diegograndi/iStock via Getty Images

The war in Ukraine was intended as a Blitzkrieg. A perfect parody of history. The Ukrainians were supposed to have welcomed the Russians with open arms and hearts in Kyiv three days after the war onset. Even American intelligence was allegedly too self-confident and thought that the war would end soon. The invasion was seen as a short local conflict where the superpower was to have conquered the home of Mother Russia in Kyiv.

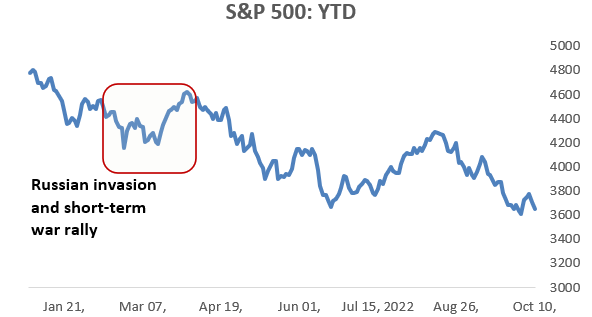

I remember going through Twitter those days where it was popular to compare S&P 500 (SP500) performance before and after the start of regional wars such as in Syria, Iraq, and Afghanistan. The idea was that the market tends to underperform before the war because of the high uncertainty. Granted, the war brings some confidence to investors as its development becomes clearer. It leads to rallying markets after the war onset as markets cheer certainty and boo ambiguity. You can see in the chart that the invasion in Ukraine was not an exception. The popular Twitter view turned into a self-fulfilling prophecy. However, the following S&P 500 performance was far from the one expected by the bullish Fintwit.

Prepared by author based on Yahoo finance

Over the past eight wartime months, the Russian invasion transformed from a failed Blitzkrieg into a shameful and cruel war. The Russian President Putin resembles a fire-breathing dragon that spews radioactive smoke to me. In his speeches he is constantly mentioning that in case the red lines are crossed, Russia may use a nuclear strike. The problem is that nobody understands where exactly the red lines are drawn, not even him. One Russian politologist compared him to a jazz man who always improvises.

Incidentally, the stock market is now in a bearish mood, the S&P 500 declined by 13% and Nasdaq (QQQ) decreased by about 18% since the 24th of February. On top of the Russian war, a lot of unexpected events happened over this time: the inflation exceeded all expectations, the UK fiscal system experienced a crisis, the Fed pressed the monetary brakes, and Europe is now in an energy crisis. But there is one more issue that was bluntly expressed by Elon Musk in his leaked private messages:

It won’t make sense to buy Twitter if we’re heading into World War 3.

The risk of nuclear war turns investors away from even thinking of buying stocks. To understand how significantly the concerns over the nuclear threat affect the markets, I decided to take a look at it from all possible angles. My team and I examined market dynamics during the previous nuclear escalation in 1990 and saw that the market did not rise until the threat was over. To assess the current crisis, we built a simple model. It showed us that the unease over the nuclear threat has a big impact on the recent market performance along with inflation fears. Plus, the anxiety over the nuclear threat allowed us to predict future market performance by several days ahead. Looking at the Cuban missile crisis from the 1960s, we see that it’s always darkest just before the dawn. A long rally may come when the crisis is over.

A flashback to the Gulf War

Or how a local war turned into a global issue.

In early 1990, Saddam Hussein, Iraq’s dictator, accused its neighbor, Kuwait, of stealing petroleum from the Iraq-Kuwait border. He used it as a pretext to invade Kuwait on August 2nd, 1990. The intrusion occurred just after the end of the Cold War and allowed the United Nations to act cooperatively. Likely the only time. They sent an ultimatum to Iraq with a demand to withdraw troops. The refusal to abide by the UN’s demands led to the military operation known as the “Desert Storm” or Gulf War that lasted 43 days and was waged by a 35-country coalition. The land campaign is infamously known as the “100-hour ground war” for a reason: that’s how long it lasted.

Prior to the Gulf War, many allegations — made mostly by Israelis — were made that Iraq had mounted chemical warheads on missiles. In July 1990, government member Minister Yuval Ne’eman stated that Israel would retaliate if it had been attacked by Iraqi chemical weapons. Israeli Prime Minister Yitzhak Shamir promised:

Whoever will dare to attack us will be attacked seven times more.

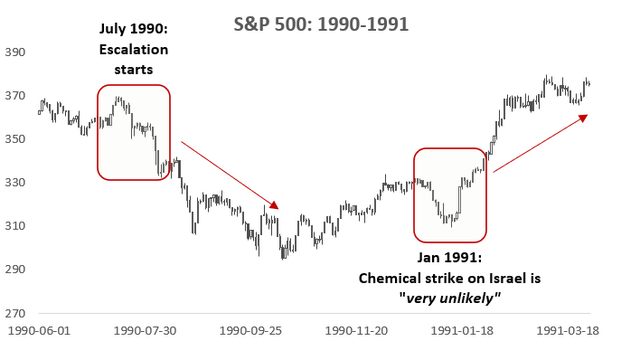

Such an escalation resonated with the stock market. No investor wanted the Iraq war to turn into a full-scale Israeli-Arabic conflict with usage of chemical weapons and potentially nuclear weapons from Israel. S&P 500 started to decline after the first statements of the Israeli officials and remained subdued until the start of the Gulf War in January of 1991. If you don’t know the peculiarities of the war, you may say that the market cheered the unity of coalition forces. But I don’t think it was the main reason for the rally. I believe that the main push was given by a single, interesting interview.

