curraheeshutter

This article was researched and written by Waleed M. Tariq.

Investment Thesis

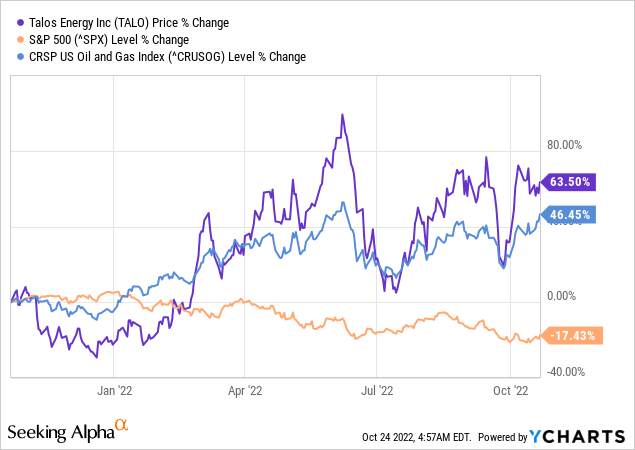

Talos Energy Inc (NYSE:TALO) has ridden on the back of the energy market surge in 2022 to outperform the market and the CRSP US Oil and Gas index by double digits in the previous 1 year, accumulating a YTD price gain of over 110%. However, the stock is highly volatile, with a 60-month beta of 2.34, which resulted in a nosedive when the pandemic hit, resulting in unimpressive gains of under 4% in the last 3 years, underperforming the market’s 25%.

Talos aims to achieve strong organic and inorganic growth through its firm operational footprint in the Gulf of Mexico (“GOM”) and the acquisition of EnVen. Additionally, the strong commodity pricing advantage has enabled it to generate substantial cash flows, augment its profitability, improve its balance sheet, and, consequently, maneuver through an upcoming recession.

Given the overall market conditions and the company’s trajectory, it is a good buy for near-term post-earnings gains and a great buy for long-term investors. However, with the potential recession around the corner and the company’s hedged position, 2023 will likely offer an even better buying opportunity.

The Company

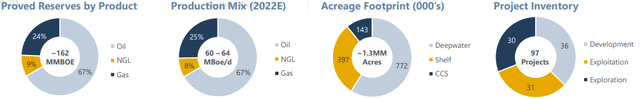

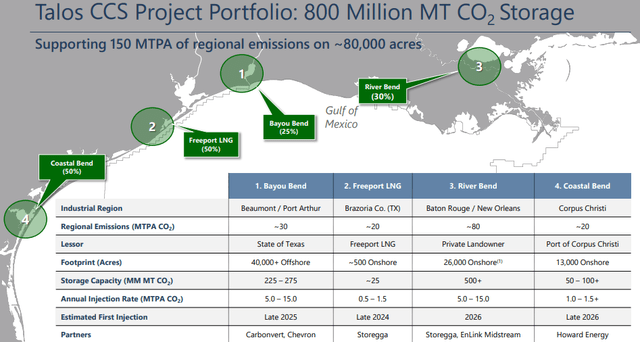

Talos Energy is a Texas-based company exploring and producing oil, gas, and NGL in the GOM and offshore Mexico. It also develops carbon capture and sequestration (“CCS”) opportunities to reduce third-party industrial carbon emissions.

The company’s proven reserves include about 108.5 mmboe of oil, almost 39 mmboe of gas, and 14.6 mmboe of NGLs, accounting for 67%, 24%, and 9% of its total reserves and 84%, 12%, and 4% of its H1 revenues, respectively.

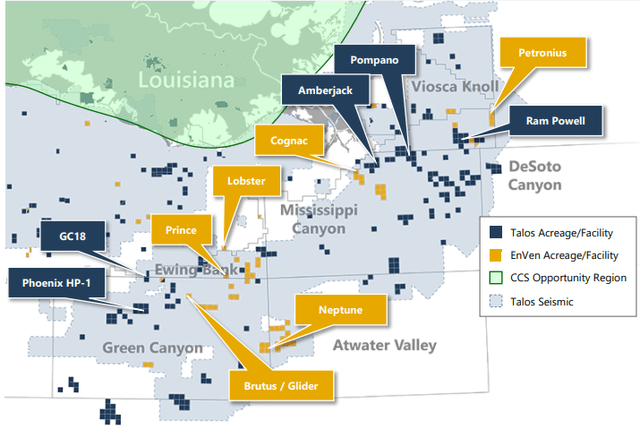

The company recently acquired EnVen Energy for $1.1 billion, including 43.8 million shares of Talos, $212.5 million in cash, and EnVen’s net debt of about $50 million. According to the investor presentation, the strategic rationale of the transaction is to expand its Gulf of Mexico operations with high-margin and oil-weighted assets, improve FCF per share in 2023, and then immediately de-leveraging.

Talos’ Acquisition Presentation

Down The Road

The oil and gas market has been extremely lucrative this year because of the much-discussed macroeconomic factors. Instead of focusing on these past events, I will solely focus on their effects on the company’s current and future financial performance and position.

First off, the company realized an average price of $100.9 per bbl of oil and $6.5 per mcf of natural gas in H1 2022, compared to $40.36 and $3.32 in H1 2021, an increase of 2.5x and almost 2x, which accounted for most of its revenue growth and margin expansion.

In H2, EIA expects the average WTI spot price to revert to $95 and natural gas prices to fall to $5.97, indicating a QoQ decline of 6% and 8% and a YoY price increase of 26% and 28.4%.

| 2022(e) | 2021 | YoY Increase | |

| Unhedged average WTI price for oil per bbl | $98 | $65.9 | 49% |

| Unhedged average HH price for gas per mcf | $6.23 | $3.99 | 56% |

Accounting for the company’s hedging instruments, the realized prices went substantially down to $49.67 per barrel of oil and $3.11 per mcf of gas in 2021. These instruments still form a part of the financial statements and will result in noticeably lower realized prices of about $54 per barrel of oil and $2.7 per MMBtu of gas in H2 2022.

However, in 2023, these hedges will likely prove to be instrumental as oil and gas prices start reacting to the recessionary threats and drop in response to a weak demand outlook. The EIA and OPEC have also lowered their estimates and will likely further cut down these estimates as we move closer to a tangible recession.

Talos produced 7,762 MBbls of oil and 17,454 MMcfs of gas in the first half of 2022, down 5.5% and up 2.2% from the 8,218 MBbls and 17,080 MMcfs at the same time in 2021. In Q3 and Q4, it expects to drop production because of scheduled dry docking activities and achieve annual production volumes of about 15,050 MBbls of oil and 34,200 MMcfs of gas.

| 2022(e) | 2021 | YoY Increase | |

| Oil Production (MMBbl) | 15.05 | 16.2 | -7% |

| Gas Production (bcf) | 34.2 | 32.8 | 4.3% |

However, the production is also expected to be ramped up in 2023 following the EnVen acquisition as it augments its position as a leading deep-water operator in the GOM, expecting the transaction to result in a 40% production increase. In its earnings call, the management shed light on the growth plans for the foreseeable future:

The projects we are undertaking later this year and early next year are both operated and non-operated opportunities that we expect will provide reserve and production growth over the next 12 to 18 months. We’re going to drill a lot of wells in the next 12 months, and we’re excited to see about those results and where that leads us as we get into kind of the second half of ’23 as we get into ’24, and we have fewer hedge volumes. And so that opens up quite a bit of price upside for us.

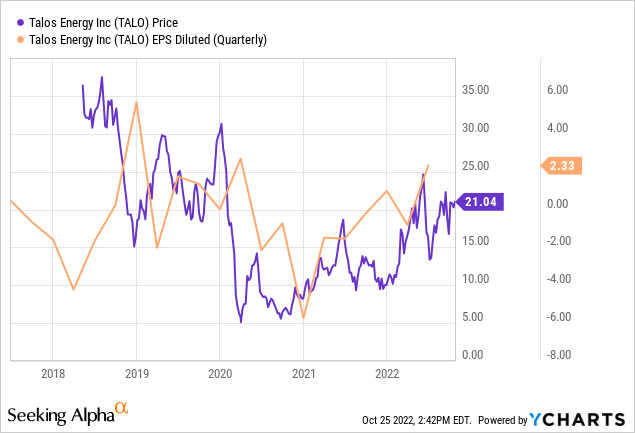

The stock price saw a substantial decline after reporting a loss in Q1 and a sizeable gain after reporting a profitable quarter in August, demonstrating a price-earnings correlation and showing that the stock price hasn’t completely detached from its fundamentals even amid the volatile market. This indicates that the market is still largely basing its fair value on revenue, earnings, and growth, and an outperformance in the upcoming reports will likely result in a stock price gain in the short term.

Given the previous information about revenues and profitability, it is most likely that the stock will show positive signs in the near term while gearing up for long-term augmentation.

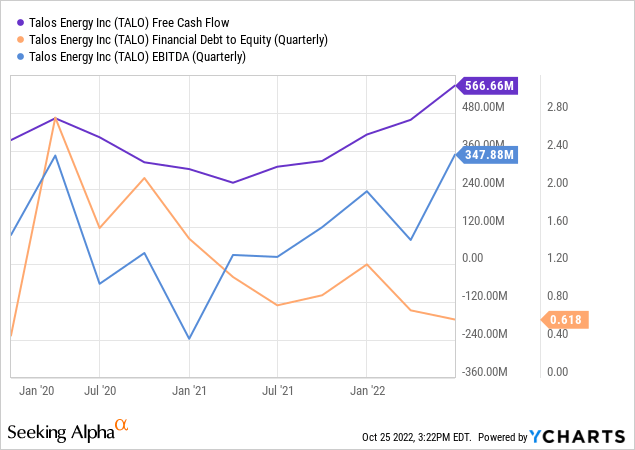

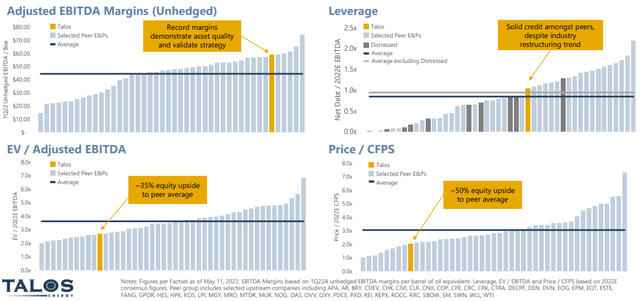

Valuation Brief

Talos stock is currently trading at about a 60% discount to its 5-year average EV/EBITDA of 7.48x. Its forward EV/EBITDA ratio of 2.69x is about 54% lower than its peers. The upcoming quarters could substantially tune up the company’s profitability, augment its EBITDA, bolster its cash flows, improve its leverage ratios, and expose a valuation sweet spot, perfect for an entry point.

However, it is undeniable that despite the volatile market conditions, the stock is cheap even today.

Talos Analyst Day Presentation

One More Thing

The company is establishing its CCS footprint by executing large-scale decarbonization solutions for reducing industrial emissions with industry behemoths like Chevron (CVX). This might further add an upside to its buy thesis as it leverages the “green movement” and the recently passed Inflation Reduction Act.

Conclusion

Talos Energy has a strong balance sheet, a TTM operating margin of 19.97%, and a levered FCF margin of 13%. These figures are better than the sector medians but will potentially improve even further within a year with the accretive EnVen acquisition. However, the stock still remains undervalued due to market risks, and even at a 5% growth rate, a 10% discount rate, and a 1% terminal rate, a FCF-based DCF model spews out a 46% upside.

With multiple catalysts awaiting realization, the upside scenario of the stock outweighs the risks, making me bullish on the stock. I rate the stock a buy for long-term investors, with expectations of better valuation multiples in 2023 as it expands its margins further.

Be the first to comment