Joe Scarnici/Getty Images Entertainment

Elevator Pitch

I keep my Buy rating for Spotify Technology S.A.’s (NYSE:SPOT) shares. I last wrote about Spotify Technology in an article published on December 14, 2021, which focused on how “SPOT’s recent acquisition of Findaway will play a key role in the company’s expansion in the audiobook market.”

In this article, I discuss about SPOT’s competition with TikTok and Resso, and also touch on the company’s growth drivers and financial forecasts. My Buy investment rating for Spotify stays the same, as I don’t see Resso or TikTok posing significant competition that will adversely affect SPOT’s positive growth outlook.

Are TikTok And Spotify Competitors?

An April 18, 2017 news article published by The Guardian cited comments from Netflix’s (NASDAQ:NFLX) CEO Reed Hastings at an earnings call, where he noted that “we’re competing with sleep, on the margin” and highlighted that NFLX and its peers are “drops of water in the ocean of both time and spending for people.”

This explains why Spotify’s competitors include TikTok, which calls itself “the leading destination for short-form mobile video.” Any company that offers products and services which could take time away from consumers listening to music, podcasts and audiobooks on Spotify’s platform can be considered a rival.

But TikTok is a platform that deserves more attention because of its focus on younger users. A recent December 20, 2021 Bloomberg article highlighted that “executives at Spotify are worried that the youngest generation of listeners isn’t using its product enough.” TikTok is very popular with the younger generation as per data cited below.

An article published on September 27, 2021 by social media advertising agency Wallaroo Media highlighted that “60% (of TikTok’s US users) are between the ages of 16-24”, and noted that users who are even younger aged “four to fifteen spend an average of 80 minutes per day” on TikTok. Another April 30, 2021 article released on the World Advertising Research Center’s website mentioned that “the majority of US tweens (67% of 8–11 year olds) and young teens (68% of 12–15 year olds)” are TikTok users.

In other words, TikTok and Spotify are competitors, as they complete for users’ time. In particular, both of them see the need to grab market share in the young user segment.

What Is Resso?

The competition between TikTok’s parent ByteDance (BDNCE) and Spotify came into the limelight again, with BDNCE introducing a new app called Resso in India in March 2020.

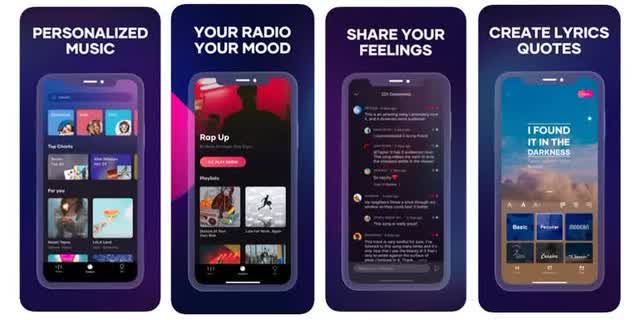

Key Features Of Resso

Indian media Mint describes Resso as “TikTok’s sister app” and “one of the top three music-streaming apps in India.”

My view is that Resso’s success and popularity in the Indian market are linked to the fact that the app has incorporated certain unique social media elements just like TikTok as highlighted above. These include uploading one’s own favorite videos and gifs to be tagged to specific songs, and also the ability to share lyrics for songs on other social media platforms.

Is Spotify Going To Continue To Grow?

I think that Spotify is going to continue to grow, notwithstanding perceived threats from TikTok or Resso.

My December 14, 2021 update on SPOT detailed SPOT’s growth plans in audiobooks, while an even earlier article published on November 18, 2021 focused on the company becoming “the No. 1 podcast platform ahead of Apple (NASDAQ:AAPL)” last year. I see Spotify’s market leadership in podcasts as the key to fending off competitive threats from other media platforms and services, including Resso and TikTok.

According to the results of an April 2021 survey of “9,000 Gen Z and millennial respondents” published in July 2021, Spotify claims that “71% of Spotify Free listeners are under 35” and “the median age of our podcast listeners is 27.” In other words, SPOT does have a fair share of young users as well.

