alfexe

Astec Industries, Inc. (NASDAQ:ASTE) recently delivered a significant increase in backlog. Management announced a list of initiatives to centralize and simplify the organization. Along with a change in the ERP, the company’s websites are being simplified, and new supply chain initiatives have commenced. Considering the new changes, my conservative discounted cash flow (“DCF”) models resulted in a valuation that is higher than the current stock price. I see risks from potential internationalization and decreases in revenue, but despite these risks, the current Astec Industries stock price is too low.

Astec Industries

Astec Industries engineers, manufactures, and markets equipment used in road building and construction activities. The company also offers other equipment for other industries, including mining, demolition activities, and industrial heat transfer, among many others.

I appreciate the company’s activities in many different industries, offering substantial diversification. With that, in my view, the most appealing is the company’s record backlog reported in the most recent quarterly report. If the backlog continues to increase, I believe that more investors will have a look at Astec. The demand for the stock could increase.

Source: Quarterly Release Presentation

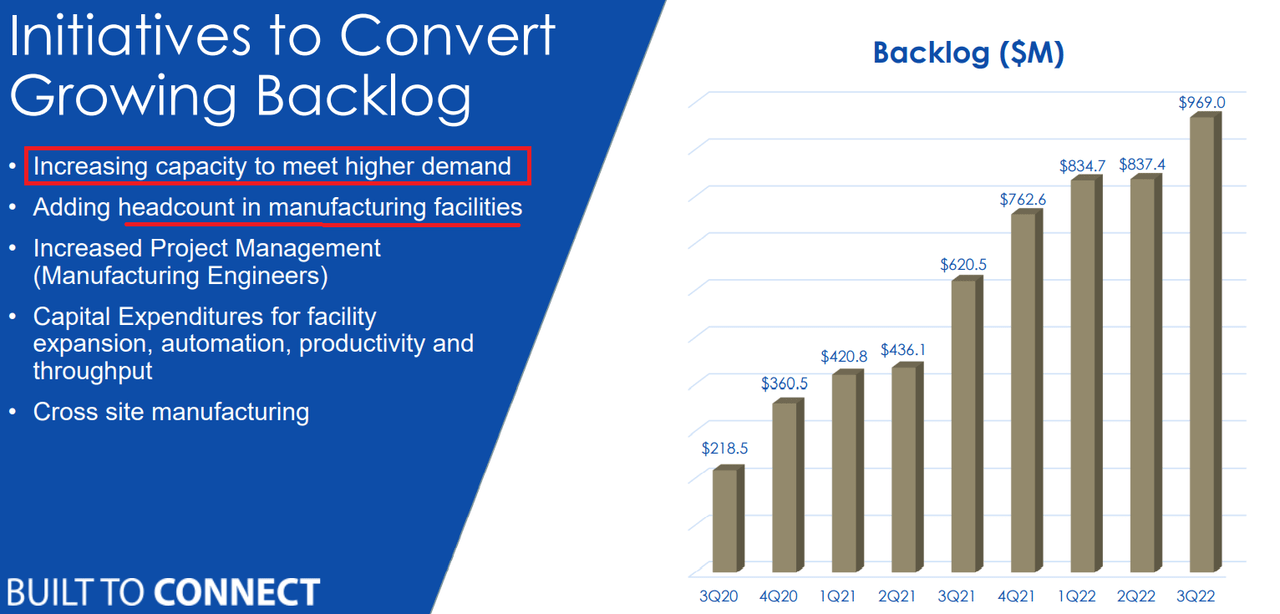

Among the explanations about the backlog growth, there is the fact that capacity has been increased to meet a recent increase in demand. Besides, Astec seemed to increase its total headcount, which offered management more growth opportunities. In sum, many parameters indicate that the business is in a period of expansion.

