BongkarnThanyakij/iStock via Getty Images

Avalara Inc (NYSE:AVLR) offers cloud-based software for large and small businesses to deal with tax compliance. The tools cover everything from transaction sales and use-tax paperwork, VAT, GST, excise, communications, lodging, and other indirect tax requirements from various authorities. The attraction here is that companies are increasingly looking for digital and automated solutions to deal with the growing complexity of these types of regulatory issues.

While growth has been very impressive over the last several years, shares of AVLR have been caught up in the broader market volatility with a deep selloff in 2022 against what was likely a stretched valuation at the top. Ahead of the upcoming Q2 earnings report set to be released on August 8th, we see several reasons to get bullish on the stock which is well positioned to recover.

AVLR Investment Thesis

We’ll get straight to the point highlighting five reasons we’re buying AVLR with an expectation that shares can outperform going forward.

- The company is a high-quality business offering an in-demand, differentiated business software service with a positive long-term outlook.

- Firming margins and climbing profitability highlight an impressive growth story and solid fundamentals.

- Operational trends including strong cross-selling momentum can support an earnings beat in the upcoming quarterly report

- Favorable technical setup with shares forming a tradeable bottom.

- Rumors of the company being a potential acquisition target add a potential near-term catalyst.

AVLR Key Metrics

AVLR last reported its Q1 results back in May with non-GAAP EPS of $0.08 which beat expectations by $0.25. Revenue of $205 million climbed 33% year over year and was also ahead of the consensus.

While the company is unprofitable on a GAAP basis with negative free cash flow, the story here is the trend of improving financials. Excluding stock-based compensation and the amortization of acquired intangibles, Avalara reached a positive adjusted operating income in Q1 of $4.7 million with a 2% margin, reversing a loss of -$2.2 million in the period last year. The result has been driven by the top-line strength while benefiting from overall scale as SG&A and R&D decline as a percentage of revenue. These trends are expected to accelerate through next year.

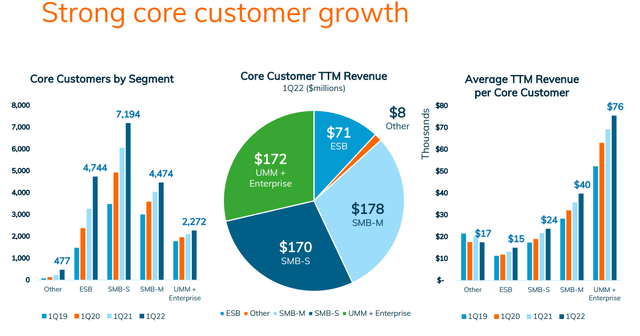

Operationally, customer growth has been the main engine of the company including a trend of climbing revenue per core customer. For context, Avalara breaks out its customer groups by size where the enterprise-level segment generating $76,000 per customer in Q1 2022 is up from a level closer to $50K in Q1 2019. The trend is similar with small and mid-size businesses. Total core customers reached 19,160 core customers, up from 18,270 in the period last year.

source: company IR

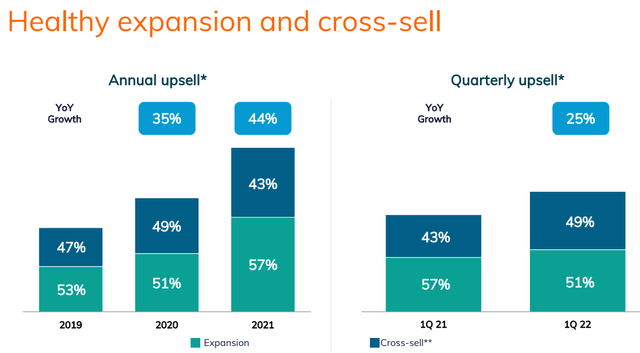

A lot of the success has been Avalara’s ability to both cross-sell and upsell new features to existing customers along with a continued international expansion as part of its strategy. Management explains that a cohort of customers that have been on the platform typically add more services to their contracts over time evidenced by a net revenue retention rate of 115%. We can also bring up that the level of deferred revenue at $304 million to the end of the quarter is up 7% just from Q4 which provides some visibility for a further growth runway.

