DNY59

Introduction

In August 2022, I wrote a bearish article on SA about Splash Beverage Group (NYSE:SBEV), in which I said that the company could run out of cash by the end of September as the loss from operations was expanding despite strong sales growth. Well, the company completed a $3.1 million share offering just before the end of September. I think that more stock dilution is likely to come before the end of the year as the loss from operations came in at $5.11 million in Q3 2022 alone. Gross sales soared by over 73% but this matters little as the gross profit margin is now below 23%. The business model seems flawed, considering that Splash Beverage Group would be unprofitable even if the gross profit margin was 100%. Let’s review.

Overview of the recent developments

In case you haven’t read any of my previous articles about Splash Beverage Group, here’s a brief description of the business. The company specializes in acquiring and expanding undervalued beverage brands and describes itself as a brand builder. Splash Beverage Group currently has four brands in its portfolio – TapouT (high-performance sports drinks), Salt Tequila (blanco agave tequila), Copa Di Vino (premium wine by the glass), and Pulpoloco (Spanish sangria). Salt Tequila is made in Mexico and the company has a 22.5% stake in the producer, with which it has also a marketing and distribution agreement.

Splash Beverage Group has a vertically integrated B2B and B2C e-commerce distribution platform named Qplash, which sells products on both Amazon (AMZN) and Shopify (SHOP). The company also sells its products through offline and online retailers and has inked several distribution agreements this year. In Q3 2022 alone, Splash Beverage Group entered into distribution deals with Lohr Distributing, Central Distributors of Las Vegas, Carey Distributors, Wantz Distributors, and Mexcor International.

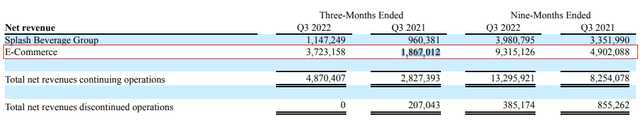

Turning our attention to the Q3 2022 financial results, you can see from the table below that the main driver of sales growth is Qplash as e-commerce sales soared by almost 100% to $3.72 million.

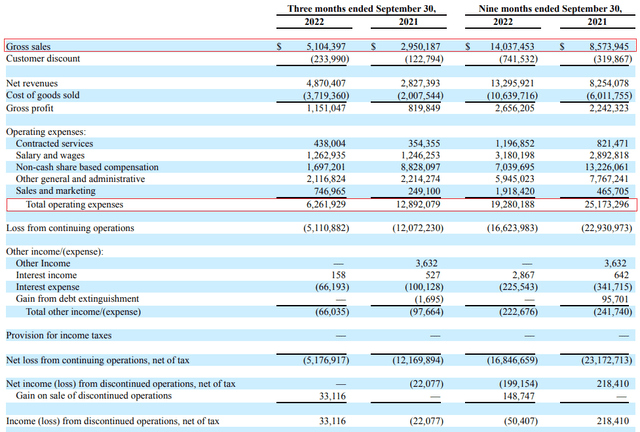

Unfortunately for investors, the margins of the e-commerce business aren’t great, and the situation was challenging in Q3 as Splash Beverage Group complained about higher supply chain costs on ingredients and freight (see page 19 here). As a result, the gross profit margin declined to 22.55% in Q3 2022 compared to 27.79% a year earlier. Still, this represents a significant improvement compared to the 13.85% achieved in Q2 2022. However, Splash Beverage Group boosted its marketing expenses in Q3 2022 as it’s accelerating the growth of its business. Overall, it seems that the company is betting on rapid growth with little regard for profitability and margins, and I doubt that this is the right strategy as few companies have made blitzscaling work. At the moment, operating expenses are higher than sales.

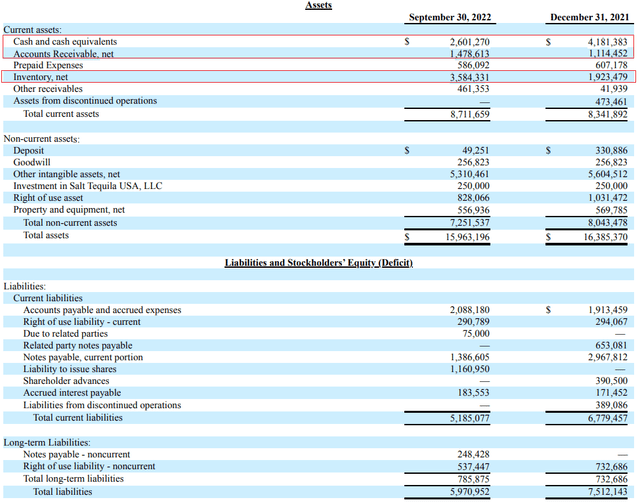

Turning out attention to the balance sheet, Splash Beverage Group finished September 2022 with just $2.6 million in cash and cash and cash equivalents, despite issuing 2 million shares for $3.1 million in a public offering just days before the end of the quarter. As you can see from the table below, the company has an asset-light business model and cash, accounts receivable, and inventory account for the lion’s share of tangible assets.

Speaking of stock dilution, matters were made even more complicated in Q3 as Splash Beverage Group agreed to issue 380,959 shares to settle a lawsuit that Copa Di Vino Corp filed against in June. The latter alleged that the company still owed it part of the final payment for rights to the Copa Di Vino brand. In my view, stock dilution is likely to remain high, considering cash used in operating activities stood at $3.52 million in Q3 2022 alone. Unless the cash burn rate is limited in the near future, Splash Beverage Group could need another capital increase before the end of the year.

I was surprised that there is no mention in the Q3 2022 financial report of Pulpoloco Sangria. The purchase of the producer of this brand was announced in June 2022 and the product is listed on the corporate website of Splash Beverage Group as the company is currently a distributor. Considering the transaction was expected to be completed by the end of August, I think we can assume that it didn’t go through.

Overall, I think that it was a bad quarter for Splash Beverage Group and that the company is running out of cash once again. More stock dilution seems inevitable, and I doubt that a blitzscaling strategy would work in the U.S. beverage market anyway as competition is high. In my view, it would be hard for Splash Beverage Group to accelerate its sales growth even if it increases its marketing expenses significantly.

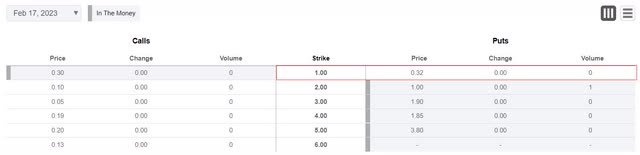

So, how do you play this one? Well, I think the best course of action could be to avoid this stock as short selling just seems too risky at the moment. According to data from Fintel, the short borrow fee rate stands at 29.56% as of the time of writing, which is pretty high. There are put options available, but they are expensive as well and the volume is almost nonexistent.

Sure, you can go for a higher strike price, but this is also risky as the share prices of microcap companies can increase for spurious and unknown reasons. Looking back at the share price performance of Splash Beverage Group, there have been several spikes over the past few years.

Investor takeaway

The operating expenses of Splash Beverage Group are still higher than its sales, and I doubt that its business could become profitable in the future. It doesn’t seem that there’s much that the company can do to make its business more economically feasible. The US beverages market is highly competitive, and I don’t think any of the company’s brands stand out at the moment.

In my view, more stock dilution is coming before the end of 2022, and I’m bearish. However, short selling seems too risky at the moment, and I think that the best course of action for investors is to avoid this stock.

I probably won’t write another article about Splash Beverage Group unless there is a major change in the fundamentals of the business.

Be the first to comment