Getty Images/Getty Images News

Chinese sportswear company ANTA Sports (OTCPK:ANPDY) is growing market share and revenues partly driven by a pandemic-induced demand for fitness products as well as the Xinjiang Cotton incident which saw foreign rivals lose market share. Further near-term market share gains are possible and long-term tailwinds including rising incomes, channel expansion and ANTA’s international ambitions can drive growth in the years ahead. Competitive risks however are significant.

Strong growth momentum could continue

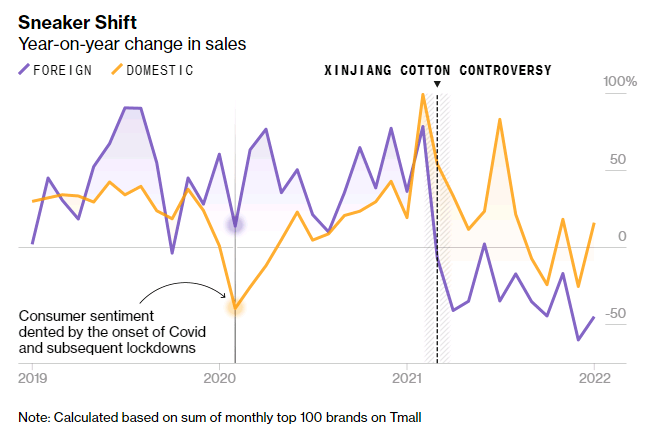

Chinese sportswear giant ANTA Sports, known as “China’s Nike” is enjoying robust growth driven by a pandemic-induced increase in interest in sports and fitness, as well as Chinese consumers’ boycott over foreign brands as a result of the Xinjiang Cotton incident.

Bloomberg

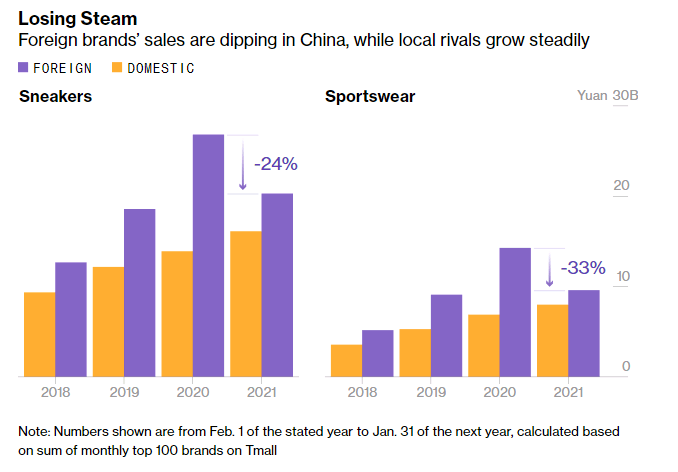

Bloomberg

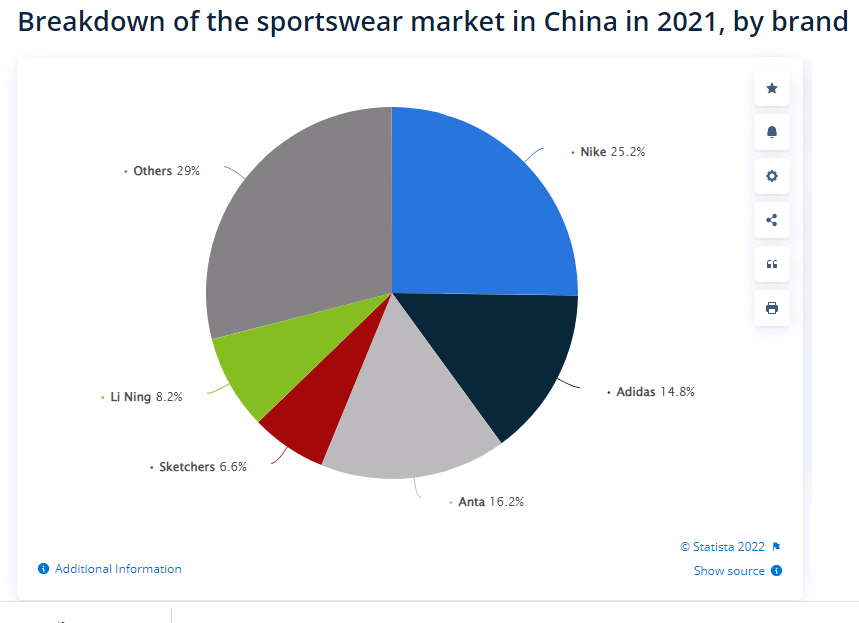

ANTA’s revenues jumped 38.9% YoY to CNY 49.3 billion in 2021 helping the company overtake adidas (OTCQX:ADDYY) to emerge as China’s second biggest sportswear player with a market share of 16.2%, narrowing the gap with NIKE (NKE) who continues to lead by a wide margin with about a quarter of the market (25.2% market share). Domestic rival Li Ning (OTCPK:LNNGF) outpaced ANTA with a 56% YoY jump in revenues, however Li Ning came off a lower base with revenues reaching CNY 22.57 in 2021, about half that of ANTA’s.

Statista

The momentum continued in 2022 with ANTA’s retail revenues growing by single-digits and its FILA brand notching a 10%-20% growth during the quarter ended September 2022 despite lower footfall to offline stores as a result of pandemic-related mobility restrictions. ANTA’s performance is in contrast to foreign rivals whose revenues in the country have been declining. Adidas’ China sales dropped by double digits, while Nike said its China sales dropped 16% YoY during the quarter ended August 2022.

Further near-term market share gains are possible with Chinese consumers seemingly still favoring Chinese brands over Western ones, a trend known as ‘guochao” (“national trend” or “national wave”) that shows little sign of abating. German sports giant Adidas cut its growth outlook for the rest of 2022 as a result of weak China sales, while fellow German rival PUMA (OTCPK:PMMAF), is unable to determine whether China sales would return to growth in the country this year. Market leader Nike’s sales in China are also on a downtrend and while the company attributes the declines to covid rather than a shift in Chinese consumer preferences, the sudden downturn in its fortunes in China (China was Nike’s fastest growing market in the quarter ended December 2020 with sales up 24% YoY despite covid lockdowns and associated supply chain dislocations) suggests an unmistakable deterioration in brand equity among Chinese consumers as a result of the BCI Xinjiang cotton incident.

Looking ahead, prospects are promising.

Push towards higher end segment, rising pricing power could boost revenues, profits, and market share

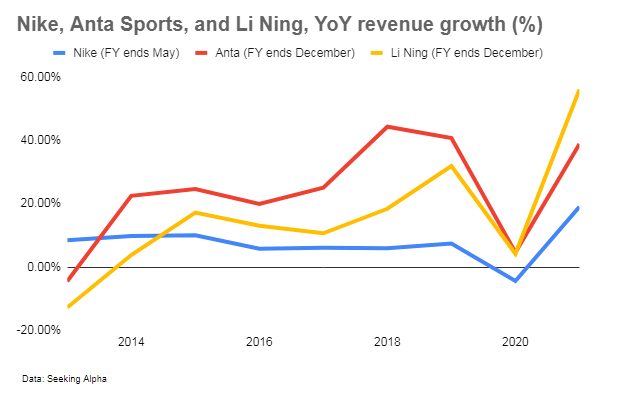

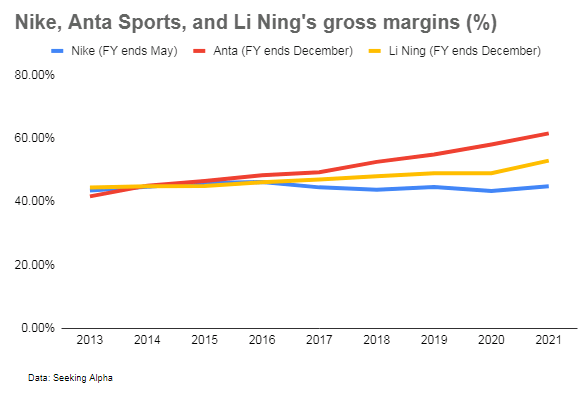

Consistent investments into brand building, marketing, product development and R&D over the years have helped ANTA steadily build its value proposition and increase market share, giving the company pricing power and enabling it to move up the higher segment, pushing up margins in the process. ANTA’s revenues have grown consistently at double digit rates over the past several years while margins have consistently trended upwards.

Author

Author

While further margin expansion opportunities may be relatively limited (ANTA’s gross margins are already higher than Nike and Li Ning), market share, revenue and profit growth opportunities are significant in the years to come.

Incomes are on the rise in China and rising incomes affords more opportunity for recreation. The Chinese government wants citizens to spend more time on sports, and is eyeing a bigger domestic sports industry by 2025. China’s 14th Five Year Plan (2021-2025) for sports development seeks to build China into a sports power (with the country’s sports industry projected to grow to CNY 5 trillion by 2025, from CNY 2.95 trillion in 2019), an ambition that bodes well for domestic sports brands as the plan focuses on increasing fitness accessibility as well as an emphasis on nurturing talent (both domestic and overseas), which could open brand building and marketing opportunities. The Winter Olympics in Beijing for instance, catapulted a number of Chinese brands into the global limelight, including ANTA, which attracted considerable media publicity thanks to its superstar ambassador Eileen Gu.

China’s “guochao” trend shows little signs of fading away and continues to remain popular, particularly among China’s younger Gen Z consumers, a coveted consumer base who already accounts for 13% of China’s household expenditure. This consumer base is expected to remain a major driving force of consumption in China, and as they rise up the income ladder in the years ahead, their interest in domestic brands and domestic cultural elements presents a growth opportunity for local brands, not just in terms of sales volume but also in terms of consumption upgrade opportunities, which opens avenues for top line growth as well as profit and potentially some margin expansion as well. Under its five year strategic plan, ANTA has highlighted its intention to strengthen its appeal among Gen Z consumers, with plans to work with KOLs, and young sports idols such as Eileen Gu.

DTC and channel expansion efforts to drive sales and competitiveness

Following an omnichannel strategy, ANTA has been investing heavily in its offline store network as well as its online retail stores in an effort to drive sales, and enhance competitiveness. The company plans to invest in expanding and improving its stores in China’s upper tier cities and double the number of stores in shopping malls.

ANTA is also investing in digitalization (over CNY 400 million has been allocated for this purpose until 2023) in an effort to drive traffic and increase repeat purchases. Online sales are expected to account for 40% of total sales by 2025. Meanwhile ANTA’s DTC efforts (which began in 2020), is aimed at increasing operating standards, as well as enhancing competitiveness through better access to consumer shopping trends and preferences. ANTA’s DTC efforts have already generated results with ANTA highlighting DTC as a factor behind strong ANTA brand sales in 2021. Short-term margins, however, are under pressure as store costs (such as staff and lease expenses) increase, but longer term, the DTC model is likely to increase competitiveness and may accordingly help support margins as well.

International ambitions

Over the coming decade, ANTA is aiming to become a global sportswear player. The company’s brand portfolio already includes sports brands with a presence outside China notably FILA (which was acquired in 2009) and Wilson (which ANTA acquired through its acquisition of Finnish sporting goods company Amer Sports in 2019), and they may be able to leverage those global distribution networks to promote their ANTA brand overseas as well.

The company is cash flow positive and has a decent leverage position (total debt to equity of 55 versus 79 for Nike, and 91 for Adidas), enabling it to make necessary investments in marketing, brand building, channel building, product development and acquisitions where relevant to drive market share growth. Under ANTA’s five year strategic plan, about CNY 4 billion will be invested in R&D to help the company move up the higher end segment, and under its ten year strategic plan, the company plans to invest CNY 20 billion on R&D to support its global ambitions.

