Spencer Platt

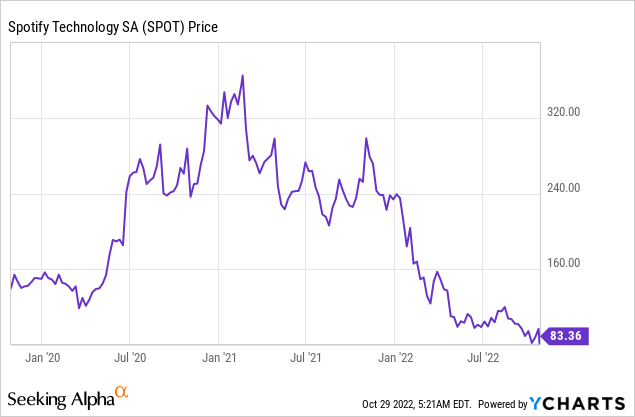

Spotify (NYSE:SPOT) is the world’s largest music streaming platform. The company owns the world’s most popular podcast (Joe Rogan experience), has extremely low “churn” and is still growing steadily. Despite these factors, its stock price has been butchered by ~77% since its all-time highs in February 2021. This was mainly driven by the high inflation and rising interest rate environment which caused a cyclical move out of “growth stocks” and into “value stocks”. The company recently announced its third quarter financial results and beat analyst expectations for revenue growth. Thus in this post, I’m going to break down the company earnings in granular detail and reveal its valuation, let’s dive in.

Third Quarter Breakdown

User Metrics

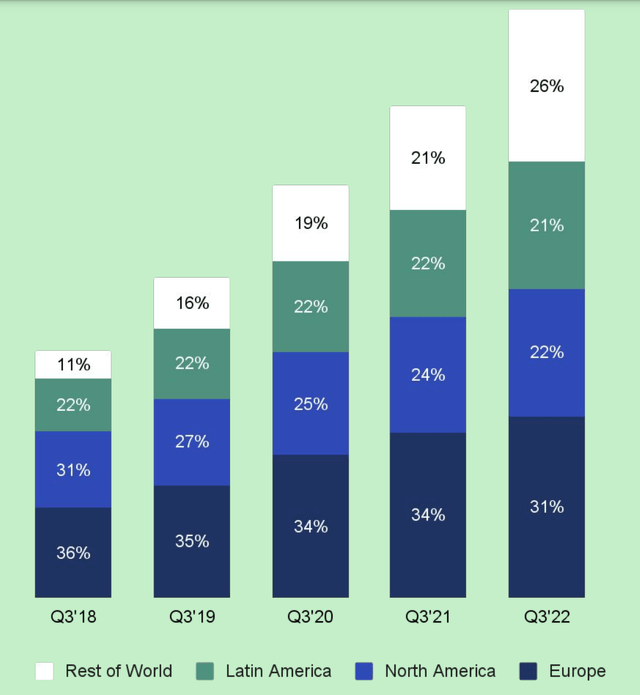

Spotify generated solid user growth in the third quarter of 2022. Monthly Active Users grew to 456 million which surpassed guidance by 6 million and was the largest third quarter in history. This growth was driven by strong tailwinds across Latin America, which was driven by marketing campaigns and OEM strength. The company also experienced a better-than-expected intake in India, which was driven by a marketing activation and reactivation campaign. The exit from Russia did offset some of the trailing 12-month results slightly, but excluding this, year-to-date net additions were at a record high.

