Michael M. Santiago/Getty Images News

This story was originally written on April 19, 2022, for Reading The Markets, an SA Marketplace service. It has been modified where italicized.

Apple’s (NASDAQ:AAPL) shares rocketed higher at the end of the first quarter and have fizzled out since. The company will report results after the close on April 28. Analysts estimate the company’s fiscal second-quarter earnings climbed by just 2% versus last year to $1.42 per share. Meanwhile, revenue is estimated to have risen by 5% to $94.1 billion. The company does not provide guidance, but analysts do see Apple’s third-quarter revenue increasing by 5.7% to $86.1 billion.

The stock has performed exceptionally well during the pandemic as investors have focused on Apple’s expanded line-up, the creation of its own CPUs, and the 5G upgrade cycle.

All of this has helped propel Apple’s revenue and earnings to record highs and has helped to expand the stock’s multiple. While Apple is likely to be a solid performer over the next few years, it doesn’t mean the stock can’t pull back over the short-term as the market reprices risk and valuations for a higher interest rate environment.

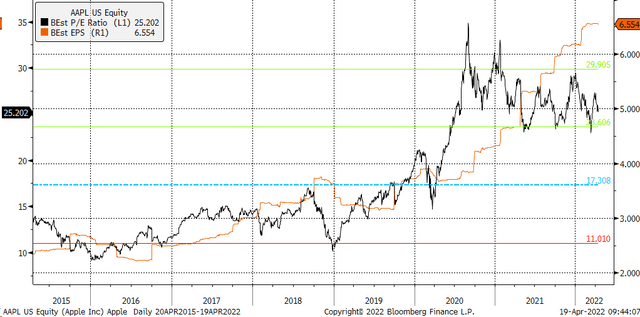

The stock currently trades at 25.2 times fiscal year 2023, with earnings estimates of $6.55 per share. The PE ratio is well above the historical average of 19.6 over the past five years, and a multiple the stock hasn’t seen since before the pandemic. If we look at this multiple of the past seven years, the average PE drops to 17.3.

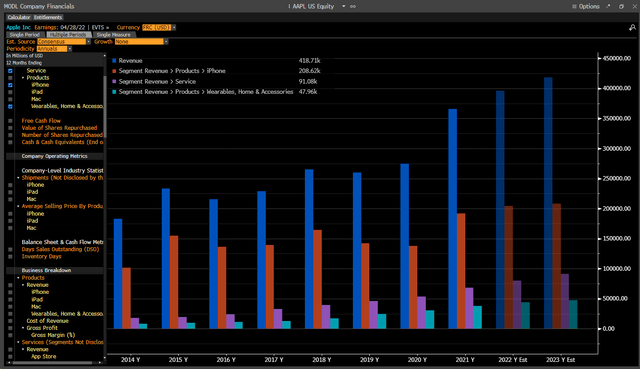

It is important to remember that Apple today is very different from a product standpoint than it stood seven years ago, with its dependence on iPhones significantly reduced. It is easy to see those iPhone sales are expected to be a considerably smaller portion of total revenue as services and wearables continue to grow. Given this increased product mix, it seems more likely that the valuation should trade between the post-Covid highs and pre-Covid lows, making 19 a reasonable and achievable long-term sustainable PE ratio.

At 19.6 times 2022 earnings estimates, the stock would be valued around $128. That would amount to a decline of around 23%.

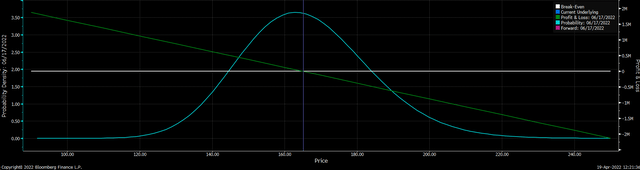

Apple – Bearish Options Trade

The risk to the stock seems to be present and has allowed an options trader to start a bearish position. The open interest for the June 17 $185 puts rose by around 25,000 contracts on April 19, while the calls saw their open interest increase by approximately 20,000 contracts. The data shows that 25,000 puts traded on the ASK and were bought for $21.74 per contract, while 25,000 calls traded on the BID and were sold for $1.44. Overall, it cost the trader around $20.30 per contract to create the bearish bet. The trader needs the stock to trade below $164.70 per share to earn a profit if held until expiration.

The trade may very well be a hedge against a significant long position. However, it does not make the intention any less critical. It suggests that somebody sees a reason to buy protection against a potentially large long position heading into earnings.

AAPL Stock – Rejection of the All-Time High

Additionally, the chart shows that the momentum is leaving the stock based on the RSI. The stock is also approaching a significant level of support that will need to hold at $161. If that level at $161 breaks, it would be a negative signal that shares are heading lower towards support at $149.

The shares rallied to a high of $180 during the March melt-up, which was likely related to options expiration and quarterly rebalancing. That price of $180 has now served as resistance on three occasions, with the most recent test indicating a significant rejection of that price.

A drop to $128 seems like too much of a stretch, but a decline to $149 certainly seems reasonable if the market macro pressure of rising yields compresses broader multiples.

Investing today is more complex than ever. With stocks rising and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

Be the first to comment