The following opinion was expressed by General Avihu Ben-Nun, Commander of the Israeli Air Force on January 15th, 1991:

Would they really decide to send a non-conventional missile on the population of Israel? My own opinion is that that’s very unlikely.

Calling a missile strike on Israel “very unlikely” calmed down the markets. If the nuclear threat had not been off the table, the markets would not have started their climbing.

Prepared by author based on Yahoo Finance

Back to the current crisis

The ongoing invasion in Ukraine can be divided into three phases: the battle for Kiev in February-March, the battle for Donbas from April to August, and the crawling Russian defeat that started in September.

In late February, the Russian army encroached on Ukraine and attempted to seize Kyiv. Soon it became clear that the Ukrainian army was much stronger than military experts had forecast. Russia’s inability to wage war effectively sparked fears that the country would use nuclear weapons to reach its goals. Plus, it was actively rumored in the media that China may support the Russian military as well. In late March, the Russian army acknowledged that it was not able to capture the Ukrainian capital and decided to focus on one particular region instead— Donbas.

From April to early August, Russia successfully led the battle for Donbas and occupied Eastern Ukrainian regions. Such a development decreased concerns about the nuclear strike. Why use nuclear weapons if you’re winning with the usual ones?

In September 2022, Russia started losing the occupied regions due to efficient Ukrainian tactics and the usage of advanced NATO weapons. To address the battleground difficulties, Putin undertook two drastic measures: drafting citizens, announcing the “partial” mobilization, and annexing the occupied territories. Putin also claimed that every type of weapon should be used to defend Russia’s territorial integrity. It raised concerns that the war could escalate into nuclear conflict if Russia lost parts of the annexed territories. I do not know how you feel reading it, but I am honestly a bit scared describing these events.

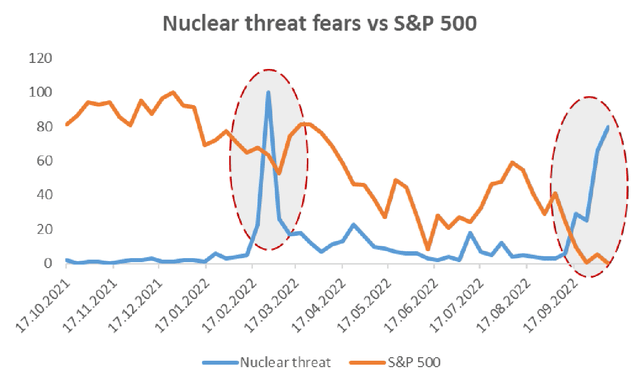

My team and I decided to understand how these developments affected the stock market. Thanks to data analytics, it’s pretty easy to assess how people perceive the nuclear threat. You just need to open Google Trends.

We found out that “nuclear threat” was quite a widespread google search over the last year. Its popularity reached its peak during the battle for Kyiv in February-March and the recent array of Russian defeats. When we compared the number of Google quarries with S&P 500 performance, we noticed a very interesting correlation. The stock market declined significantly at the Google search peaks.

Prepared by author

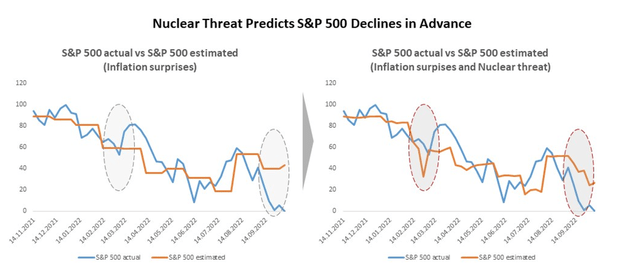

We were baffled. Was the stock market driven by fears over the nuclear threat, or was it just a coincidence because high inflation data was announced on those days? To find out, we built a simple econometric model. You do not need to have a minor in econometrics to grasp it.

First, we looked at how the inflation data affected the market performance. We gathered data of all recent inflation announcements and compared it with forecast inflation. When actual data was above or below the forecast, we called it an “inflation surprise.” Then we measured the connection between S&P 500 and inflation surprises. For econometricians: we regressed index data on inflation surprises using dummy variables. With this tool, we estimated S&P 500 development based only on inflation data. You can see the estimated S&P 500 as an orange line in the left chart. Although it is pretty close to the actual index— shown as a blue line— there is a slight difference in the areas marked with grey ovals.

To check for the nuclear concerns, we added data from Google queries to our model and estimated its connection with S&P. Then we forecasted S&P 500 based on inflation data and Google searches about the nuclear threat. You can see the results in the chart to the right. The estimated S&P 500 started declining earlier in March than the actual index. In late September, the forecast incorporating nuclear data was closer to the actual index than the forecast solely based on the inflation data.

