Andy Feng

NIO (NYSE:NIO) is a TechStockPros favorite in the Electric Vehicle (EV) market. While Tesla (TSLA) is the billboard face of the EV market, we believe NIO is rapidly gaining market share through its stronghold in China and, more recently, its expansion into Europe. We’re bullish on NIO as we expect the company provides a favorable turnaround investment for investors looking to buy into the global adoption of EVs.

Investors are more often than not hesitant about Chinese stocks, but we believe NIO provides a favorable-risk reward profile. We believe NIO is better positioned to grow as China begins to ease its strict COVID regulations that have depressed the economy over the past year. We expect China’s economy to recover and subsequently expect the Yuan will rise against the dollar, benefiting car exporters like NIO. We’re also constructive on NIO expanding its position as a global EV producer as it penetrates the European market with battery swap stations. We believe NIO has growth drivers working in its favor at home and abroad and recommend investors buy the massive 61% YTD pullback now.

Moving out of COVID-19 regulations and back to normalcy

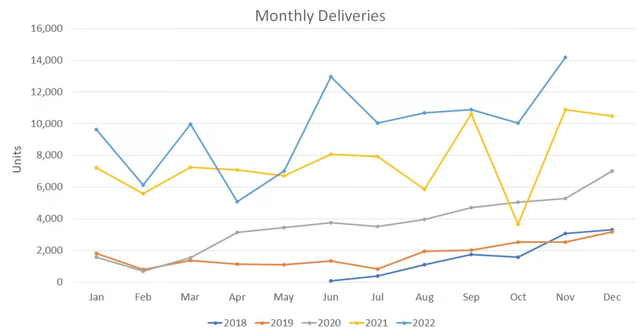

December’s been a big month for Chinese stocks and, by extension, NIO as the country moves away from its COVID-19 regulations. We believe easing regulations will benefit NIO as the Chinese economic slowdown slowly becomes history. NIO’s stock took a hit this year, dropping nearly 61% YTD; we attribute the drop to the economic slowdown in China and macroeconomic headwinds causing battery prices to increase. In spite of the challenges, we like NIO’s financials- the company has continued to consistently deliver growth in Vehicle Sales. The company’s vehicle sales grew 32% Y/Y and nearly 25% sequentially in their 3Q22 report. We expect NIO to achieve higher highs once the consumer demand in China recovers and the Yuan trades against the U.S. dollar, making NIO sales more lucrative when transitioned to dollars.

The following graph outlines NIO’s vehicle sales over the past few years.

Our bullish sentiment is also driven by our expectation that NIO is well-positioned to ride the demand tailwinds from the global EV adoption. Forecasts report that more than 50% of the global population will reside in areas where EVs are the only means of transportation by 2030. The global EV market is estimated to grow at a CAGR of 22.5% between 2022-2030, while the Chinese EV market is forecasted to grow at a CAGR of 13.95% from 2022-2027. We believe NIO is well-positioned to take advantage of EV adoption on both global and Chinese fronts. Vantage Market Research forecasts China to be the biggest market for EVs, and we believe NIO will benefit from the increased adoption of EVs within China.

Battery swaps driving top-line growth

NIO, like other Chinese stocks, is looking to export revenue streams overseas, and we believe NIO is already further ahead of other Chinese EV markers by exporting to Europe. We believe NIO’s expansion into the European market will be a major growth driver for the company during 2023 and help mitigate any downsides from Chinese markets. We believe NIO is strategic in its global expansion; choosing European markets to tackle gives NIO a foot in the second-largest EV market globally.

NIO began leasing cars to Germany in October 2021 and has ramped up its game by investing 20 battery swapping stations into charging parks this year. NIO’s leasing model allows users to lease cars with a 75 gigawatt-hour battery on a monthly basis. We expect this to be an added stream of revenue. The company also announced plans to have around 120 battery-swapping stations in Europe by the end of 2023. We believe the battery swapping stations are more than just an added overseas revenue stream. NIO’s battery swapping stations put NIO ahead in the game against competitors Tesla, Geely, and Polarstar at the high end of the EV market. Essentially, swapping stations allow drivers to switch their car battery for a fully charged one without the wait. We believe the stock pullback creates an attractive entry point into NIO’s 2023 growth prospects.

