mysticenergy/E+ via Getty Images

Note: All figures are in $CAD unless otherwise specified.

Hi Everyone,

The last time I was on here writing about Cardinal Energy (OTCPK:CRLFF), which can be found here, I promised to highlight another E&P that I thought was a better risk/reward. That company is Whitecap Resources (OTCPK:SPGYF), which is in many ways is a larger and higher-quality version of Cardinal Energy.

Whitecap Resources is a Canadian mid-cap oil and gas producer whose assets are located in Alberta and Saskatchewan. Production is guided to average 131,000 boe/d this year and the company’s market cap in $CAD is roughly 6 billion.

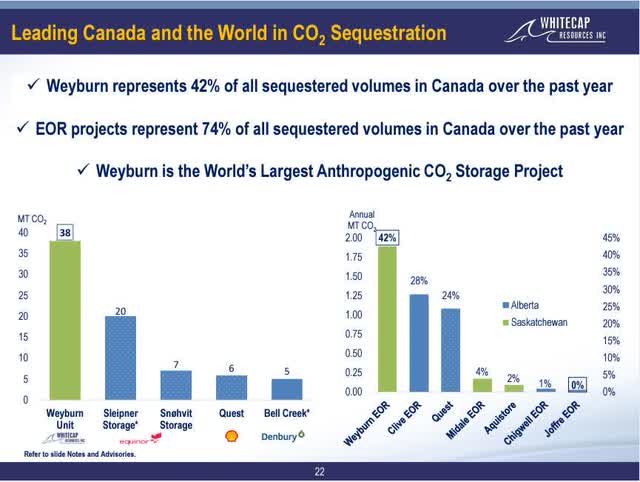

Whitecap’s claim to fame is that they operate the world’s largest carbon capture, utilization, and storage (CCUS) project in the world via their Weyburn EOR (enhanced oil recovery).

Whitecap March 2022 Investor Presentation

This feat means that Whitecap is a net-negative producer (the only one in the world that I’m aware of) with negative scope 1 & 2 emissions. For those that are interested, the Midale EOR which is shown on the chart on the right is Cardinal’s flagship property.

Management has discussed extensively how they hope that the new CO2 regulations will mean that they will receive credit for their efforts. However, the most recent comments from the environment minister re-iterated that CCUS that are used for oil exploration and development (i.e. EOR) would be excluded.

This would be a disappointment (and a missed opportunity), but don’t despair! Because even without the CCUS/EOR aspect, Whitecap Resources is a fantastic company that is extremely well run, has rock-solid financials, and management is fully aligned with shareholders.

Eating Other’s Cooking

Whitecap has a decade-long history of acquiring and consolidating smaller competitors to turn into what it is today. This hasn’t changed over the last two years during COVID where they have used their strong balance sheet and free cash flow to go on offense and continue to gobble up smaller competitors. Here are the major acquisitions that they’ve made just in the last two years:

- August 31, 2020: Whitecap acquired privately-owned NAL Resources from Manulife for $155mm in an all-stock transaction (58.3mm shares or $2.65/share), which can be found here. (More on this transaction later)

- December 8th, 2020: Whitecap acquired TORC Oil & Gas in another all-stock transaction for $900mm in total consideration (including net debt of $335mm), which can be found here.

- April 5th, 2021: Whitecap acquired Kicking Horse Oil & Gas for total consideration of $300mm (including $54mm in net debt), which can be found here.

- December 6th, 2021: Whitecap made another acquisition for $342.5mm from an unnamed seller. At the same time, they repurchased 19.2mm shares from Manulife (1/3 at first lock-up), which can be found here.

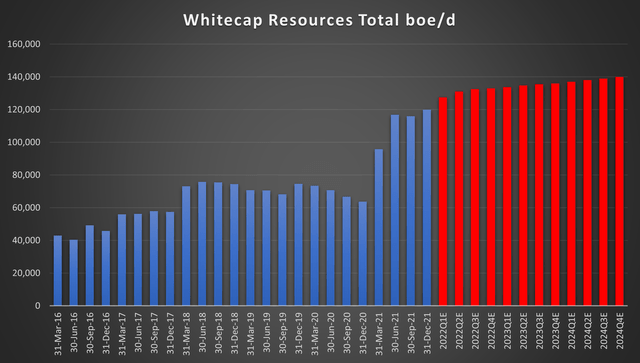

The net result is that Whitecap’s production has increased dramatically. Since 2016, Whitecap’s production has increased from 43k boe/d to 120k boe/d (280% increase). Meanwhile, due to the company’s large reserves and capacity to expand production, management is guiding for organic production growth with a jump to 131k boe/d average this year and to continue to grow 3-4% going forward.

Here is the chart of Whitecap’s production, and I’ve highlighted in red future production that hasn’t yet occurred but is instead management’s guidance:

Whitecap Resources Historical MD&A’s and March 2022 Investor Presentation

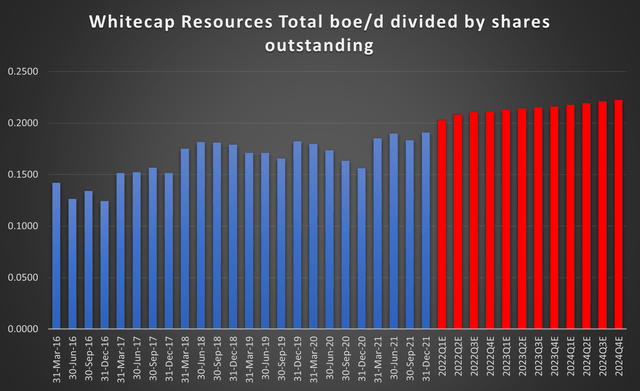

Of course, you could say that increasing your share count significantly to increase production leads you nowhere, and that is true. When adjusted for total shares outstanding, we can see how accretive these transactions have been for Whitecap shareholders:

Whitecap Resources Historical MD&A’s and March 2022 Investor Presentation

Now, this graph might not look that impressive, but there are a couple of things to note. At the beginning of 2016, each Whitecap shareholder proportionally owned ~0.15 boe/d. By the end of 2021, that ratio had increased to almost 0.20 boe/d, which represents a ~35% increase per share (or 5% annualized). But it gets better, while I’ve used management guidance for future production, I left the number of shares outstanding unchanged. With significant share repurchases, the ratio of boe/d per share could easily reach 0.25 boe/d in no time. We could be looking at a 10% CAGR production rate per share.

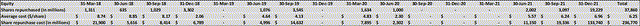

Eating Your Own Cooking

Not only is Whitecap busy gobbling up other people’s companies. They have also been busy buying back their own shares. From 2018 to the end of 2021 (last reported filings), Whitecap has repurchased 37.86mm shares at a total cost of $236.7mm ($6.25/share). Just yesterday (Monday, April 4th), Whitecap announced that they had repurchased another 10.0mm shares at an average cost of $10.34 as part of a large block sale presumably by Manulife, which can be found here.

Whitecap MD&A and Financial Statements

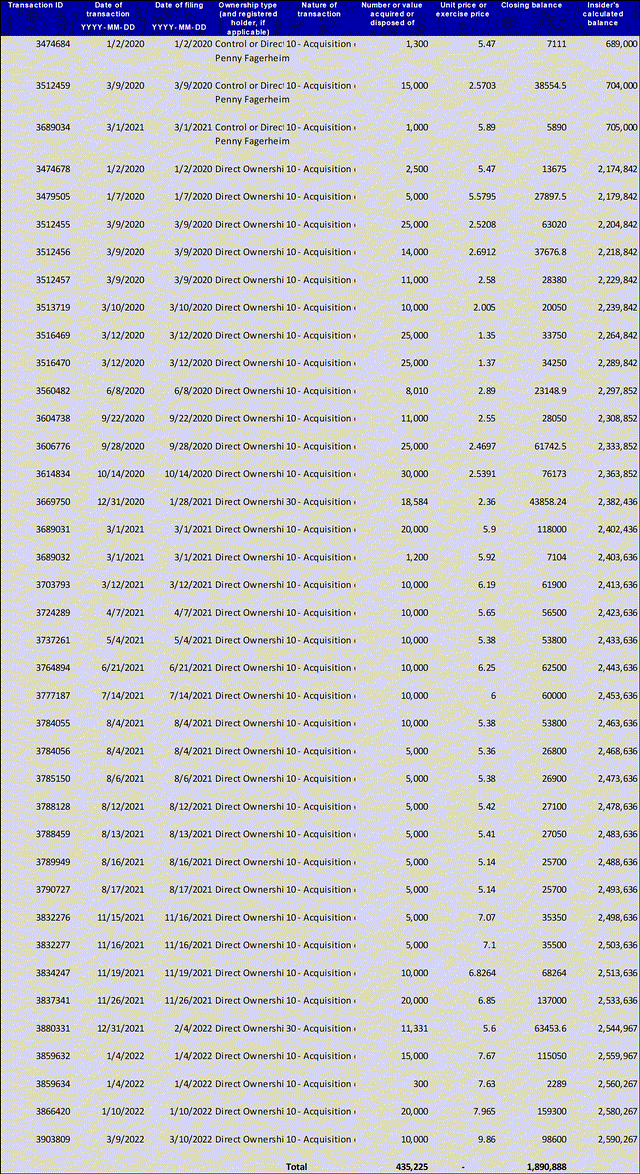

But it’s not just Whitecap that’s busy buying shares. Grant Fagerheim, Whitecap’s founder, President, and CEO, along with other members of the executive management team, regularly purchases shares of Whitecap in the open market with their own money. Here are all of Grant’s share purchases since the beginning of 2020:

From 2020 until last month, Grant has made 39 separate purchases of shares totaling 435,225 shares at an average price of $4.34/share. In the last two years, Grant has spent almost $2mm of his own money buying Whitecap shares on the open market. Grant’s total stake in Whitecap now stands at almost 2.6mm shares (worth almost $30mm based on current share prices).

