JacobH

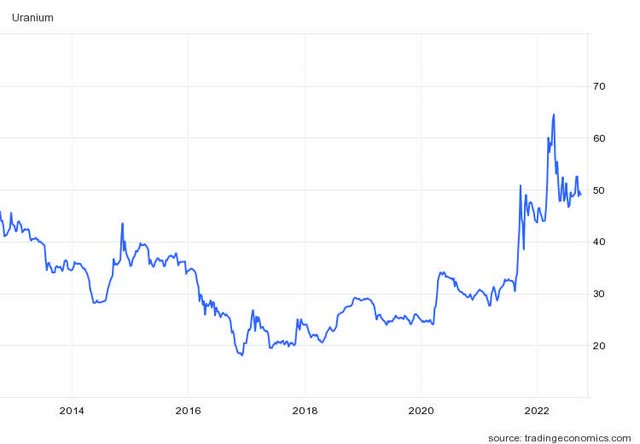

Since bottoming in 2016, uranium prices have been on a slow and steady climb. This trend looks set to continue, as an ever-growing number of regulatory and geopolitical developments push energy markets toward an increased adoption of nuclear power. And as more investors are becoming aware of these structural shifts, the amount of liquidity flowing into the space continues to grow.

The problem, however, is that the uranium world is small, insular, and opaque. The uranium spot price is not widely quoted in the media, and U3O8 futures are very thinly traded. Investors wanting to buy shares in Kazatomprom (KAP.LI), a world leader in uranium production, have to do so on the London market which, for a whole host or reasons, is something that many North American investors may not be inclined to do. And investing in pre-production junior uranium miners brings with it a lot of project-specific risks.

Therefore, investing in a fund or exchange-traded fund (“ETF”) that provides solid exposure to the uranium industry is a logical choice. The problem with the VanEck Vectors Uranium+Nuclear Energy ETF (NYSEARCA:NYSEARCA:NLR), though, is that in spite of its name, it doesn’t provide solid exposure to the uranium industry. Rather, the fund’s heavy concentration of utility holdings results in price action that is much more aligned with those of utility ETFs. This results in NLR being a sub-optimal choice for investors wanting to add uranium exposure to their portfolio.

Large Utility Holdings

NLR seeks to replicate the performance of the MVIS Global Uranium & Nuclear Energy Index. This is an index that was created with the stated purpose of tracking companies involved in at least one of the following:

- Uranium mining projects that currently are, or have the potential to, generate at least 50% of the company’s revenues or constitute at least 50% of its assets.

- Construction, engineering, and maintenance of nuclear power facilities.

- Be involved in the production of electricity from nuclear sources.

- Provide equipment, technology, or services to the nuclear power industry.

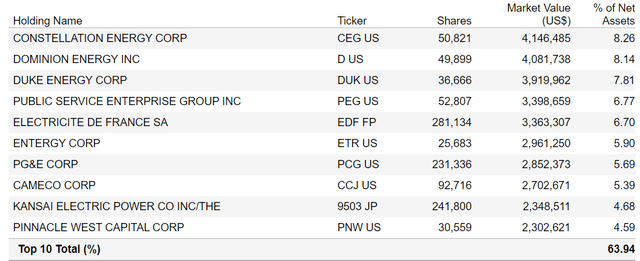

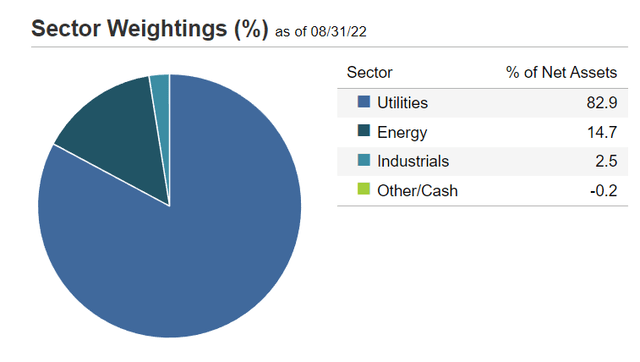

As many readers will probably note, the criteria become increasingly vague as one goes down the list. These very broad conditions for inclusion have resulted in the fund being heavily weighted towards utility stocks. In fact, utilities account for most of the fund’s Top 10 holdings and constituted almost 83% of its total holding at the end of August.

