Bet_Noire

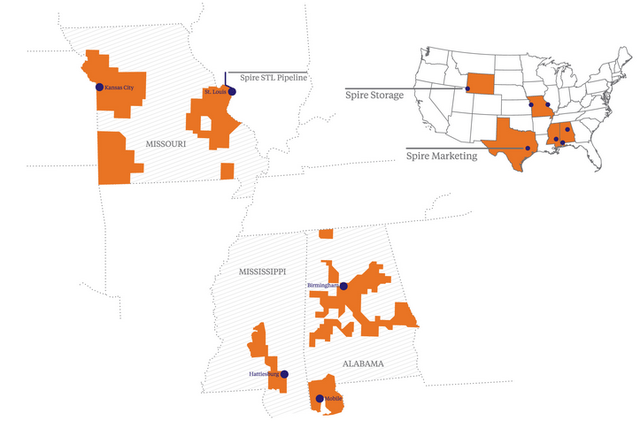

Spire Inc. (NYSE:SR) is one of the largest natural gas utilities in the United States, serving customers in Missouri, Alabama, and Mississippi. The natural gas utility sector has struggled somewhat against electric utilities in the markets over the past year due largely to investor concerns about their long-term sustainability. However, these fears are unfounded and natural gas will almost certainly continue to be heavily used by households and businesses for space heating and cooking over the next several decades. We will discuss why in this article. For its part, Spire has many of the things that have made utility companies popular among more conservative investors, such as retirees. The company enjoys remarkably stable cash flows over time, a high 4.24% dividend yield, and significant growth prospects. Unfortunately, the company’s valuation is not as attractive as many of its peers, which is quite disappointing. There could still be an argument for following it and considering it for investment though, so read on.

About Spire Inc.

As stated in the introduction, Spire Inc. is one of the largest natural gas utilities in the United States. The company serves approximately 1.7 million homes and businesses across the states of Mississippi, Missouri, and Alabama:

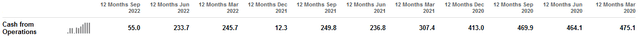

One of the characteristics of utility companies is that they enjoy remarkably stable cash flows regardless of economic conditions. This is because the product that they provide to their customers is generally considered to be a necessity. After all, how many people in the United States do not have a space heating system in their homes today? Due to this, most people will prioritize paying their utility bills ahead of making discretionary expenses during times when money gets tight. This is something that may be especially relevant today as the high inflation in the United States has strained the finances of many consumers. We can see this quite clearly by considering that credit card debt increased by 15% in the third quarter of 2022, which represents the largest increase in twenty years. It seems unlikely that this would happen if people were not struggling to cover their expenses. Spire’s stable cash flows are immediately apparent by looking at the company’s operating cash flows in the previous trailing twelve-month periods. Here they are, up to and including the fourth quarter of 2022 (Spire’s fiscal year runs from October to September):

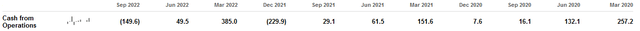

We can clearly see that with the exception of one or two periods, the company’s cash flows have generally hovered around the same level. It is important that we look at the trailing twelve-month periods though, as the company’s quarterly numbers tend to be much more volatile. We can see that here:

The reason for this should be fairly obvious. Natural gas is most often used as a fuel for heating interior spaces. This is something that is most needed during the colder months of the year. As the consumption of natural gas tends to be highest during the winter months, the bills paid by consumers will be highest during these periods and this boosts the company’s cash flow.

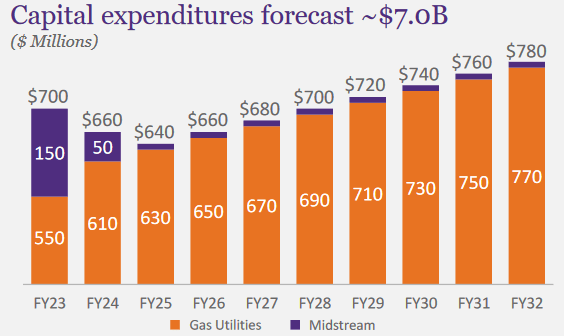

As investors, we are naturally interested in seeing a company deliver more than just financial stability. We want to see the growth of that cash flow. Fortunately, Spire is well-positioned to do that. The company is currently engaged in a $7 billion ten-year capital investment plan that should have the effect of growing its rate base at a 7% to 8% annual rate.

Spire Inc.

This is a somewhat expanded plan than the one that the company was working on when we last looked at it back in March. The fact that the company’s growth program has both seen increased spending over the 2023-2026 period as well as been expanded to cover a much longer period serves as evidence that management sees strengthening prospects for the future, which should provide investors with a certain amount of reassurance. The reason why this program should result in cash flow growth for the company is that it will increase the company’s rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase to the company’s rate base allows the company to increase the prices that it charges its customers in order to earn this specified rate of return. As already mentioned, this program should grow the company’s rate base at a 7% to 8% compound annual growth rate but it will not grow its earnings per share at the same rate. This is partly because the company will have to finance this spending because it cannot pay all of the money out of its income. It will do this by issuing debt and equity, the payments on both will be a drag on earnings per share growth. However, Spire should be able to grow its earnings per share at a 5% to 7% compound annual growth rate over the ten-year period. When we combine this with the company’s current 4.24% dividend yield, it should be able to deliver a 9% to 12% total return over the period. This is a very reasonable return over the period, particularly from a sleepy utility stock.

Natural gas utilities are not often thought of as being especially environmentally conscious, which is one reason why they tend to trade at a discount to electric utilities despite having many similar characteristics. This is partly because of the popularity of environmental, social, and governance investing, which is something of a trend on Wall Street right now. As I mentioned in a previous article, American environmental, social, and governance funds controlled approximately $357 billion of assets on December 31, 2021, and probably control more now considering that many younger investors have been pouring money into these funds. This is enough money to artificially lift up an entire sector, such as electric utilities that benefit from the perception of being environmentally sound compared to natural gas utilities. This does not mean that Spire does not have any credentials that may appeal to those investors that are worried about sustainability, however. Spire currently has the ambition to reduce its methane emissions by 59% by 2025 and by 73% by 2035 compared to its baseline level. The company is replacing old pipeline infrastructure as a part of its bid to achieve this. In 2021 alone, the company replaced 285.8 miles of infrastructure, which reduced natural gas leaks by 35% compared to 2020. If the company were to achieve these goals, it may begin to garner interest from various environmental, social, and governance funds, and given the size of these funds, the stock price would likely increase. Admittedly though, this is a rather far-fetched thesis as it seems unlikely that any of these funds will begin buying shares in any company that is so connected with the fossil fuel industry. As we have already seen though, it should still be able to provide us with reasonably strong returns.

Fundamentals Of Natural Gas Utilities

Another reason why investors have generally not been as enthusiastic about purchasing shares of natural gas utilities compared to electric utilities is because of the electrification trend. This is a trend that has been widely promoted by the media, politicians, activists, and many others. At its core, the trend refers to the conversion of things that are historically powered by fossil fuels to the use of electricity instead. The most commonly cited things for conversion are space heating and transportation (electric cars). The first of these is the most common use for utility-supplied natural gas so this would, in theory, represent an existential threat to natural gas utilities. However, it is highly unlikely that this trend will be anywhere near as strong as promoters have led people to believe.