For comparison, Mark Little, who runs Suncor only, directly owns 115k shares (not counting RSU/DSU’s) for a total value of ~$4.7mm (based on Suncor’s 2022 Management Information Circular). Meanwhile, the rest of Suncor’s named management team only owns ~305k shares (again not counting the RSUs/DSUs) that are worth ~$12.5mm.

In summary, Grant owns more Whitecap shares than the entire Suncor executive management owns Suncor shares; so it seems pretty obvious which management team is more closely aligned and it’s not even close. The only two other companies where management is as or more closely aligned are Canadian Natural Resources (CNQ) and Tourmaline (OTCPK:TRMLF), which have both worked out pretty well.

Valuation & Wrapping Things Up

It goes without saying that Whitecap is dramatically undervalued, but there is a great deal of uncertainty in the world which makes coming up with a target price difficult. I’ve built a DCF model and could easily get to a target price of CAD$20-$25/share (which represents 100%-150% upside).

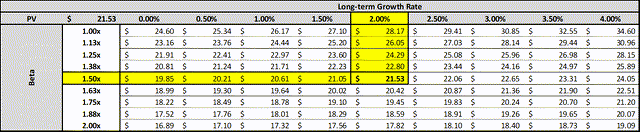

To value the company, I used a 12% discount rate (1.5x beta, 3% risk-free rate, and 6% equity risk premium) and assumed a 2% long-term (nominal) growth rate. The sensitivity is the following:

The big key things that I’m thinking about in regards to valuing Whitecap right now are:

The first and most important consideration is obviously oil prices. Oil (WTI) has averaged ~USD$92.5/bbl so far this year, and the WCS differential has stayed in a pretty tight range of between -$13.5/bbl and -$11.5/bbl. I think oil is headed higher, with oil averaging $125/bbl in Q2 and $150/bbl in Q3, given production shortfalls out of OPEC, a slow pickup in oil drilling the US shale patch, and continued strong demand (aided by direct government subsidies). The retreat of Western supermajors and oil field services from Russia along with likely oil bans will make oil shortages even worse and push energy prices even higher from here.

This scenario of rapidly increasing prices for energy will likely cause a modest global recession (i.e. not nearly as bad as 2007/2008). Right now, I think it’s likely that will happen in Q4 2022 or Q1 2023, and I’m assuming oil prices halve (down to $75/bbl) fairly quickly before slowly recovering. Longer-term though, I still think that oil will remain strong, and it is quite possible that oil will average over $100/bbl for the next five years as the decades-long underinvestment in energy CAPEX confronts rising demands from developing economies continues to play out.

Another key risk and concern is the possibility that the WCS differential blows out again this year due to the combination of production increases across the industry (Whitecap isn’t the only one growing production) and the delayed completion of the Transmountain pipeline. Recently, the annual Q4 blowout in differentials has been quite muted. In 2021, the differential reached ~$20/bbl versus ~$15/bbl in 2020 and ~$23/bbl in 2019. In 2018, we saw the oil differential blow out to over $40/bbl, which forced the provincial government to step in and mandate production cuts across the entire industry. I don’t think (or perhaps hope) that it gets as bad as 2018, but I think it’s entirely possible that we see differentials blow out to $25-$30/bbl. And if the global economy does fall into recession at the same time, we could be looking $45-$50/bbl oil for WCS by year-end.

But it’s not all doom and gloom! With current oil prices, Whitecap is printing money. Under the scenario that I laid out for you just now, they will generate ~$1.2 billion in FCF in the first half of this year (even after ~200mm in heading losses). That’s roughly 20% of its market cap and we’re already more than halfway through H1! If oil does in fact average $150/bbl in Q3, they will make close to $1 billion in FCF in that quarter alone!

With all this cash, Whitecap will be able to repay all of its bank debt (it was $460mm at year-end) and enter the downturn with a huge war chest (all else being equal).

Lastly, I haven’t factored in any share repurchases to my DCF model, given the uncertainty in both the timing and size (even though management has signaled they will return 50% of FCF to shareholders via dividends and share repurchases). As mentioned above, Whitecap just repurchased another 10mm shares and renewed its NCIB (details which can be found here). However, I don’t feel comfortable modeling large share repurchases, given the uncertainty in both timing, amount, and per-share cost.

This leaves the model with a bit of a conundrum. Even with fairly significant dividend increases every quarter, Whitecap is going to be bursting with cash. For my baseline, I have oil averaging ~USD$85/bbl from 2023 to 2026 and even then, Whitecap would be able to fully repay all of its debt and have in excess of $4 billion in cash sitting on its balance sheet. This is what I call a nice problem to have!

In summary, Whitecap is a very well-run firm with great alignment between investors and management. They can organically grow production for the next 5 years while we investors can sit back and collect an increasing stream of dividends. Whitecap might not offer the same upside as many other small and mid-cap E&Ps, but I still think on a risk/reward basis, nobody is going to be complaining when it’s all said and done.

Be the first to comment