Stock performance

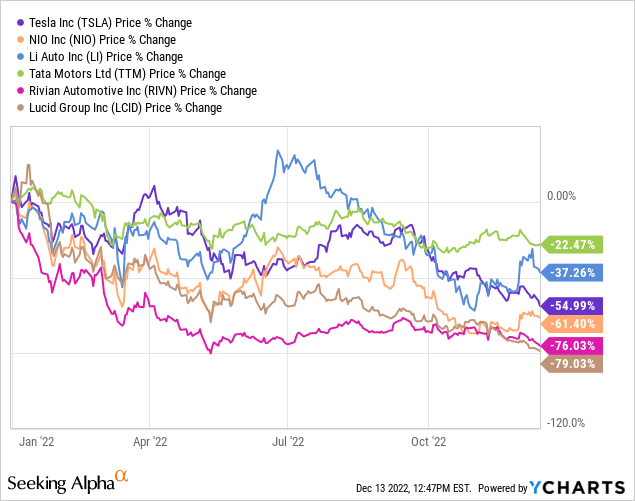

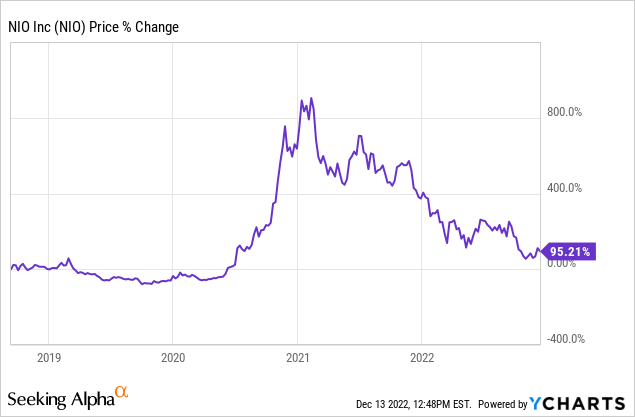

NIO went public at the end of 2018 and has grown nearly 95% since, booming during the height of the pandemic in 2021. The stock is now down almost 81% from its high of $62 in January 2021. YTD, the stock is down around 61%. We believe the stock is down due to the economic slowdown in China. Competition has also dropped YTD; Tesla is down around 59%, Li Auto (LI) about 37%, Tata Motors (TTM) around 23%, Rivian Automotive (RIVN) about 76%, and Lucid Group (LCID) around 79%. We expect NIO stock to rebound now that China is easing lockdown regulations and recommend investors buy the pullback.

The following graphs outline NIO’s YTD performance compared to the competition and five-year performance.

TechStockPros

TechStockPros

Valuation

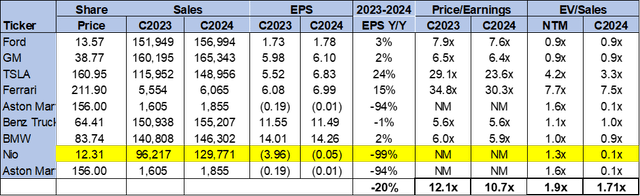

We believe NIO is relatively cheap, trading at 0.1x on EV/C2024 Sales versus the peer group average of 1.7x. We like NIO’s position in the EV market and recommend investors buy the stock as we see multiple growth drivers for NIO in 2023.

The following table outlines NIO’s valuation compared to the peer group.

Word on Wall Street

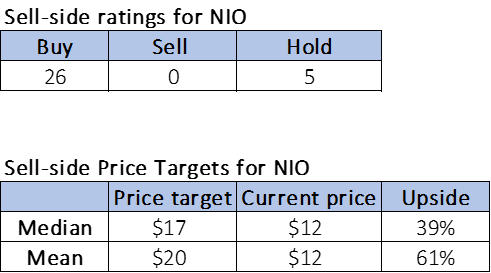

Wall Street is bullish on the stock. Of the 31 analysts covering NIO, 26 are buy-rated, and five are hold-rated. The stock is currently priced at $12. The median sell-side price targets are $17, while the mean is $20, with a potential upside of 39-61%.

The following table outlines NIO’s sell-side ratings and price targets.

TechStockPros

What to do with the stock

In spite of NIO YTD stock pullback, we are buy-rated on the stock. We believe NIO now provides an attractive entry point as we expect the company will finally be free of China’s COVID-19 regulations that previously weighed the stock down. We’re also constructive on NIO’s expansion into European markets, as we believe the company is slowly but surely competing with high-end players in the EV market. We recommend investors buy the stock at current levels to enjoy the 2023 growth.

Be the first to comment