Davizro/iStock via Getty Images

When we last covered Energy Transfer LP (NYSE:ET) we looked at the preferred shares and opined on a fair value for both sets of shares.

The preferred shares are a good holding for income. They should remain safe and their perceived safety should improve on even modest levels of deleveraging in 2022. Key risk remains another acquisition which increases leverage ratios. We think this is a very low risk at present but might increase as ET common shares rise. Those remain undervalued at present and we are increasing our price target for 2022 to $12.00.

Source: Preferred Shares Remain Attractive Despite Lower Resets

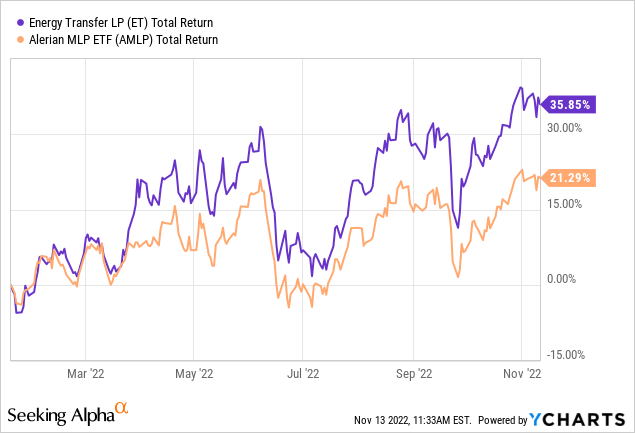

The stock agreed with our outlook and has achieved the 1-year price target a bit sooner than expected. It has also outperformed the ALPS Alerian MLP ETF (AMLP) and rewarded investors with solid distribution hikes.

We examine the recently released results and tell you why we are reluctant to boost our price target on this. We also look at the preferred shares which might offer an interesting risk-reward proposition in light of a hawkish Federal Reserve.

Q3-2022

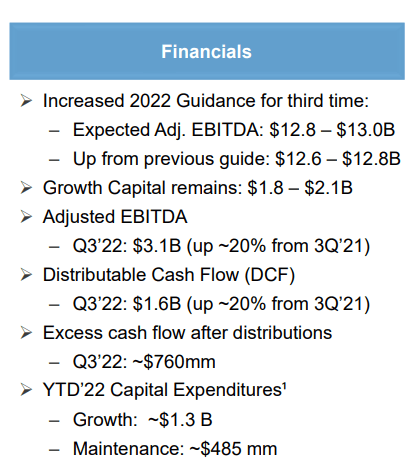

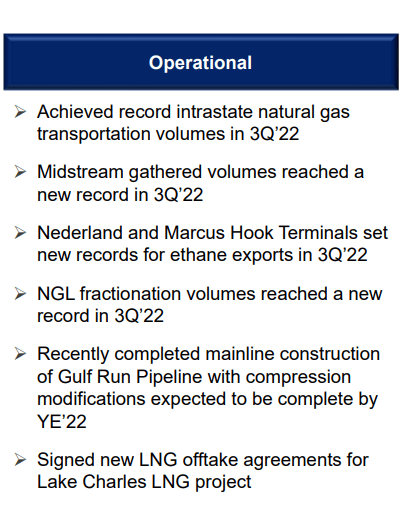

ET’s Q3-2022 was extremely strong leading to a boosted EBITDA guidance of almost $13.0 billion for the year.

Q3-2022 Presentation

The star was marketing as ET devoured wide spreads across the board.

Q3-2022 Presentation

It also got a boost from Natural Gas volumes which reached an all-time high. ET was able to participate fully in the export boom, thanks to the Enable transaction. The distribution was raised, and ET management guided that their priority was to get investors back up to pre-pandemic levels.

In October 2022, Energy Transfer announced a quarterly cash distribution of $0.265 per common unit ($1.06 annualized) for the quarter ended September 30, 2022. This distribution represents a more than 70% increase over the third quarter of 2021. Future increases to the distribution level will continue to be evaluated quarterly with the ultimate goal of returning distributions to the previous level of $0.305 per common unit per quarter ($1.22 annualized) while balancing the Partnership’s leverage target, growth opportunities and unit buybacks.

Source: ET Q3-2022 Press Release

The Same Old Ways

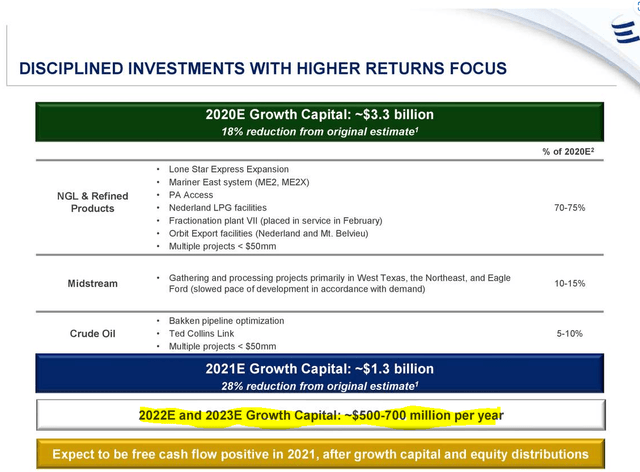

ET has slowly bumped up its capital expenditure number and now is expecting growth capex to go past $2.0 billion for the year.

For full year 2022, we expect growth capital expenditures to be near the high end of our range of $1.8 billion to $2.1 billion. Over 90% of our 2022 growth capital spend is comprised of projects that are already online or are expected to be online and contributing cash flow before the end of 2023, at very attractive returns. We will provide our 2023 growth capital outlook on our fourth quarter earnings call.

Source: ET Q3-2022 Press Release

This does not include the purchase of Woodford Express midcontinent gas gathering system for $485 million during Q3-2022. Of course, there are few here that are old enough to remember when growth capex for 2022-2023 was supposed to be smaller, way smaller.

Back then the argument was, “we cannot stop the 2020 projects that are on their way to completion, but you watch our discipline in 2022 and beyond”. Ha ha. We all fell for that one. We are going to bet 2023 capex numbers will blow your mind. ET’s poor capital allocation continues through up and down cycles. Yes, the distribution was raised and we are likely to reach the old rate at some point in 2023. ET still has not reached its leverage targets and we don’t see that credit upgrade happening with this kind of spending.

Valuation

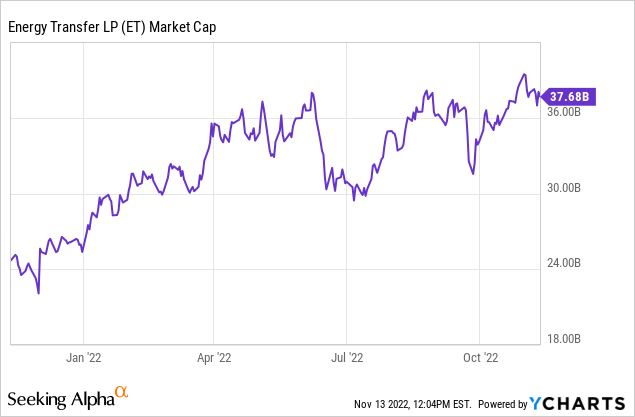

ET appears cheap on a standalone basis if you use a Distributable Cash Flow, or DCF, multiple. With a $7.0-$7.5 billion of DCF expected in the year, DCF yield appears juicy in relation to its market capitalization.

One reason to not get excited about this is that DCF does not count growth capex and growth capex has historically done zilch for DCF per unit growth.

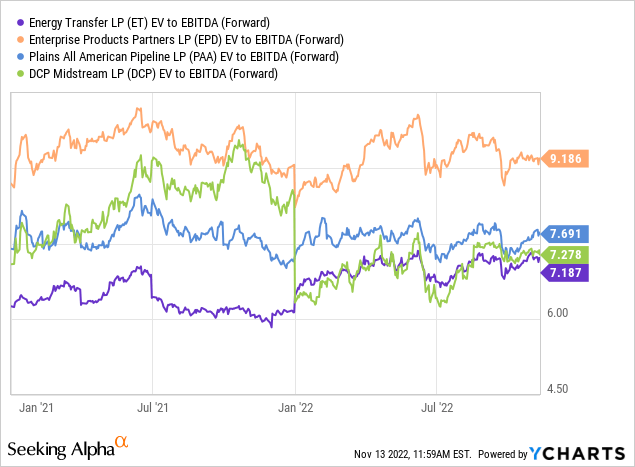

ET’s multiple adjusted for its debt is about where it has been historically. This is in line with the Plains All American Pipeline LP (PAA) and DCP Midstream LP (DCP). ET, as expected, continues to trade 1.5-2.0X multiples lower than Enterprise Products Partners (EPD), a firm we believe shows far more capital discipline.