NLR Top 10 Holdings (vaneck.com) NLR Sector Weights (vaneck.com)

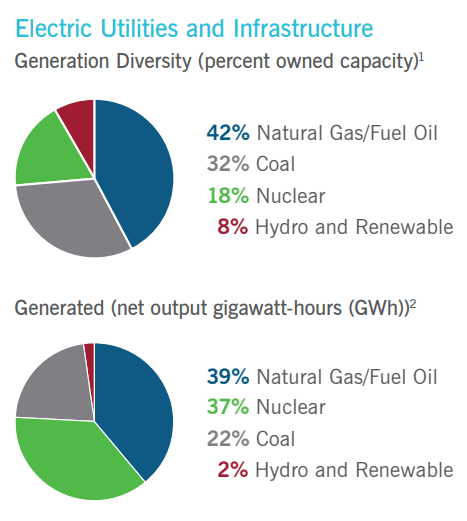

And while it’s true that utilities are the obvious owners of nuclear power facilities, some of the utilities included in the fund don’t even count nuclear as their main source of electricity. That is certainly the case for Duke Energy Corporation (DUK), which last year counted Natural Gas/Fuel Oil as its greatest source of production as well as its largest installed capacity.

Duke Energy 2021 Capacity and Production by Source (2021 Duke Energy Annual Report)

Price Action

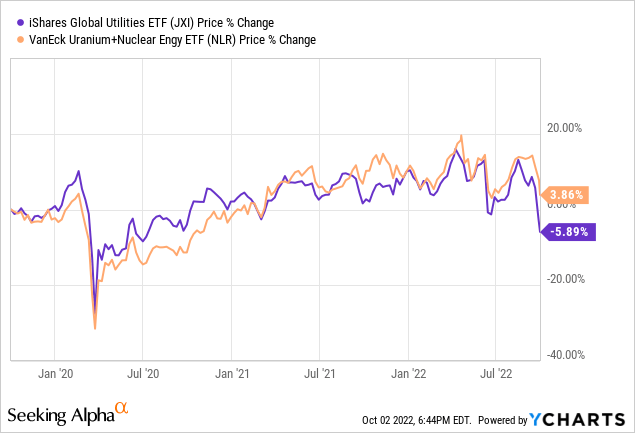

Having such large equity holdings in both domestic and international utilities has resulted in NLR’s performance tracking that of iShares Global Utilities ETF (JXI) to a high degree.

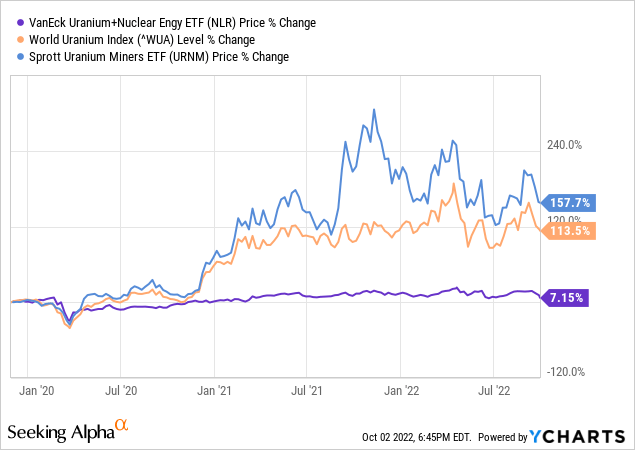

Granted, the two funds are far from being perfectly correlated, but NLR clearly tracks global utility funds much more closely than it does the price of uranium. If we compare its performance to the World Uranium Index (“WUA”) and to the North Shore Global Uranium Mining ETF (URNM), also known as the Sprott Uranium Miners ETF and the subject of a previous article, we see that both the WUA and URNM reflect to a much higher degree the increased liquidity flows going into the uranium space than does NLR.

Takeaway

Of course, there’s nothing wrong in seeking the typically slow, low risk, and steady returns provided by utility stocks and ETFs. However, potential investors should be cognizant of the fact that the utility sector and the uranium industry are very distinct. And it’s highly likely that an investor allocating capital to NLR will get returns much more similar to those provided by the utility sector.

Investors wanting to add uranium exposure to their portfolio would be better served by considering funds such as the previously mentioned URNM. Individuals with a higher risk tolerance may even want to take a look at individual stock search as Denison Mines Corp (DNN) and Cameco Corporation (CCJ).

Be the first to comment