Source: Quarterly Release Presentation Source: Ycharts

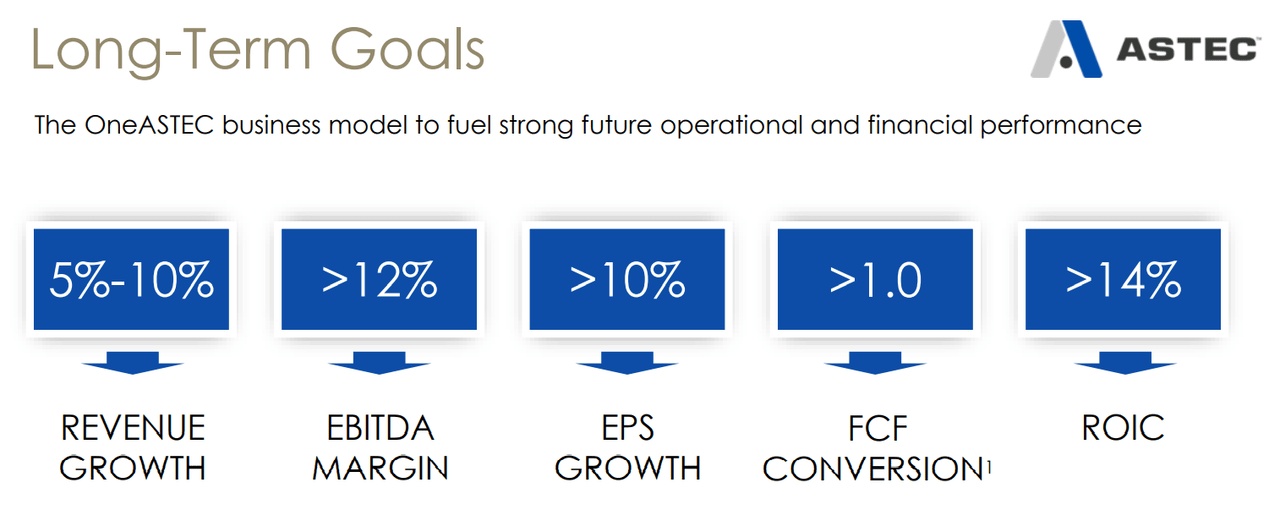

In line with the previous lines about business expansion, Astec Industries noted ambitious business growth that includes 5%-10% revenue growth, an EBITDA margin close to 12%, and high free cash flow (“FCF”) conversion. I am not that optimistic in my financial models, but I believe that mentioning the company’s figures is very important.