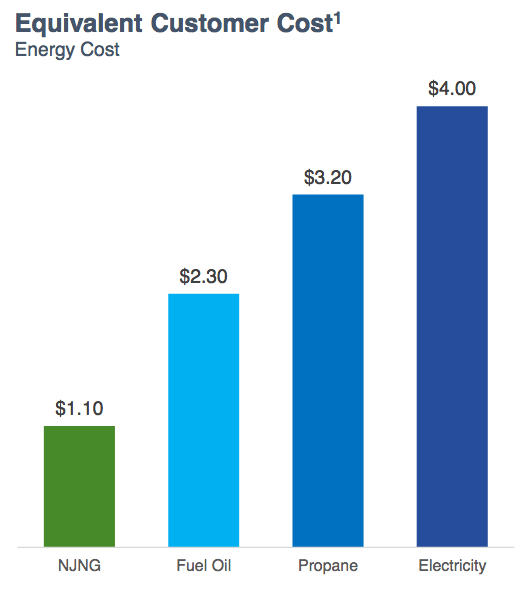

One of the biggest reasons for this is that electricity is far less efficient at producing heat than natural gas. According to the American Gas Association, natural gas burned on the premises converts about 91% of its energy output to heat. However, burning natural gas or using other fuels to produce electricity and then converting it back to heat is only 36% efficient. As a result, it requires more electricity to heat a space to the same temperature as natural gas. This results in it being considerably more expensive to heat a home or business with electricity as opposed to natural gas. According in the U.S. Energy Information Administration, it can be nearly four times as expensive to heat a house with electricity as with natural gas, even given the price surge that we saw in natural gas this year:

New Jersey Resources/Data from EIA

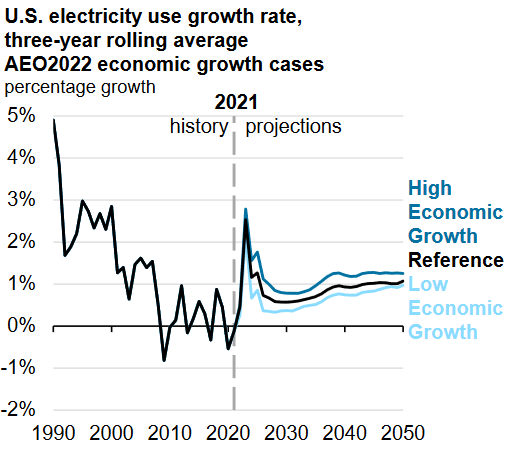

It seems highly unlikely that very many people will willingly pay the much higher price to heat with electricity. This is particularly true for those of limited means, who may not be able to afford the higher prices. The U.S. Energy Information Administration appears to agree as it only foresees the national demand for electricity growing at a 1% to 2% rate over the next thirty years:

U.S. Energy Information Administration

This is nowhere close to the growth rate that we would expect if wide swathes of the economy were to convert from fossil fuels to electricity. Thus, the natural conclusion here is that electrification will not render natural gas utilities such as Spire obsolete anytime soon.

Financial Considerations

It is always important to look at the way that a company is financing its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. As this is usually accomplished by issuing new debt and using the proceeds to finance the existing debt, a company’s interest costs may increase following the rollover depending on the conditions in the market. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes a company’s cash flows to decline may push it into insolvency if it has too much debt. Although natural gas utilities like Spire tend to have very stable cash flows, bankruptcies are not unheard of in the sector.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity would cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important.

As of September 30, 2022, Spire Inc. had a net debt of $4.3509 billion compared to $2.8185 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 1.54. Here is how that compares to some of its peers:

|

Company |

Net Debt-to-Equity |

|

Spire Inc. |

1.54 |

|

Atmos Energy (ATO) |

0.88 |

|

NiSource, Inc. (NI) |

1.44 |

|

New Jersey Resources (NJR) |

1.72 |

|

South Jersey Industries (SJI) |

1.82 |

|

Northwest Natural Holding (NWN) |

1.20 |

As we can see here, Spire is a bit more levered than the strongest companies in the industry but it is certainly not out of line with its peers. Its ratio is also in-line with the ratio that the company had when we looked at it back in March. Overall, this tells us that management appears to use an appropriate level of debt to finance the company and it should not have any particularly outsized risk with respect to its debt load.