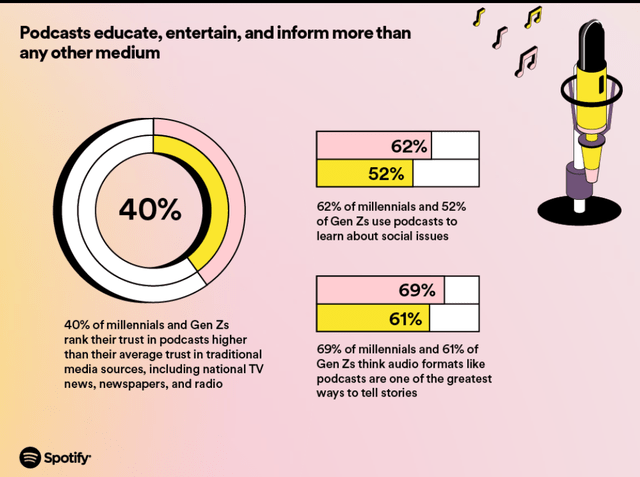

More importantly, a significant number of young consumers actually have a favorable view of podcasts as a source of information, as highlighted below. In other words, growing its podcasting business could possibly help SPOT to compete more effectively for younger users with TikTok.

What Spotify’s Young Users Think About Podcasts

Separately, it seems too early to view Resso as a credible competitor in music streaming. The Resso app is currently only available for download in a handful of markets like India, Indonesia and Brazil now, which suggests that it seemed to have been slow in expanding in foreign markets. A July 1, 2021 KrAsia article speculated that international growth plans for Resso “were put on the back burner” after the departure of TikTok’s former CEO in August 2020. But more than a year later, Resso still does not appear to have made significant headway in launching in other new markets. In contrast, SPOT already has a firm foothold in the global music streaming market with a presence in “184 countries and territories” as per its corporate website.

In summary, as an increasing number of Spotify’s users listen to more content (music, podcasts and audiobooks) and spend a longer period of time on the company’s platform, this will increase users’ stickiness and ensure that the company’s future growth is not derailed by competition.

Spotify’s future growth prospects are validated by the market consensus’ bullish financial forecasts for the company detailed in the next section of the article.

SPOT Stock Forecast

Based on market consensus financial estimates sourced from S&P Capital IQ, Spotify’s revenue and EBITDA are expected to grow at very impressive CAGRs of +16.5% and +68.4% between fiscal 2022 and 2025, which I view as realistic.

With regards to the company’s revenue growth potential, there is lots of room for Spotify to expand its user and subscriber base, and also raise its subscription prices in future. With Spotify expanding more aggressively in podcasts and audiobooks, this expands the total addressable market for the company. For example, certain users could be less interested in music streaming, but they might consume audiobooks or podcasts instead. Also, as SPOT offers more content on its platform, it is in a good position to justify future price increases.

In terms of margin expansion, sell-side analysts predict that SPOT’s EBITDA margins can expand from 1.6% in FY 2021 to 6.9% in FY 2025. In my mid-December 2021 update, I explained that “the podcasting business is expected to have higher margins than the music business in a steady state”, and I also noted that “SPOT’s audiobook could help to expand the company’s overall profit margins.”

In other words, a more favorable revenue mix with increased sales contribution from higher-margin product segments like audiobooks and podcasts will enable SPOT to improve profitability over the next few years.

Is SPOT Stock A Buy, Sell, Or Hold?

SPOT stock is a Buy. Spotify is valued by the market at consensus FY 2022 and FY 2023 Enterprise Value-to-Revenue multiples of 3.1 times and 2.6 times, respectively as per S&P Capital IQ. With the company expected to expand its top line by growth rates in the mid-teens and progressively achieve higher EBITDA margins, Spotify should command forward Enterprise Value-to-Revenue multiples in the mid-single digit range at the minimum in my opinion.

Be the first to comment