Source: Quarterly Release Presentation

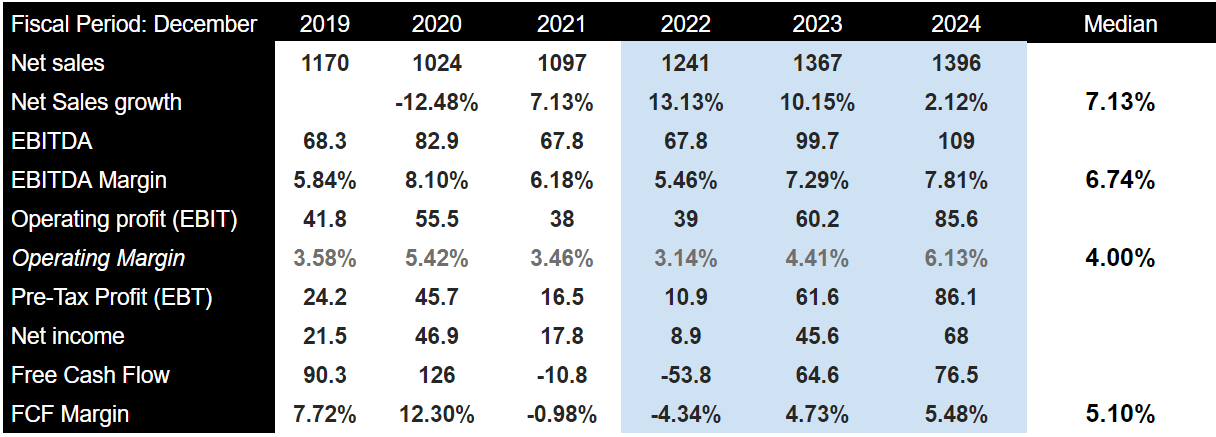

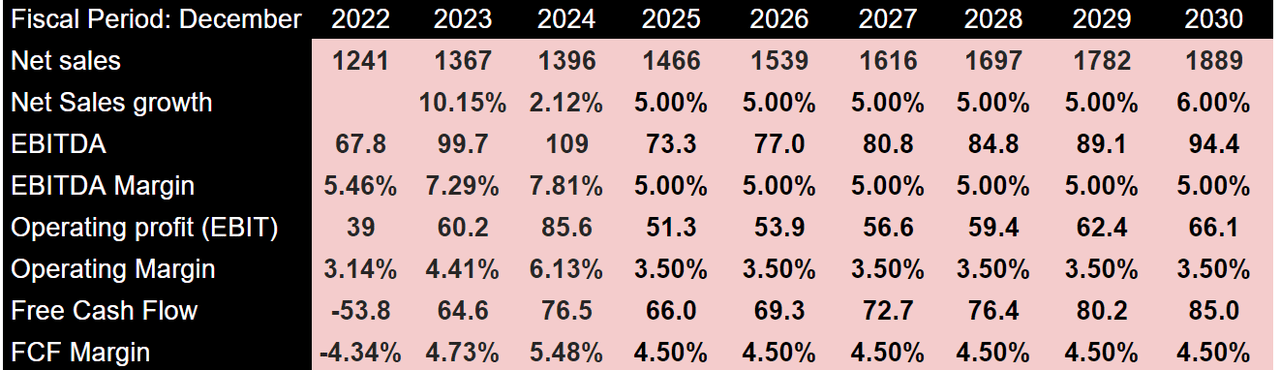

Expectations From Analysts Include FCF Margin Close To 5%-6%

I believe that the numbers delivered by analysts are quite beneficial. Astec Industries is expected to deliver 2024 net sales of $1.396 billion with a net sales growth of 2.12%. In addition to an EBITDA of $109 million and EBITDA margin of 7.81%, 2024 operating profit is likely to be close to $85.6 million along with an operating margin of 6.13%. Besides, tax profit would be close to $86.1 million, with a net income of $68 million and free cash flow of $76.5 million. I used some of these figures in my financial models, as I believe that including them in the article makes sense.

