Rasi Bhadramani/iStock via Getty Images

Metacrine (NASDAQ:MTCR) is an intriguing and mispriced merger arbitrage that I initially covered on Special Situation Investing in September. The spread used to stand at 22% and has been fully eliminated since then generating very solid IRR. However, recently, some unexpected developments came to light and added a different angle here which I believe is quite interesting.

MTCR is merging with another nanocap biopharma Equillium (NASDAQ:EQ) in a stock-for-stock deal. The exchange ratio will depend on MTCR’s net cash levels at closing and is currently expected to be 0.282x. For EQ the deal is similar to an equity raise as it is only interested in MTCR’s cash. Merger closing conditions include shareholder approvals on both sides as well as Metacrine’s net cash being at least $23m upon closing (the cash condition should be easily satisfied). MTCR shareholder meeting is set for December 20, with the expected closing date on December 23.

The main nuance here is that due to a decline in EQ share price since the merger announcement, the all-stock bid now values MTCR at a wide 45% discount to its net cash. At current EQ price of $1.23/share, MTCR shareholders are only receiving $15m worth of EQ shares compared to MTCR’s net cash of $27m (expected at merger closing). Not surprisingly, recently activist investor BML Investment Partners raised its stake from 5.9% and 15.2% and said it will vote against the merger unless the exchange ratio/consideration is improved. After this announcement, the merger spread promptly turned negative with MTCR now trading slightly above the offer price. The market clearly expects EQ to raise the offer in order to secure the shareholder approval.

Given how lowball the current offer is compared to MTCR net cash, there seems to be sufficient headroom for a higher offer. For example, if the consideration is raised to 20% discount to net cash, it would result in 30% gain for arb investors. EQ is a clinical stage biopharma with its main candidate in phase 3 (started in Q1’21). The company is a cash burning machine and could definitely use the extra liquidity resulting from MTCR acquisition. So there is a chance the buyer will raise the price.

The main risk is that EQ might decide that proceeding with MTCR deal at a higher price is not worth the struggle anymore and it will rather look to raise cash through other ways (e.g. recent partnership with Ono Pharmaceutical).

If the merger breaks (gets voted down by shareholders), the downside seems somewhat protected by MTCR’s discount to net cash and there is a decent chance that the company would pursue a liquidation after that. Notably, recent merger proxy shows MTCR’s liquidation value is estimated at $27.3m – very close to the net cash position. The presence of the activist that already owns 15.2% gives confidence that MTCR management won’t waste the cash, for instance, on any value destructing acquisitions.

Some details on exchange ratio calculations

The current merger with EQ is structured as an all-stock transaction in which Equillium will issue stock at a 25% premium above Metacrine’s net cash at closing. Management estimates MTCR’s net cash will be $27 million at close.

The amount of EQ shares received for each MTCR share will be based on an exchange ratio equal to MTCR’s net Cash at the 25% premium divided by EQ’s VWAP for the 10 days before closing and then divided by MTCR’s fully diluted share count.

The important nuance is that EQ’s VWAP is subject to a collar between $2.70-$4.50, a range well above where the stock currently trades. The bottom end of the range was set around the levels where EQ traded at the time of the merger announcement ($2.73). The activist is arguing that EQ should raise the lower limit of the collar in order to lift up the exchange ratio.

In the recent merger proxy, MTCR has assumed 0.282x as the exchange ratio.

BML Investment Partners

BML Investment Partners is a small investment firm focused on small-caps and biopharma liquidations in particular. It held/holds positions in multiple biopharma liquidation plays, including FBRX, ABIO, IMRA (this one worked out particularly well recently resulting in multi-bagger gains for the activist).

Metacrine

Metacrine develops therapies to treat gastrointestinal diseases. Their main focus is MET642 – a farnesoid X receptor platform. Equillium may seek a strategic partner to advance Metacrine’s MET642 agent for treating inflammatory bowel diseases, but they will likely wind down Metacrine’s other programs to reduce incremental opex following the transaction. Notably, EQ has clearly stated that its main aim in acquiring MTCR is to increase its cash runway – from the merger conference call:

And from the Equillium perspective, this is what we consider to be largely an acquisition for the cash and runway extension we get out of this transaction. We are expecting to onboard approximately $33 million in cash [author’s note – gross cash] at closing. I should clarify that closing is expected to take a couple of months here as we go through the formal process of regulatory submissions and then shareholder votes that will be required to complete the transaction. But this is an important addition to our balance sheet as we think about our operating plans going into the future, while this extends our runway into—comfortably into the 2024 timeframe.

Equillium

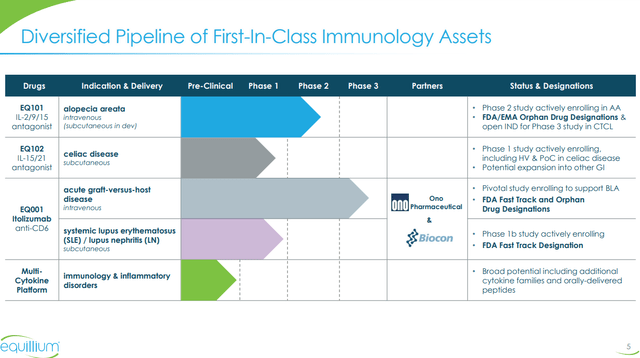

Equillium is focusing on treatments for severe autoimmune and inflammatory disorders. Their primary potential product Itolizumab (EQ001) is focused on the treatment of acute graft-versus-host disease and has recently entered a phase 3 study. EQ’s development pipeline is shown below.

Equillium Investor Presentation, December 2022

Conclusion

MTCR presents an interesting opportunity with potential for either a merger arb or a liquidation. Added confidence in a favorable outcome for MTCR shareholders comes from the involvement of a reputable activist BML. Meanwhile, the downside seems to be protected by MTCR’s net cash position, suggesting that at current MTCR share price levels this situation might have an asymmetric risk/reward.

Be the first to comment