andresr/E+ via Getty Images

Overview

In my opinion, there is an undervaluation of Super Group (NYSE:SGHC). The vast and growing betting and online casino gaming markets across Europe, Africa, and America, the significant marketing economies of scale of Betway, and the multi-brand strategy of Spin targeting multiple markets, are SGHC’s key investment merits.

Business description

Super Group is a global online sports betting and gaming operator. Its global online sports betting and casino gaming services are delivered to customers by way of two primary product offerings.

Betway is SGHC’s single-brand online sports betting offering with a global footprint derived from licenses to operate throughout Europe, the Americas and Africa. The brand is sports-led, but also offers casino games.

Spin is SGHC’s multi-brand online casino offering. Spin’s diverse portfolio of more than 20 casino brands is designed to be culturally relevant across the globe while aiming to offer a wide range of casino products. Spin is casino-led, but some of its brands also offer sports betting products.

Investments thesis

The global betting and casino gaming market are huge and growing

SGHC’s brands work in two different areas of the global online gaming market: sports betting and online casino games. Both of these areas have grown a lot in recent years and are expected to keep growing in the years to come.

According to SGHC filings, global online sports betting gross gaming revenue is projected to grow from $53.8 billion in 2021 to $87.2 billion by 2026, while the global online casino gaming market is projected to grow from $33.0 billion in 2021 to $61.3 billion by 2026, in part due to projected strong growth in newly regulated markets, including within the United States.

Several countries in Africa and Europe have already liberalized and regulated sports betting and/or online casino gaming, with several more in the early stages of doing so. It is also projected that European sports betting, and online casino gaming GGR will grow from $38.1 billion in 2021 to as much as $54.8 billion by 2026, and projects African GGR to grow from $1.5 billion in 2021 to $4.1 billion by 2026, based on figures in SGHC S-1. Africa and Europe are important markets for SGHC, and the company thinks it is in a good position to take advantage of opportunities when online sports betting and online casino games are legalized in these areas.

According to management estimates, SGHC is a market leader in sports betting and online casino gaming, with net gaming revenue of $1.48 billion in FY21. The company has licenses for both sports betting and online casino games in 24 jurisdictions. This does not include up to 12 jurisdictions in the U.S. where DGC USA has initial agreed market access deals. The company is currently applying for licenses in other states and jurisdictions or negotiating licenses with them.

Regulatory no longer a big hurdle

In May 2018, the U.S. Supreme Court repealed the Professional and Amateur Sports Protection Act of 1992 [PASPA], the effect of which was to remove federal restrictions on sports betting and give individual states control over the legalization of sports betting within their jurisdictions. As of December 31, 2021, according to SGHC prospectus, 33 states plus Washington, DC have passed measures to legalize sports betting. Out of that number, 22 states have authorized statewide online sports betting while 11 remain retail-only at casinos or retail locations. Seven states have passed measures to legalize online casino gaming. In Canada, Parliament recently passed legislation allowing provinces to regulate single-game wagering within each province. In particular, Ontario has started a system in which it is now accepting registration applications for legal sports betting and casino games.

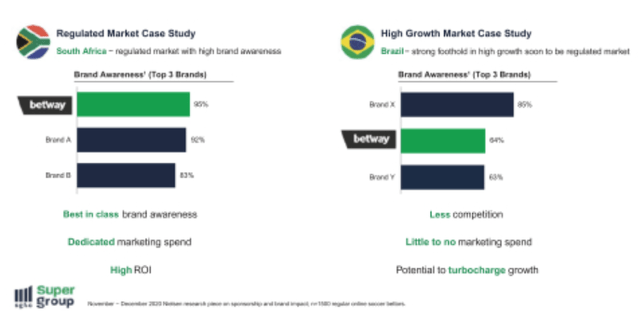

Betway single brand strategy offers economies of scale

SGHC’s flagship brand, Betway, operates as a global, online, sports-led betting brand that is consistently positioned in all markets. This strategy aims to use money spent on marketing at the national, regional, and local levels to help the company as a whole. The company’s management thinks it will lead to significant marketing economies of scale as the business grows and Betway continues to enter new markets.

