naphtalina/iStock via Getty Images

30 Big Banks

This post covers 30 big banks.

Assets as of 12/31/21 ($B.)

| (ALLY) | Ally Financial Inc | $ 182 |

| (AXP) | American Express Co. | $ 189 |

| (BAC) | Bank of America Corp. | $ 3,169 |

| (BK) | Bank of New York Mellon Corp. | $ 444 |

| (C) | Citigroup Inc. | $ 2,291 |

| (CFG) | Citizens Financial Group, Inc. | $ 188 |

| (CMA) | Comerica Inc. | $ 95 |

| (COF) | Capital One Financial Corp. | $ 432 |

| (DFS) | Discover Financial Services | $ 110 |

| (EWBC) | East West Bancorp, Inc. | $ 61 |

| (FRC) | First Republic Bank | $ 181 |

| (FITB) | Fifth Third Bancorp | $ 211 |

| (GS) | The Goldman Sachs Group, Inc. | $ 1,464 |

| (HBAN) | Huntington Bancshares Inc. | $ 174 |

| (JPM) | JPMorgan Chase & Co. | $ 3,744 |

| (KEY) | KeyCorp | $ 186 |

| (MS) | Morgan Stanley | $ 1,188 |

| (MTB) | M&T Bank Corp. | $ 155 |

| (NTRS) | Northern Trust Corp. | $ 184 |

| (NYCB) | New York Community Bancorp Inc. | $ 60 |

| (PNC) | PNC Financial Services Group Inc. | $ 557 |

| (RF) | Regions Financial Corp. | $ 163 |

| (SBNY) | Signature Bank | $ 118 |

| (SCHW) | The Charles Schwab Corp. | $ 667 |

| (SIVB) | SVB Financial Group | $ 211 |

| (STT) | State Street Corporation | $ 315 |

| (SYF) | Synchrony Financial | $ 96 |

| (TFC) | Truist Financial Corp. | $ 541 |

| (USB) | U.S. Bancorp | $ 573 |

| (WFC) | Wells Fargo & Co. | $ 1,948 |

YTD Stock Prices

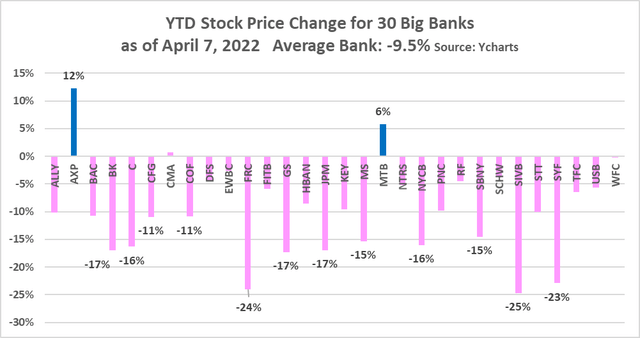

Year-to-date big banks are down 9.5% on average. Only two banks show gains in 2022.

American Express is up smartly this year. You might think the nice pop was in response to a 20% increase in dividends announced March 10, but alas, PNC on April 1 announced its own 20% dividend growth rate, yet its stock is flat.

Biggest laggards include two of my favorite long-time holds: First Republic and Silicon Valley Bank. I will address these two niche banks below.

Stock Prices (YCharts)

Price Targets

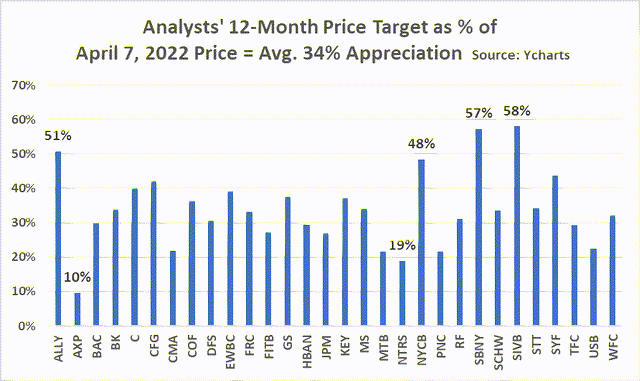

Despite the lack of price momentum, bank analysts expect bank share prices to rebound nicely over the coming twelve months. I am not so confident.

Analysts expect three banks to grow more than 50%: Car-lender ALLY, apartment-lender Signature, and tech specialist Silicon Valley Bank.

