chaofann/iStock via Getty Images

Stocks declined for a second day over concerns about the geopolitical ramifications of House Speaker Nancy Pelosi’s visit to Taiwan. In addition, several members of the Fed emphasized that the central bank still has a lot of work to do before bringing inflation under control. That combination resulted in a risk-off day with the dollar stronger, long-term interest rates lower, and stocks weak across the board with the exception of the technology sector, which finished with more than a 1% gain.

Finviz

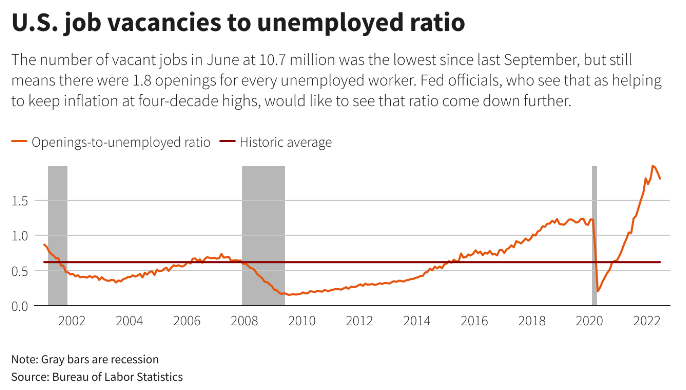

It seems like every day there is another sign that the rate of economic growth is slowing, which I call a post-pandemic normalization, and that inflationary pressures are easing. Yesterday’s sign was a decline of 605,000 job openings for the month of June, according to the Labor Department’s Job Openings and Labor Turnover Survey, which was the largest drop in more than two years. Yes, that is good news, because any slowing in the demand for labor eases wage inflation. There are still 10.7 million job openings, which means that the labor market remains strong. The drop in openings is what the Fed wants to see, as it indicates that tighter monetary policy is working in the real economy.

CNN

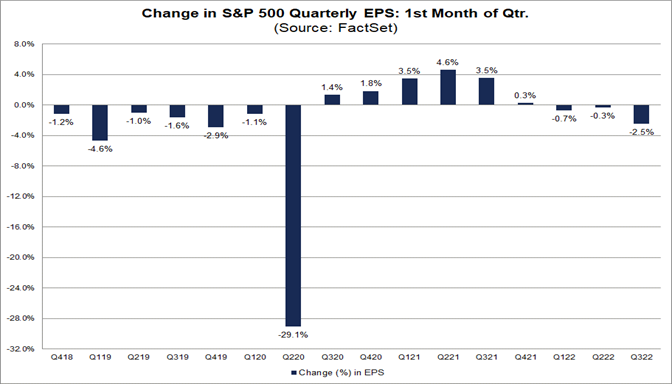

Slower growth will clearly have a negative impact on corporate revenues and profits, but not to the same degree for all sectors and companies. There are some winners and some losers, as we are learning in the midst of this earnings season. Pundits are ringing alarm bells about analysts lowering earnings estimates for the third quarter, as though that was something out of the ordinary, but it is not. In fact, it was the pre-pandemic norm to see consensus earnings estimates decline during the first month of every quarter, which is what we saw in July.

FactSet

FactSet noted this week that analysts lowered third-quarter estimates by 2.5% during July. That has been standard practice for decades, but I will grant that the decline is modestly larger than normal. The 10-year average decline is 1.8%, and the 15-year average is 2.1%. Still, this is not a warning sign. It’s a game Wall Street seems to play to make it a tad bit easier for companies to report an earnings beat.

