kanawatvector

Per the IBES data by Refinitiv, the forward estimates for the S&P 500, continue to be revised lower, which is actually not that unusual from the normal pattern of how earnings estimates evolve during a quarter, but when you combine it with a tightening monetary policy and the looming risk of recession, it just adds another log to the building bonfire (dumpster fire?) known as the 2022 stock and bond market returns.

YTD as of Friday night, the S&P 500 is down -14.9% after today’s rout.

The sentiment is absolutely horrid and yet we could still end up with a day like today – Friday, August 26th, 2022 – where the S&P 500 fell -3.37%, the Nasdaq fell -3.94% and the Dow fell -3.03%.

The irony about today was that the PCE prices and PCE Core (inflation measures) actually came in better-than-expected, but it’s July ’22 data (almost 2 months old) and it didn’t matter since Jay Powell stepped on the stock market with his “more pain ahead” commentary. The PCE deflator (the personal consumption expenditures deflator) is actually the Fed’s preferred inflation measure, and it was improved, and it didn’t matter at all.

S&P 500 data:

- The forward 4-quarter estimate (FFQE) fell again this week to $232.55 from last week’s $232.60, and has now been revised lower every week since the quarter started on 7/1/22.

- The PE ratio is 17.5x based on Friday, August 26th’s close.

- The S&P 500 earnings yield has now risen for the 2nd straight week to 5.77%, versus last week’s 5.50%. During the last Fed tightening cycle in late, 2018, the S&P 500 earnings yield hit 7% near the peak of the correction.

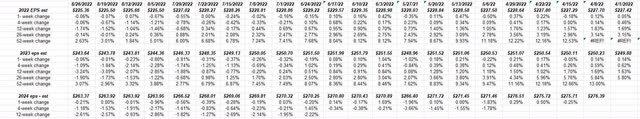

The “rate of change” of calendar SP 500 EPS estimates:

The “rate of change” of calendar S&P 500 EPS estimates: (Author)

What’s ironic about this data, showing the various rates of change over different time periods, the S&P 500 estimates started turning lower the week the S&P 500 bottomed in mid-June ’22 and the 10-year Treasury peaked at 3.50%, the same week.

One last data point:

Current calendar year estimates (Author)

Again, click on the attached spreadsheet to expand it: it shows that current calendar year estimates are expecting 8% EPS growth for the S&P 500 for the next 3 years, 2022, 2023, and 2024, down from 9-10% expected growth on April 1 ’22.

Maybe more interesting and to add context, the “average” annual S&P 500 EPS growth rate from 2017 to 2021 (or 5 years) was 14%, boosted by the Tax Cuts & Jobs Act year, and the 2021 growth rate last year of 49%.

It’s probably not unreasonable to expect some slower S&P 500 EPS growth, after a run like that.

Covid caused so many distortions in the US economy and the capital markets, it will likely take another year to get through all this.

Summary/conclusion: The negative trend to S&P 500 earnings is a somewhat return to pre-Covid normal for the S&P 500 estimates, but also a source of growing concern. Dell (DELL) was the big disappointment this week as they specifically said customers have turned cautious. Other companies like Salesforce (CRM) and Nvidia (NVDA) also had cautious commentary. Salesforce was particularly discouraging given its cloud and software.

The fact that the 10-year Treasury yield was relatively unchanged today on Powell’s comments while the 2-year Treasury yield traded up to 3.40% and rose 15 bps on the week, which tells readers it’s really all about the Fed and Jay Powell’s posture rather than the data.

The market-driven signals like the Treasury breakeven rates and the price of crude oil and gasoline, have been sliding lower for 2 months and yet Jay and the Fed Governors really want to stand with both feet on the brake and keep a boot on the market’s neck.

As a wise old person once said, “trade the market in front you, not the market you want”.

Back with more over the weekend.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment