tobiasjo

Introduction

The markets are treacherous and volatile now, but this volatility often creates distortions and relative mispricings that allow for excellent opportunities to swap out of a relatively overvalued security for one that is relatively undervalued. These swaps can improve your portfolio’s yield without adding risk, or provide you with more price upside or less risk than you currently have. Swaps are one of the best ways to beat the fixed-income benchmarks. For those interested in fixed-income swapping strategies, I highly recommend this article.

Prospect Capital

Prospect Capital (NASDAQ:PSEC) is a business development company, aka BDC, that has been public for 18 years. It is managed by Prospect Capital Management L.P.. Like many BDCs, it invests in middle market sized private companies providing them various types of loans (generally senior and subordinated secured debt) as well as having some equity investments and investments in collateralized loan obligations (CLOs). Here is what Yahoo Finance says about PSEC.

Prospect Capital Corporation is a business development company. It specializes in middle market, mature, mezzanine finance, later stage, emerging growth, leveraged buyouts, refinancing, acquisitions, recapitalizations, turnaround, growth capital, development, capital expenditures and subordinated debt tranches of collateralized loan obligations, cash flow term loans, market place lending and bridge transactions. It also makes real estate investments particularly in multi-family residential real estate asset class. The fund makes secured debt, senior debt, senior and secured term loans, unitranche debt, first-lien and second lien, private debt, private equity, mezzanine debt, and equity investments in private and microcap public businesses. It focuses on both primary origination and secondary loans/portfolios and invests in situations like debt financings for private equity sponsors, acquisitions, dividend recapitalizations, growth financings, bridge loans, cash flow term loans, real estate financings/investments. It also focuses on investing in small-sized and medium-sized private companies rather than large public companies. The fund typically invests across all industry sectors, with a particular expertise in the energy and industrial sectors.

PSEC currently sells for $6.53 and yields 10.64%. Since the bottom of the 2008-2009 financial crisis, PSEC’s performance has been reasonably good as holders received very high dividends and their common stock price has held fairly steady. Leading up to and during the financial crisis, they did take a good hit to their stock price. We would be neutral on PSEC common stock here.

PSEC Price Chart Since 2009 Bottom

Prospect Capital’s Note Maturing 10/15/2028 – CUSIP 74348TAW2

The PSEC note that we like is the 3.437% note maturing on 10/25/2028 with the CUSIP number 74348TAW2. A “note” is just a shorter term bond. Amazingly this 3.437% note is now yielding approximately 9%. This shows you just what has happened to the fixed-income market over the past year. This note was issued almost exactly 1 year ago at par $100. The bid/offer is now $74/$75 which represent a yield-to-maturity (YTM) of 8.9% to 9.1%.

The 9% yield is outstanding given that PSEC has a strong credit rating. This note, yielding 9%, is rated BBB- by S&P and Baa3 by Moodys. These are both investment grade ratings. It has the same credit rating as the well know blue chip BDC Main Street Capital (MAIN) as well as other larger cap BDC bonds like those from Ares Capital (NASDAQ:ARCC), and Goldman Sachs BDC (GSBD) but offers a much higher YTM.

I agree with the credit ratings for the following reasons, despite PSEC’s portfolio of investments being generally more risky than other BDCs with the same rating. Here are the reasons:

- It operates at lower leverage than other BDCs to compensate for not having primarily senior secured debt investments. While a typical BDC with the same credit rating has leverage of around 55%, PSEC operates with a leverage only 37%.

- Unlike other BDCs with the same credit rating, PSEC has issued a healthy chunk of preferred stock which provides extra protection for the bonds. Having preferred stock provides PSEC with flexibility in that they never have to refinance preferred stocks and preferred stock dividends can be suspended if problems arise – which is extremely unlikely given that no preferred stock from a BDC has every gone bad. The value of their preferred stocks must be wiped out before the bonds would even start to be impacted. And it seems that lately PSEC is moving in the direction of carrying a higher amount of preferred stock versus bonds. If this trend continues, the bonds just get safer and safer as the debt leverage gets lower and lower.

- BDCs have legal leverage limits. They must keep leverage below 67%. This means that a BDC bond should theoretically never default, and in reality, no BDC bond has ever defaulted. That alone should give PSEC an investment grade credit rating.

- BDCs almost universally have a small number of large bonds that they have issued to raise capital. This is somewhat risky because when a large bond comes due, the company must be able to refinance it. During times of financial crises or where credit has become harder to obtain, refinancing can be problematic. But PSEC uses an unusual financing model and has issued hundreds of smaller bonds which greatly reduces refinancing risk

- There are investors who don’t like PSEC common stock because the company has issued common stock below net asset value (NAV). But as a bondholder, we really like that management will raise cash through stock issuance in order to insure that leverage remain low and liquidity good.

So what we have here, with this PSEC note, is a large mispricing. While BDCs with the same rating and approximate maturity tend to have a YTM of around 7.5%, the current YTM of 9% for this PSEC bond looks just outstanding. We consider this PSEC note a strong relative buy.

