Abstract Aerial Art LAVA

“Predicting rain doesn’t count. Building arks does.” – Warren Buffett

I recently wrote a research article on Seagen (SGEN). That is to say, the company is entering into a partnership with LAVA Therapeutics (NASDAQ:LVTX) for the use of its Precision Gammabody platform. As I was analyzing the aforesaid development, my intuition tells me that there has to be substantial unlocked value/growth in LAVA for Seagen to be interested in the firm. After all, a highly reputable firm would not form a partnership with a smaller operator unless there are tremendous promises. As I learned more about LAVA, I’m excited to deliver to you what I found. In this article, I’ll present a fundamental analysis of LAVA and share with you my expectation of this growth equity.

Figure 1: LAVA’s chart (StockCharts)

About The Company

As usual, I’ll feature a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. Operating out of the Netherlands and USA, LAVA is a clinical-stage company that is focused on the innovation and commercialization of cellular therapies. Leveraging the Gammabody platform, the company is advancing a portfolio of bispecific gamma delta T cell engagers to treat both solid and blood cancers.

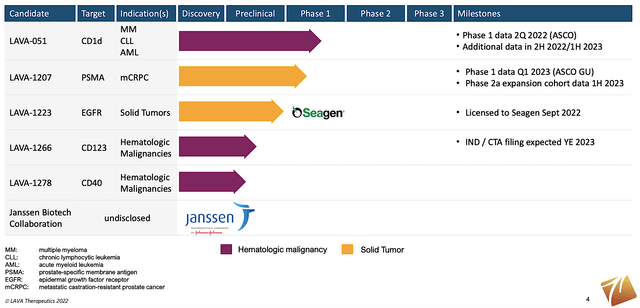

Figure 2: Therapeutics pipeline (LAVA)

Partnerships

On the partnership front, you can see that LAVA is able to ink two deals: one with Seagen and the other with Jansen which is a subsidiary of Johnson & Johnson (JNJ). That is big because it signifies that their drug/technology holds tremendous value. Else, big pharma wouldn’t be interested in a partnership.

Another point to consider is that the partner can offer their expertise as well as the capital needed for the lengthy and costly innovation process. As you know, both expertise and tremendous capital are required to develop blockbuster drugs.

Mechanism of Action (i.e., MOA): Precision Gammabody Platform To Unlock Power of The Immune System

Shifting gears, let us walk through the mechanism of action of the said platform. I know science can be quite boring for some of you. Nevertheless, it would make a huge difference in your investment returns in the long haul.

That being said, if you’ve been following my research on cellular therapy, you can see that I’m a huge proponent of using the T-cells – the General of the body’s natural defense (i.e., immune) system. Inside your body are constant battles between diseases and healing by the immune system. The two cells that are most important are the T-cells and B-cells. As you know, T-cells are “the Generals” while B-cells are “the commanding officers.”

By engineering the T-cells with the intelligence against various cancers, you can launch a highly efficacious attack to decimate these rogue cells. If you went back to my research on Kite Pharma (KITE) and Juno Therapeutics (JUNO), you can see that Kymriah saved lives in seemingly hopeless situations.

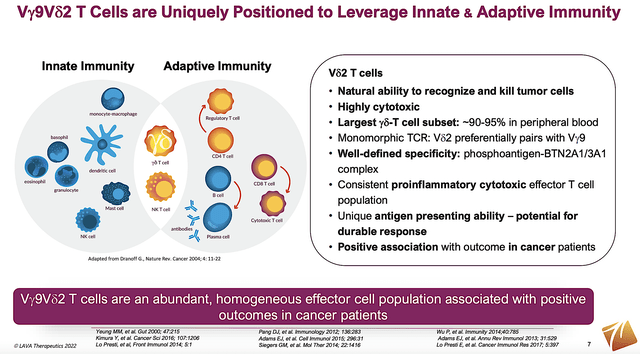

From the figure below, you can tell that LAVA is using a subpopulation of Vγ9Vδ2 (Vgamma9 Vdelta2) T cells that has tremendous potential. For sake of simplicity, I will refer to those cells as GD-T-cells. Precisely speaking, these T-cells can communicate between both innate and adaptive immunity. The innate system is like your skin barrier against infection. Whereas, your adaptive immunity comes from the intelligence that T-cells gained from attacking invaders.

When you focus on molecules that can integrate both innate and adaptive defenses together, the results are extremely powerful cancer eradication.

