Scott Olson

Investment Thesis

Boeing (NYSE:BA) is again dealing with problems in the commercial aircraft and military contracts. While we don’t see any significant difficulties in terms of the company’s long-term recovery, we do not recommend buying Boeing in the near term. The company is traded at fair prices and does not offer significant upside, but incur high operating risks, so we maintain HOLD status.

Aircraft deliveries decreased once again – supply chain & China market remain bottlenecks

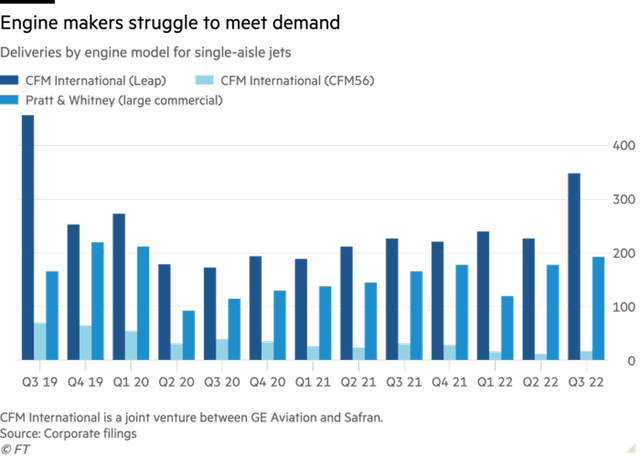

Boeing Q3 report again showed negative indicators of disrupted supply chains. In particular, the company delivered fewer aircraft than planned. LEAP engines shortage is the main issue.

CFM reported problems with engine deliveries. Supply chain disruptions, shortages of certain electronics components and manpower continue to affect the aviation industry as a whole, Airbus (OTCPK:EADSY) also highlighted similar problems. Although engine deliveries were up by 56% QoQ in Q3, according to Financial Times, volumes are still below expectations. LEAP-1B engines are the key part of the sought-after Boeing 737-MAX models, so even though the demand is huge, Boeing cannot deliver the required number of aircraft now, and sales will again be prolonged until production cycles normalize by 2025.

Boeing still has many 737-MAX and other models in its inventory but need to retrofit them with engines. However, in addition to supply chain disruptions, uncertainty regarding China as the major sales market remains. Although the regulation issue was resolved positively, the existing epidemiological situation in the country constraints resumption of deliveries.

Boeing had 139 737-MAX jets designed for the Chinese market at the end of Q3, and if the situation persists in the long term, the company will have to retrofit the aircraft for other customers. However, we believe that deliveries will resume in Q2 2023. Chinese airlines have already announced the initiative to increase the number of international flights, and the players are unlikely to find an alternative to Boeing amid limited market supply.

We believe deliveries to China will resume with the removal of covid restrictions, tentatively in Q2 2023, and all 139 jets will be sold by the end of 2024.

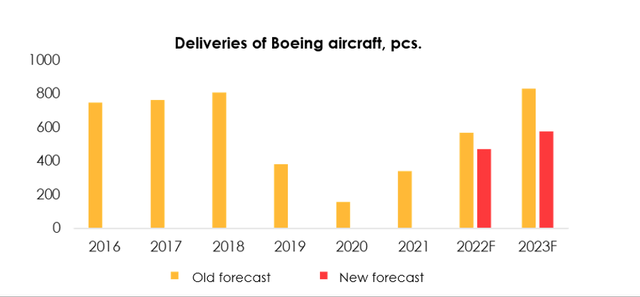

Based on Q3 reports, we have revised our aircraft deliveries forecast downwards from 560 to 470 for 2022 and from 830 to 575 for 2023. If logistics remain an obstacle in the engine market, Boeing is unlikely to achieve high delivery rates.

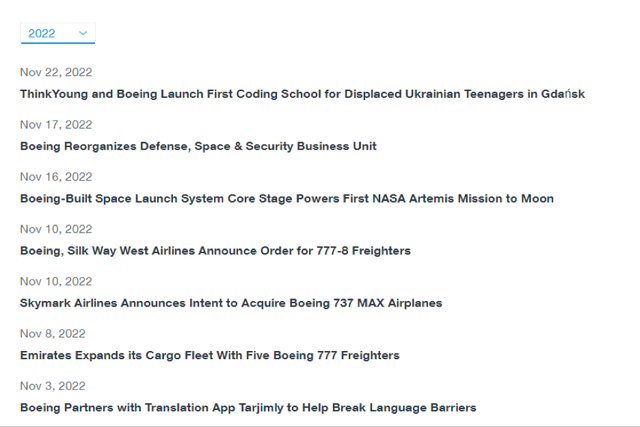

However, we do not dispute the demand for the aircraft, airlines are constantly announcing new agreements with Boeing, so the backlog continues to grow steadily.

