OlegAlbinsky/iStock Unreleased via Getty Images

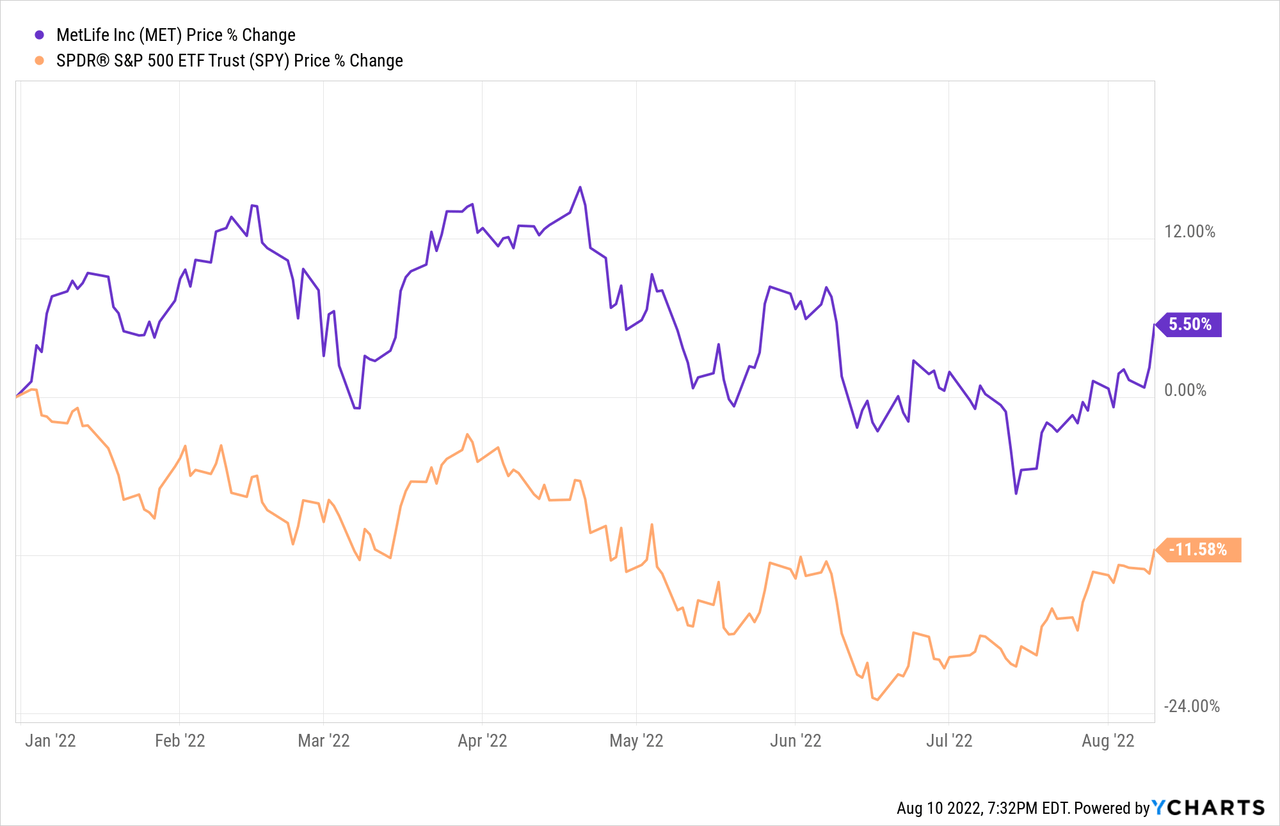

MetLife’s (NYSE:MET) stock has performed well so far in 2022, as it has outperformed the broader market by almost 16bps over the last 8+ months.

I think shareholders should consider staying the course with their MET shares, even after the recent outperformance, as I still believe MetLife is a great, long-term investment at today’s price. In my opinion, whether the U.S. enters into a recession or not, this global insurer is well-positioned for 2023 and beyond.

Investment Thesis

MetLife is a global insurance company that has been busy de-risking its business profile (and investment portfolio) over the last few years. As such, MetLife’s global business is well-positioned to weather a downturn in the global economy but the company also stands to benefit from an improving economic backdrop and a potentially rising interest rate environment.

Additionally, this global insurer should be viewed as a capital return story, as the current management team has an impressive track record of returning excess capital to shareholders, while also improving the company’s long-term business prospects in several key industries.

The Latest: The Noisy Q2 2022 Results

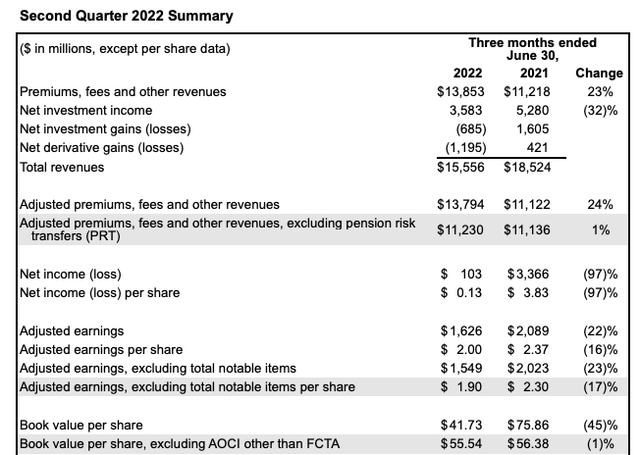

MetLife has reported strong operating results over the last few quarters and Q2 2022 was more of the same, as the company released results that beat the consensus bottom-line estimate. The company reported adjusted EPS of $2.00 (beat by $0.55) on total revenue of $15.6bn.

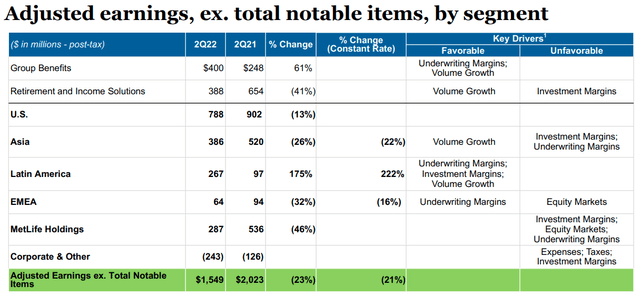

Highlights from the quarter:

- Premiums, fees and other revenues increased by 23% YoY, which was positively impacted by premium and fee pricing growth

- Net investment income declined by 32% YoY as results were impacted by rising interest rates and other macro factors (more on this below)

- The Q2 2022 direct expense ratio was 11.9%, which is well-below the long-term target of 12.3%

- Adjusted earnings were $1.6bn (or $2.00 per share) as compared to $2.1bn (or $2.37 per share) in the year-ago quarter

There was a lot of noise in the Q2 2022 results but, in my opinion, the overall takeaway is that the company’s long-term thesis remains intact.

I consider the impact of the sharp rise in interest rates as noise because, while the company has to book accounting losses, I believe a higher rate environment is a net-positive for MetLife over the long haul. For example, the company’s new money rate (i.e., the yield for new money being invested) was 3.92% for Q2 2022 and that compares to the roll-off yield of 3.71% (i.e., the yield for the investments that matured), which makes this the first quarter in over a decade that MetLife did not have spread compression for its investment portfolio. As such, the accounting losses booked as a result of rising rates should be viewed as short-term noise, in my opinion.

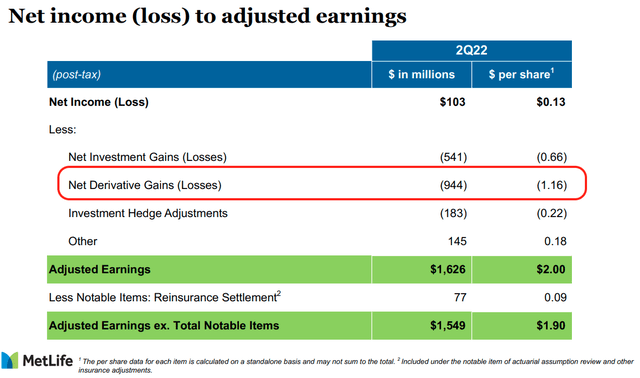

To this point, another factor that impacted earnings is the material net derivative losses that were booked for the quarter.

For context, net derivative losses totaled $1.2bn ($944mm after-tax) in Q2 2022 as compared to net derivative gains of $421mm ($333mm after-tax) in the same period of the prior year. That is, there was an after-tax swing in earnings of ~$1.3bn that was largely a result of several macro factors (i.e., sharp increase in interest rates, strengthening U.S. dollar, currency fluctuations, etc.), which again I would argue are short-term headwinds.