Source: Marketscreener.com

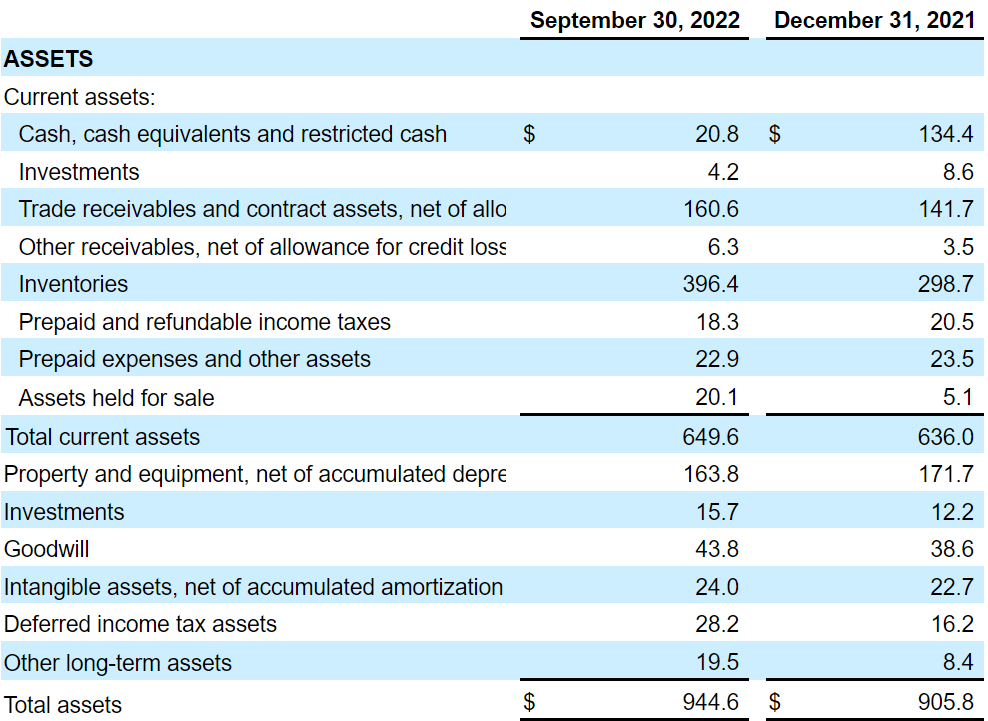

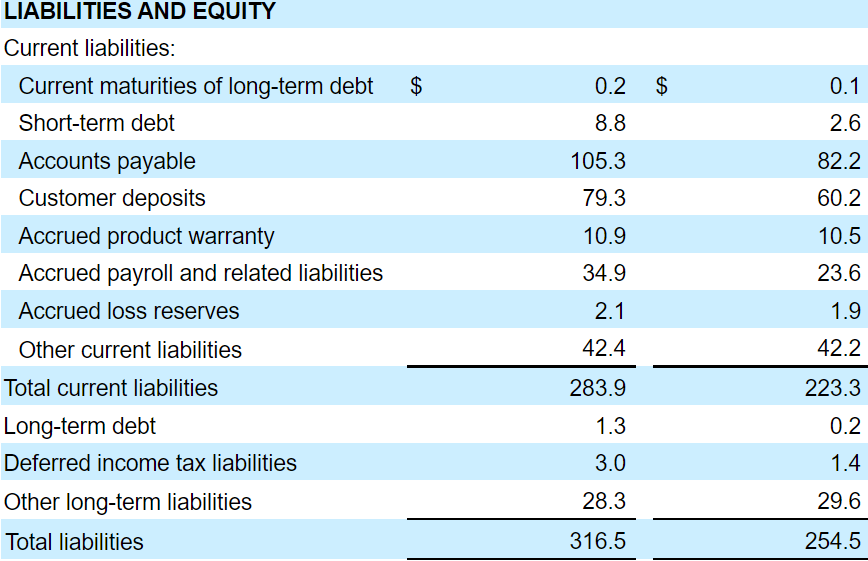

Healthy Balance Sheet

As of September 30, 2022, Astec Industries reported cash equivalent of $20.8 million, with trade receivables of $160.6 million, inventories of $396.4 million, and prepaid expense of $22.9 million.

Including assets held for sale worth $20.1 million, total current assets would stand at $649.6 million, significantly higher than the total amount of current liabilities.

Property and equipment stand at $163.8 million, with goodwill worth $43.8 million, resulting in the total assets of $944.6 million. The asset/liability ratio stands at close to 3x, so I would say that the balance sheet appears quite healthy.

Source: 10-Q

Regarding the liabilities, Astec Industries reported accounts payable of $105.3 million along with customer deposits of $79.3 million. The accrued payroll stood at $34.9 million with other current liabilities of $42.4 million. Total current liabilities stand at $283.9 million. The other long term liabilities were $28.3 million. Finally, total liabilities become $316.5 million.

Source: 10-Q

A New EPS Version, Centralization, And Supply Chain Modification Could Imply A Valuation Of Around $63 Per Share

I believe that management recently enacted several initiatives that will likely bring a very decent EBITDA margin and FCF generation. First, Astec Industries decided to centralize its platform, so that customers, partners, employees, and shareholders can interact from the same site. In my view, the initiative will likely bring efficiency and lower costs.

Centralizing our organization into sites with common platforms and operating models supports organic sales growth as it is easier for our customers, partners, employees and shareholders to understand and interact with us. Source: 10-k.

Astec Industries also noted several actions related to supply chain to enhance supply chain targeting lower lead times and logistics costs. In this regard, let’s also note that management installed a new version of the ERP, which could bring further automatization and efficiency.

We strive to optimize the supply chain through leveraging the size and scale of our global operations to improve lead times, lower logistics costs and introduce localized product support. Source: 10-k

The upgraded ERP will initially convert our internal operations, manufacturing, finance, human capital resources management and customer relationship systems to cloud-based platforms. This new ERP system will provide for standardized processes and integrated technology solutions that enable us to better leverage automation and process efficiency. Source: 10-k

