LeoPatrizi

I heard a sort of “real life is stranger than fiction” news story recently about a small group of Indian men who pulled off a reasonably elaborate scheme to defraud Russian gamblers. The con went like this: the men hired people to play cricket matches, creating a fake league of several Indian teams. The games were streamed on YouTube, with commentary that sounded professional, crowd noise piped in digitally, and a banner along the bottom with player stats. The outcome of the games was thrown, while bets were booked through the Telegram app. Indian police have arrested the men and put a stop to it.

I am not personally a sports gambler or into fantasy sports, other than getting together once a year with friends at a local horse track with a twenty dollar bill for placing a few $2 bets; it is a substitute for going to a movie or out for a round of golf, mainly a casual way to spend a good time with friends. Despite my personal non-interest in fantasy sports and wagering on sports outcomes, I recognize an obvious trend when I see one. When the United States Supreme Court ruled in 2018 that states may legalize sports betting if they want, the door was opened for major expansion. Although the United States context is my primary focus, the rapid legalization of sports betting globally is happening as well, which is what leads me today to take a look at one of my newer holdings, Sportradar Group AG (NASDAQ:SRAD).

Intro to Sportradar and Recent Performance

Sportradar Group AG is a Switzerland-based company that provides a service of supplying sports-related data and statistics, with clients including sports federations and leagues, media companies, and book makers enabling sports betting based on data integrity. It was founded in 2001, and became a publicly traded company in September of 2021 through a traditional IPO process. It has the backing of some big names in sports and business, including Mark Cuban and Michael Jordan. Competitors include Genius Sports Limited (GENI) and some privately owned firms like Stats Perform and others.

Sportradar has agreements with a diverse set of sports interests around the globe, such as NASCAR in the United States, the International Tennis Federation, DraftKings (DKNG), and World Rugby, to name just a few. In addition to such arrangements with leagues and governing bodies themselves, Sportradar also supplies some media outlets, such as being the data provider for CBS Sports (PARA) during the NCAA men’s college basketball tournament.

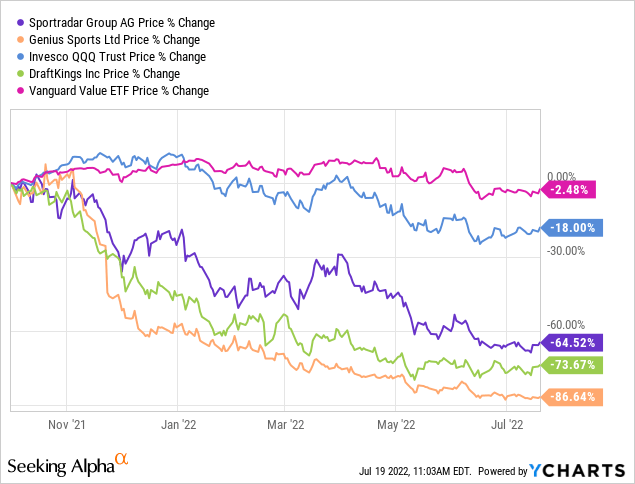

Sportradar does not keep every deal it seals in this competitive market. It let go of a big one last year, losing its previous relationship with the National Football League to Genius Sports, although it gained the rights to the National Basketball Association starting with the 2023-2024 season. Nevertheless, any investor in either of these who bought and held since the start of Q3 last year would be sitting on some unpleasant paper losses at the moment.

The IPO was perhaps unfortunately timed for investors, coming into a market last fall that was starting to turn against high-growth names in favor of value stocks. As a result, Sportradar’s shares are sitting around their lows, off 60% or more from the IPO price since early May.