source: company IR

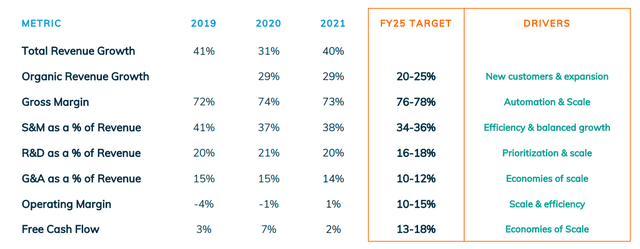

In terms of guidance, management is targeting full-year 2022 revenue between $867 and $871 million which represents an approximate 25% increase over 2021 at the midpoint. While Avalara expects a negative non-GAAP operating loss for the full year between $6 million and $8 million, it’s worth noting that this estimate was revised from prior operating loss guidance between $17 million to $21 million. Furthermore, management sees the company approaching breakeven or better in Q4 2022 which sets up an earnings tailwind into next year.

Avalara has also released targets for fiscal 2025. Over the next three years, the plan is for the operating margin to trend towards 10-15% as it benefits from its larger scale and efficiency. Compared to a gross margin of 73% in 2021 and Q1, the expectation is that the metric can trend towards 76-78% based on the top-line momentum and a push towards automation. The expectation is that organic revenue growth continues above 20% per year over the period.

Finally, we note that Avalara ended the quarter with $1.5 billion in cash and equivalents against approximately $1 billion in total debt. The cushion here should provide ample liquidity to support continued growth which will be further strengthened as cash flows improve going forward.

source: company IR

Is AVLR A Good Long-Term Investment

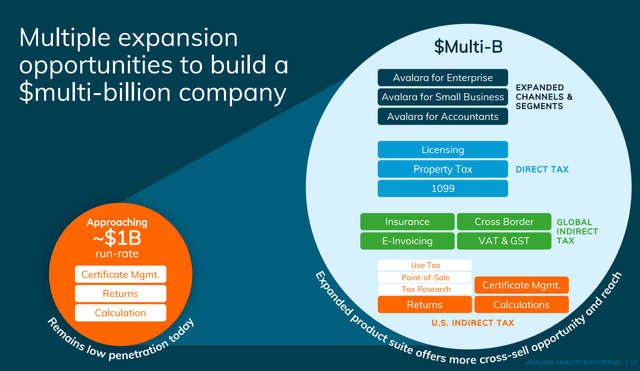

We won’t claim tax compliance is the most exciting area of software tech, but the point here is that Avalara has established itself as the leader in dealing with these specific functions. The upside is that clients are often captured based on basic functionality, opening the door for Avalara to expand the relationship through its full product suite.

source: company IR

One of the most encouraging developments is Avalara’s more recent push to integrate with related SaaS marketplaces and e-commerce platforms. In essence, businesses dealing with large volumes of payments and transactions are targeted customer types that can benefit from Avalara solutions. Management notes that the new relationships are driving a new wave of growth. From the earnings conference call:

Customers of all sizes and in all industries are more quickly becoming omni-channel, having to deal with tax compliance across multiple systems and in more jurisdictions even globally. This greatly increases their tax compliance complexity and renders manual status quo solutions ineffective. The millions of new e-commerce customers created over the last two years will need to deal with this reality and we capture tens of thousands of them and still growing using our calculation on our e-commerce partners platforms. This offers us a large number of prospects to upsell additional compliance products beyond just calculation.

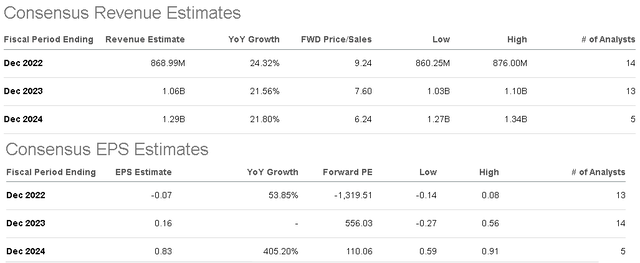

According to the current revenue and earnings consensus, 2023 is set to be the breakout year for EPS to turn positive with a current estimate of $0.16 compared to the forecast for -$0.07 in 2022. From there, the market expects earnings to accelerate, in line with management targets supported by the recent operating trends.

Seeking Alpha

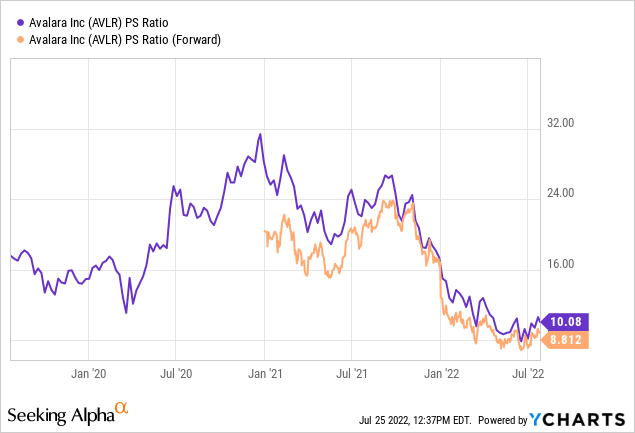

AVLR trading at 9x 2022 sales suggests the growth story here is hardly a secret. At the same time, recognized that the stock traded with a sales multiple as high as 30x in late 2020. We make the argument that the growth story and long-term outlook for the company are as strong as ever.

As it relates to valuation, shares are looking interesting considering the earnings momentum expected through 2025 and beyond. Compared to the consensus EPS of $0.16 in 2023, the potential that EPS climbs more than 400% towards $0.83 by 2024 with revenue climbing above 20% is the type of trend that can justify a higher premium.

AVLR Stock Price Forecast

We mentioned shares AVLR have been under pressure all year, since hitting a high above $190 in Q4 of 2021. A lot of this considers the broader market concern over global growth and the impact on general business activity. AVLR as a high-growth, yet unprofitable tech name is exactly the type of stock the market has punished amid the historic volatility.

That being said, the recent action in the stock has been encouraging, rebounding sharply from a low of $66 back in June. To us, shares have built a tradeable bottom representing an attractive entry point for a long-term holding.

Seeking Alpha

AVLR is set to report its Q2 earnings on August 8th, after the market close. The consensus for revenue at $209 million represents an increase of 24% y/y with an EPS loss of -$0.08. We see room for the company to outperform expectations, particularly on the top line, with a sense that the current macro headwinds have not materially impacted the company. By this measure, the market may be too pessimistic about Avalara’s outlook with a stronger report potentially working as a catalyst for shares to rally higher.

Finally, we can bring up reported rumors of AVLR as a potential acquisition target. A headline earlier this month of interest from private equity group “Vista Equity Partners” sent shares higher by over 16% on the day. While nothing has been confirmed, the possibility of a takeover at a premium to the current market price adds a layer of optionality to AVLR that would be rewarding to shareholders.

Final Thoughts

There’s a lot to like about Avalara within the segment of “back office business management tools”. While the share price performance has been disappointing to investors, we believe the company is a long-term winner entering a breakout year for earnings in 2023. The potential that shares to rally above ~$95.00 as an area of technical resistance could set the stage for more sustained momentum towards $120 as our upside price target over the next year. We are bullish and rate shares as a buy.

Beyond the upcoming Q2 earnings report, its likely volatility will continue until macro conditions stabilize. On the other hand, a deterioration in the global growth outlook represents a key risk that would undermine the bullish momentum. Weaker than expected results would also force a reassessment of the long-term earnings outlook and open the door for a leg lower in the stock. Cash flow trends and the operating margin are key monitoring points this year.

Be the first to comment