For example, in advance of launching in the United States, Betway has entered into marketing partnerships with U.S. sports franchises such as the Chicago Bulls, the Cleveland Cavaliers, the Los Angeles Clippers, the Golden State Warriors and the New York Islanders. In addition to raising the profile of Betway’s brand in the United States, the global reach of these brands will benefit the company in markets outside of the United States where U.S. sports are followed. The company’s partnership with the English Premier League team West Ham United is a good example of how this strategy has paid off in the past. According to an independent evaluation, the partnership has so far brought back 5.8 times what it cost.

Spin’s multi-brand strategy targets multiple markets

Spin’s multi-brand online casino is made to get more shelf space in a lot of different marketing channels, especially in markets where it’s hard to find effective large-scale brand advertising and/or where a lot of different marketing approaches are needed.

For example, in some markets, the company believes that the predominant or most effective form of marketing is with the assistance of independent “affiliates” marketers. In these kinds of situations, the company thinks that giving these “affiliates” a wide range of brands to sell is especially helpful.

Data is key to continuous customer satisfaction

SGHC’s strategic focus on data and analytics is embodied in the development of proprietary technology systems designed to leverage the large volumes of proprietary data that SGHC collects and analyses on a daily basis. These systems and this data collection and analysis are designed to operate in conjunction with all of the company’s product platforms, regardless of whether the latter are proprietary or supplied by third parties, and are aimed at analyzing and understanding customer behaviors in as close to real-time as possible.

Using this information, I believe SGHC can profitably improve customer satisfaction and loyalty through interactions and recommendations delivered as close to real-time as possible, reduce fraud, and more importantly meet regulatory and compliance requirements efficiently.

Forecast

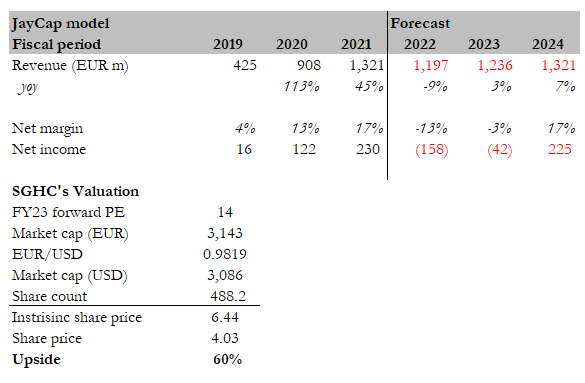

The primary objective of my model is to show the potential upside once SGHC recovers from the COVID damage. My model assumes SGHC to meet the mid-point of management guidance and margins to follow consensus estimates (since they revolve around management’s estimates). Where I differ slightly from the consensus is that I assume SGHC will recover back to 2021 levels in 2024, and not exceed them. My assumptions are that the sports betting and casino gaming industries are expanding, and that the secular uptrend will eventually assist SGHC in recovering.

If these assumptions hold, SGHC could be worth $6.44 in FY23, representing 60% upside from today’s share price.

Author’s estimates

Red flags

Competition from other entertainment avenues

SGHC operates in the worldwide entertainment betting and gaming sector of the larger entertainment industry. It offers only two of the business-to-customer segments, sports betting and online casino gaming. SGHC’s customers have access to a wide variety of entertainment options. Their customers perceive various well-established entertainment forms, like television, movies, athletic events, other non-gambling activities, and physical casinos, as providing more variety, affordability, interactivity, and delight. SGHC competes with these entertainment programs for their customers’ discretionary time and income.

Stigma towards gambling

Several negative elements impact the ability of SGHC businesses to retain or attract customers. These elements include negative occurrences, negative media attention, a decline in the popularity of online sports betting, online casino gaming, or the underlying sports or players on which sports betting is based.

Conclusion

SGHC is undervalued when compared to its current share price. SGHC’s upside would stem from the tremendous market growth of its product offerings, liberalization and regulation of these products across several countries, and a focus on data and analytics for reducing fraud and financial risks. All these merits of SGHC’s business model make the company a good pick for investors.

Be the first to comment