BRENT CRUDE OIL (LCOc1) TALKING POINTS

- Strong storage data backed by OPEC+ comments.

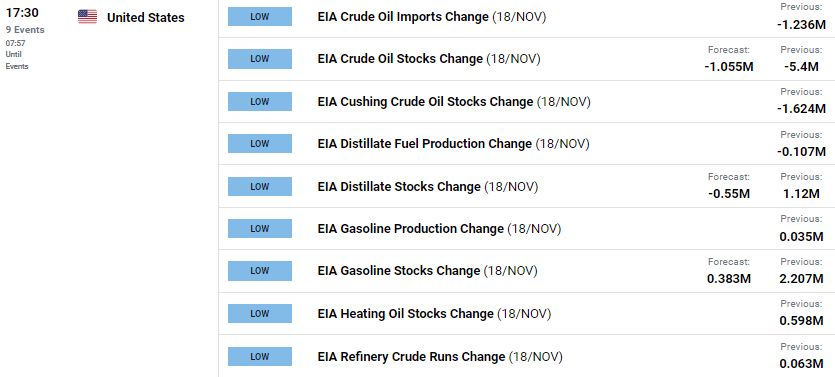

- U.S. centric data dominates headlines today along with EIA.

- $90.00 resistance under threat.

Recommended by Warren Venketas

Get Your Free Oil Forecast

BRENT CRUDE OIL FUNDAMENTAL BACKDROP

Brent crude oil is trading higher today after yesterday’s continuation of OPEC+ member nations denying rumors around a possible 500 million bpd output increase. In addition, the API weekly crude oil stock change which missed forecasts (2.6MMbbls), falling by 4.8MMbbls. This morning shows the greenback marginally on the back foot stemming from an underwhelming statement by the Fed’s Bullard who many expected to reiterate his prior hawkish comments which were not the case.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The economic calendar is fraught with U.S. economic data including durable goods orders and consumer sentiment but the real focus would be this evenings FOMC minutes which markets will look to for the cadence of future interest rate hikes and if there is any change to the current information at hand. From a crude oil standpoint, the EIA weekly report is also due and should this report follow a similar trend to yesterday’s API, we could see added brent crude price appreciation post-release.

ECONOMIC CALENDAR

Source: DailyFX economic calendar

On a broader scale, concerns around China’s COVID situation and recessionary fears keep weighing on crude oil prices and the tug of war between push and pull factors continue to plague the crude market.

TECHNICAL ANALYSIS

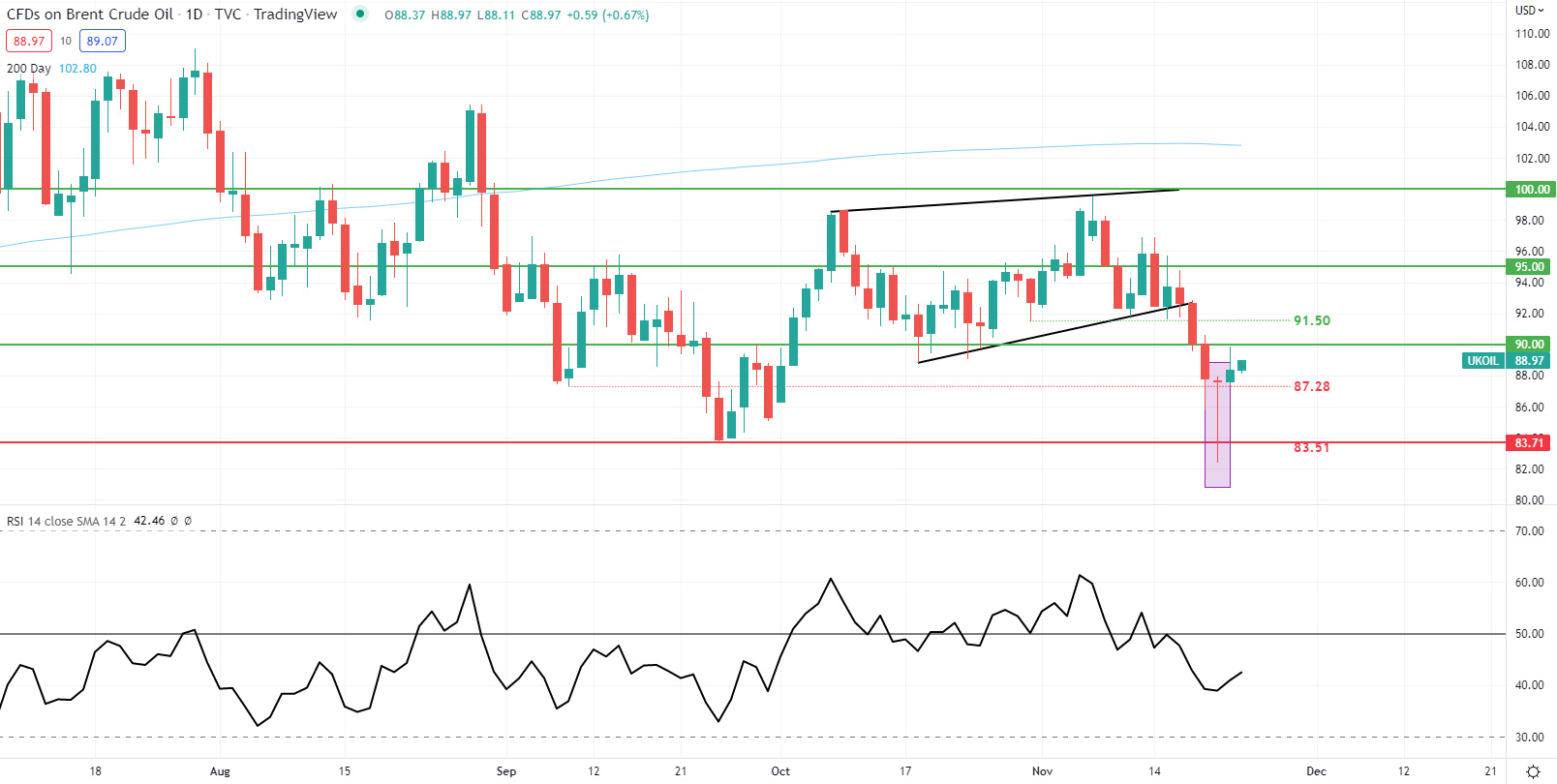

BRENT CRUDE (LCOc1) DAILY CHART -UNDATED

Chart prepared by Warren Venketas, IG

Daily brent crude price action continues to push following on from the lower long wick earlier this week. As mentioned in my previous analysis, the 90.00 psychological handle is likely to come under pressure in due course however, today’s fundamental releases could possibly invalidate this view by supporting the USD and thus lower crude oil prices.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT: BEARISH

IGCS shows retail traders are NET LONG on crude oil, with 84% of traders currently holding short positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside bias.

Contact and followWarrenon Twitter:@WVenketas

Be the first to comment