Spotify Monthly Active Users (Q3 Earnings)

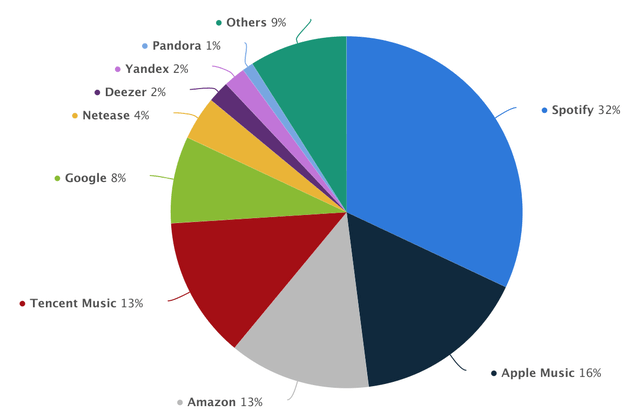

Premium Subscribers increased by 13% Y/Y 195 million, which surpassed guidance by 1 million and was driven by strong growth across Latin America. The company also highlighted strength in User plans. It was surprising to see Spotify still growing its user base well, as there is concern about the increasing competition from rivals such as Apple Music, YouTube Premium, and Amazon Prime Music (more on this in the “Risks” section). The latest market share data I can find online (from 2021) shows Spotify is the dominant music streaming service and has ~32% market share. Given the recent growth this quarter, I imagine the results to be similar as we enter 2022. Apple Music has the second largest market share at 16% and Amazon Prime Music at 13%.

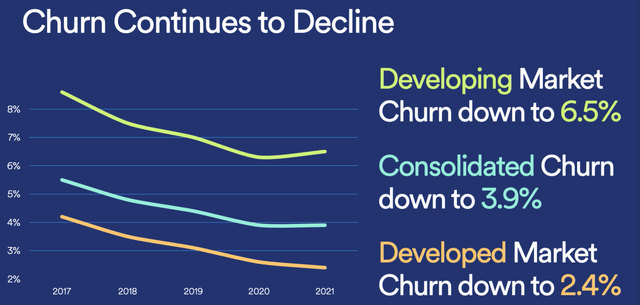

In previous posts on Spotify, I discussed how Spotify focuses on increasing the Lifetime Value [LTV] of its customers. This is a common metric used in acquisition marketing to help assess what is the average value of a customer who stays with the platform. Spotify’s platform is highly “sticky” due to high retention and low “churn”. Churn is the percentage of users who are canceling subscriptions and leaving the platform. In Marketing, a software product with high churn would be classed as a “leaky” bucket or customer funnel. In Spotify’s case, the company has an extremely low churn of ~6.5% in developing markets and 2.4% in Developed markets. In the third quarter earnings call, management alluded to Price increases in response to competitor (Apple Music and YouTube Music) price increases. Spotify believes it has “significant pricing power” and the company has done 46 price increases in the past two years with no major impact on churn. Spotify costs just $9.99 per month in the US, Duo packages are just $12.99 and Family Packages are $15.99 per month. In my eyes, this is extremely cheap and offers significant room for price increases, which means great revenue. Apple Music’s equivalent plan is $10.99 per month, thus slightly cheaper. Although the company does offer much cheaper plans ($4.99) with a lower music selection. In this category, I don’t believe customers actually compare prices (as most platforms are fairly cheap). I believe the customer choice comes down to the distribution channel (Apple/Android), prior preferences, word of mouth, and advertising. As Spotify had a solid first-mover advantage and has captured the most market share, the company is in a strong position.

Churn Spotify (investor presentation)

Financials

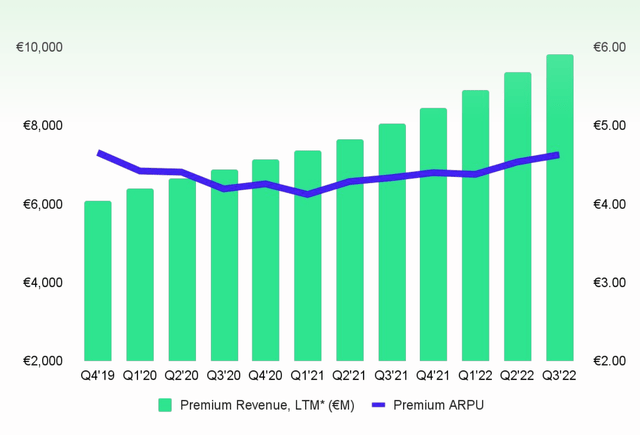

Diving into the financials for the third quarter of 2022, Spotify generated $3.03 billion in revenue which increased by 21% year over year and beat analyst expectations by $46.59 million. This was driven by strong user growth and also tailwinds from foreign exchange metrics as the company reports in Euros but earns in dollars in its U.S. market. Recent exchange rates show 1 Euro = 1 USD which is astonishing. On the chart below you can see the Average Premium Revenue per user (blue line) is just under €5 with a slight upward trend.

Premium Revenue (Q3 earnings Report)

The beautiful thing about Spotify is if a customer doesn’t like a price increase they can simply switch to the “free” ad-supported version. Spotify’s ad-supported revenue grew by 19% year over year, which was driven by strong growth in its podcasting business. The podcast growth was spearheaded by the Spotify Audience Network, which sells advert impressions in a marketplace/auction-style format.

The ad business now makes up 13% of total revenue and I’m happy to see most users prefer to pay directly for the platform. In my personal experience, I started with the ad-supported model for literally two days and bought premium, as Adverts really do impact the flow of music.

Spotify generated a solid Gross Margin of 24.7%, which came in below guidance by ~50 basis points. This was driven by a renewal of its publishing contract outside the US, with slightly higher publishing rates.

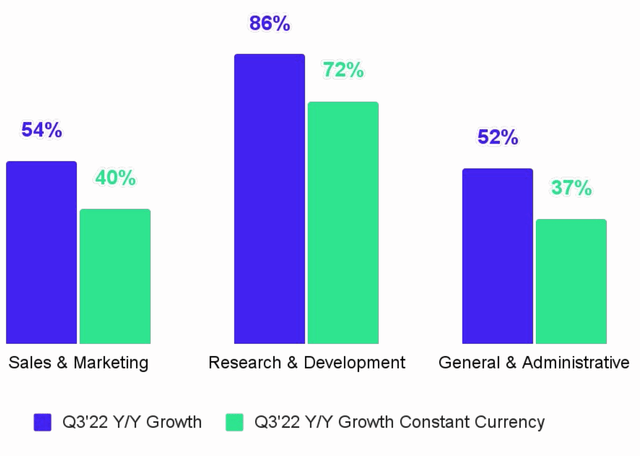

The company reported an eye-watering 65% year-over-year increase in operating expenses or 51% on a constant currency basis. On an FX-neutral basis, Sales and Marketing expenses increased by 54% year over year, driven by Localization Marketing campaigns in Latin America and an FC Barcelona sponsorship. As mentioned prior Spotify focuses on optimizing its customer lifetime value [LTV] and thus the company is expected a return on this investment over the long term. I personally believe Spotify should focus purely on Performance-based marketing as it is highly measurable and invest less into flamboyant brand awareness campaigns. Operating Expenses were also impacted by the integration of recent acquisitions such as Podsights, Findaway (Audiobook partner), Sonantic (AI Voices), Chartable (Podcast analytics), Whooshakka (radio), and Heardle (a music intro game). Overall these acquisitions do look to have a lot of synergies with Spotify if they can integrate the platforms seamlessly, without the user interface becoming messy. Longer term, Spotify’s management believes the company will gain operating expense leverage, as its infrastructure investments become fixed costs and revenue continues to grow.

Operating Expenses (Q3 Earnings Report)

Spotify’s substantial operating expenses have resulted in earnings per share of $0.86, which missed analyst expectations by $0.03.

