P_Wei

The Vanguard Mega Cap Growth ETF (NYSEARCA:MGK) gives investors relatively concentrated exposure to the United States’ largest and fastest-growing companies. The fund has not weathered the bear market very well and is down 19.5% year to date. However, MGK has rallied off the lows in June and the top holdings in the fund have performed well both operationally and financially. That being the case, investors who may find themselves underweight U.S. large-cap growth stocks may want to consider initiating a position in MGK or adding to an existing position.

Investment Thesis

The MGK ETF is designed to track the Center for Research in Security Prices (“CRSP”) Mega-Cap Growth Index. CRSP is an affiliate of the University of Chicago Booth School of Business and classifies growth stocks using the following metrics:

- future long-term growth in earnings per share

- future short-term growth in earnings per share

- 3-year historical growth in earnings per share

- 3-year historical growth in sales per share

- current investment-to-assets ratio, and

- return on assets

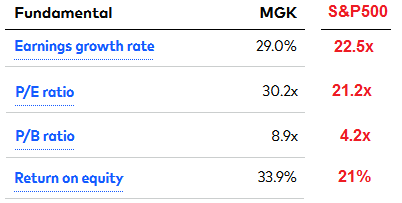

Given the CRSP index screening metrics shown above, it is not surprising to see that the MGK portfolio grows faster than the S&P 500 and, as a result, has a premium valuation as well:

Data from Vanguard, www.multpl.com, Ed Yardeni, CSIMarket

Given the bear market, it is therefore not too surprising that the MGK ETF has underperformed the S&P 500 by ~7.8% YTD. However, since the June lows note that MGK has outperformed the S&P 500 by ~2.6%. That being the case, if the market continues to struggle given the many macro-environment headwinds, the MGK ETF will likely lag the S&P 500. However, once the market turns around and heads higher (as it always does), MGK will likely lead the S&P 500.

So, let’s take a closer look at the MGK ETF and see how it has positioned investors for success going forward.

Top 10 Holdings

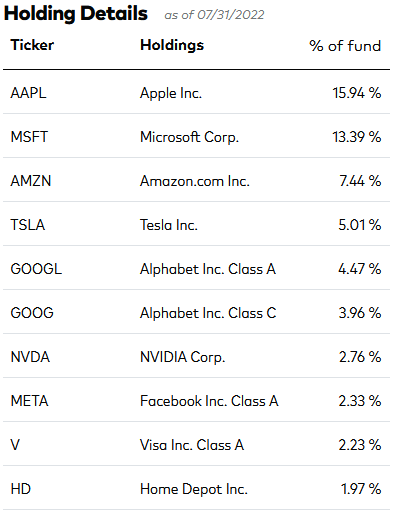

The top 10 holdings are shown below and equate to what I consider to be a relatively high concentration (~60%) of the entire 99 company portfolio:

Vanguard MGK ETF Webpage

Apple (AAPL) and Microsoft (MSFT) are the top-two holdings and, in aggregate, equate to a little over 29% of the entire portfolio – and I cannot argue with that. Apple obviously has a very strong global brand and a well-diversified portfolio of products (iPhone, iPad, Mac, Wearables, Eco-system). Microsoft’s recent Q4 FY22 EPS report was strong:

- Revenue of $51.9 billion, +12% yoy (up 16% in constant currency)

- Operating income of $20.5 billion, +8% (up 14% in constant currency)

- EPS of $2.23, +3% (up 8% in constant currency)

- Azure and other cloud services revenue were up 40% yoy

If we count both classes of Google (GOOG) (GOOGL) stock, it is the #3 holding with an 8.4% weight. Google announced a very strong Q2 FY22 EPS report:

- Revenue of $69.7 billion was up 13% yoy (16% in constant currency)

- EPS of $1.21/share (down $0.15 yoy)

- Generated free-cash-flow of $12.6 billion

- Ended the quarter with $125 billion in cash (an estimated $9.40/share), and that’s even after spending $15.2 billion on stock repurchases during the quarter

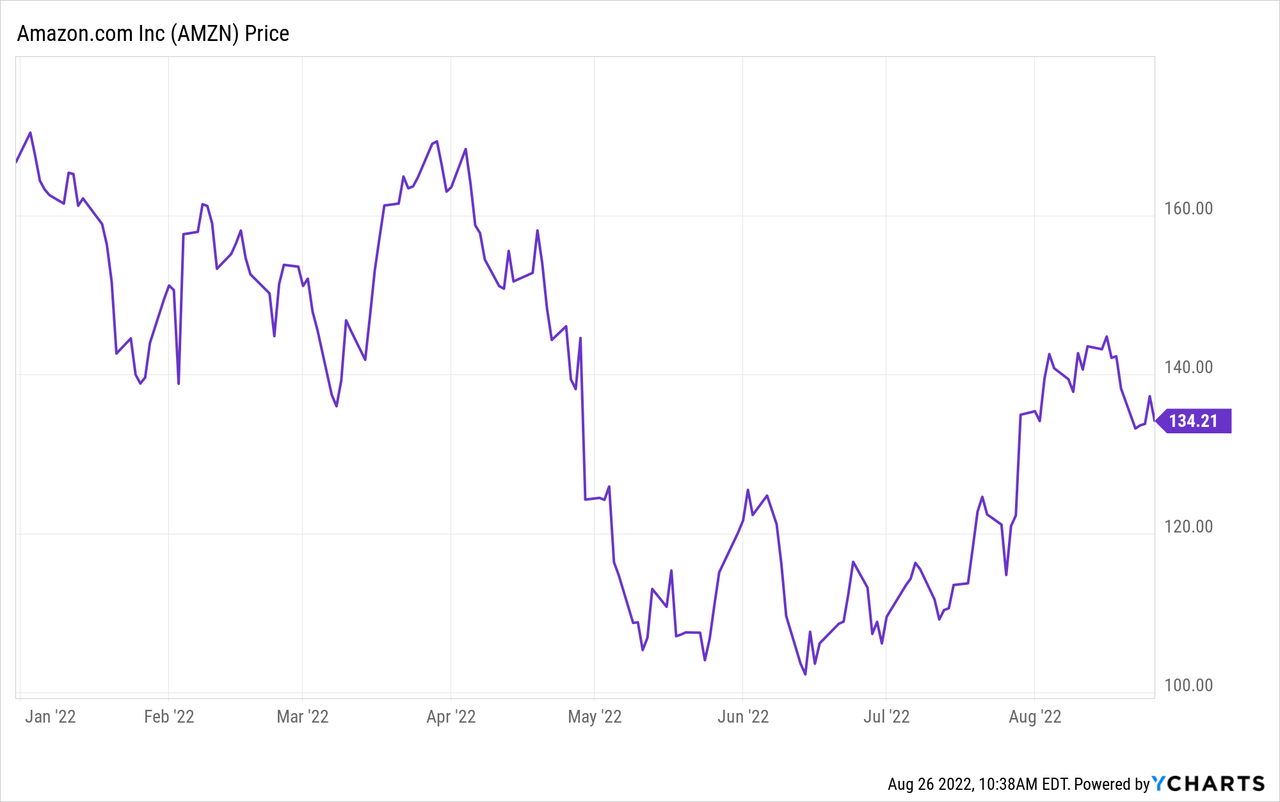

Amazon (AMZN) has a 7.4% weight in the MGK ETF and rallied sharply off the June lows before the recent pull-back:

MGK has a 5% allocation in Tesla (TSLA), which is now trading post the 3-1 stock split which took place yesterday (Thursday, Aug 25th). Tesla is up 25% over the past year, despite CEO Elon Musk’s self-inflicted drama with Twitter (TWTR).

Nvidia (NVDA) is the #7 holding with a 2.8% weight. Nvidia is seeing a slow-down in its graphics & crypto markets and has issued reduced guidance for two straight quarters. As a result, the stock is down 20%+ over the past year, yet still carries a rather lofty forward P/E of 52.5x.

Home Depot (HD) rounds out the top 10 with a 2% weight. Home Depot stock has performed quite well during the bear market and is down only 3.3% over the past year. The stock yields 2.3% and trades at a forward P/E of only 18.7x.