Figure 3: GD-T-cells mechanisms of action (LAVA)

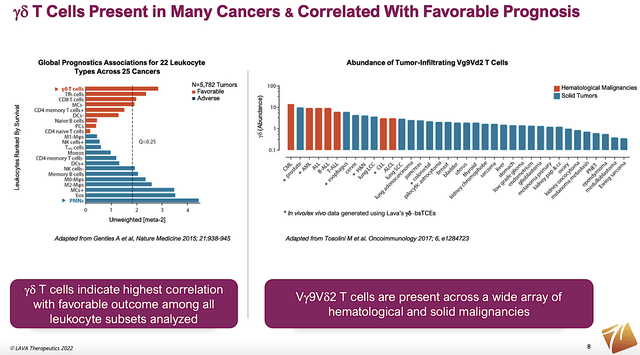

Disease Context (i.e., DC): GD-T-cells Are Excellent At Eradicating Cancers

Viewing the figure below, you can appreciate two trends. The first is that these GD-T-cells are present in many cancers. Second, the more of these GD-T-cells present, the better the patient’s chances of survival. If you put those two facts together, you can see that GD-T-cells have tremendous therapeutic potential in the cancer disease context.

As you can imagine, cancer cells exert immunosuppressive effects on their environment. Putting it another way, cancer cells excrete chemicals that dampen the immune response. Therefore, they put key immune cells like (B and T cells) to sleep.

By activating the specialized GD-T-cells, those supreme Generals will wake up the body’s whole defense army to launch an effective/efficient counterattack against cancers. In a nutshell, the GD-T-cell mechanism of action fits perfectly in the disease context of treating cancers like matching puzzle pieces.

Figure 4: GD-T-cells as a differentiation factor against many cancers (LAVA)

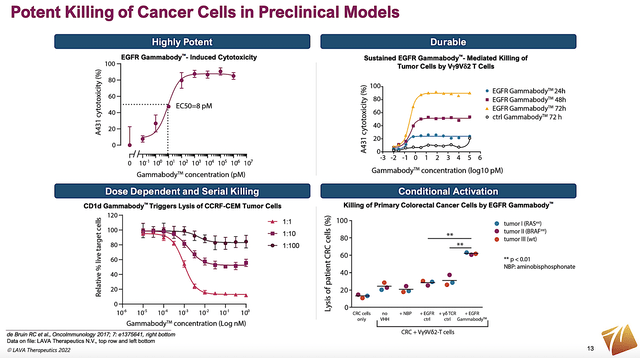

Supporting Data: Robust Early Results

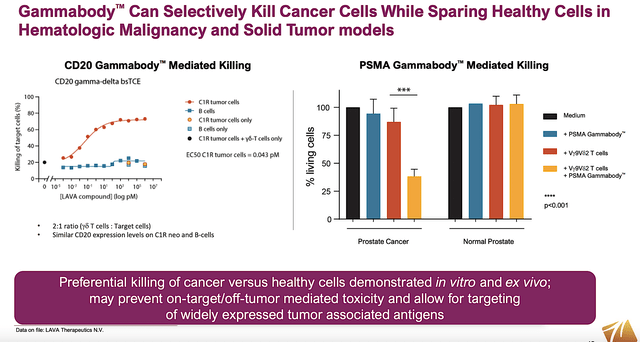

All the sound science with the matching MOA and Disease Context is meaningless unless GD-T-cells can demonstrate strong data results. In the preclinical models below, you can appreciate two developments. The first is the higher killing of cancer cells (i.e., cytotoxicity or lysis) comes from a higher concentration of GD-T-cells (i.e., Gammabody). The second is that longer treatment duration leads to more cancer cell destruction. Essentially, it indicates that GD-T-cells work against cancers.

Figure 5: GD-T-cells exhibit potent cancer-killing in preclinical models (LAVA)

A big concern about cancer drugs is that they can be quite toxic to normal cells. That’s why patients on chemotherapy lose their hair, etc. Nevertheless, chemo/immunotherapies are still being used because their benefits outweigh the harms.

Interestingly, GD-T-cells kill cancer cells (in both blood and solid tumor models) while not hitting the normal cells. As LAVA advances its drug, that selective killing is huge market differentiation. And that advantage would lead to launch success. Perhaps, that’s why LAVA is able to garner partnership deals with Seagen and Janssen.