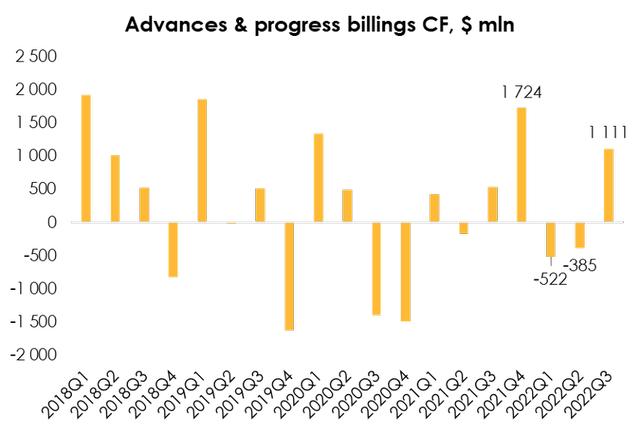

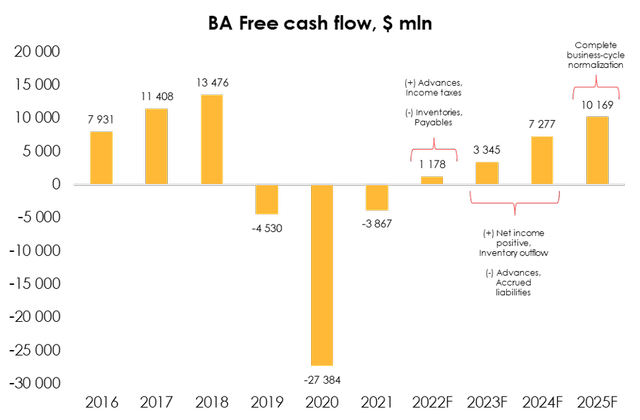

However, the company continues to receive impressive advance payments (from commercial aircraft sales and military defense programs), so we believe that even with a slower inventory release, Boeing will generate stable FCF to maintain financial stability.

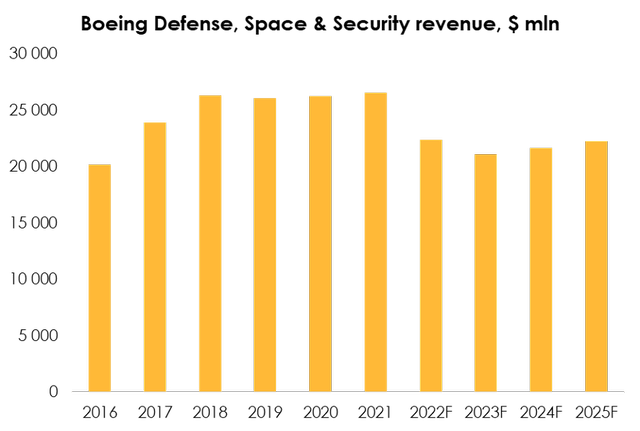

Another failure in the military defense segment, but the losses are not that dramatic for the cash flow

Big loss in five programs of the military defense segment was noticeable in Q3 and resulted in negative EBITDA. The management claims that it is due to logistics issues, shortage of labor and technical problems. Although Boeing showed loss in H1 (~$3.66 bn), it became a big surprise for us and for the market.

KC-46 Tanker and VC-25B programs were especially loss-making, the total loss was more than $1.9 bn.

Fixed-price contracts initially entail high risk for the contractor, and it increases significantly amid elevated inflation. Although management has stated its initiative to end all troubled contracts in 2024-2025, we believe that the realization of this goal and the future commercial success of these programs is rather uncertain.

Due to the high uncertainty of fixed-price contracts, we excluded the basis for organic revenue growth in future periods from the forecast, and included the loss accrued in Q3 in Cash Flow. We expect the liabilities to be settled by the end of 2024.

Given slower inventory disposal and generation of losses, we have revised our 2022-2025 free cash flow forecast. We believe the company will go through a full business normalization cycle by 2025 if no new challenges arise.

A company like Boeing always has technical risks, which materialized several times in the past 3 years (aircraft crash in 2019-2020, engineering problems with military defense segment programs), so future financial results are highly dependent on BA product quality factor. However, given that most of the 737-MAX as well as the 787 model have already received approval from most regulators, we believe that the major risks have already materialized.

Valuation

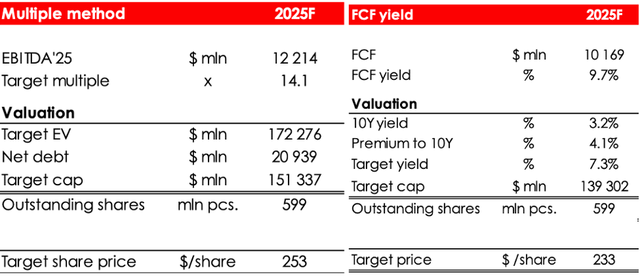

We are evaluating BA’s fair value price based on 2025 EV/EBITDA multiples and FCF Yield methods, and think the fair value price for the stock is $184 (average discounted prices). We are evaluating the fair value price of Boeing stock by discounting projected prices in 2025 at the rate of 13%. Fair value prices in the tables depicted below are without discounting at the rate of 13%. We are maintaining the rating for the shares at HOLD. The potential downside is -1.6%.

Conclusion

Boeing stock has already recovered from its lows, and we think it is not attractive to buy it at current prices, as the shares are traded at their fair price. The company still has positive long-term prospects, but it will have to face difficulties again soon due to logistics problems and the military defense segment failure. In our view, it would be attractive to invest in Boeing at ~$140 per share, which corresponds to the upside +30%.

To manage the position, we recommend keeping an eye on financial statements of Boeing, industry research (IATA, FAA, OAG), reports of contractors (General Electric, CFM) and competitors (Airbus).

Be the first to comment