georgeclerk

Thesis

Amazon (NASDAQ:AMZN) stock has recovered remarkably from its June lows. We highlighted in June that it’s likely at a bottom, and therefore we anticipated a rally to occur. But, we urge investors to be wary of adding at the levels in June, as we didn’t think that Amazon would continue to outperform in the medium term.

The company’s Q2 card showed that its AWS and advertising segments were instrumental in helping Amazon outperform the lowered Street consensus. As a result, it helped AMZN stage a robust post-earnings rally as investors looked ahead.

We believe that the company will likely continue its recovery from previous quarters’ challenging comps but believe the near-term upside has been reflected accordingly.

Therefore, we maintain our view that AMZN could struggle to outperform at the current levels. However, AMZN could still perform in line with the market if it regains its operating leverage robustly moving ahead. Therefore, investors with AMZN shares can continue to hang on to them and observe how its recovery pans out.

Therefore, we reiterate our Hold rating on AMZN for now.

Amazon Q2 Earnings: Pretty Strong, But Retail Is A Problem

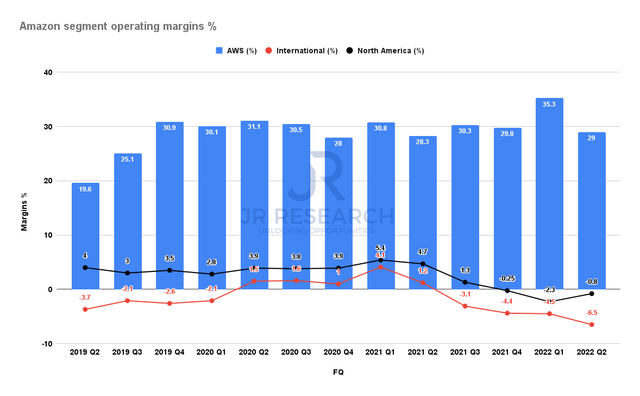

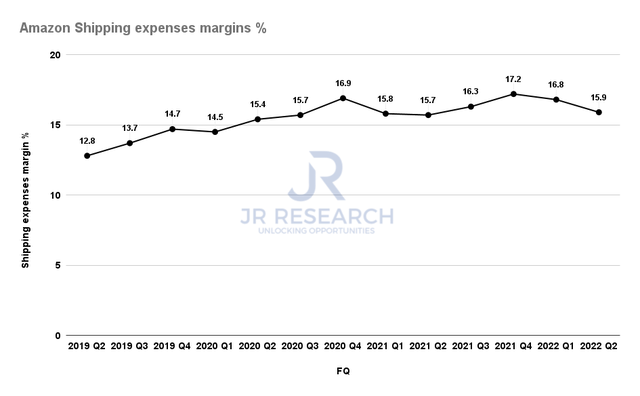

Amazon segment operating margins % (Company filings) Amazon shipping expenses margins % (Company filings)

Amazon’s Q2 release indicated that retail continues to face challenges as its US and international segments posted negative operating margins. However, its US segment saw an improvement from Q1’s -2.3% margin, which we believe could likely be its bottom.

Bloomberg also reported that the supply chain crisis could ease as congestion has reduced. Notably, Amazon’s shipping expenses margins have moved markedly to 15.9%, down from Q1’s 16.8%. Therefore, what turned out to be significant headwinds for Amazon over the past few quarters could help support its revenue and profitability growth moving forward.

However, we also noted a marked decline in AWS’ margin, as it posted an operating margin of 29%, down from Q1’s 35.3% and slightly below trend. CFO Brian Olsavsky highlighted (edited):

So on margins in AWS, it is dropping sequentially. The margin rate is going to fluctuate in this business. It’s going to be always a factor of new investment and things like the sales force and new regions and infrastructure capacity, offset by infrastructure efficiency gains that we see, pricing issues as we extend contracts. But, we see a lot of strength in the business right now. We’re very happy with the growth rate, and happy with the adoption of the cloud. As you hit a potential rough patch in the economy, I think the last time we saw this was back in 2008-ish, and started to draw lessons from that. When you’re trying to launch a new product or service and you are faced with building your own data center and getting capital for a data center and building it yourself or moving to the cloud and essentially buying incremental infrastructure capacity, cloud computing really shows its value. (Amazon FQ2’22 earnings call)