Figure 6: Selective kill of cancer cells while sparing healthy counterparts (LAVA)

The Seagen Deal

As you know, Seagen put LAVA on the map by inking a huge partnership deal back on September 26. Accordingly, LAVA would receive $50M in upfront payment with the potential to earn up to $650M in milestones and royalties. Notably, the partnership would allow Seagen to in-license LAVA-1223 for EGFR-expressing solid tumors. Seagen also has an option to pick up two additional targets using the Gammabody platform. I noted in the prior article,

Capturing the power of the Gammabody technology, LAVA-123 triggers a specific subset of T-cells … to target a highly prevalent surface marker in solid tumors. Namely, that marker is the epidermal growth factor receptor (i.e., EGFR). You can think of LAVA-1223 as a smart medicine telling the GD T-cells to zone in on cancers having the EGFR on its surface while sparing normal cells. That confers tremendous specificity and highly efficacious cancer decimation. With EGFR being found on many cancer cells (colorectal, lung, head/neck), the potential of this first-in-class drug is tremendous.

You can see that this deal is tremendous for LAVA. The $50M in cash is substantial capital for the $153.1M market cap company. LAVA doesn’t have to do much work now. They can just simply wait for Seagen to use Gammabody to advance LAVA-1223 for various tumors. Meanwhile, the deal substantially improves LAVA’s reputation in the market. Highly enthused by the collaboration, the president and CEO of LAVA (Stephen Hurly) commented,

LAVA is pioneering the development of gamma delta bispecific antibodies to treat cancer, and we are pleased to work with Seagen in this pursuit. The combination of LAVA’s proprietary Gammabody platform and deep bispecific expertise, with Seagen’s leadership in developing targeted therapies for cancer and commercialization infrastructure, makes this an ideal partnership to advance novel therapies for patients. This agreement enables LAVA to further validate its platform in a second solid tumor product candidate, bringing us closer toward our goal of generating effective Gammabody medicines for cancer patients. We look forward to working with Seagen to develop potential next generation cancer treatments.

Financial Assessment

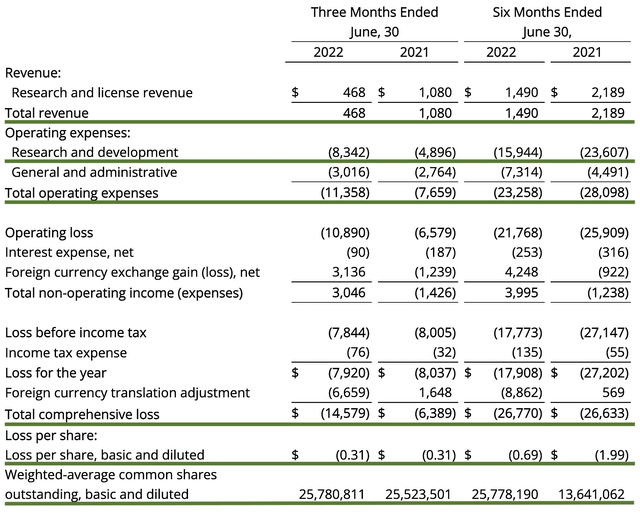

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll assess the 2Q 2022 earnings report for the period that ended on June 30.

As follows, LAVA procured $468K in sales compared to $1.0M for the same period a year prior. Notably, the revenues are related to research and licensing. That aside, the research and development (R&D) for the respective periods registered at $8.3M and $4.8M. I viewed the 7.2% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $14.5M ($0.31 per share) net losses compared to $6.3M ($0.31 per share) decline for the same comparison. On a per-share basis, the bottom line remains the same.

Figure 7: Key financial metrics (LAVA)

About the balance sheet, there were $110.7M in cash, equivalents, and investments. On top of the $50M upfront payment, the cash position is increased to $160.7M. Against the $11.3M quarterly OpEx, there should be adequate capital to fund operation into 1Q2025. Simply put, the cash position is strong relative to the burn rate.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for LAVA is whether various pipeline assets (LAVA-1223, LAVA-051, LAVA-1207) can deliver positive results.

The most immediate data release at the upcoming SITC this November. As I believe the company would post positive data, I ascribed the corresponding 35% risk of a failed clinical binary. In that situation, the stock is likely to tumble by 50% and vice versa.

Conclusion

In all, I recommend LAVA a speculative/diversification buy with the 4.5/5 stars rating. As a diversification/highly speculative play, LAVA is trading at a deep bargain to its intrinsic value. And that is made possible by the aggressive bear market. Nevertheless, there are several catalysts that indicate the stock would trade higher in the coming months and years. The Seagen partnership is solid proof in the pudding of the Gammabody platform’s prowess. Next month, if the phase 1 data release is strong, you can potentially see another rally. Nevertheless, it’s likely to be tempered due to the said bear market.

Be the first to comment