Sundry Photography

Investment Thesis

If you are an investor in 2022 you have probably seen your portfolio falling drastically since the beginning of the year. Every sector, every company, especially tech stocks, has lost a significant chunk of its market capitalization and Splunk (NASDAQ:SPLK) is not an exception to the rule. The company’s stock price has dropped almost 30% YTD and it only keeps dipping. This means one of two things: Either the company has now reached a price where it becomes a value play, or it was so massively overpriced that it has more to fall in order to be a good deal. Keep reading to learn which one it is.

How Does Splunk Make Money?

meeracapital.substack.com

Splunk is a tool that finds and indexes log files and assists businesses in extracting information from the data. Splunk also employs indexes to store data, eliminating the need for a separate database, which is one of its key advantages.

Splunk generates revenue in four (4) ways:

1. Cloud services

Without acquiring ownership of the program, cloud services allow customers to use hosted software during the term of the contract. The customer may gather, monitor, search, report, and analyze all of the current and historical machine data using Splunk’s cloud platform. The company makes money from this service by charging its customers a subscription fee.

2. License

When control of the software is transferred, the license cost is acknowledged. License sales to new clients as well as further license sales to current clients, including the renewal of term licenses, all result in the recognition of license income.

3. Maintenance revenues

A term license comes with maintenance included for the duration of the licensing period when it is purchased by a customer. On the other side, a customer who purchases a perpetual license also pays a portion of the licensing fee for a year’s worth of maintenance.

4. Professional services and training revenues

The professional services offered by Splunk are aimed at assisting customers in using the software in extremely complicated operating contexts. Fees for instruction and professional services are recorded as revenue when they are rendered or accrued throughout the subscription term.

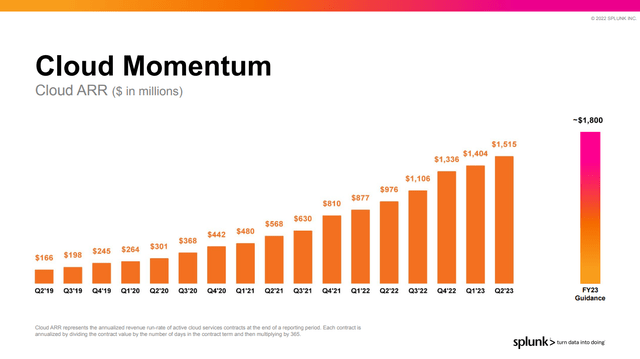

Growing Company In A Growing Market

For creative enterprises, cloud computing is a wise decision. Almost everyone is aware that cloud computing is a trend in the IT sector that cannot be stopped.

At a Compound Annual Growth Rate (CAGR) of 16.3% over the forecast period, the size of the worldwide cloud computing market is anticipated to increase from USD 445.3 billion in 2021 to USD 947.3 billion by 2026. So if the company was to just keep its current market share, it would also grow its top-line revenue by 16.3% annually. However, analysts estimate that Splunk’s revenue will grow at about 20% annually for the next 4 years. This suggests that as time goes on, the company will likewise increase its market share and, as a result, outgrow its peers in terms of revenue growth rate.

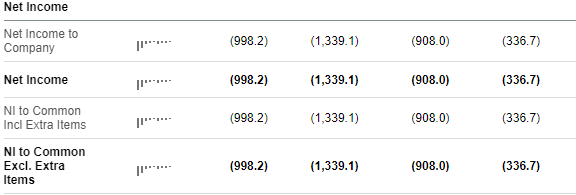

Still Unprofitable

SeekingAlpha SeekingAlpha

As of today, the company has never made a dollar in profit since it launched its IPO in 2012. Many investors may view this as a warning sign because, as we all know, a firm is useless regardless of how much revenue it generates if it doesn’t somehow translate to profit. However, according to analysts, this year Splunk will experience its first year of profitability, and following that, its EPS will continue to increase quickly.

This should be quite reassuring for the company’s shareholders, as once the business reaches a breakeven point, it not only will have proven to its investors that it can be a profitable business, but it also will not have to dilute its shareholders anymore in order to raise funds as it will be able to sustain itself.

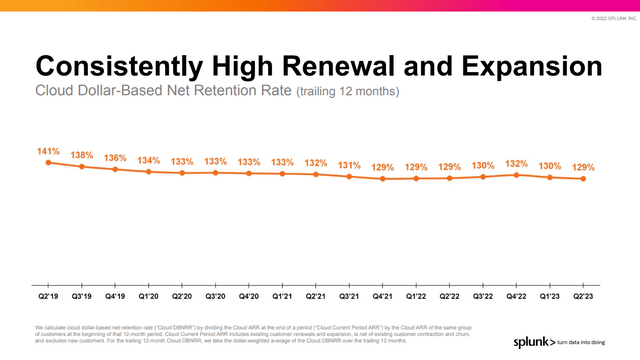

Net Retention Rate

The percentage of recurring income that is kept from current customers over a given time period is known as Net Revenue Retention (NRR).

The fact that the company has such a high NRR of 129%, implies that the company is good at maintaining its current client base and producing new revenue from those same consumers. This is just evidence of how high the quality of the service that Splunk offers is, as it not only sustains its customers but also manages to make them spend more and more money on its platform.

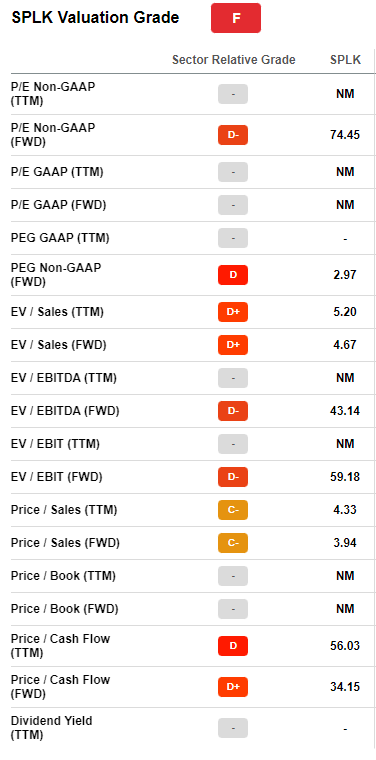

Valuation

SeekingAlpha

Splunk scores pretty bad in the Valuation model. This is mainly due to the fact that the company is still unprofitable and thus, ratios like EV/EBIT (FWD) and P/E Non-GAAP (FWD) are much higher than the ones that its peers have. However, I do not believe that we should criticize the company based on its earnings but mostly based on its P/S and the future that this company has. The current P/S ratio for Splunk is 4.33. Although the company’s P/S ratio is a bit higher than that of its peers, you should be willing to pay a little premium for a company that is set to outpace them in terms of top-line revenue. Also, let’s not forget that a P/S ratio of 4.33 is still a low one for a SaaS company.

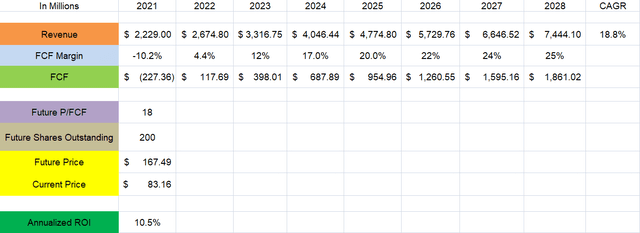

Valuation Forecast

Based on the analysts’ forecasts, I predicted a revenue CAGR of 18.8% for the following 6 years. This brings the company to an annual revenue of almost $7.4 billion by 2028. Moving forward, I also projected a 25% FCF margin. As a SaaS company, by the time Splunk reaches its maturity stage, it should have a high margin; most companies in the same sector have FCF margins that exceed 30%, so I believe that 25% is without a doubt achievable. Lastly, just to be a bit conservative, I assumed a P/FCF of 18, which is even lower than the average of the company’s peers’ P/FCF, although you get a faster-growing company.

Assuming that everything above does come true, 6 years from now you will end up with a stock worth $167.49. This valuation implies an annualized ROI of 10.5% for the next 6 years which is neither a great nor a bad return on your money.

Risks

Competition

The cloud sector has been pretty hot lately and therefore many companies are trying to take a piece of the pie. I do not believe that the company is in danger of going out of business in the following years but I do think that it will have to find a way to differentiate itself from its competitors and that as competition increases, gross and profit margins are going to shrink, leaving less money for the company to reinvest in itself and grow even further. This could lead to a slowdown in the business’ growth rate, which would drive the price of the stock down.

Dilution and Profitability

The company is yet to profit any money and although analysts expect it to become profitable this year, no one can know for sure. Having that in mind, it would not surprise me if the management of the company kept diluting its shareholders, giving them a smaller piece of the company, in order to raise capital and fund its expenditures.

Conclusion

Splunk trades at roughly 4.3 times sales right now. This appears to be a very fair price given the huge growth prospects. However, we shouldn’t forget the risks that come with buying the stock and mainly the fact that it is going to have a hard time differentiating itself from the competition. Factoring everything in, at these prices, I rate Splunk as a HOLD.

I’ll keep a careful eye on this one, and if it gets any cheaper, I might start a position there.

Be the first to comment