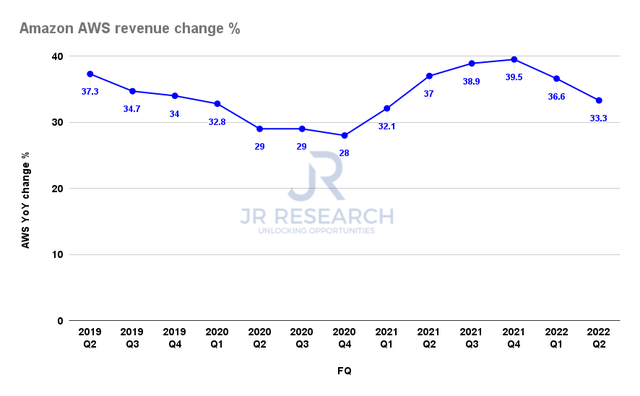

Amazon AWS revenue change % (Company filings)

Notwithstanding, AWS’ revenue growth has also continued to slow. AWS posted an increase of 33.3% in Q2, down from Q1’s 36.6%. However, we concur with Olsavsky that we don’t observe a structural slowdown or deteriorating profitability in its cloud computing business. In contrast, we believe that Amazon has proved to be the highly formidable leader that Microsoft (MSFT) Azure is still trying hard to unhinge from its catbird seat.

WSJ reported that Microsoft has been gathering support to pressure the Federal government toward a multi-cloud approach, given AWS’ dominance. It added (edited):

Microsoft has issued talking points to other cloud companies aimed at jointly lobbying Washington to require major government projects to use more than one cloud service, taking aim at Amazon’s dominance in such contracts. – WSJ

Amazon Could Recover Its Operating Leverage Markedly

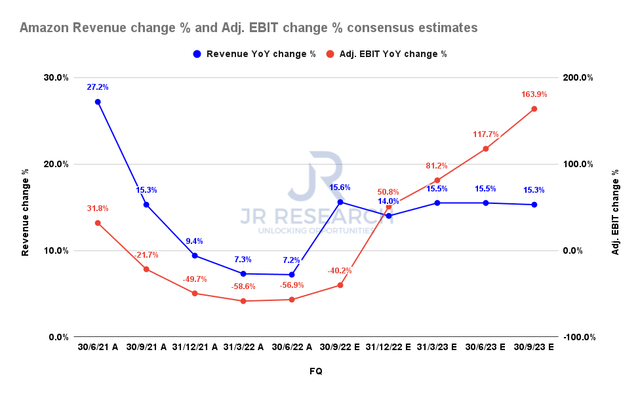

Amazon revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (very bullish) suggest that Amazon could recover its operating leverage markedly as its revenue growth climbs out of its nadir from Q3 onwards.

Therefore, we believe the market re-rated AMZN, as it expects easier comps for the company to lap moving ahead.

| Stock | AMZN |

| Current market cap | $1.37T |

| Hurdle rate | 11% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 5% |

| Assumed TTM FCF margin in CQ4’26 | 10.5% |

| Implied TTM revenue by CQ4’26 | $1.032T |

AMZN reverse cash flow valuation model. Data source: S&P Cap IQ, author

However, we urge investors not to chase the recent rally, as our valuation model shows that AMZN could underperform the market. Investors need to be cautious in expecting Amazon to recover its market outperformance potential, given slowing topline and bottom-line growth.

We believe it explains why the market de-rated AMZN in November 2021, even though it traded at an FY25 free cash flow (FCF) yield of 4.23%. The Street also expects Amazon’s FCF margins to continue improving through FY25, but the market wasn’t convinced.

As a result, we believe investors need to be less aggressive with their assumptions on AMZN and demand a higher FCF yield to compensate for potentially slower growth.

Accordingly, our model suggests that Amazon needs to deliver a TTM revenue of $1.032T by CQ4’26, to meet a market-perform hurdle rate of 11% in our model, which is unlikely. Therefore, it suggests that AMZN could likely underperform at the current levels.

Is AMZN Stock A Buy, Sell, Or Hold?

We reiterate our Hold rating on AMZN.

While we acknowledge that AMZN should hold its June lows, we are not convinced that AMZN could outperform the market moving forward. Given the recent tech and growth bear market, we urge investors to consider other opportunities to increase their potential for outperformance.

Be the first to comment