However, make no mistake about it, MetLife’s earnings were under pressure for most business units.

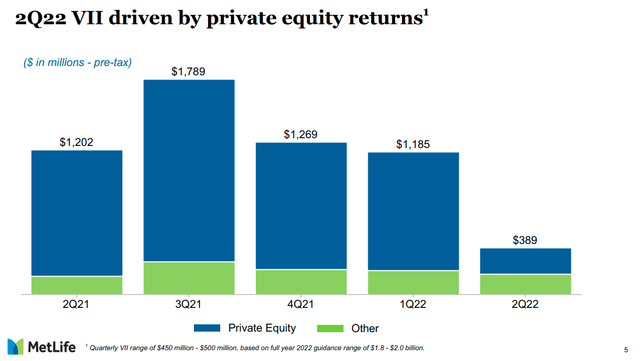

The significant decline in variable interest income (“VII”) was one of the main factors that negatively impacted earnings in Q2 2022.

The weaker-than-expected VII was mainly driven by the disappointing returns for private equity investments during the quarter. Looking back, MetLife’s VII results have been an earnings growth driver over last few years so investors should pay close attention to how the next year or so shapes out. One down quarter shouldn’t cause investors to be too concerned but I do expect for the VII results to remain under pressure through at least 2022.

MetLife’s Q2 2022 results were well-received by the market because I believe investors were willing (and able) to look past some of the noise in the numbers. A rising interest rate environment is a net-positive for a global insurance company from a long-term perspective so the large quarterly swings in operating results shouldn’t be viewed as deal breakers, as some pundits would have you believe. Moreover, I believe bulls should continue to hang their hat on the fact that MetLife’s management team has also remained committed to rewarding patient shareholders through the market turmoil.