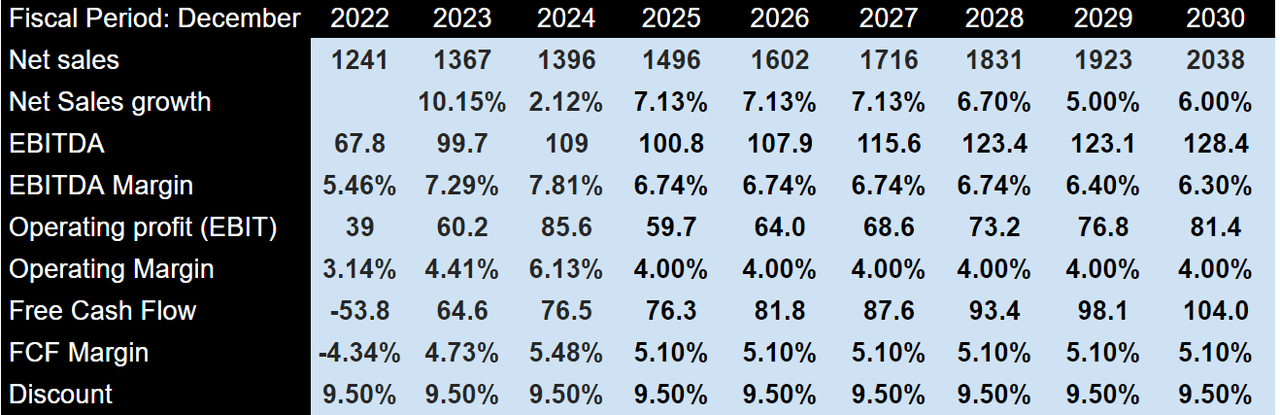

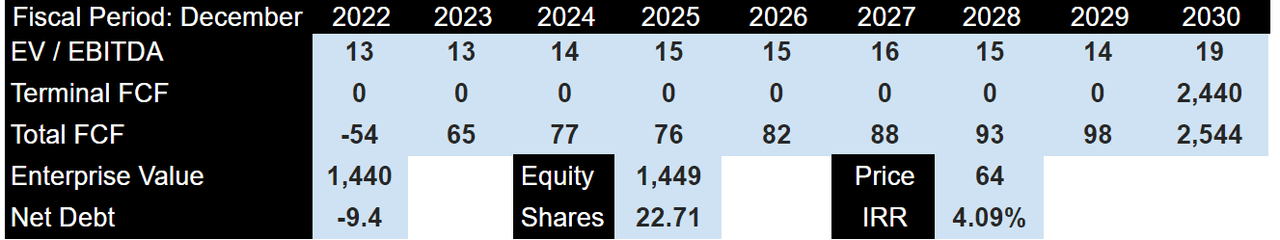

My base case scenario includes net sales growth close to 7%-6% from 2025 to 2030, an EBITDA margin of 7%-6%, operating margin around 4%, and FCF/Sales close to 5.1%. The results would include 2030 net sales of $2 billion, FCF close to $103 million, and an EBITDA of $128 million.

Source: Author’s DCF Model

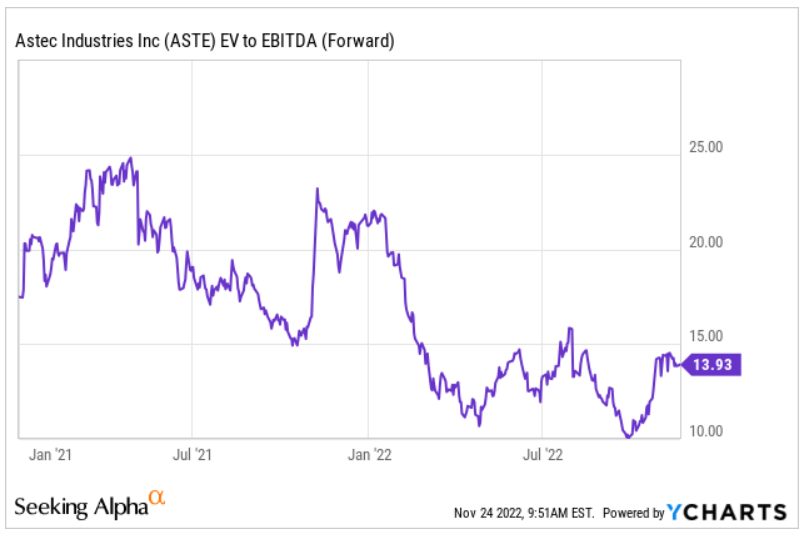

If we assume an EV/EBITDA of 19x, the terminal FCF would stand at $2.4 billion. Note that my EV/EBITDA multiple does not sound that optimistic. In 2021, traders out there saw the company trading at 25x.