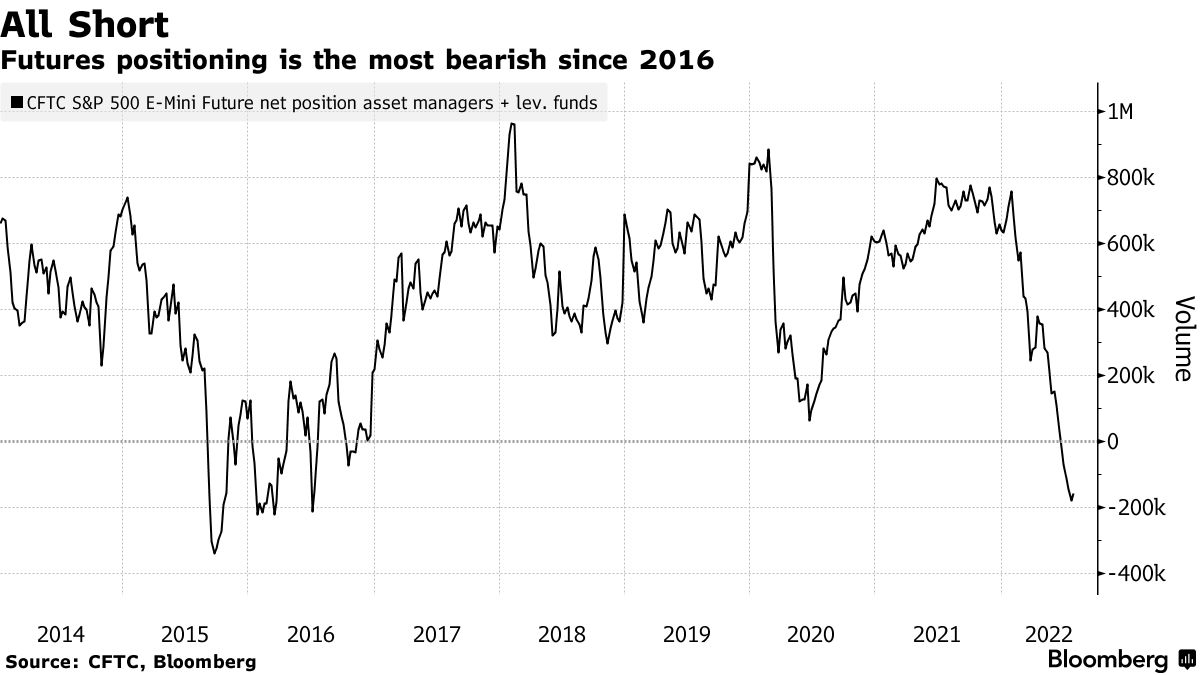

While I’m calling for a pullback in the S&P 500 during the month of August, which I think will consolidate the gains from July, I think we can see a higher high shortly thereafter. It appears that July’s gains did nothing to dent horribly bearish sentiment. Central bankers are not helping, as expected, taking turns reminding investors that there are more rate hikes ahead in order to suppress June’s enthusiasm. The Fed does not want financial conditions to continue easing through higher stock and bond prices. Regardless, professional money is positioning for another big decline in stocks based on futures positioning. This means a little good news can take the market a long way if these bears are forced to cover their shorts.

Bloomberg

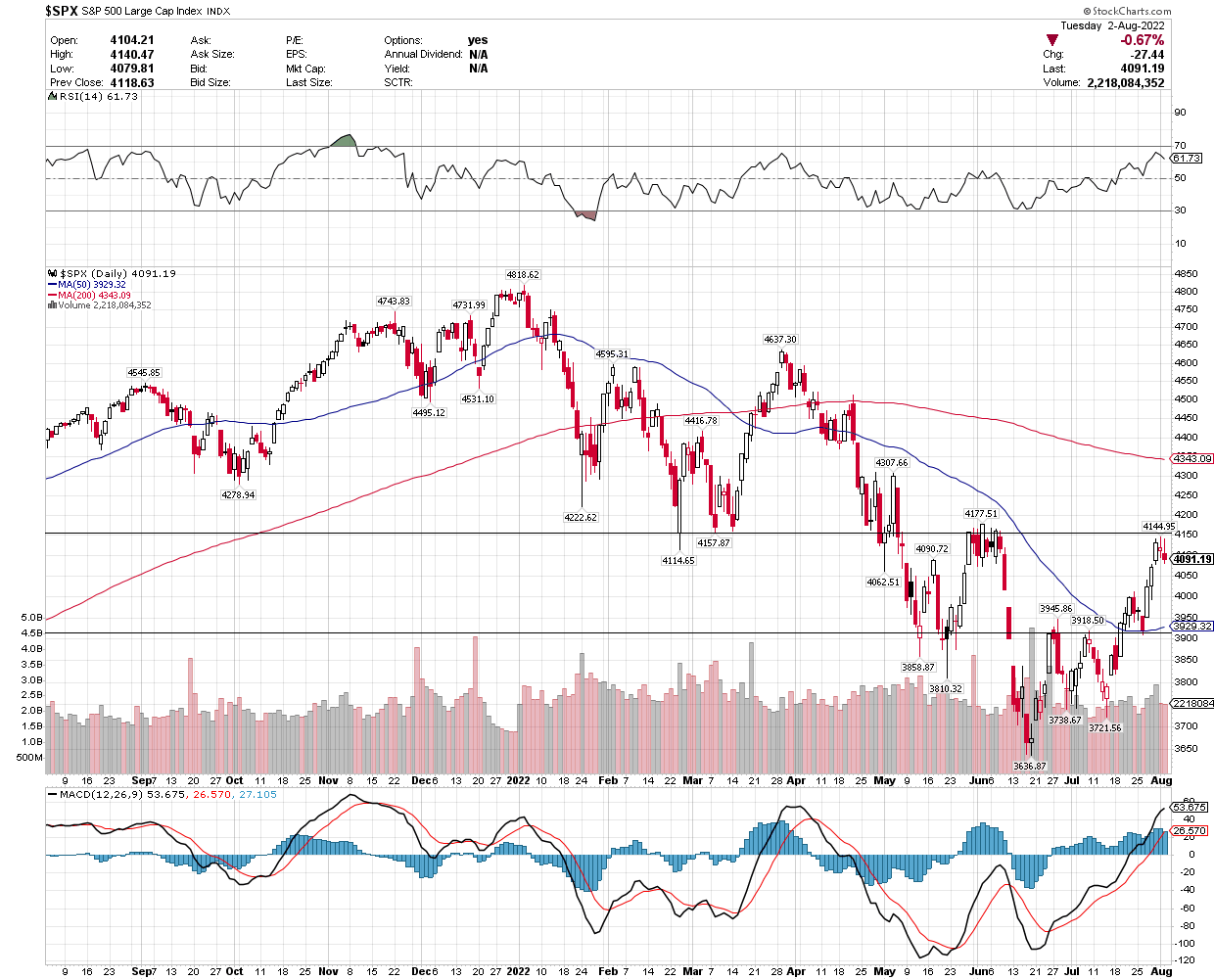

Technical Picture

I’m looking for a pullback to the rising 50-day moving average on the S&P 500 at what is now 3,929.

Stockcharts

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment