Antonio Suarez Vega/iStock via Getty Images

Investment Thesis

Markforged Holding Corp. (NYSE:MKFG) provides industrial additive manufacturing platforms. The company has recently announced a significant acquisition which has expanded its production capacities and will increase operational efficiency in coming years. I believe this deal can be a strong growth factor for the company. Thus, I assign a buy rating for MKFG.

Company Overview

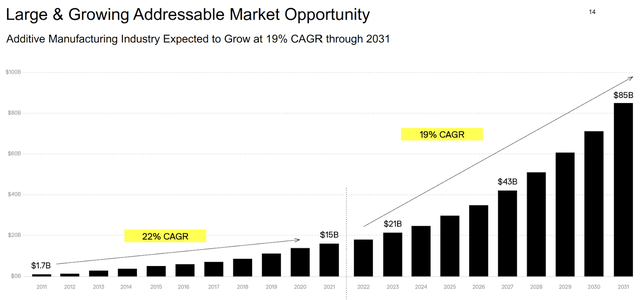

Markforged Holding Corp provides a platform, The Digital Forge, to consumers such as powering engineers, designers, and manufacturing professionals. The Digital Forge is cloud-based education software that helps manufacturers to build more reliable and agile supply chain operations by combining precise & dependable 3D printers with metal and unique composite materials. The company offers services across six key verticals: Industrial Automation, Aerospace, Military & Defense, Space Exploration, Automotive, and Healthcare & Medical. The company reports its revenue in four operational segments: hardware, consumables, and services. The hardware segment generates 71.2% of the total revenue. The consumables segment contributes 21.5% of the total sales, and services generate 7.3% of the total revenue. Since 2011, the company has addressable market opportunity has grown at 22% CAGR, and it is estimating the market to grow at 19% CAGR for the next ten years.

The company wants to accelerate product innovation by expanding the Digital Forge capabilities to expand maximum market share. It is also planning to enhance its operational expertise by building a brand value and expanding & optimizing global go-to-market coverage. The company targets companies for mergers and acquisitions, which synergizes with the current business model and future growth prospects. Recently, the company acquired Digital Metal to expand into mass production of end-use metal parts.

Acquisition of Digital Metal

Recently, MKFG announced that it is entering into an agreement with Höganäs AB to acquire its subsidiary Digital Metal which is the developer of a well-known, precise, and dependable binder jetting method. This acquisition will help to expand its capacity for large-scale production of metal additive parts. Digital Metal also provides the solution for all the production issues for industrial clients at the point of need. With this innovative product, producers may generate functioning metal parts in large quantities with little setup time. Traditional manufacturing frequently takes months to complete the design to production transition, involves risk associated with third-party suppliers, and offers subpar unit economics during ramp-up and at smaller volumes. The company believes the powder binder jetting business is highly scalable, and I think it can provide robust growth to the company’s earnings in the coming years. The company estimates to close this deal in the third quarter of FY2022. So, the effects of the acquisition will be visible from the fourth quarter of FY2022. The company has closed this for $32 million in cash and 4.1 million shares of MKFG common stock. The deal is significantly big for the company as the deal’s value is more than 10% of the current market capitalization. I believe this deal will be a primary growth factor for the company in the coming years as it benefits the MFG in many ways.

Shai Terem, president and CEO of MKFG, stated:

With the Digital Metal acquisition, Markforged is advancing our vision for distributed manufacturing by enabling the reliable, high-volume production of precise metal parts at the point of need. Infusing Digital Metal’s solution into The Digital Forge platform allows us to address new applications in the medical, automotive, luxury goods, and other industries. The Digital Metal team has created a robust and scalable solution that complements our existing technologies. I look forward to welcoming their talented people to Markforged.

Key Risk Factor

Limited Suppliers: MKFG relies on a limited number of suppliers for the supply of key components of various products. Most of these third-party suppliers are located in south Asian countries. This issue had affected the company’s performance in FY21 due to supply chain disruption in these countries. The limited supplier issue intensifies the cost of procuring material as the company has less bargaining power, and it could also adversely affect product availability. The company also relies on third-party manufacturers to produce 3D printers, which has resulted in increased costs for the company as these manufacturers source the raw material themselves at a higher price. The company has seen better results in FY22 due to improvement in the supply chain issue, but it is important for the management to address the supplier issue to ensure smooth functioning.

Valuation

MKFG has a market cap of $406 million and is trading at a market price of $2.16, a YTD decline of 62%. The company has witnessed this decline in the share price due to the supply chain disruption’s impact on the company’s performance. MKFG has shown improvement in Q1 2022 with higher profit margins and revenue increase y-o-y. The company is expected to maintain this growth trajectory in FY22 and FY23. I believe we can witness a significant upside potential from current price levels as the YTD decline of 62% has made the stock very attractive in terms of valuation.

Conclusion

The acquisition of Digital Metal by MKFG is expected to drive significant growth for the company by providing innovative technology and capacity expansion. Digital Metal provides scalable solutions to the company, which will ensure significant market expansion. MKFG is trading at an attractive valuation with a steep decline in the share price. I assign a buy rating for MKFG after taking into consideration all the growth and risk factors.

Be the first to comment