Ares Capital

Like PSEC, Ares Capital is a BDC. It has also been around for 18 years. They are managed by Ares Capital LLC. Like PSEC, they serve middle market companies generally making senior 1st lien and 2nd lien loans but they also invest in mezzanine loans, equity and preferred equity. Here is what Yahoo Finance says about ARCC.

Ares Capital Corporation is a business development company specializing in acquisition, recapitalization, mezzanine debt, restructurings, rescue financing, and leveraged buyout transactions of middle market companies. It also makes growth capital and general refinancing. It prefers to make investments in companies engaged in the basic and growth manufacturing, business services, consumer products, health care products and services, and information technology service sectors. The fund will also consider investments in industries such as restaurants, retail, oil and gas, and technology sectors. It focuses on investments in Northeast, Mid-Atlantic, Southeast and Southwest regions from its New York office, the Midwest region, from the Chicago office, and the Western region from the Los Angeles office.

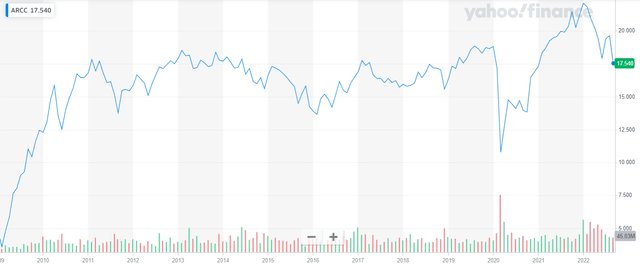

ARCC Price Chart Since 2009 Bottom

ARCC currently sells for $16.97 with a yield of 9.81%. ARCC common stock has clearly been a much better performer than PSEC since inception. So here we reverse ourselves. While we like the PSEC bond much better than the PSEC common stock, we think ARCC common stock is a better buy than their bonds. We think that ARES bonds/notes could fall further in price even if interest rates stabilize here.

Ares Capital Note Maturing November 15, 2031 – CUSIP 04010LBC6

The ARES Capital note that we are looking at is the 3.2% note maturing November 15, 2031 CUSIP number 04010LBC6. The current YTM on this note is 7.2%. There are 2 other ARCC notes that mature sooner than this one, and we also consider them a sell. You will see these in the table below.

ARCC has the same credit rating as PSEC, BBB- from S&P and Baa3 from Moodys. Bond yields generally move higher the further out the maturity date is. So it is surprising that this ARCC note, which is 3 years longer in maturity than the PSEC note, has a yield so much below the 9% YTM of the PSEC bond with the same rating. Here is a comparison chart of other BDC bonds with same credit rating as PSEC and ARCC and maturing around the same time as our PSEC recommendation, including the ARCC bond upon which we are focusing.

Symbol CUSIP Maturity-Year Yield-To-Maturity

ARCC 04010LBD4 2027 6.4%

ARCC 04010LBB8 2028 7.1%

ARCC 04010LBC6 2031 7.2%

FSK 302635AL1 2027 7.3%

GBDC 38173MAC6 2027 7.3%

MAIN 56035LAE4 2026 7.5%

ORCC 69121KAG9 2028 7.4%

PSEC 74348TAW2 2028 9.0%

While ARES has a safer portfolio than PSEC, it operates at 57% leverage versus 37% for PSEC. This is why they both achieve the same credit rating with the other factors I mentioned above possibly weighing in as well.

And if you look at the other 2 ARES notes, they also seem overvalued. When you can get 7.5% YTM on a blue chip like Main Street Capital, why would you go out one year longer in maturity and buy the ARES 2027 bond with only a 6.4% YTM.

One thing to like in the BDC sector now is that much of their assets are floating rate and should be generating higher returns going forward. Unlike most sectors, higher short term rates is a benefit to them. We would only call ARCC common stock a weak buy here simply because the market is so treacherous now and not because we see problems with ARCC.

Conclusion

In the currently volatile and jittery market, prices can become quite distorted creating excellent opportunities for improving your portfolio’s yield without taking on any additional risk. Swapping relatively overvalued securities, or even fairly valued securities, for undervalued securities can significantly boost your total returns and the more of these swaps you find the better.

Currently we have a BDC note that is very undervalued relative to its peer BDC notes with the same credit rating and similar maturity dates. That bond is a Prospect Capital 2028 note (see above) that offers an extremely attractive 9% yield for an investment grade note/bond. We consider this bond quite safe due to:

- having very low leverage

- having legal leverage limits that apply to BDCs which don’t allow them to become overleveraged

- no BDC bond having ever gone bad

- PSEC having issued hundreds of small bonds reducing refinancing risk

- the company’s willingness to issue common stock to raise cash

- the fact that PSEC benefits from higher short term rates because it holds a lot of floating rate investments.

And currently we have a sell on the 3 ARES notes, the 2027, 2028 and 2031 maturing notes. Although ARCC is generally a well run BDC, the 7.2% YTM on its 2031 is just far inferior to what else is out there, and their shorter term bonds are also relatively unattractive.

Be the first to comment