aydinynr

The S&P 500 (SP500) might have a reputation for solid long-term returns, but those performance results have come with a level of volatility that many moderate-risk and conservative investors might not want as much as they think they do. After all, it has been a long time since we’ve had a bear market, and we are clearly in one in 2022.

For those seeking a potentially smoother ride, albeit with plenty of equity market risk, Invesco S&P 500 Low Volatility ETF (NYSEARCA:SPLV) aims to deliver a smoother ride than the full S&P 500 index that its holdings are selected from. It is based on the S&P 500 low volatility Index, which tends to filter down to many of America’s largest and most profitable companies.

Does that mean SPLV ETF is a buy in the current market?

The answer to that question is no – it’s a sell.

It can be a good choice for investors looking for stability and lower risk in a bull market; however, currently we’re in a bear market. This lower volatility ETF is directly related to the S&P 500, since its holdings are roughly 100 of the 500 stocks in the S&P 500 at any one time. So, it typically goes down when the overall market declines, but with less intensity.

Let’s discuss it in detail

SPLV is a passively managed ETF comprising around 100 securities from the S&P 500 index with the lowest realized volatility over the past 12 months. The goal of the fund is to provide investors with a safer and more stable option by investing in mega- and large-cap stocks.

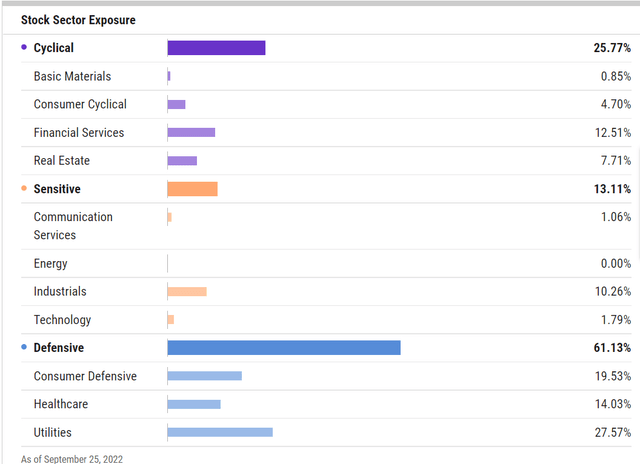

While this is not an equal-weighted fund, the variance in volatility among stocks is low, so it operates similarly. The holdings are spread across 10 of the S&P’s 11 sectors (no REITs), and the top 10 holdings make up only 12.14%, providing good diversification for a fund with a relatively small number of equities. It is mainly dominated by stable industries like utilities (27.5%), followed by consumer staples (19.5%) and healthcare (13.9%). Top holdings include names like Johnson & Johnson (JNJ), PepsiCo (PEP), Gilead Sciences (GILD), and DTE Energy (DTE). So don’t expect any highfliers here.

SPLV Sector Exposure (YCharts.com)

These low-volatility stocks help reduce the overall volatility for the ETF, especially when compared to broader markets. But this is far from a guarantee. There are market environments where “classic” low volatility sectors do not lose less. And, as with all equity investments, we have no modern history to point to how this market theme might fare in a sustained high inflation environment. Low volatility funds are heavily based on stocks’ past performance, which might not be a good guide to the next few years in the market.

AUM movement in a market meltdown

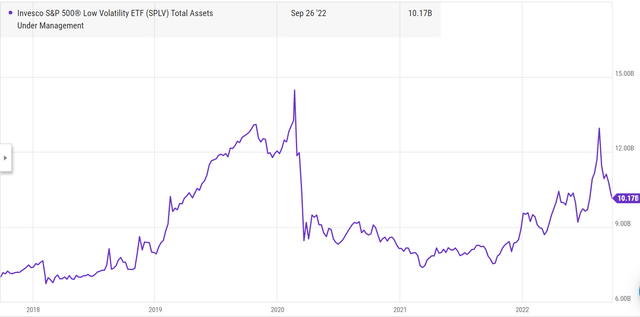

Over the last three years, SPLV’s total assets under management (AUM) has changed vividly. A deep look at the fund shows that every time a crisis occurs, whether it’s during the pandemic (February-March 2020) or the recent market meltdown, it has put this fund to the test.

Risks and rewards

Investors should be aware that there are both risks and rewards associated with investing in SPLV. The weightings of its holdings are updated quarterly, but the stock volatility analysis is only updated once a year. That leaves open the risk that some holdings can be uncharacteristically volatile.

These funds might, in theory, allow investors to survive in the market during challenging times by reducing the risk up to a certain level, but failing to serve the function when the market turns bearish. In most market climates, this ETF is likely to be less volatile than other broad market options. But this is a stock fund – in a recession, all sectors become volatile.

Short-term risk is high

The short-term risk rating for SPLV is high. Low volatility ETFs are designed to perform less poorly than the broader market during market downturns, while not participating in all of the upside delivered during a bull market.

Short-term reward is low

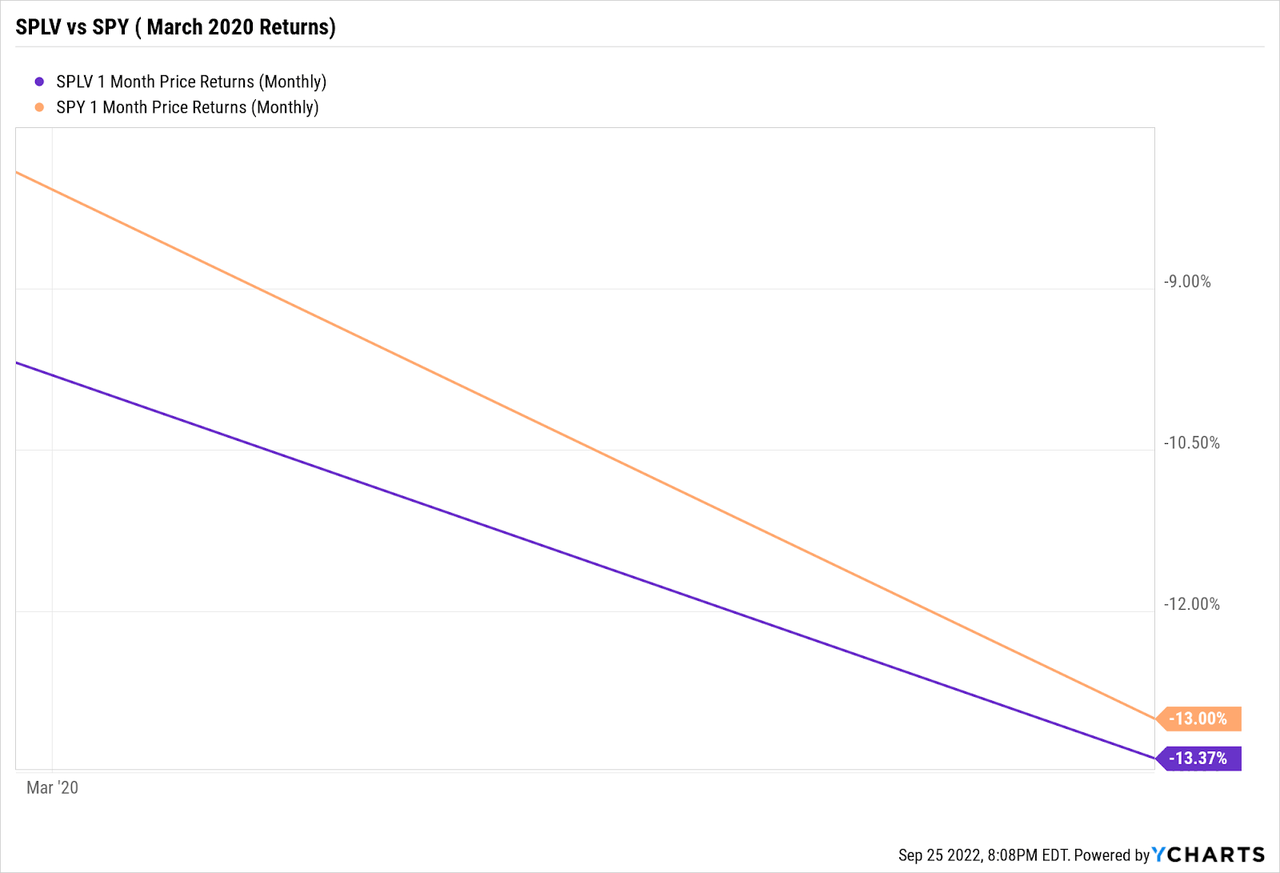

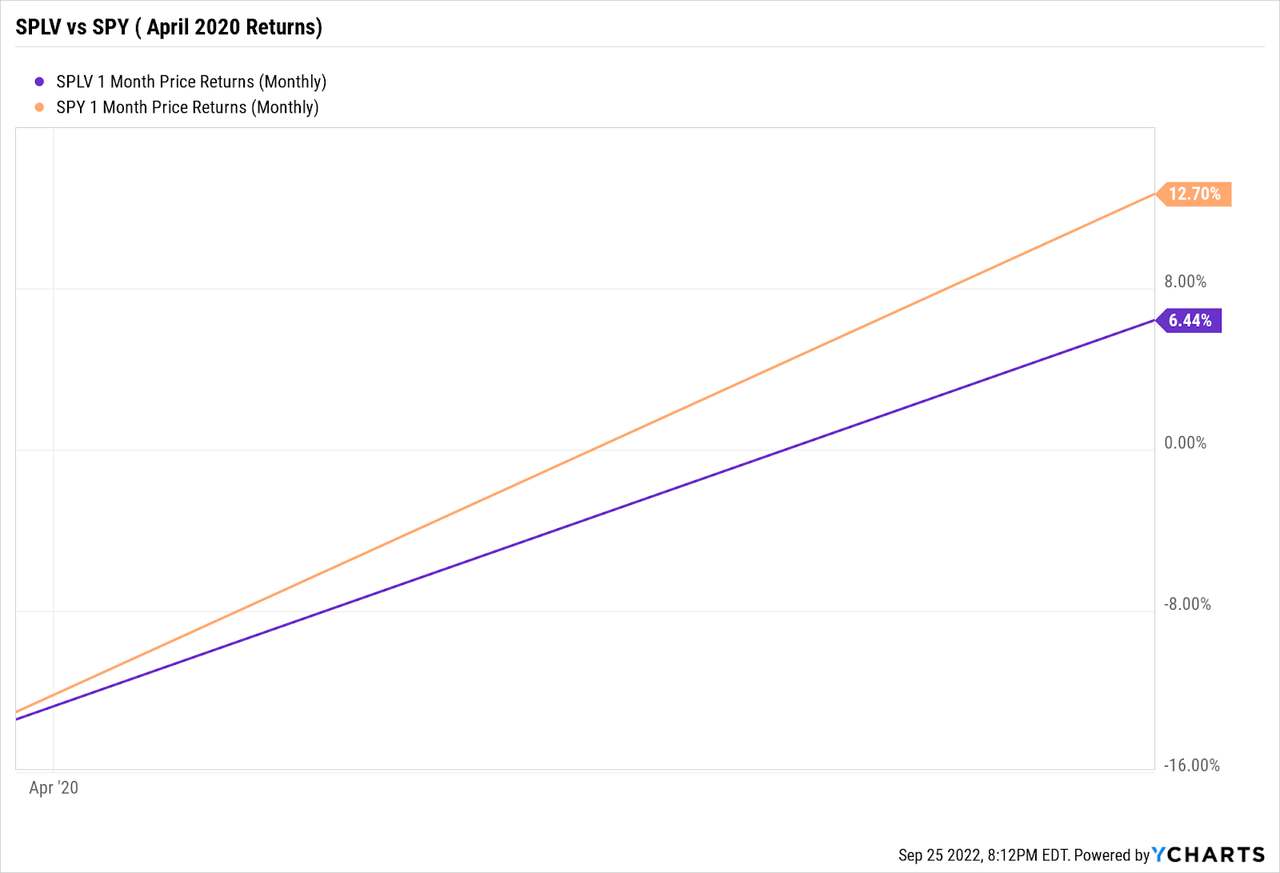

That leads to a low short-term reward rating because lower volatility doesn’t mean positive returns. For instance, in March-April 2020, the fund captured all of the S&P 500’s downside but only half of its initial recovery.

YCharts YCharts

Long-term risk rating is high

The long-term risk rating is also high. That’s because in the long term, especially during bull markets, tech stocks have some of the fastest growth.

Long-term reward rating is low

This fund lacks exposure to tech stocks, resulting in low long-term growth opportunities and low rewards in the long term. It does offer a potentially smoother ride over the long term, but as history has shown, it will have periods where it will not add value over an S&P index fund.

Takeaways

The fund’s utility exposure has been a blessing so far in 2022 as the utility sector has outperformed the broad market by a wide margin. But it could be a curse if that sector’s strong outperformance of the overall market starts to narrow. The fund could find itself in trouble as it can quickly lose its value if investor sentiment shifts, and it could become a drag on performance.

If you love FAANG stocks, look elsewhere. This fund habitually keeps a low weighting in that sector because tech stocks tend to be a high-risk, high-reward situation. The SPLV ETF is a good investment to have in your portfolio, but now is not the time to make heavy use of it.

Bottom-line rating is sell

We rated this ETF a sell, as we believe that the current macro risk in the stock market – which includes inflation, Fed policies, economic growth, and market sentiment – makes it too early to start bottom fishing in nearly all equity segments.

Be the first to comment