In spite of the share price performance, the underlying growth has been solid so far in 2022. The following figures are sourced from the company’s SEC filings; references to 2021 and prior are from the 2021 year end report, whereas Q1 2022 figures are from the company’s first quarter 6-K (report of foreign issuer). First quarter revenues came in at €167.9 million, nearly €40 million more than the same quarter of 2021, or 30% growth. This top line growth has been a steady trend; for full year comparisons for example, 2019 has revenue of €380 million, 2020 grew to €404 million, 6% growth in spite of Covid-19. Sales really took off again in 2021, finishing at €561 million, 39% higher than 2020. Guidance for 2022 is for continued strong sales growth, in the range of 18% – 25%, and this guidance was affirmed during the Q1 earnings call. At the midpoint of guidance, 2022 would end up with around €680 million in sales.

The impressive thing, in my view, is that Sportradar manages to be both high growth and profitable at the same time, and has been for a while before becoming a public company. Just to take one measure, earnings per share in 2019 were €0.05, in 2020 were €0.06, and for 2021 were €0.05. Other profitability metrics are also in positive territory, such as the company’s adjusted EBITDA results. For example, in Q1 of 2022, adjusted EBITDA was €26.7 million, which was actually down 5% relative to the prior year, but indicates clearly that the prior year’s 1st quarter had also been EBITDA positive.

The major cash expenses for the company are labor, the cost of licenses, and operating (G & A) expenses, which for 2021 added up to €391 million. Once you add in the cost of financing its €435 million of debt, it leaves an operating margin of around 25% (not counting depreciation).

Shifting to review the balance sheet and cash flow statements, Sportradar has improved its liquidity on account of its financing activity in 2021, going from €386 million in cash at end of 2020, to €743 million as of December 2021, and €716 million at end of Q1 2022, compared to a debt balance of €435 million, so there is plenty of liquidity. The company has consistently generated cash flow from operations. Their cash flow statement breaks down separate figures for operations for before and after taking into account changes in working capital and taxes (as a Swiss company, it follows IFRS accounting practices, not US GAAP, so there are a few minor differences in how financial statements are presented). Over the period 2019 – 2021, cash from operations before working capital adjustments and taxes grew from €157 million to €197 million, while after factoring in those elements, cash flows declined from €146 million to €132 million.

The explanation for the diverging figures is clear enough – the year 2021 showed big changes in scale to changes in receivables, payables, and taxes, going from a combined impact of positive €9 million in 2019 to negative (€57 million) in 2021. The essential message, however, is that operations have been established as a source of cash, and not a use of cash.

Where the Momentum Is Heading

I am not concerned about the changes in any one specific measure from quarter to quarter, but encouraged to see the combined trends of revenue growth and positive earnings and operational cash flow. In the near term, growth is coming online from expanding opportunities in the United States. The U.S. market is currently seeing the highest growth; Q1 2022 sales grew 124% over 2021 as more states came online with legalized sports betting.

So far this year, Maine and Kansas have joined this list of legal states, with California still on the table in the form of November ballot initiatives. The chances in Massachusetts for 2022 appear to be getting dim as the legislative time window for state senate approval is getting short, but it could still happen. Regardless of the final outcomes for this year, the chances of more states legalizing sports wagering in some form over the coming years is a clear tailwind for Sportradar. The United States isn’t the only growing opportunity around either – Canada is also expanding access, especially in Ontario, by which Sportradar has already benefited with additional contracts.

Even in a recession, management is confident of overall resilience in consumer involvement in sports betting. The specific question was raised during the Q1 earnings call, and CEO Carsten Koerl responded in part by saying:

We see no impact from the current downturn and recession and we expect no impact. In all the 25 years where I operated, I see one thing: Sports betting and sports is resilient on this crisis and recessions. We see exactly the same thing now. We think we might even see some acceleration in some markets. . . It probably. . .has probably more a positive impact for us, because if the crisis is getting bigger, people have the mentality to small money into winning big prizes. That’s what you see in lotteries. You see the same in sports betting.

The combination of expanding legalization and no major negative impact from an economic slow down are a compelling set-up, and one that looks to set the stage for sustainable growth over at least the next two to three years. Though there is some research suggesting casinos are themselves not exactly recession-proof, the underlying strength of a company Sportradar that provides the data used in odds making will not identical exposure as casinos, who have to navigate the impacts to the overall hospitality industry as well as gaming.

Valuation

The growth potential and historical results are sitting in plain view for the entire market to consider, and so it could be that the good news is already fully factored into the equity’s value in spite of the decline. Given the fairly rapid and assertive moves taken by the Federal Reserve on interest rates that are widely expected to continue this week, nearly every growth stock has seen an erosion in market value, and Sportradar is no exception.

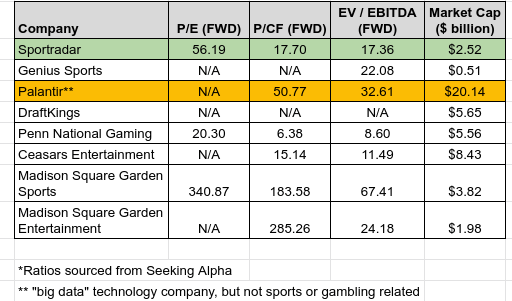

The flip side, of course, is that the shares are more attractively valued now relative to the past. That does not necessarily make them fairly valued, but it does make the question of what constitutes “fair value” an essential one for investors. Since Sportradar has positive earnings and cash flow, but some reasonable equities for comparisons are companies without these features, I looked a broad range of possible comparisons and valuation metrics, including Price / Earnings, Price / Cash Flow, and Enterprise Value / EBITDA. Within this milieu of sporting, data, gambling and entertainment peers, I narrowed down to a selection with market caps between $2.0 billion and $9.0 billion, with two exceptions.

I did include Genius Sports Limited, who is the closest pure competitor in terms of offerings, but is considerably smaller in scale (but managed to secure the NFL contract). I also used Palantir Technologies (PLTR), which is massively larger and also has no particular specialization in sports or wagering (although it does some work with Ferrari (RACE) on racing), but Palantir is a fast growing big data analytics company. Other than these two, the comparisons are either traditional names in casino operations like Ceasars (CZR) and Penn Gaming (PENN), hosting live sports with Madison Square Garden Entertainment (MSGE), or operating professional sports franchises through Madison Square Garden Sports (MSGS). DraftKings, the fantasy sports giant, doesn’t have positive earnings, cash flow, or EBITDA, so although I have it in the chart, there is not really any meaningful comparison that can be made yet on these metrics.

Valuation Comparisons; Sportradar and select companies (author’s spreadsheet)

A couple of things become clear in looking at the comparisons. First of all, Sportradar is not any more richly valued than its smaller competitor, Genius Sports. Secondly, its valuation measures seem to be relative closer to those of Caesars Entertainment than any other firm, although noting that Caesars has a premium valuation relative to Penn Gaming. Finally, I believe it is a broad enough set of comparisons that all share some overlapping interests and exposure (with the exception of Palantir) that I am comfortable concluding that Sportradar is not overvalued on a relative basis to its sector peers.

I would not go so far as to describe it as being undervalued at this time, but I do expect to see the earnings, EBITDA and cash flow aspects of these ratios all grow in the coming 24 to 36 months, and I expect the market will adjust accordingly in due time.

Conclusions

The growth narrative here has plenty of tailwinds driving it forward. The legalization of sports betting on a state by state basis should continue over the coming years, and Sportradar is well positioned to benefit as that expansion unfolds. The shares are valued in-line with high growth peers, and Sportradar is already cash-flow and EBITDA positive.

I do need to point out the unequal share class structure, as it could be considered a risk in governance. Sportradar has two classes of shares, A and B, and the structure is tilted to putting most of the voting power into the class B shares. The exclusive holder of the class B shares at the time of going public was the company’s founder and current CEO, Carsten Koerl, who therefore holds a concentration of about 82% of the voting power.

Though I am long-term bullish on the company, I am starting out with a hold rating, primarily because I expect both the Federal Reserve and the European Central Bank to continue raising interest rates, and therefore I am not convinced that shares will move up in value meaningfully over the next 12 months. Over a longer horizon of 2 to 3 years, I consider them a buy.

Be the first to comment