jetcityimage/iStock Editorial via Getty Images

Dear readers/Followers,

Remember Johnson Controls (NYSE:JCI)? I reviewed the company a few months ago, calling it much too expensive for investing in. It’s time to revisit the company and see if the thesis has changed somewhat. Since my last article, the company has beaten the market slightly – around 8% – showcasing its stability here.

Let’s see what we have going on here.

Revisiting Johnson Controls International

As you may recall, Johnson Controls is a blue-chip sort of stock, headquartered in Ireland, but listed on the NYSE under the JCI ticker. The company has been on my list for a long time, but I haven’t yet been able to buy it at an attractive sort of price, which has prevented me from adding the stock to my conservative investment portfolio.

The company was founded, or shall we say, merged, back in 2016 through Johnson Controls and the Tyco International Corporation, a merger which now is 5 years old. This was done on the basis of avoiding U.S. taxes on its foreign operations, as well as some monetary benefits of the then-CEO.

The company that formed the basis for the merger, Johnson Controls the largest of them, was founded in 1883 when a professor received a patent for the first electric room thermostat. This invention helped launch the entire building control industry, which was the basis for the company itself, and the company went on to establish the installation and servicing for room temperature regulation in buildings. It quickly decided to focus on nonresidential.

Despite its headquarters, the company should be viewed as an American-based business in part due to its revenue split and customers, but also how it’s being run, even if criticism from the Democratic side of the aisle at the time was very prevalent, with prominent politicians like Hillary Clinton speaking firmly against what the company did at the time.

JCI works with a geographical revenue split and works in NA, EMEALA, Asia, and the Global product segments. Its primary focus is Air quality technology and building management tech, with products such as Fresh Air units, Return Air Units, Service Solutions, Pressure monitoring, frictionless security, and thermal detection. Plenty of attractive and ubiquitous products have a high degree of cyclical resilience – much like the company itself.

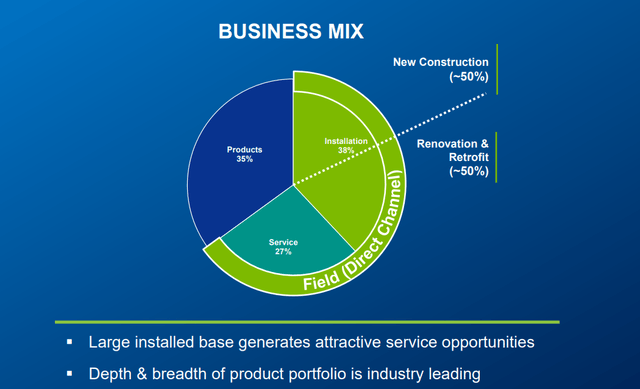

The company makes money through the design, development, manufacturing, selling, managing, and servicing of these products, with a most appealing mix of business.

Johnson Controls International IR (Johnson Controls International IR)

The company retains its very appealing fundamentals, which is something we’d like to see in every conservative investment that we plan to make. Its payout ratio is not worrying, it has a double-digit operating margin despite the overall current headwinds, a sub-2x Net debt/EBITDA, and operates with a BBB+ credit rating. By every one of these metrics, it’s a very conservative business.

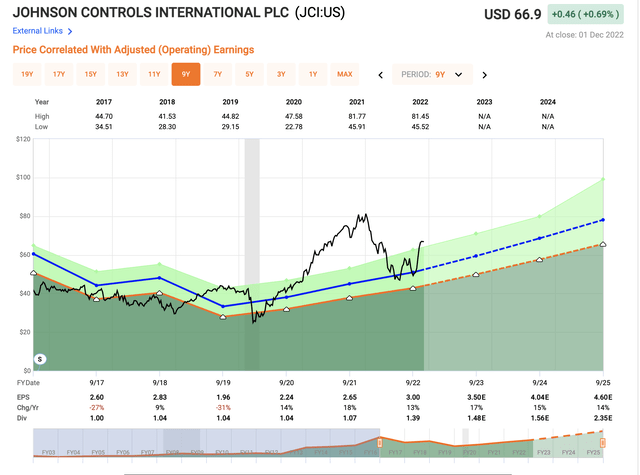

A major piece of news is that JCI recently spun off its Automotive experiences division into the now-listed company Adient (ADNT). This had significant impacts on both company earnings, the dividend, and the company appeal. This transaction caused the company to cut the dividend, meaning the company sports a 3-year dividend tradition – which isn’t all that great. We can see in the following graph how the company has developed and seen its EPS trends change.

JCI Valuation/EPS (F.A.S.T Graphs)

So, as you can see the company has seen its EPS decline since that particular spin-off, but its recovering slowly. The market grossly overreacted in terms of valuation premium back in 2020-2021. We were at what can be considered a fair-value premium a few months back, but now we’re back to the company trading higher.

Justified? We’ll see this in the next section.

For now, EPS has been improving, and the expectation is that this is going to continue to improve.

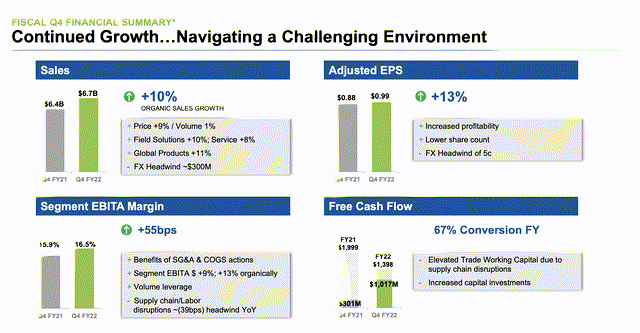

Recent earnings would suggest this is a fair expectation because the company delivered strong order flows, EPS growth, and margins despite ongoing margin pressures and issues on the macro side of things.

JCI recorded a large backlog, that’s up 13% organically on a YoY basis. Total field orders are up 10% organically as well, and the company has actually been able to record margin improvement as opposed to declines due to positive pricing actions.

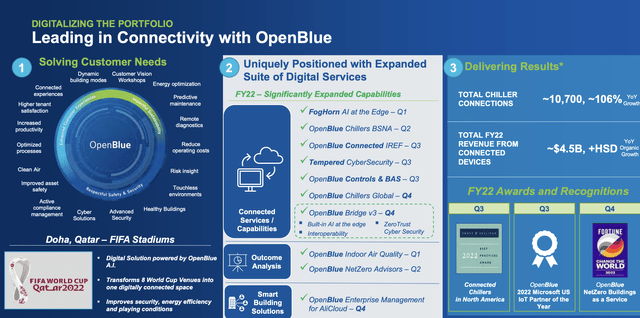

JCI’s savings program has been overdelivering in relation to its promises as well, and simplification and ERP roll-out are set to improve this even higher. When you look at company trends, you start to understand what might cause the market to give this business such a premium. The company is also leading the charge in digitization.

As a company in building products and building tech, JCI is actually one of the primary net beneficiaries of adopting an ESG-oriented and future proof way of working. The case to be made for indoor air quality is stronger than ever, and to do this while being able to save energy. The company’s orders are up 57% YoY in this segment, showing a 2-year growth of 332%.

Despite very challenging macro, therefore, Johnson Controls is significantly growing.

EPS trends show us that improvements come not just from pricing, but from volume and mix. Customers are ordering better and more expensive products and services. Supply chain issues do weigh down these improvements, but not even close to as much as SG&A and COGS savings, and these positive trends are pushing them upward.

JCI is on the right side of the equation and trends. Backlog levels remain at record levels, and have an appealing service/install slit, with just above $11B worth of business on the company’s books. The current trends haven’t stopped customers from ordering new installations of JCI products, and these positive trends come both from global customers and from NA customers.

Fundamentally speaking, it remains very conservatively leveraged with 92% debt at fixed rates and a sub-3% interest rate, showcasing the company’s superb credit quality. The company guides for 2023 to be another impressive year for the company, with end markets remaining strong and a very solid backlog. The company’s value proposition seems to continue to resonate with its customers.

JCI expects an FCF conversion of upwards of 90%, and an upper-end EPS range of $3.6/share for the next year. This is 10 cents above what FactSet currently estimates the company to be able to manage for the next year.

Let’s see how this crystallizes into what price we want to pay for the company.

Johnson Controls Valuation

If you paid attention to company valuation, you’ll have noted two times that the company was technically buyable. I saw both of those, but decided, unfortunately, not to go for it due to other companies being more attractive to me at the time.

The company has a tendency to warrant that sort of 16-18x P/E premium, and I’m more open to that premium than I was when I wrote my last article on the business.

Johnson Controls International remains one of the strongest companies that I kick myself for not investing in during the COVID-19 downturn. The company’s poor dividend history, as well as more appealing alternatives, caused me to go different routes – but looking back, not investing there was a massive mistake. I hope that the company drops back down to appealing valuations once again, which could lead me to actually start investing here, and beefing up with a 0.5% starter position in the company.

Two issues prevent me from being all that clear about when it’s time to do that.

To the first, valuation. In order for this to generate meaningful overall returns, the company would need to maintain premia of at least 21-22X P/E over the next 4 years to come to 10-11% annualized rate of return, owing to the lower yield. The yield is not as low now, it’s closer to 2%, which is starting to be “decent”, all things considered, but we’re still only at a sub-5% EPS yield, which is really quite low.

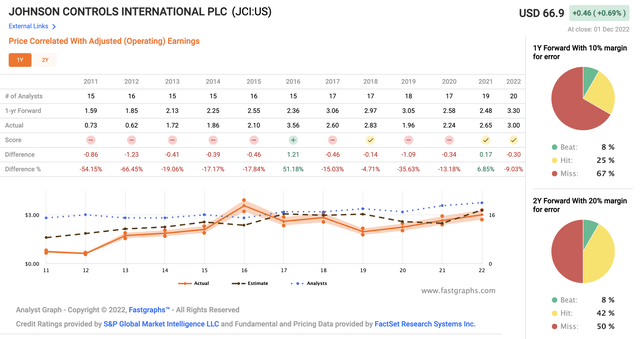

The second is analyst accuracy. Johnson Controls International may sound good on paper, in investor presentations, in historicals, and in forecasts – but the forecasts are abysmal at actually making correct predictions, or the company can’t predict its own earnings or trajectory.

That expectation for $3.6 might materialize, but current expectations call for the company actually coming in at significantly lower levels, if we just go by how things have been forecasted and expected for the past 10 years. Not a good trend.

JCI analyst accuracy (JCI analyst accuracy)

When we combine the facts of the low yield, the massive premium, the low forecast accuracy and the demand for a high P/E premium for this company, all the positive fundamentals in the world can’t make the difference for me here.

I’d be all over JCI at fair value. Anything between a 15-16.5x P/E, and I’d be investing in little else at this time. This implies a share price of $45-$50, which is why I’m uninterested in a share price closer to $67/share.

Buying today at a blended P/E of 21.7x, you’re locking in potential growth rates in the double digits at an 18x P/E, if the company does manage its 15% annual EPS growth rate, but significantly closer to 5-6% annually, if it does not or results come in down, leading to the company trading closer to 16x P/E.

That’s below my minimum required annual RoR of 8-9%, depending on the company.

Analyst targets for JCI are more positive. Significantly more positive in fact, with averages of $59-$80/share. 12 out of 20 analysts currently call this company a “BUY”.

Maybe I’m being too conservative?

I do not believe that I am. I believe the company, based on volatility and how often it fails to reach earnings, will normalize closer to 15x P/E again, which is where we then have the ability to buy it cheaply.

I believe that is the right way of buying this company – and remember, the same S&P Global analysts called for the company to be worth $91/share a year back. Did it ever reach that high – no it did not.

The average S&P analyst target indicates a 3% undervaluation at today’s price. I call this irresponsible and give JCI a fair-value premium price target of 17X 3-year average earnings. For long-term investors, I consider JCI investable at around $45/share.

At such levels, even conservative results would give you an upside of 8-9% annually, and you have a comfortable cushion in terms of valuation and yield of nearly 2% to rest upon, even should the company face some challenges.

Anything else here, I consider being irresponsible.

I don’t shift my targets here.

Thesis

My thesis for JCI is as follows:

- Johnson Controls International is a solid, appealing company with business in building technologies and air technologies. We want to own this company – at least we want to own it at the right price.

- That time is not today. At current times, the company shows us the “bad” sides of an overvaluation play, and trades $10 above where it should, as I see it.

- For that reason, I’m currently at a “HOLD” here, and I do not change my $45/share PT.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company, therefore, fulfills 3 out of 5 criteria, but due to the 2 missing being valuation-oriented, I cannot in good conscience call this company a “BUY” here.

Be the first to comment