The Capital Return Story Continues

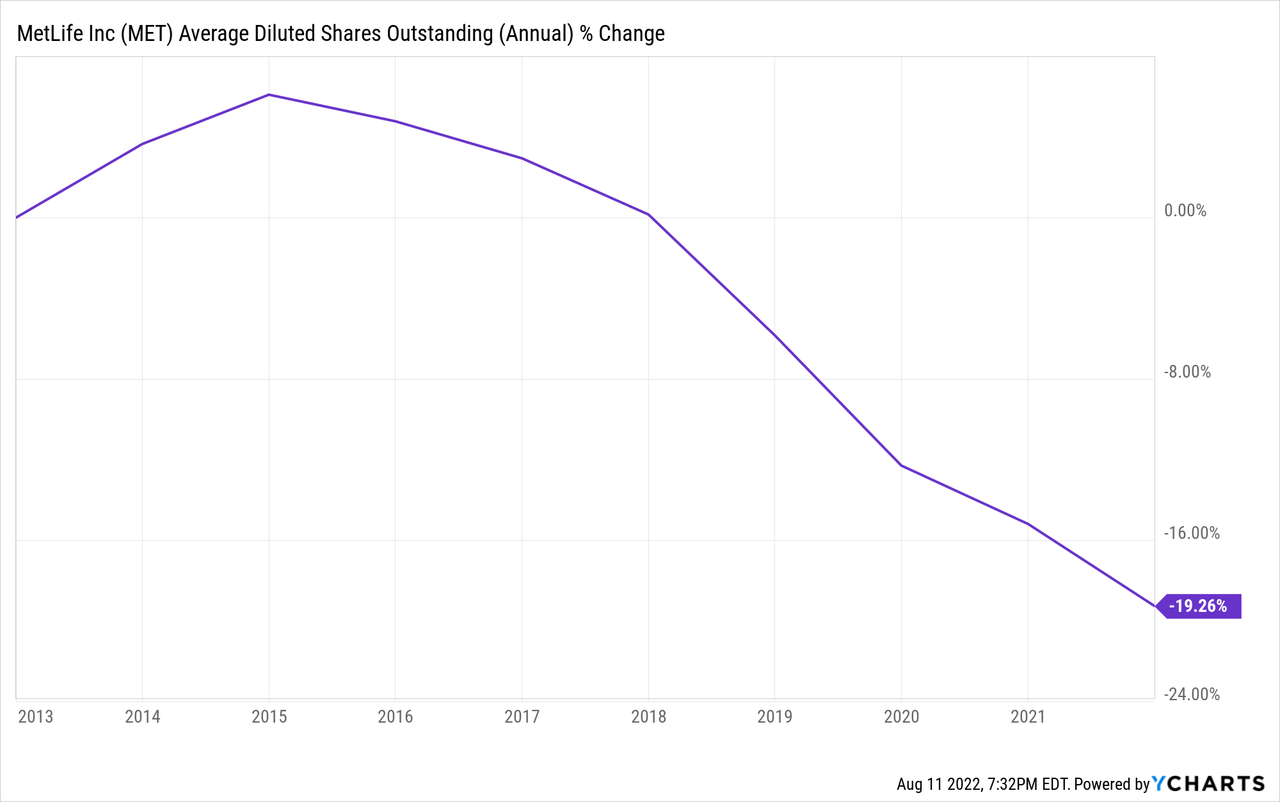

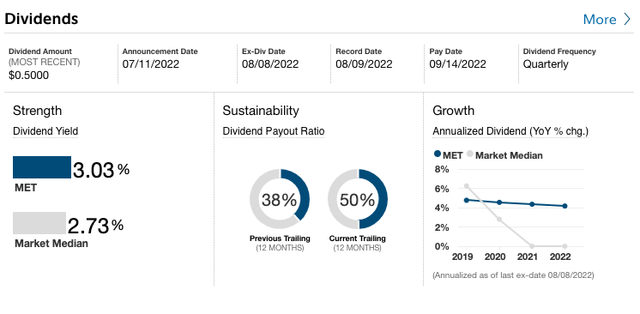

MetLife’s management team has a strong track record of returning capital to shareholders over the last few years and the latest quarter was no exception. In Q2 2022, management returned more than $1.5bn to shareholders in the form of dividends ($408mm) and buybacks ($1.1bn). Moreover, the team has bought back ~$2bn in common stock over the first half of 2022, which adds to the long-term trend of a shrinking share count for this global insurer.

During the conference call, management mentioned that they intend to repurchase additional shares in the second half of the year but that they would likely slow the pace over the next few months. It’s also important to highlight that management proactively accelerated their buybacks as the market pulled back over the last two quarters, which is an encouraging sign for shareholders.

MetLife has an above-average dividend yield and, as shown by the payout ratio, the company has the room to grow its dividend in the years ahead.

The capital return story is a big reason to consider staying long the stock but it’s not the only reason.

Valuation

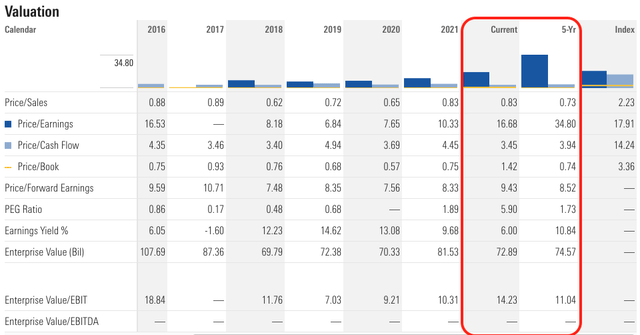

MetLife’s stock is currently trading above its 5-yr trends for several valuation metrics.

There is no denying that MetLife is not as cheap as it was a year ago but, as I mentioned earlier, this global insurer is well-positioned for 2023 and beyond. Plus, it helps the bull case that management is paying shareholders to be patient as the story plays outs.

Risks

The biggest risk for any insurer, including MetLife, is the sufficiency of the company’s reserves. The company will likely have immaterial one-off reserve charges on a somewhat consistent basis, but any material adjustment could negatively impact the stock price.

And lastly, the Federal Reserve and rates are a [short-term] concern right now, but investors need to also consider the macro environment. A deteriorating global economy would eventually negatively impact the financial sector.

Bottom Line

2022 has been a bumpy ride for MetLife shareholders but, looking out, I think there is a lot to like about MET shares at current levels. The company’s Q2 2022 earnings metrics were not impressive but, in my opinion, the operating results showed that the long-term thesis for MetLife remains intact.

Simply put, it appears that MetLife’s management team has the company properly positioned for 2023 and beyond. The stock may remain under pressure over the next few quarters due to the inflation and global market concerns, but in my opinion, investors with a long-term perspective should consider adding MET shares on any significant pullbacks.

Disclaimer: This article is not a recommendation to buy or sell any stock mentioned. These are only my personal opinions. Every investor must do his/her own due diligence before making any investment decision.

Be the first to comment