Risks

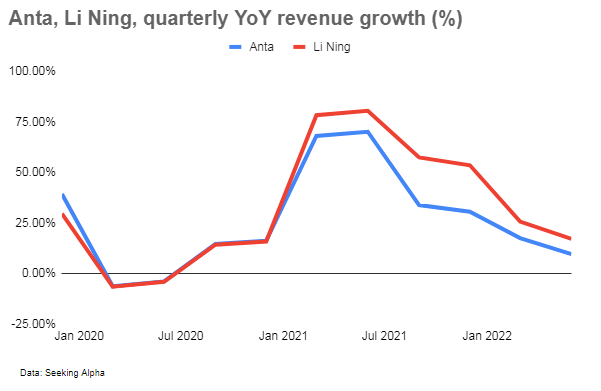

Although domestic brands such as ANTA have opportunistically capitalized on foreign brands’ challenges since 2020, it remains to be seen whether they have the long-term stamina to maintain their recent market share gains. Both ANTA and Li Ning have seen decelerating top line growth over the past few quarters.

Author

Moreover, despite foreign brands’ sagging fortunes in China, the country is still too big to ignore, and executives at foreign sportswear giants Nike and Adidas say they’re doubling down on China. With a view to the long term, both have immense financial resources to outspend ANTA who is still relatively a minnow compared to Nike and Adidas (at USD 47 billion, Nike’s revenues are nearly six times bigger than ANTA, and Adidas’s revenues of EUR 21.3 billion is nearly triple that of ANTA’s). Moreover, both are also quick to adapt with both Nike, and Adidas launching Chinese culture-inspired sportswear collections, efforts that may help stem market share erosion as well as regain some brand equity lost as a result of the Xinjiang cotton incident.

Furthermore, competitive pressures from domestic rivals, notably Li Ning who has the advantage of having a national sports champion as its founder (Li Ning’s founder, known as the “Prince of Gymnastics” is a household name in China) cannot be overlooked.

Summary

Chinese sportswear giant ANTA is enjoying robust growth driven by growing demand for fitness as well as a shift in consumer interest away from foreign brands and towards local names. This “guochao” trend shows little sign of fading suggesting possible further market share gains at the expense of foreign brands in the near term.

Longer term, rising incomes, an encouraging policy environment, channel expansion and international ambitions could drive top line growth. Risks include competitive risks as foreign rivals, notably Nike and Adidas, both of whom have considerable resource advantages, ramp up efforts to regain lost market share in the long term. ANTA and homegrown rival Li Ning have already been seeing decelerating growth over the past few quarters.

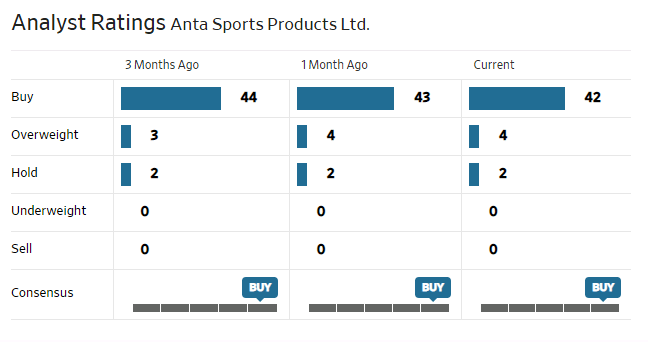

With a P/E of 27, ANTA is relatively cheap compared to Nike (P/E 35), and domestic rival Li Ning (31); however, with ANTA’s ability to sustain its market share gains in the long term remaining as a question mark, a P/E of 27 may be viewed as a bit pricey and investors may opt to wait for a price that offers a better risk/reward. Analysts are strongly bullish on the stock.

WSJ

Be the first to comment