Overall, the MGK portfolio is, unsurprisingly, very concentrated in two sectors:

- Technology (52.1%)

- Consumer Discretionary (25.8%)

That being the case, investors already overweight in these two sectors, and looking to build and maintain a well-diversified portfolio, should think twice about adding to a position in MGK.

Performance

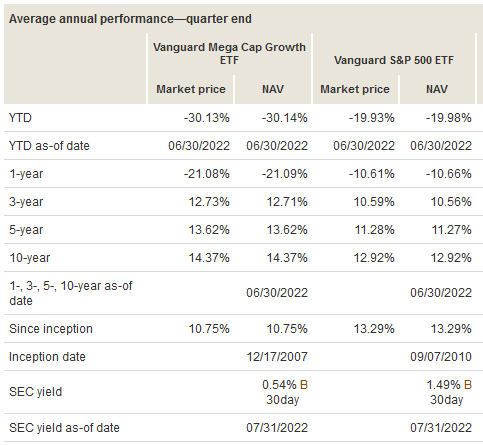

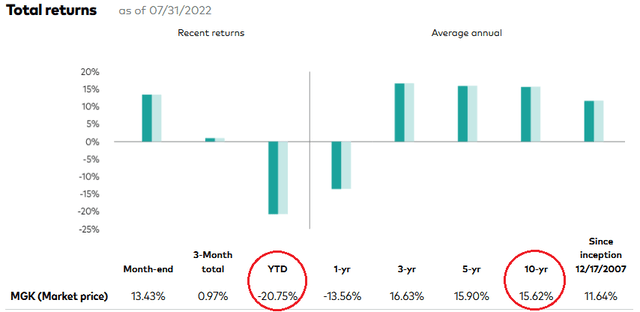

The performance track record of the MGK ETF is shown below:

Granted, near-term performance has been lousy, but investors who have held this ETF over the past decade have enjoyed a 15.6% average annual return and have outperformed the broad market as measured by the S&P 500.

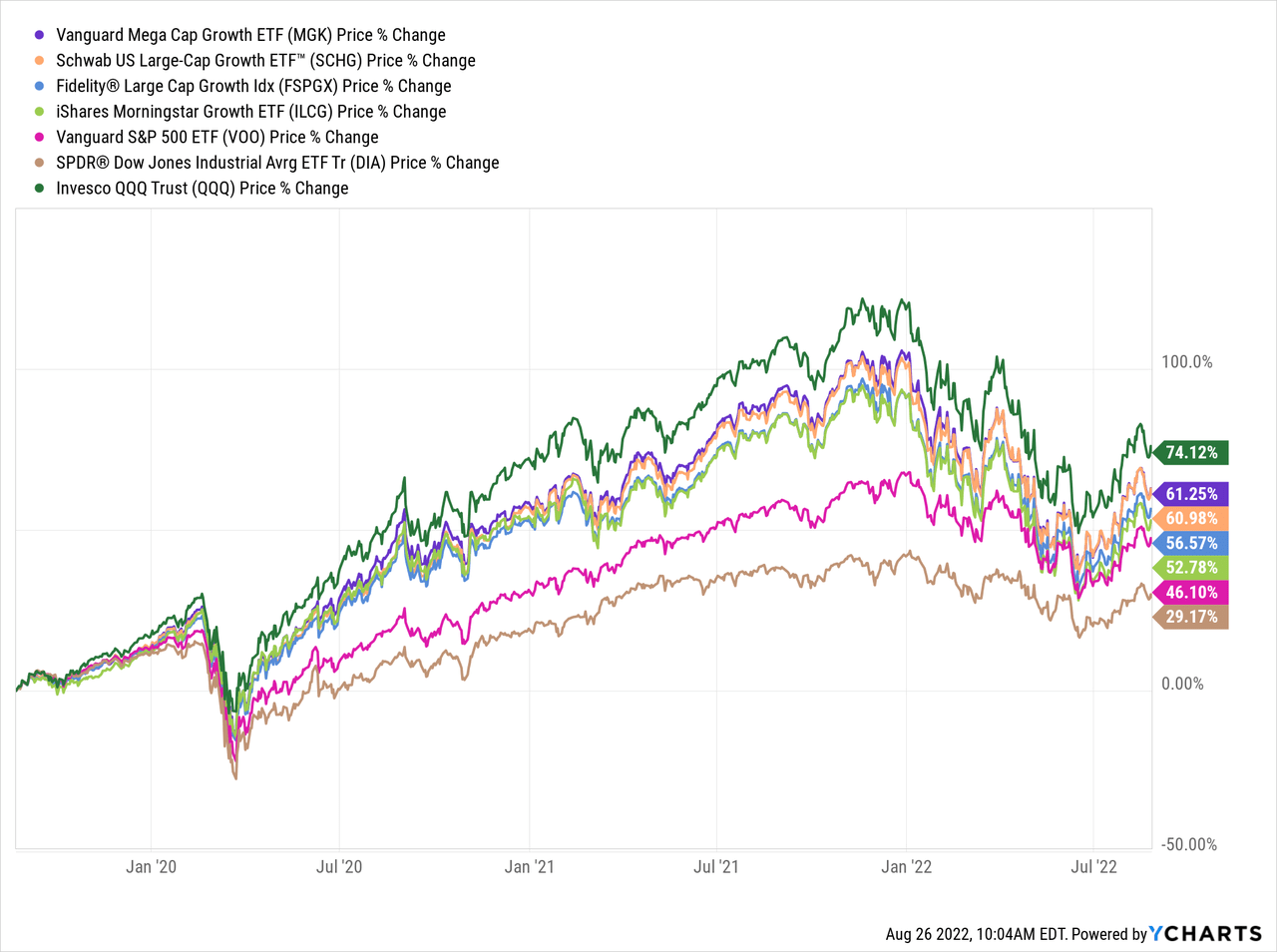

The following graphic compares the three-year performance of the MGK ETF against competitors the Schwab U.S. Large-Cap Growth ETF (SCHG), the Fidelity Large Cap Growth Index Fund (FSPGX), the iShares Morningstar Large-Cap Growth ETF (ILCG), and the broad market averages as represented by the (VOO), (DIA), and (QQQ) ETFs:

As can be seen by the graphic, the MGK ETF trails only the triple Qs and has outperformed its peers and outperformed the S&P 500 by ~15%.

Over the long-term, and despite a higher expense ratio and a near 1% lower yield, the MGK ETF has outperformed the S&P 500 as measured by its sister fund, the Vanguard S&P 500 ETF:

Vanguard Fund Compare Tool

That being the case, the MGK ETF appears to be a good choice for investors wanting to construct a well-diversified portfolio built for the long-term and would like to beat the market (as measured by the S&P 500).

Risks

The MGK is not immune to the many headwinds of the current macro-environment. These include the lingering and negative impact of Covid-19 shut-downs and supply-chain disruptions, high inflation, the potential for higher interest rates, foreign-exchange headwinds due to the strong US dollar, and the impact of Putin’s horrific war-of-choice on Ukraine which, in combination with the sanctions placed on Russia by the United States and its Democratic & NATO allies, has effectively broken the global energy & food supply-chains. Any or all of these factors could cause a slowdown in the domestic and/or global economy or lead to a severe recession that would put downward pressure on the MGK share price.

If the EPS growth rate of the major holdings in the MGK ETF begins to slow, the stock might also be hit with a valuation (i.e., multiple) downgrade. That would be a one-two punch and is one reason the YTD performance of the MGK ETF has lagged that of the S&P 500.

One could argue that governmental regulation risks are substantial given the size and dominance of some of the companies within the MGK ETF. I don’t subscribe to that argument as my belief is that companies like Amazon and Google would actually be more highly valued if they were to spin-off operations such as AWS or GCP.

Summary & Conclusion

I like the MGK ETF. Like most Vanguard funds, it is reasonably cost-efficient. By holding only the cream-of-the-crop in the US markets, MGK’s long-term track record has beaten that of the S&P 500 and, I believe, that will continue over the next decade as well. Given the 0.54% yield, the primary investment opportunity in MGK is clearly capital appreciation, not income. MGK is a BUY. That said, investors should look for opportunistic buy points given recent market volatility. In my opinion, averaging into the MGK slowly over time is the best strategy to achieve your ultimate allocation goal.

Be the first to comment