Certainly, a re-rating higher is possible, but we would not give it a lot of weight, unless ET starts showing capital discipline. All these projects that look very juicy at present will likely look atrocious when the next cycle peaks and midstream assets once again exceed demand.

Preferred Shares

ET has three listed preferred shares.

1) Energy Transfer LP 7.375% PFD SR C (NYSE:ET.PC)

2) Energy Transfer LP 7.625% PFD UNIT D (NYSE:ET.PD)

3) Energy Transfer LP 7.60% CUM PFD E (NYSE:ET.PE)

All three are callable with Series C having the earliest date. All three will also have distribution resets on those dates, if not called.

On and after May 15, 2023, distributions on the Series C Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 4.530% per annum.

On and after August 15, 2023, distributions on the Series D Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 4.738% per annum.

On and after May 15, 2024, distributions on the Series E Preferred Units will accumulate for each distribution period at a percentage of the $25.00 liquidation preference equal to an annual floating rate of the three-month LIBOR plus a spread of 5.161% per annum.

Source: Preferred Stock Channel

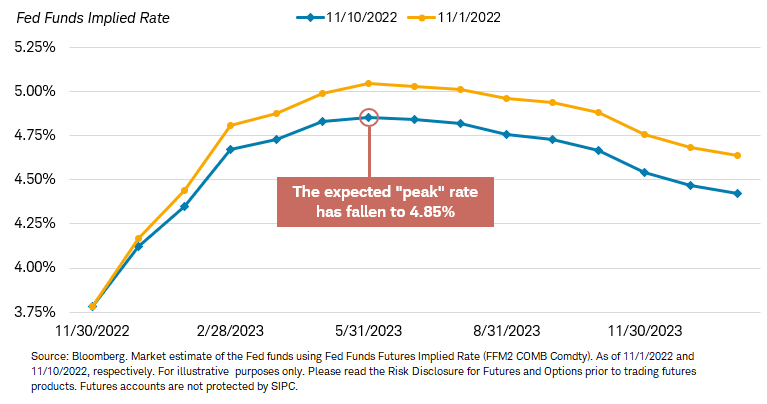

The interesting aspect here is that based on expected Fed Funds rate, ET.PC will yield over 9.25% on par and over 10% at the current price.

Bloomberg-Twitter

ET.PD and ET.PE should start floating at similar rates if the graph above is accurate. This is a very high yield for an investment grade rated company. ET’s longer term bond yields are also about 300 basis points below this.

The preferred shares occupy the space between equity and debt, and rating agencies give them a 50% credit as equity. That said, even taking a blended yield of the long-dated bonds (7%) and the equity (8.9% currently), the cost of Preferreds appears a bit expensive. Of course, that cost could go down over time if the projections of peak Fed rates are accurate, but in theory that should also benefit ET’s cost of capital across debt and common equity.

Which One Will Be Redeemed?

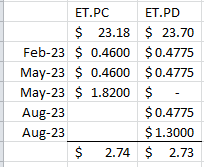

ET-PE is the largest size offering with $700 million outstanding. If that was coming up first, we would say it was a virtual certainty that it would be redeemed. That certainty would come from its size and the very large spread over LIBOR. Unfortunately, ET-PC is coming up first and it has $450 million outstanding vs $400 million for ET-PD. We think ET will decide on both these as a single entity and either both will be redeemed or neither. Considering our outlook on interest rates, we think both will be called. If that turns out to be the case, then ET.PC offers a far superior total return to redemption.

Author’s Calc

Both offer about similar total dollars, but ET.PC does so with lower deployment and in a faster timeline (By May 2023, vs August 2023). The 24% annualized return looks like a good setup. ET.PE is still an interesting setup here as it could rally to par around the time ET.PC is redeemed. It has also the highest spread to LIBOR when it floats, so it is possible that if ET redeems only 1 out of the 3, it would be ET.PE.

Verdict

ET’s actions should be watched closely as there are signs that the old spending ways are making a comeback. The company has generally not seen a capital project that it has been able to say no to historically. That behavior took a small, forced hiatus post COVID-19. Unfortunately, that time has passed. Midstream remains the weaker asset class for us relative to upstream and our returns there over the last 12-15 months have proven this. Within midstream, ET is a below average capital allocator and we would only pick it up if it was very cheap. Currently, the preferred shares look attractive, given our outlook for a moderately hawkish Federal Reserve relative to consensus.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment