DarthArt/iStock via Getty Images

The “Apostles to the Slavs”

Church Slavonic was the first literary language of the Slavic world. Formed as a result of the translation of the Holy Scriptures by Thessalonian monks Cyril and Methodius, the language first appears in manuscripts between the 9th and 11th centuries.

Noble Greeks Cyril and Methodius, called the “Apostles to the Slavs,” were sent around the middle of the 9th century to preach in Moravia. They did extensive proselytizing that lasted four years, during which they laid the foundation for the evangelization of the immense Slavic population.

In fact, the two brothers fine-tuned the first Slavonic alphabet, called “Glagolitic” (from “glagol,” meaning word or verb), with the intention of translating and rewriting the sacred texts. It was an immense task of patience, study, and graphic experimentation. Taking their cue from medieval Greek, they succeeded in giving written form to an idiom hitherto only spoken.

Their linguistic mediation work was later perfected by the subsequent elaboration of the Cyrillic alphabet, so named by its originator, Clement of Ohrid, in honor of his master, Cyril. This alphabet is still the basis of the cultures of many Eastern European nations.

“Investor Philologist”

When, in the early 1980s, I decided to major in Slavic philology, Church Slavonic became my bread and butter, among ancient Russian, Bulgarian and Serbian texts, which I learned to read and decipher in order to be able to understand modern Slavic languages.

It took patience: patience to deal with these ancient alphabets, patience to assimilate their sounds, patience to decipher their meaning, patience to understand their message. After I completed my philological studies and got out of college, the “job world” sucked me into its vortex of urgencies, unbreakable commitments, and tight deadlines. I entered the world of “everything now.”

What followed was twenty-five years of impossible rhythms until a decade ago, life circumstances led me to devote my time again to research, study, and reflection. I became passionate about finance and rediscovered the invigoration that deeply focused thinking brings.

A lot has changed since then. I studied and delved into countless investment sectors and instruments. I started reading finance books with the attention and patience as when I was a student of Slavic philology. I became passionate about behavioral finance and the biographies of great investors, from which one can only learn.

Waiting for the Fat Pitch

All great investors, bar none, practice patience and discipline. Most of all, they embrace and savor the art of waiting. Waiting, the core of successful investing, is exemplified by Warren Buffet’s “waiting for the fat pitch” strategy inspired by baseball hitter Ted Williams.

Despite understanding the waiting strategy, the fear of missing the train still plays tricks on me. When, in the past few months, the stock markets reversed heavily and the major U.S. indices entered bear territory, I decided to deploy the cash I had procured over the course of 2021 by gradually lightening the highest-gaining positions of my overall portfolio.

With the nest egg set aside, I began to buy the new stocks that I had carefully studied over the previous months while I waited for an opportunity to buy them at a cheaper price. So it was: I had investment return targets for each security and I met them. But the market continued to decline, and as always, I bit my tongue over my impatience to start building positions that, though averaged down, still went immediately into a loss.

Unfortunately, I learn every time that I have to know how to be more patient, even at the risk of missing some opportunities in case of a market rebound.

Cupolone Income Portfolio’s Gains and Losses

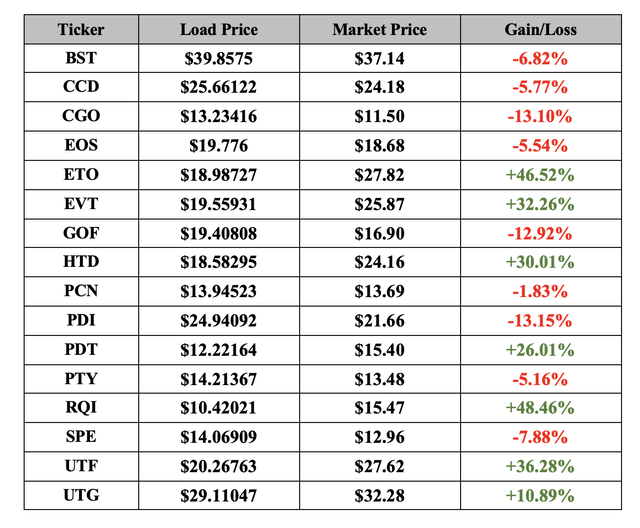

My Cupolone Income Portfolio (named after Brunelleschi’s Florentine dome) is my strategic, primary investment portfolio. It now contains the following sixteen CEFs:

- BlackRock Science And Technology Trust (BST)

- Calamos Dynamic Convertible and Income (CCD)

- Calamos Global Total Return (CGO)

- Eaton Vance Enhanced Equity Income II (EOS)

- Eaton Vance Tax-Adv. Global Dividend Opps (ETO)

- Eaton Vance Tax-Adv. Dividend Income (EVT)

- Guggenheim Strategic Opp (GOF)

- John Hancock Tax-Adv. Dividend Income (HTD)

- PIMCO Corporate & Income Strategy (PCN)

- PIMCO Dynamic Income (PDI)

- John Hancock Premium Dividend (PDT)

- PIMCO Corporate & Income Opportunity (PTY)

- Cohen & Steers Quality Income Realty (RQI)

- Special Opportunities Fund (SPE)

- Cohen & Steers Infrastructure (UTF)

- Reaves Utility Income Fund (UTG)

The following table shows the stocks held, their load price, and gain or loss compared to the current market price after the recent rebound from the spring lows. All data is as of July 29, 2022.

Barring possible further adjustments, my new positions have all been completed but are currently at a slight loss. The positions built in the spring of 2020, on the other hand, are still profitable and have not been increased because I never average up my load prices on high-yielding CEFs and ETFs. I will only deploy my remaining liquidity for these in case their market price falls below my load price (UTG did, but by a small amount, and it was not worth for me to buy it to mediate downward a few cents).

The four fixed-income CEFs (GOF, PCN, PDI, PTY) are all at a loss, but I decided not to downwardly average their price by increasing their positions, given the rate hike schedule by the FED.

Of course, I know full well that it is unthinkable to expect to buy at the minimums, but a little more patience would not have hurt. Let’s just say that I never manage to be as patient as I should, even though I try to train myself every day to exercise some form of mental discipline. I often fail to be completely patient in building new positions, but I do manage to restrain myself from increasing positions I already have in the CEFs that are gaining in value.

In fact, I have not invested a single new dollar in ETO, EVT, HDT, PDT, RQI, UTF, and UTG so far because I don’t want to mediate their price upward, thereby lowering their yield. I prefer to keep my cash aside even if it means getting low rates of return on my cash holdings – typically SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL) – as I await future market developments.

The Art of Waiting

All of humanity’s problems stem from man’s inability to sit quietly in a room alone.” (Blaise Pascal)

Sitting quietly in one’s room means turning off the background noise that bombards us every day through the press, television, and the Internet, prompting us to do something, anything, as long as we don’t fall behind when there are so many opportunities out there… Instead, we would very often do better if we just let go.

Although I repeat this guidance to myself daily, like a mantra, I can’t always manage to wait. I’m caught between the urge to resist and the fear of missing the train. As Oscar Wilde said, “I can resist everything except temptation.” The temptation to do something gnaws at us. Those who can turn way from temptation and embrace the art of waiting can come out on top. However, standing still and waiting, for most investors, is not an easy thing to do. It means setting aside a cash reserve and not deploying it until the prices of the securities we care about collapse. No one can know when, but this will happen sooner or later.

If we invest at the peak of a bullish trend and then the market collapses, it may take us several years to recoup our losses, although the distributions from our CEFs may partly alleviate the wait. This is why I tend to lighten positions and set aside liquidity as the market rises. Of course, I accept that liquidity may offer me a mediocre return, trusting that I can trade poor initial returns for years of high returns when the prices of the CEFs I am interested in collapse.

Meanwhile, I study to select the best funds by applying my “rule of thumb,” which says: “Choose a CEF with a positive NAV trend, the highest discount and the lowest leverage, and whose Total Return is more than its yield on NAV.”

Embracing the wait is a way to build mental presence, thinking for long periods only about what I am doing at the moment and not worrying about either the past or the future. Living only in the moment means knowing that I am mentally ready to take action when the opportunity arises.

Be the first to comment