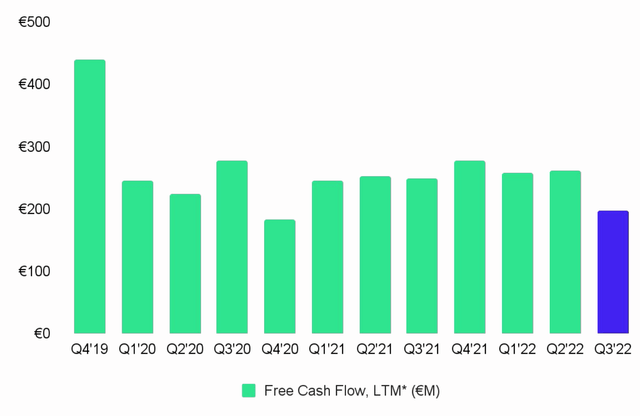

The company achieved its tenth consecutive quarter of free cash flow. The business generated ~$200 million in free cash flow during the trailing 12 months. Third quarter cash flow did decrease Year over year to €35 million. This was driven by lower Net Income adjusted for non-cash items. The good news is over the past three years, Spotify has averaged ~€200 million in free cash flow during trailing 12-month periods, thus quarterly fluctuations are expected.

Spotify has a solid balance sheet with $3.6 billion in cash and short-term investments. In addition, the company has long-term debt of ~$1.17 billion.

Future Strategy and Outlook

Moving forward Spotify aims to focus on expanding its Audiobook platform and already has over 300,000 titles on the platform in the U.S. The company also rolled outs its new personalized home feed for users which should help boost retention and engagement longer term. Netflix has a similar model in which it offers a personalized home screen for each and every user.

Spotify Personalized Feed (Q3 Earnings)

The “Spotify machine” as management calls it is investing in a “better freemium experience, better personalization, and a better ubiquity experience”. The company recently launched a marketplace website to sell tickets to live events for the artists on its platforms. The platform is still in its “early days” but this has vast potential for the future. The majority of Artists make their income from touring and thus helping to better enable this, should boost the Platform.

Management is forecasting “materially higher” monthly active users by the end of the year and a further increase in Average revenue per user, as per the current trend. However, due to macroeconomic uncertainty management didn’t provide guidance for 2023.

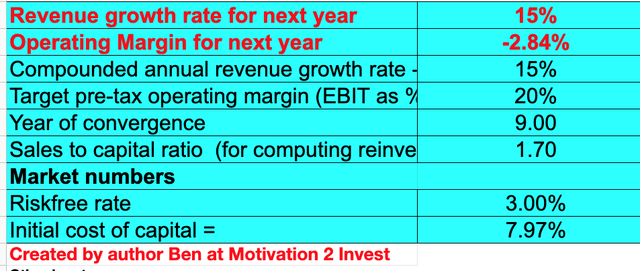

Advanced Valuation

In order to value Spotify, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow valuation method. I have forecasted a conservative 15% revenue growth per year over the next 5 years, which is slower than the 21% growth rate achieved in the prior quarter. I forecast its growth to be driven by increased expansion into Emerging Markets (mainly Latin America) and further upsells through its various acquisitions.

Spotify stock valuation 1 (created by author Ben at Motivation 2 Invest)

I have forecasted the business to benefit from its infrastructure investments and its operating margin to increase to 20% over the next 9 years. This is below the 23% average for the software and industry and looks to be achievable. I expect its margin to be enhanced by an expected price increase and upsell opportunities.

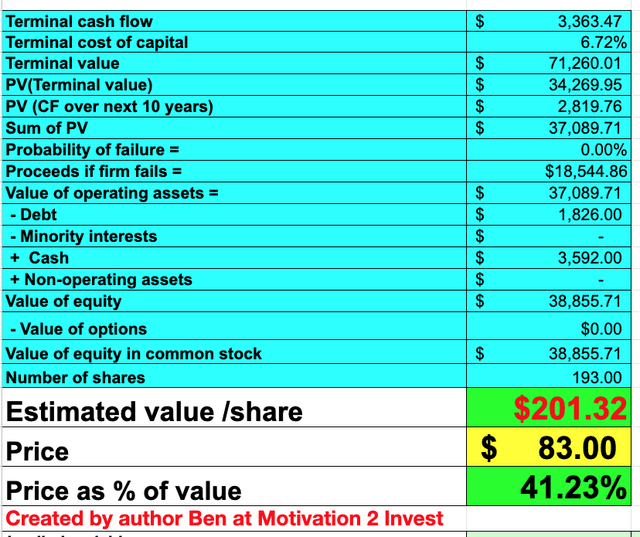

Spotify stock valuation 2 (created by author Ben at Motivation 2 Invest)

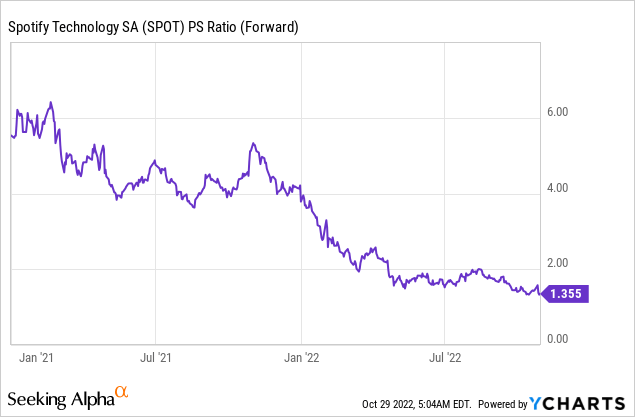

Given these factors, I get a fair value of $201 per share, the stock is trading at $83 per share at the time of writing and is thus ~59% undervalued. As an extra data point Spotify trades at a Price to Sales ratio = 1.37, which is 63% cheaper than its 5-year average.

Risks

Competition/Inflation

As mentioned prior Spotify faces intense competition from the “1,200 lb Gorilla” which are Apple, Amazon, and Google with YouTube Music. The company is still the market leader, but the ease of distribution through the competitors could be an issue. Spotify’s management was also vocal about Apple making it more difficult for external apps and developers to develop applications to compete effectively. The only consolation for Spotify is its low churn and high platform stickiness which I think will help them to stay ahead long term. Also, the big tech giants, are likely distracted from the macroeconomic activity which is affecting their core businesses. As Warren Buffett likes to say “Inflation Swindles everybody”, cost inflation has squeezed Spotify’s margins and the company is unprofitable despite positive free cash flow.

Cancel Culture

Spotify is at risk of “Cancel Culture” after the Joe Rogan podcast was previously boycotted due to CV19 comments. We also saw outspoken social media, Andrew Tate, get “canceled” from all social media platforms including YouTube. More recently, Kanye West has been “Cancelled” by brands such as Adidas and Balenciaga, after his alleged Anti-Semist comments. Spotify was asked if they would “cancel” Kanye also, but the company hasn’t removed his music currently. Now although I personally don’t agree with the comments Joe Rogan, Kanye West or others have made, I do see Freedom of Speech, as a major issue in the current climate. I believe someone can listen to the Music of Kanye West without supporting his recent comments. The same way someone can listen to Michael Jackson without supporting his past alleged actions. Either way “Cancel culture” may be a risk for the company from a distraction point of view at least. I would like to know your thoughts on this subject, so feel free to comment below.

Final Thoughts

Spotify is the world’s largest music streaming company and the business has seen solid growth in its Podcast platform. Management is making big bets on Audiobooks which will put them head-to-head against Amazon and Audible. I personally believe this is a risk for the company, but I also see the upside potential, and assuming the core platform is improved this could pay off long term. As a personal forecast or wishful thinking, I would like to see Spotify implement more social elements to the platform so people can connect with others through similar music tastes. With Meta Platforms on its knees and distracted by the Metaverse I see potential there. Spotify has not announced anything strongly social-related yet but you heard it here first, should they announce in the future. What we do know right now is the stock is undervalued intrinsically and relative to historic multiples.

Be the first to comment