hapabapa

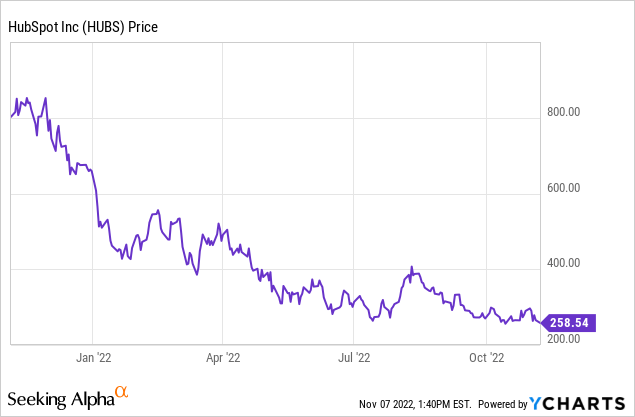

Trust me, I get it: there’s a lot of pain right now if you’re invested in tech stocks. Even the highest-quality tech names with solid brands and heaps of recurring revenue have undergone wild gyrations in stock price, and many former high-fliers are now sitting well below pre-pandemic prices.

Everyone’s answer, of course, is interest rates and macroeconomic trends. Companies are slowing down spend, affecting enterprise software names; and higher interest rates also mean valuation multiples must come down. But the reality is that many of these corrections have gone too fast and too far, and many strong fundamental performers that are now underwater are deeply undervalued.

HubSpot (NYSE:HUBS) is a great example here. This CRM vendor, one of the best known platforms for inbound marketing, has lost 60% of its market value this year, despite very strong fundamental results year to date. Opportunistic investors have a well-timed opportunity to enter into this stock at a great valuation.

Owing to the double circumstance of strong results (HubSpot’s recent Q3 earnings were initially well-received by the markets, but the post-earnings pop was only temporarily and quickly turned into a sell-off in sympathy with other tech stocks) and a declining valuation, HubSpot has turned into a high-conviction play for me and I’m upgrading my view on it to very bullish.

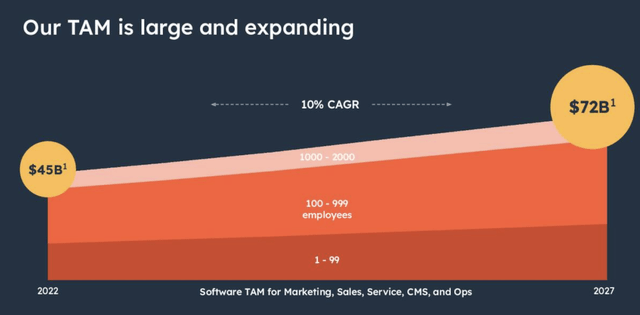

It’s important to keep the long-term bull case for the company in mind. Recall particularly that HubSpot continues to expect its TAM to grow 10% annually through 2027 to reach $72 billion by that year, implying that the company’s current ~$1.5 billion annual revenue run rate is only ~2% penetrated into the overall market.

HubSpot TAM (HubSpot Q3 earnings deck)

Here are the other key long-term bullish drivers for HubSpot:

- Growth at scale. Typically, when a company hits over a >$1 billion revenue run rate, it will have run into saturation issues and its growth rates rarely exceed 20-30% y/y. This is not the case with HubSpot. Through strong sales execution plus success in cross-selling the various modules in its portfolio, HubSpot has managed to retain incredible >35% y/y growth.

- Inbound marketing will continue to grow in prominence. Companies are increasingly relying on soft marketing and social media experts to bring in customers versus direct sales (many salespeople got laid off during the pandemic and many aren’t returning). HubSpot’s shares of the overall CRM space will continue expanding.

- Nearly pure recurring revenue base. 97% of HubSpot’s FY21 revenue was subscription revenue. The fact that such a large degree of HubSpot’s revenue is already locked in gives the company plenty of revenue visibility.

- Sky-high subscription gross margins. HubSpot boasts ~84% subscription gross margins on a pro forma basis, which creates plenty of opportunities for operating leverage.

- “Rule of 40” member. HubSpot is generating >30% y/y revenue growth on top of ~10% pro forma operating margins, which is a truly rare profile in the tech sector. These days, 30%+ growth itself is hard to come by – and rarely is it accompanied by profitability.

From a valuation perspective, HubSpot’s steep declines this year have also positioned the stock much more favorably. At current share prices near $260, HubSpot trades at a market cap of $12.57 billion. After we net off the $1.44 billion of cash and $453.7 million of debt on the company’s most recent balance sheet, HubSpot’s resulting enterprise value is $11.58 billion.

For next fiscal year FY23, meanwhile, Wall Street analysts are expecting the company to generate $2.07 billion in revenue, representing 22% y/y growth. This puts HubSpot’s valuation multiple at just 5.6x EV/FY23 revenue – versus a mid-teens multiple in the past, and quite a bargain for a stock that currently passes the “Rule of 40” test. We should remember as well that HubSpot’s long-term operating plan calls for 3-4% annual increases in operating margin when its growth falls shy of 30% y/y.

Stay long here: though the near term may be rocky, HubSpot’s fundamentals are solid and a <6x revenue multiple is a perfect entry point for a long-term oriented position.

Q3 download

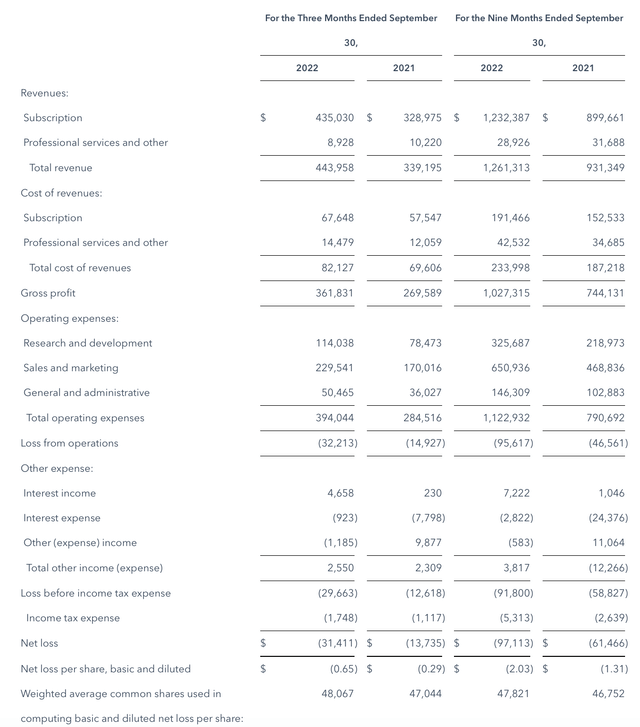

Let’s now go through the details of HubSpot’s latest Q3 results in greater detail, which initially sparked a short-lived rally in the stock. The Q3 earnings summary is below:

HubSpot Q3 results (HubSpot Q3 earnings deck)

HubSpot’s revenue grew 31% y/y to $444.0 million, decimating Wall Street’s expectations of $426.1 million (+26% y/y) by a wide five-point margin. Revenue growth decelerated from 36% y/y in Q2, but this is mostly an FX-headwind story. FX headwinds were a seven-point drag to revenue this quarter (constant-currency revenue growth would have been 38% y/y), versus only a five-point headwind in Q2.

Billings grew 26% y/y to $444 million. Again here, this was impacted by FX headwinds of eight points: on a constant currency basis, billings growth would have been much stronger at 34% y/y.

Management has noted that tightening macro conditions have led to elongated deal cycles and greater risk of non-approval, which is very similar to the color commentary that other SaaS companies are providing. Per CEO Yamini Rangan’s remarks on the Q3 earnings call:

Next, I want to talk about the demand environment, we see today and reiterate our playbook for managing through it. Last quarter, I talked about the demand trends we were seeing in the business through the end of July, including a lengthening of deal cycles, and more decision-makers involved in deals.

Since then, the macro environment has become incrementally more challenging. We see two clear trends in this environment based on our customer and prospect conversations. On one hand, deals are taking longer to close. There are more decision-makers involved, more approval layers and budgets are tighter. We continue to see this across the geographies and segments we serve.

On the other hand, HubSpot is emerging as a platform of choice to help customers get through these uncertain times. Our customers need more leads, better conversions and better customer experience. But they need to do it all with less. Our value proposition of easy-to-buy, easy-to-use and easy to build, resonates even more now as customers are looking to consolidate their tech stack.

Despite the softer macro environment, I’m confident in HubSpot’s playbook for resilient growth through the cycle.”

Specifically as it impacts metrics, management also noted that net dollar-based retention rates slowed to 109% this quarter, down three points from 112% in Q2 – reflecting lower net upgrades and fewer seat additions, with the latter also being impacted as companies slow down their discretionary sales hiring. Still, the company did note that its average subscription revenue per customer grew 7% y/y to $11.2k (12% y/y on an FX-neutral basis).

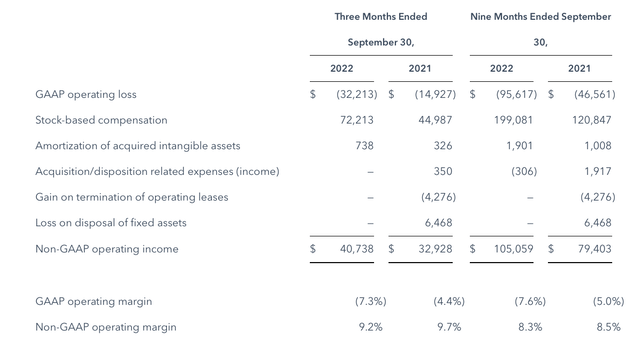

Where HubSpot outperformed this quarter was on margins. Pro forma operating margins only shed 50bps y/y to 9.2% (whereas many other SaaS companies lost anywhere between 3-10 points on margin due to opex inflation).

HubSpot Q3 margins (HubSpot Q3 earnings deck)

The company expects to sharply moderate its hiring pace in Q4, picking up net-new headcount only in R&D and revenue-generating sales functions.

Key takeaways

Focus on the long term here: an attractive product portfolio with a massive $70+ billion TAM, continued expectations for 20%+ revenue growth, and a profitable company operating structure that has seen minor margin contraction despite sharp FX headwinds. Use the dip as a buying opportunity.

Be the first to comment