Price Targets (YCharts)

1Q EPS Estimates

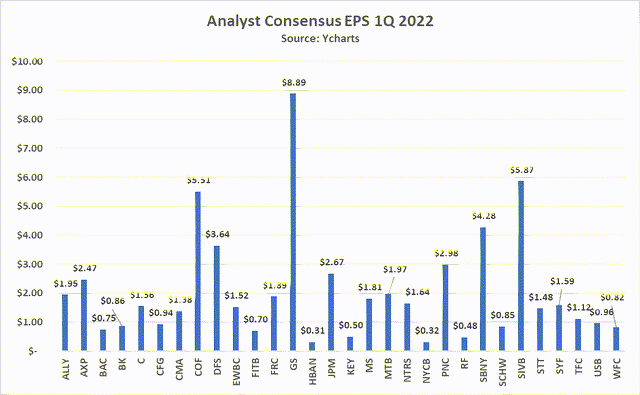

Here are consensus 1Q EPS numbers for the 30 banks.

EPS Est. (YCharts)

Estimates Ratcheted Down

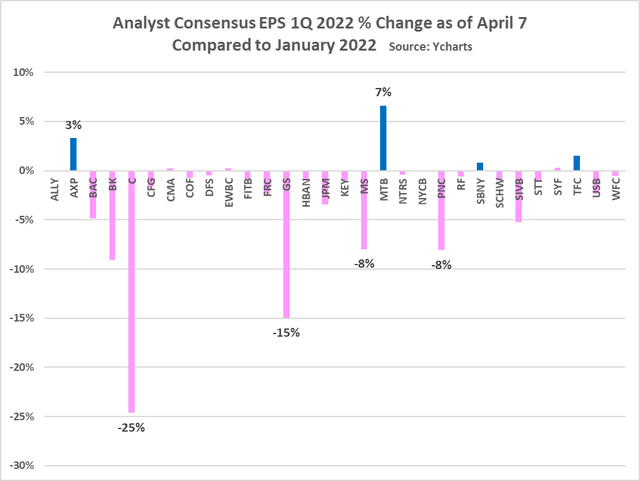

Analysts have ratcheted down earnings estimates since January. See next chart. None more than Citi which is undertaking a “transformation” which includes the unenviable task of selling its Russia business. Citi executives have acknowledged $10 billion in Russian exposure, a not inconsequential number. Ugh.

Goldman Sachs is suffering from concerns about a slowdown in its erstwhile booming corporate and investment banking activities.

Buffalo-based M&T bank closed its acquisition of Peoples United on April 2. Investors now have a clear line of sight on merger costs and benefits.

EPS Est. Chgs. (YCharts)

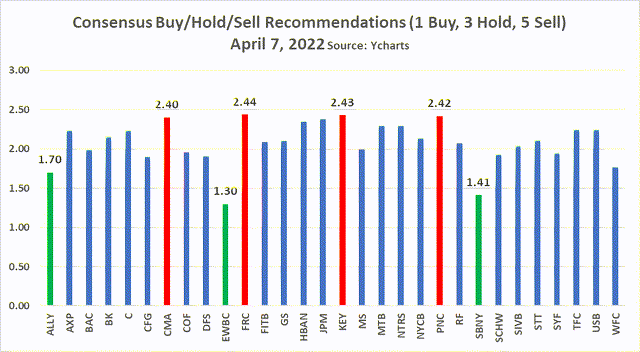

All Banks Stocks are Outperform, Buys

Surprising to me, all the big banks earn either an Outperformance or Buy rating from analysts. Seems optimistic. Leading the way are East-West Bank, Signature Bank, and ALLY. East-West raised its dividend 21% in January. Weighing against this Southern California bank are China worries given the bank’s business model centers on “east-west” trade.

Consensus Ratings (YCharts)

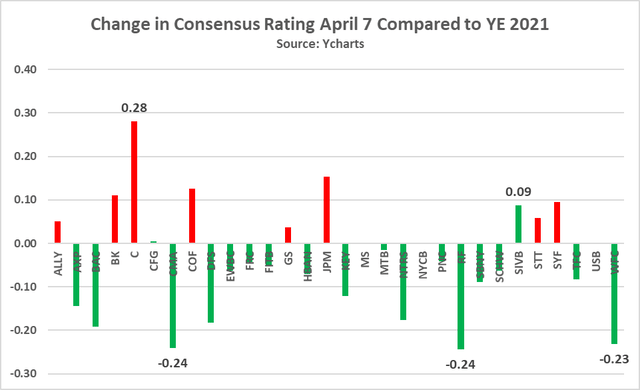

Consensus Ratings Improving

Banks noted with green bars show consensus upgrades since year-end. Banks that were downgraded in 2022 are noted in red. Citi is no longer an industry darling since underwhelming analysts during Citi’s much ballyhooed March 2 analyst meeting. Somehow some investors were surprised to learn that the transformation will take years, not days.

Biggest improvement in analyst confidence this year goes to Comerica, Regions, and Wells. Comerica, like Silicon Valley Bank, benefits enormously from rising rates, especially if accompanied with anything close to a normal yield curve.

Change in Consensus (YCharts)

Five Items to Watch When Big Banks Report 1Q Earnings

I will be a broken record as my top watch items are not new: Credit Quality, Personnel Expenses, Loan Growth/Net Interest Margin, Buybacks, Business Cycle,

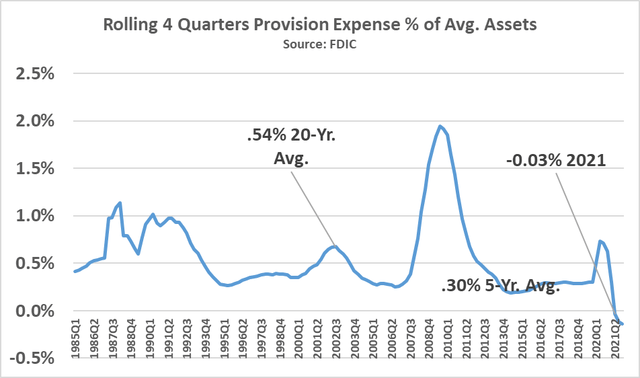

Watch Item 1: Provision

Bank earnings are more correlated to Provision expense than any other single factor. Take a look at this next chart that I find utterly unfathomable. During the past year Provision was negative.

Like youth and beauty, negative Provision does not last forever.

One reason I think analyst 2022 EPS forecasts may be too rosy is because of a failure to appreciate the reality that Provision must revert sooner or later to something like 30 basis points per $100 of assets (at industry level).

What banks are most vulnerable to a correction? That’s easy: The big consumer lenders like Capital One, Synchrony, and ALLY that have shown a willingness to go deeper into credit pools which produces industry-leading loan yields.

I am not surprised that the industry’s most recent (March 16) credit numbers reveal some weakness in consumer borrowers. Capital One investors will want to keep an eye on credit trends that have slipped over the past 90 days more than peers.

Rolling 4-Quarters Prov. (YCharts)

Watch Item #2: Personnel Expenses

I spent the past two days with bankers from around the country. Their top concern: Talent.

While the talent gap challenge has been long in developing, in 2022 the gap is now acute. There is absolutely no question that banks are having to work hard to find talent.

Jamie Dimon and JPM took some arrows during the January earnings call because of a sharp rise in non-interest expenses, “predominately due to higher compensation.”

Supply and demand challenges mean the best bankers (and risk managers, auditors, finance, tech) are routinely seeing material double-digit earnings growth. In JPM’s January call, execs mentioned the word “compensation” eight times, including references to lines of business where comp growth was 9% and 10%.

As Citi ramps up 3,000+ new hires to remedy profound risk and control failures, it has developed bold new compensation plans to attract and retain talent. Time will tell if Citi can compete with JPM and Bank of America and Wells for the industry’s top talent.

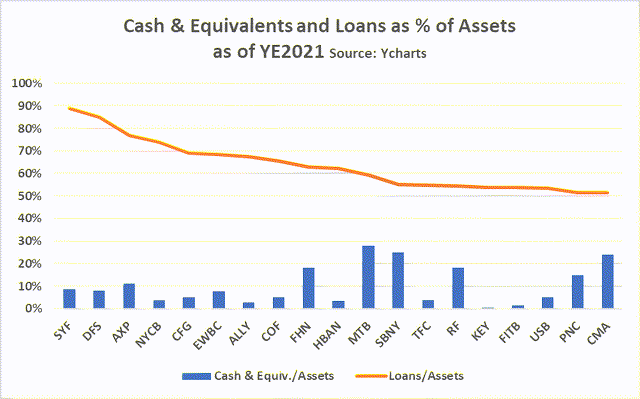

Watch Item #3: Earning Assets, Net Interest Margin

Banks desperately need earning assets (i.e., loans, securities with a decent yield) at a time of record liquidity.

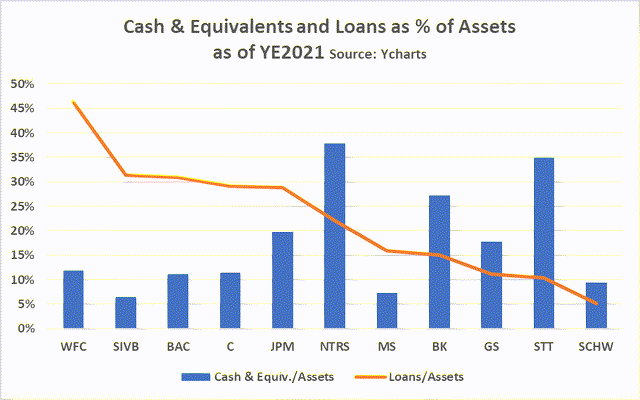

Take a look at these next two charts that show two data points for each of the 30 banks:

- Loans to Assets as of YE 2021

- Cash & Equivalents to Assets as of YE 2021

The first chart shows the banks with the highest percentage of loans to assets. Card-lenders, Synchrony and Discover and American Express, show the highest percentage of loans. The good news for these banks is that they have lots of loans; the bad news is that rising rates will inflict two challenges on them: 1) Increase cost of deposits (since they lack core deposits and must pay “market” rates); 2) Increase credit default risk as borrowers pay higher rates.

% of Assets (YCharts)

This second chart shows the banks with the lowest loan to asset ratios. Wells, Bank of America, and JPM have never had a lower ratio of loans to cash.

% of Assets (YCharts)

Revenue improves two ways. The first is loan growth. The second is expanding net interest margin. Q1 earnings calls will focus on these two themes.

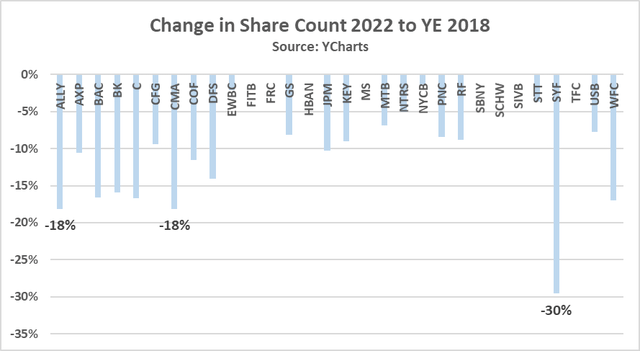

Watch Item #4: Share Count/Buybacks

The recent decline in stock price benefits the banks buying back shares. The chart below excludes banks that have added shares since YE 2018. (Banks add shares through mergers as well as executive/board compensation.)

Share Count (YCharts)

Watch Item #5: The “R” Word

As I have noted on these pages in the past, I like to count key words spoken by bank CEOs and CFOs during earnings calls. During the upcoming calls, I will be counting “recession” and “inverted yield curve.”

As I documented in my investing book, banks and bank investors do great with a robust economy (>3% GDP). But banks struggle big time when the cycle turns and goes negative (recession).

An inverted yield curve, which we saw momentarily in recent weeks, often is viewed as a precursor to a recession.

Thoughts on Banks

I remain a Citi bear as documented in December. Avoid even at $50. Sobering reality: Citi’s stock price is down 88% from January 1, 2000. Value trap.

East-West remains intriguing and clearly shows the best analyst support. However, a lesson learned from Russia-Ukraine is that geopolitical risk is real. Given that EWBC’s business model centers on trade with China, I will remain on the sidelines given geopolitical uncertainty.

I no longer view Capital One as a Strong Sell since its price has fallen to $129. It is not yet a Buy, however. My guess is that it is just a matter of time before provision expense normalizes and Cap One’s return on equity reverts to its long-term run rate. Avoiding for now, though I really like the incremental $5 billion stock buyback plan announced April 6.

Given my concerns about mass consumer borrowing, you might think I would avoid ALLY. Perhaps I should, but as I documented in a February article, I am currently holding a position in my trading account. I like the stock at $45 where I have sold Puts.

I still like the four big banks in my long-term portfolio: JPM, First Republic, Silicon Valley Bank, and Wells Fargo. I am dividend reinvesting the first two at today’s prices.

First Republic’s esteemed founder, Jim Herbert, took a medical leave at the end of December. Unfortunately, since then, the bank has suffered from succession issues, hard as that is for me to believe. The CEO questions have contributed to the bank’s big stumble. For many of us, Jim Herbert is First Republic, and we sure wish him a strong recovery. At $150, I may buy more shares after the earnings call if I see a strong report.

Silicon Valley is intriguing <$500. This niche banks acquired Boston Private last year, giving the bank a strong presence in the high-tech Boston-Cambridge area. The bank has industry-leading returns and cost of funds. I view this niche bank with superior competitive advantages to be a mainstay in my long-term portfolio.

Be the first to comment