Source: Ycharts

Besides, with a discount between 9%- and 10%, the implied enterprise value would be $1.44 billion. Finally, the equity valuation would stand at close to $63 per share, with an IRR of 4%-5%.

Source: Author’s DCF Model

Risks: Cyclical Revenue Fluctuations, Failed Internationalization Efforts, And changes In Regulatory Framework Could Bring The Fair Price Down To $37 Per Share

I believe that the largest risk for Astec Industries would come from a generalized decrease in the number of road and utility construction projects. If clients decide to decrease their capex, the company’s revenue would likely decline. Astec Industries offered the following lines about this risk.

We sell equipment primarily to contractors whose demand for equipment depends greatly upon the volume of road or utility construction projects underway or to be scheduled by both government and private entities. The volume and frequency of road and utility construction projects are cyclical; therefore, demand for many of our products is cyclical. The equipment we sell is durable and typically lasts for several years, which also contributes to the cyclical nature of the demand for our products. As a result, we may experience cyclical fluctuations to our revenues and operating results. Any difficulty in managing our manufacturing workflow during downturns in demand could adversely affect our financial results. Source: 10-k

Astec Industries is currently trying to increase total international revenue. I believe that the risks of failing in the internationalization process are elevated. Keep in mind that Astec needs to understand well and respect host country laws as well as laws in the United States. Fines and penalties could bring the company’s finances down, which may deteriorate the company’s total market valuation.

In 2021, international sales represented approximately 23.3% of our total sales as compared to 20.2% in 2020. We plan to continue increasing our already significant sales and production efforts in international markets.

Such risks include the possibility of unfavorable circumstances arising from host country laws or regulations and general economic and political conditions in the countries we do business, which are typically more volatile than the U.S. economy and more vulnerable to geo-political conditions. Source: 10-k

There is also the risk of not understanding well the demands of clients outside the United States. Clients in Asia, the Middle East, Africa, and Latin America are for sure completely different from those in the United States.

This requires a thorough understanding of our existing and potential customers on a global basis, particularly in Asia, Middle East and Africa, and Latin America. Failure to deliver quality products that meet customer needs at competitive prices ahead of competitors could have a significant adverse effect on our business. Source: 10-k

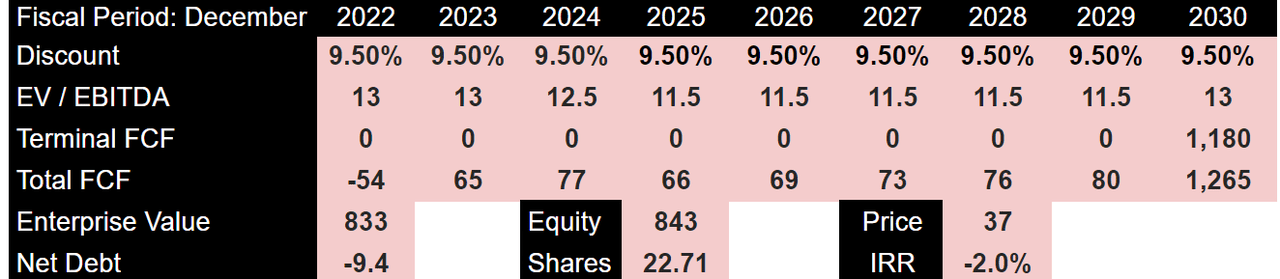

Under the previous assumptions, I included net sales growth close to 5%, an EBITDA margin around 5%, and FCF/Sales close to 4.5%. It means that 2030 FCF would stand at close to $85 million, and 2030 EBITDA would be around $95 million.

Source: Author’s DCF Model

Under these conditions, I also included a discount of 9.5% and 2030 EV/EBITDA of 12.5x-13.2x, which implied an equity valuation around $843.2 million. The fair price would be close to $37 per share.

Source: Author’s DCF Model

Conclusion

Astec Industries recently delivered a significant increase in the backlog and a lot of new initiatives that may enhance efficiency. A new version of the ERP, only one site for the whole organization, and supply chain initiatives will likely improve the company’s FCF generation. Under my own discounted cash flow models, I obtained a fair valuation that is significantly higher than the current market price. Even considering risks from the current internationalization process or cyclical declines in demand for projects, the Astec Industries, Inc. stock price appears cheap.

Be the first to comment