Thus, we can conclude that the nuclear concerns were a big agent in the market decline. On top of that, it was the leading market indicator in March. Concerns were raised first, and then the market followed. It’s a huge advantage to the inflation data that was immediately factored in by the market.

Prepared by author

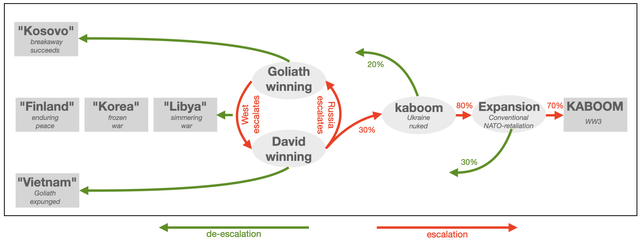

The current situation seems to indicate that further escalation is inevitable. I would not like to go into war details of the conflict in this article because I am not a military expert, but I would like to present one picture showing different conflict scenarios. Please take the scenario probabilities with a pinch of salt as they change every day depending on the battlefield situation.

Source: lesswrong.com

You can find the original source of the chart here.

It is clear that a further escalation can increase the probability of a nuclear war and lead to the declining stock markets. I hope we will not reach the KABOOM phase. Then nobody will care about indices.

Cuban crisis. A brief shock, long-lasting relief

To better understand what to expect after the threat is off the table, I would suggest looking at the Cuban missile crisis. Back then, the world was on the verge of a global war that threatened both the general public and markets a lot. Before we go into details of those days, I would like to show you how significant the crisis was and quote the US Secretary of Defense Robert McNamara’s on his comment from the week of the crisis:

I thought I might never see another Saturday night.

In May 1962, the USSR decided to deploy strategic weapons near the US by placing intermediate-range nuclear missiles in Cuba. It was done to challenge the US’ growing lead in the war race and, as the USSR’s Premier Nikita Khrushchev hoped, leverage the nuclear threat to back its strategic interests in Europe. Particularly, he dreamt of getting West Berlin under control.

Although the USSR tried to keep this operation below the radar as long as possible, the CIA identified the Soviet military in Cuba. The agency regarded them as medium-range ballistic missiles and reported to the US President, John F. Kennedy. On October 22nd, Kennedy delivered a nationwide televised address where he made the public aware of the threat. He also outlined the measures the US would take to address the issue. It is important to note that the address was delivered after the market closed. Therefore, the market factored in the announcement only the day after. S&P 500 declined by 2.7%! Such a high decline was extreme for those times. My team and I calculated the number of days when the daily market movements were over 2%. Throughout the entirety of the 60s, there were only 30 days like this, while in the 2010s there were about 120 days— four times more! Therefore, 2.7% probably does not seem like much through modern-day lenses, but it meant real panic back then.

On October 24th, President Kennedy announced a Navy blockade against Soviet ships to stop any missiles from arriving in Cuba. This news was perceived as a strong reaction from the strong leader. Wall Street likes such responses. The market rose by 3.2% the same day.

To object to the blockade, the Soviet Premier Khrushchev sent a telegram to President Kennedy where the USSR warned the USA that “outright policy” would lead to war. In contrast to their open rhetoric, the Soviet Union and the US had secret negotiations in the backyard. They sought a way out of the situation.

The very next day, a tragic event that could have threatened the negotiations happened. On October 27th, a US aircraft was struck by a missile launched from Cuba. Although social media did not exist in those times, the event became a big issue in media coverage. What happened with the markets? Nothing. They were closed on Saturday.

Despite the incident, the secret negotiations continued. The same day, on 27th, Kennedy agreed to remove all the missiles set in Turkey and possibly southern Italy in exchange for the USSR removing all the missiles from Cuba. On the 28th, Khrushchev made a radio announcement publicly proposing a solution to the crisis. The world disaster seemed to be averted. But what happened with the market? Again, nothing. It was Sunday.

On Monday, Kennedy confirmed the successful outcome of the negotiations. The market cheered the news and led to 2.2% growth on Monday and 1.5% on Tuesday.

We can see that since the public became aware of the situation only a few days before its peak, the market did not have much time to react. Plus, the bitterest point happened over the weekend and was resolved almost immediately.

However, those events affected a lot of ordinary Americans. During the crisis, 65% of Americans thought about the nuclear threat. But after the escalation, 45% said that “the chances of war between the United States and Russia” decreased “because of the Cuba situation,” with only 28% saying that it increased instead. For the only time from 1960 to 1980, the majority looked at the upcoming year as at the time when Soviet power would decline. People saw the outcome of the crisis as an US victory and an advantage expected to continue the next year. I believe such a relief was a solid basis for the market rally that continued almost uninterrupted over one year, until another tragic event — Kennedy’s assassination in November 1963.

Conclusion

I strongly believe that the ongoing war in Ukraine is one of the most important factors for investors to consider, and should not be underestimated. Any potential escalation could have a dramatic fallout not only on the markets, but on all of us. I just hope that any worse situation will be averted as it was once done in 1962. Again, it’s always darkest just before the dawn.

Be the first to comment