Avid Photographer. Travel the world to capture moments and beautiful photos. Sony Alpha User

Spotify (NYSE:SPOT) has released its Q2 earnings results this week. I wouldn’t have touched this stock in late 2021 but it is now a value play.

Spotify released its second quarter earnings

Spotify released its second-quarter earnings report this week with the stock rallying shortly thereafter. The company beat analysts’ expectations and surprised investors with healthy subscriber numbers.

Earnings per share came in at a loss of 85 euro cents per share versus a loss of 63 euro cents per share, based on Refinitiv data. Revenue came in at 2.86 billion euros versus 2.81 billion.

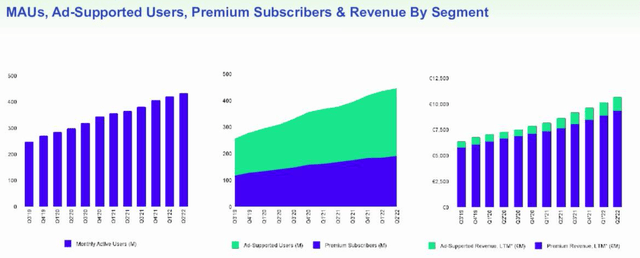

Spotify has been on a mission to improve its advertising offering, and ad-supported revenue grew by 31% over the year to 360 million euros. That also marked an all-time high of 13% of total revenue for the latest quarter. Paying subscribers also jumped by 14% to 188 million, which was a gain of 6 million and higher than estimates. That included a loss of 600,000 subscribers in Russia after Spotify made a full exit from the country. Free cash flow at the company improved from 34 million euros to 37 million.

Looking to the future in Spotify

CEO Daniel Ek noted on an earnings call:

“The acceleration in our user growth continued. And we had a very strong beat on MAU growth, coming in about 5 million users ahead of forecast. As a reminder, this was one of the weak spots for us in Q2 of 2021.”

“Going forward, while the macro environment continues to present uncertainty, we are currently not seeing any material impact on our expectations for users or subs growth from the economic downturn. In fact, we are seeing several markets trending ahead of our forecasts… in anticipation of a potential slowdown, we already shared that we proactively reduced our hiring by 25% and instituted a double-down weekly revenue monitoring… but it’s hard to be anything but optimistic given what I am currently seeing.”

We could be seeing a post-pandemic trend in music streaming with Spotify. During the pandemic lockdowns, there was a rise in TV and film streaming and that may relate to the dynamic of shared viewing or a need for visuals. With less downtime available, it is likely that streaming is returning for the work commute or for background noise in workplaces and households.

Talking of a longer-term outlook, Ek talked of the “Spotify Machine,” which he said: “Is powered by three revenue-generating business models: subscriptions, ads and marketplace… we are confident in our ambitions to get to 1 billion users by 2030, while at the same time, we are also focused on improving our gross margins and continuing to generate positive free cash flow.”

The company noted in a slide deck that MAU growth came off the back of marketing plans, so there is potential to build further on that.

The latest earnings report noted that the company had closed its acquisitions of Findaway and Sonantic. The former is an audiobook platform for authors, publishers and consumers. The latter is an AI voice platform that creates voices from text. These will allows Spotify to leverage its current users and let them engage in publishing activities for new revenue streams.

In forward-looking statements, Spotify expects total MAUs in Q3 at 450 million, with premium subscribers at 194 million.

Spotify’s metrics highlight value in the stock

Alongside a strong quarter, the slump in the company’s stock has seen the price move from late-2021 highs of $387.40 and the company now trades at $117 after a post-earnings pop. The 70% dump in the stock is where we uncover the value in this name because it has led to a similar slump in financial metrics. Price-to-sales in Spotify is now only 2X from a high of 6.55x in late-December.

The price/earnings ratio is still high but the company is still on a growth mission and is not looking to be viewed on earnings, but a pivot is starting towards higher EPS.

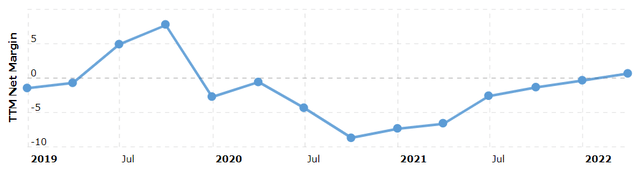

Margins are another metric that is improving for Spotify and that has been the case since late-2020.

These metrics are also representative of 38% higher operating expenses, which have been driven by growth initiatives. Recent acquisitions in Podsights, Chartable, and Whooshkaa have also added to the expenses burden. The integration of acquisitions may be a headwind in the near-term but the company is slowing headcount by 25%.

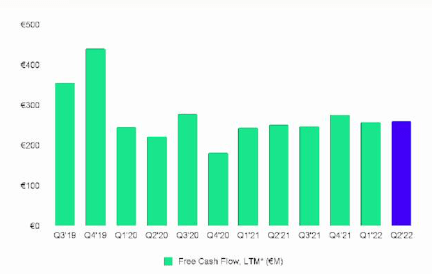

The push for growth means that the company has a high P/FCF ratio, but they’ve seen a ninth-straight quarter of free cash flows, so their expenses are easy to predict.

Free Cash Flow (Spotify)

In trending charts, the MAU metrics are on a good uptrend and have not found their plateau yet. Ad-supported revenue is starting to outpace premium subscriptions and that is an area that could improve further with more users keen to use the free service with ads. That is a good option for the background music that I noted in workplaces and households, where people are generally focused on other tasks and ads are less intrusive.

As I noted earlier, I was not interested in Spotify last year but the metrics are more compelling for a value play. At only 2X sales, there is growth in the stock on that metric alone and the company is performing well in its core business model. New acquisitions can open up new revenue streams in the company and there is room to scale back operating expenses later and boost cash flow and earnings per share.

Be the first to comment