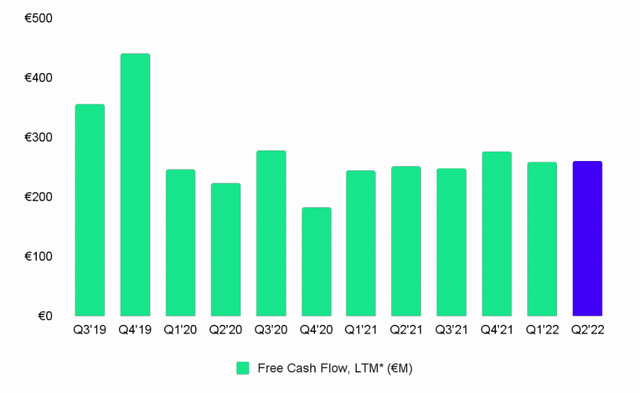

Sticking to the financials, I’m also pleased to see that Spotify has remained free cash flow positive for the 9th quarter in row. When it comes to fast-growing, unprofitable businesses, positive free cash flow is key and makes for a much more stable company – even when net income is negative.

Spotify Q2’22 Shareholder Deck

Continued Growth Beyond Music

Spotify for Artists saw strong demand continue this quarter, with triple digital YoY growth in total campaign volume for Sponsored Recommendations. The company continues to expand its offering throughout the globe, with US-based teams now able to promote new releases outside of the US in 13 new markets, including 7 of the 10 largest streaming markets in the world. In Spotify’s investor day presentation, the growth of this segment was highlighted and is something I’m watching very closely.

Spotify 2022 Investor Day Presentation

Spotify also continued to see Podcasting growth, with the number of MAUs that engaged with podcasts growing ‘in the substantial double-digits’ YoY range, and the number of users listening to podcasts are expected to continue rising.

The expansion away from Music continued, as Spotify closed on its Findaway acquisition in the quarter. According to Spotify’s Q2’22 presentation:

Findaway works across the entire audiobook ecosystem with a platform and offerings that serve authors, publishers and consumers. Their technology will help Spotify accelerate its entrance into the audiobooks market.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Spotify is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

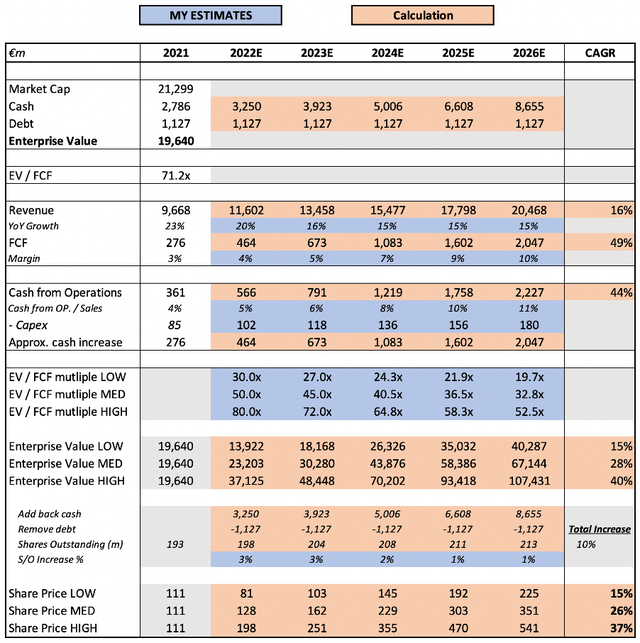

My original assumptions for this model are explained in my previous article, and I made the following changes after these Q2’22 results and the guidance provided:

- YoY revenue growth increased from 19% to 20%, following a beat on revenue guidance and an outlook ahead of analyst expectations

- Updated market capitalization, cash, and debt to reflect the current position of the company. Market capitalization is reflective of Spotify’s pre-market price at the time of writing.

Put all that together, and I can see Spotify shares achieving a 28% CAGR through to 2026 in my mid-range scenario. Accordingly, I believe Spotify’s shares to be substantially undervalued right now.

Thesis: On Track

I view this as a pretty strong quarter for Spotify. Not only did they beat substantially on revenue, but there is also evidence that the company is successfully moving away from the royalty-constrained music industry. Margin pressures are a concern, but I am personally satisfied with the explanations offered by management; I think I would be more troubled if the rest of the business was not performing so successfully.

Given everything in this quarter, I am happy to say that my thesis for Spotify is firmly on track, and reiterate my ‘Buy’ rating.

Be the first to comment