Dividend Analysis

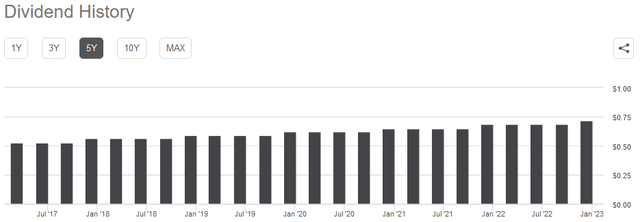

One of the reasons that investors purchase shares of utility companies like Spire is that they tend to possess higher dividend yields than the rest of the market. Indeed, Spire currently has a 4.24% dividend yield, which is quite a bit above the 1.54% yield of the S&P 500 index (SPY). In addition, Spire has a long history of increasing its dividend every year, which it did during the most recent quarter:

The fact that the company increases its dividend annually is something that we like to see during inflationary periods, such as today. This is because inflation is constantly reducing the number of goods and services that we can obtain with the dividend that the company pays out. This can make it seem as though we are getting poorer and poorer over time. The fact that the company increases the amount that it pays us helps to offset this effect and ensures that we can maintain the purchasing power of the dividend over time. However, it is important that we ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to cut the dividend since that would reduce our incomes and most likely cause the stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow is the amount of money that was generated by the company’s ordinary operations and is left over after it pays all its bills and makes all necessary capital expenditures. It is therefore the money that is available to do things such as reduce debt, buy back stock, or pay a dividend. During the trailing twelve-month period that ended September 30, 2022, Spire had a negative levered free cash flow of $259.2 million. This is obviously not enough to pay any dividend, let alone the $156.7 million that the company actually paid out during the period. At first glance, this is certainly a bit concerning.

However, it is common for a utility to finance its capital expenditures through the use of debt and equity issuance while paying its dividend out of operating cash flow. This is due to the extremely high costs involved with constructing and maintaining utility-grade infrastructure over a wide geographic area. In the most recent trailing twelve-month period, Spire had an operating cash flow of $55.0 million. This is likewise not enough to cover the dividend. The company blames the substantial year-over-year decline in operating cash flow on the increase in natural gas prices and working capital changes over the year. We can see earlier in the article though that Spire usually has an operating cash flow of approximately $250 million in a given twelve-month period so it should be able to maintain a $156.7 million dividend over time.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any given asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Spire, we can value it by looking at the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s forward earnings per share growth into account. A price-to-earnings growth ratio of more than 1.0 is a sign that the stock may be overvalued relative to its forward growth prospects and vice versa. There are very few companies that have a price-to-earnings growth ratio of less than 1.0 in today’s market though, particularly in the low-growth utility sector. As such, we should compare the company’s valuation to that of its peers in order to determine which company currently offers the most attractive relative valuation.

According to Zacks Investment Research, Spire will grow its earnings per share at a 5.00% rate over the next three to five years. This is at the very low end of the figure that we used to calculate the company’s projected total return so it is probably pretty close to what the company will actually earn. This gives the company a price-to-earnings growth ratio of 3.22 at the current stock price. Here is how that compares to the company’s peer group that we have been using for our analysis:

|

Company |

PEG Ratio |

|

Spire |

3.22 |

|

Atmos Energy |

2.66 |

|

NiSource, Inc. |

2.83 |

|

New Jersey Resources |

3.36 |

|

South Jersey Industries |

N/A |

|

Northwest Natural Holding |

4.38 |

As we can see, Spire falls in the middle of its peer group using this valuation metric. The company is certainly not as cheap as some of its peers but it is also not the most expensive company on this list. Overall, it does appear that Spire is fairly valued today so it is certainly not a bad choice today but it may be a good idea to wait for the price to drop a bit before purchasing its shares.

Conclusion

In conclusion, Spire offers many of the characteristics that we have come to appreciate in utility stocks. However, it does seem to be overlooked somewhat due to being a natural gas utility. As we have seen though, the future of natural gas utilities is fairly bright despite what some politicians and activists want you to believe. The company has a fairly reasonable debt load and valuation along with one of the highest yields in the sector. Overall, it might be worth considering.

Be the first to comment