Michael Vi

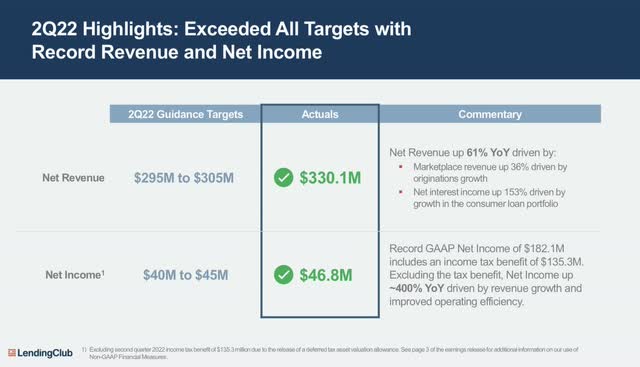

LendingClub Corporation (NYSE:LC) beat Q2 2022 guidance by a fair margin.

All charts in this article are extracted from the LC Investor Relations website (Q2’2022 earnings presentation).

This is quite an impressive result, especially so as LC retained ~$1 billion of unsecured lending on its balance sheet. Retaining substantial loans on its balance sheet reduces profitability in the quarter due to the accounting requirement to expense expected life-time loan losses upfront (otherwise known as CECL).

This is a key point to understand. Whilst retaining loans on the balance sheet is 3x more profitable than selling the loans in the marketplace, there is a timing lag before revenue gets recognized, so current quarter profitability “suffers.” This, however, should be seen as high returning investment both in terms of stream of income as well as lifetime value of LC member, including repeat business and multi-product offering.

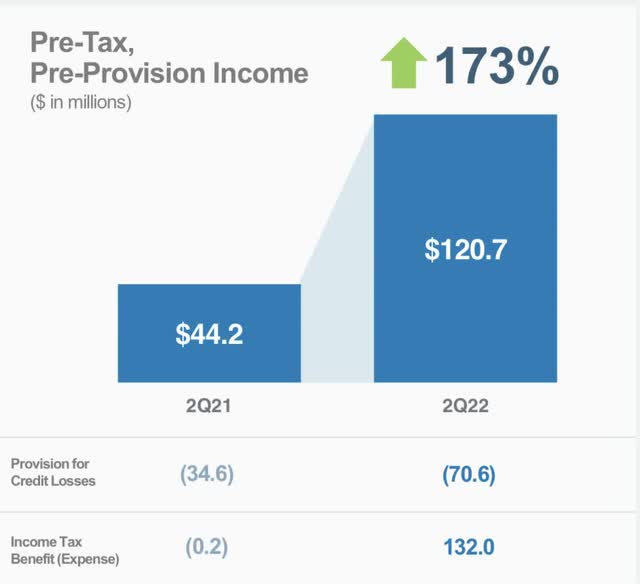

The best metric to gauge LC’s underlying performance is pre-tax pre-provision income, as it backs out the noise from CECL as well as tax adjustments.

On a sequential quarter’s basis, LC’s pre-tax pre-provision income is up ~22%.

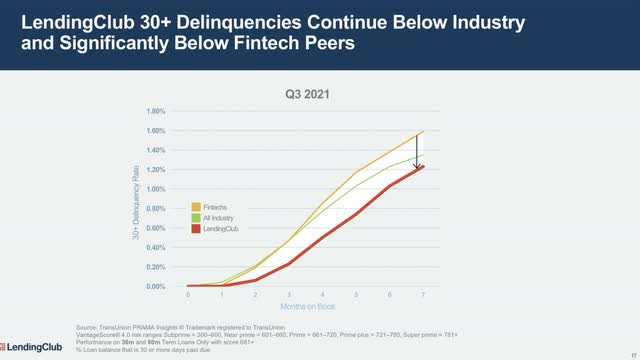

Credit risk

Credit losses have so far been quite benign. However, loan losses tend to deteriorate quite quickly once a recession ensues and unemployment rises.

LC’s credit risk models seem to outperform the industry. The below chart demonstrates the outperformance for the Q32021 origination tranche.

LC has gradually shifted its portfolio to higher FICO score clients and the average Hold For Investment (“HFI”) score for its unsecured lending portfolio is now 730.

The combination of above factors suggests that even in a recessionary scenario, LC credit should hold reasonably well and certainly better than other FinTechs.

The playbook for a recession

A banker will readily lend you his umbrella when the sun is shining and wants it back the minute it begins to rain.

The marketplace model becomes more challenging as interest rate rise and recessionary clouds are appearing on the horizon. At the same time, demand for personal loans grow strongly.

In the earnings call, LC management clarified its playbook and it is all about leveraging its core advantage of being a bank with access to low funding costs.

In the short term, LC is going to focus on retaining carefully selected personal loans (prime plus, super prime) on its balance sheet and somewhat de-emphasize the marketplace. LC’s CEO articulated this clearly in the earnings call:

In today’s environment, we are leaning more towards the bank model, being conservative on credit and using our low cost deposit funding to hold more loans for investment and drive recurring revenue. As the economy improves, we’ll be ready to lean into our FinTech advantage, dialing up the marketplace to drive scale capture market share.

To use an analogy, we are reducing our speed heading into the corner, but we are planning on retaining momentum and accelerating as we come out of it, to carry out our bold ambitions, to create a next generation, multi-product digital first bank that will deliver a new banking experience for our members and strong multi-year revenue and earnings growth for our shareholders.

During Q2’2022, LC retained 27% of originations and ~$1 billion of personal loans. At this rate, LC’s end of period loans could be as high as $4.5 billion yielding ~14% yield. The gross yield has dropped by 100 basis points primarily due to retention of higher rated loans. This translates to >$500 million of accrual net interest income in 2023 and beyond. The longer-term opportunity is lifetime value from LC members through multi-product offerings.

LC is also likely to focus on existing LC members. The rationale is quite straight-forward, LC repeat customers have a lower cost of acquisition and exhibit lower credit risk profile.

Final thoughts

I am not making any heroic forecasts that the current benign credit conditions will remain so. In fact, I expect it to deteriorate given the damage the Fed has and will be inflicting going-forward. Having said that, I would argue that LC is well-positioned to weather and in fact take advantage of current macro certainties.

LC is buffered by high capital ratios, superior credit risk models and a focus on prime assets. It is also well provisioned having taken a conservative underwriting assumptions based on pre-pandemic models.

Importantly, LC is prioritizing, in a risk responsible manner, retaining prime assets on its balance sheet that drive high profitability in future periods. It also has the capital to strongly build its HFI portfolio supported by high capital ratios also supported by the recognition of tax assets (incremental $85 million of capital and growing).

I believe that we are at the very early innings of the LC story. The profitability profile of the firm grows exponentially as its unsecured portfolio grows to $5, $7 and $10 billion in the next few years. The opportunities for multi-product offerings to LC members is also very accretive.

I remain very bullish on LC and utilize various options strategies to capitalize on it.

Be the first to comment