amriphoto/E+ via Getty Images

A wise man gets more use from his enemies than a fool from his friends.”― Baltasar Gracian

Today, we take an in depth look at a small retail stock that appears dirt cheap even in an uncertain market. The stock has seen some recent insider buying and has a new CFO as well. An analysis follows below.

Company Overview:

Solo Brands, Inc. (NYSE:DTC) is a Grapevine, Texas based operator of four outdoor lifestyle brands under a direct-to consumer-platform, which accounted for 81% of FY21 sales. It boasts 3.2 million customers, of which 50,000 have purchased at least two of its brands. The company started selling its flagship brand, Solo Stove, in 2011 and acquired three more outdoor brands in 2021 before going public in October of that same year, raising net proceeds of $198.4 million at $17 per share. This busted IPO trades for just under four bucks a share, translating to a market cap of approximately $375 million.

The company is capitalized by two classes of stock. The 63.5 million shares of publicly traded Class A stock confer economic interest and one vote per share. The 31.4 million shares of privately held Class B stock bestow no economic interest, one vote per share, and are exchangeable into Class A shares.

Brands

Curiously, with only four brands, the company elects not to disaggregate its revenue by brand.

Solo Stove. Its largest selling brand is Solo Stove, led by Solo Stove Lite. The ultralight and portable woodburning stove can boil water in under ten minutes using just twigs, sticks, and leaves. The company now has three stoves priced between $65 and $105. It also introduced a line of wood-burning fire pits (now priced between $80 and $430) in 2016, followed by a grill and a pizza oven amongst other innovations employing its secondary burn technology that speeds the cooking process. Each device has its own line of accessories. Solo Stove has experienced extremely rapid growth with net sales of $362.0 million in FY21, representing an eye-opening 171% improvement over $177.5 million in FY20 and 807% from $39.9 million in FY19.

Oru Kayak. Solo’s first acquisition of FY21 was Oru Kayak, a manufacturer, marketer, and seller of kayaks and accessories. The brand features six models priced between $600 and $2,000. For this brand, Solo paid $25.4 million cash for the initial 60% in May 2021, followed by a consideration of 9.3 million Class B shares (at the time LLC ‘units’) for the balance in September of that same year.

ISLE. The company then added to its portfolio with the purchase of International Surf Ventures in August 2021. For a cash consideration of $24.8 million plus Class B units valued at $16.5 million, Solo received a manufacturer of 17 stand-up paddle boards models (priced between $395 and $1,595) and accessories.

Chubbies. That acquisition was soon followed by the company’s foray into casual wear, sportswear, swimwear, and other accessories when it bought Chubbies in September 2021 for cash of $100.4 million and Class B units valued at $29.1 million. In addition to its ecommerce model, Chubbies has five retail stores.

Assuming all of these acquired brands were under Solo at the onset of FY21, they collectively generated net sales of $121.3 million, up 60% over FY20.

International Markets

In addition to the $220 billion U.S. sporting goods and outdoor recreation market and the $124 billion domestic online clothing and accessories category, Solo is expanding internationally with Solo Stove selling in Canada and Europe, with an introduction scheduled in Australia during 3Q22. The other brands are launching in Canada and Europe during mid-22. International sales comprised 9% of total in 1H22.

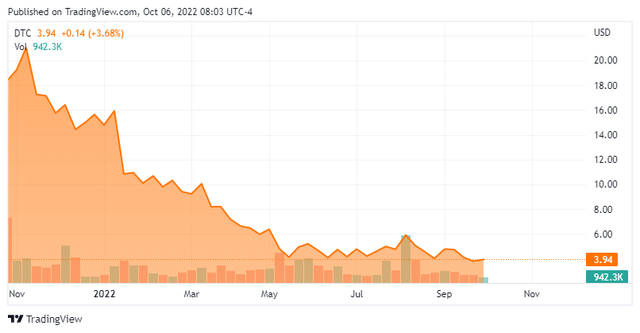

Stock Price Performance

Arguably a quintessential beneficiary of the post-pandemic need to reengage with nature, Solo’s stock surged to $23.39 a share on its first day of trading, equating to a market cap of $2.3 billion for a company that would earn $1.55 a share (non-GAAP) on pro forma net sales of $483.3 million ($403.7 million reported) in FY21. With gross margins in the mid-60s, the price-to-sales of 4.7 could be justified and the PE of 15.1 was arguably cheap. However, the first day of trading marked the high point for shares of DTC, which are now down 83% from their all-time intraday high.

It initially wasn’t a case of overpromising and underdelivering. In fact, when management provided its first forecast for FY22 net sales of $555 million (based on a range midpoint) in March 2022, it was essentially in line with the Street estimate of $554.3 million. It also guided Adj. EBITDA to $126.5 million, and maintained those projections as part of its 1Q22 earnings announcement in May 2022. It was simply a matter of the market believing that the pandemic had pulled forward demand for its offerings, combined with a menacing inflationary outlook that would eat into discretionary spending. Also, with the majority of its camp stoves and fire pits manufactured in China, Solo’s DTC model was subject to the whims of the supply chain.

2Q22 Earnings & Revised Outlook

By the time the company reported 2Q22 earnings on August 11, 2022, its stock had already traded below $4 a share on several occasions. There was nothing wrong with 2Q22, in which Solo earned $0.40 a share (non-GAAP) on net sales of $136.0 million, which were $0.11 and $11.0 million better than Street consensus. Adj. gross margin was 65.0%, down from 68.1% in the prior year period, reflecting the contribution of the three brands onboarded in FY21 and higher freight costs.

However, management was compelled to lower its FY22 forecast to mid-teens Adj. EBITDA margins on revenue growth in the mid-20s, which translates from Adj. EBITDA of $126.5 million on net sales of $555.0 million to Adj. EBITDA of $75.7 million on net sales of $504.6 million. The drop in the top line was a function of weakness in paddleboard sales and a newly onboarded CFO being conservative with the uncertain economic environment and ~40% of its overall business coming in 4Q. The Adj. EBITDA revision, which is down on a margin basis from 23%, was due not only to the lower revenue forecast, but also from accelerated spending in the international markets and higher customer acquisition costs as the artificially low pandemic environment recedes.

Shares of DTC, which had bounced off the high-$3 level to close at $6.03 in the trading session prior to the 2Q22 report, did not initially react negatively to the report, closing the subsequent session at $6.00. However, over the ensuing four weeks they have ground approximately one-third lower.

Balance Sheet & Analyst Commentary:

The recent decline in the company’s stock is not a function of its balance sheet, which with $26.7 million cash against debt of $155.6 million, reflected net leverage of 1.7 based on its FY22 Adj. EBITDA outlook (less than 1.5 on a trailing twelve-month basis). Solo’s cash and inventory of $128.2 million essentially cover its debt. The only potential disruption would come from an acquisition of another brand, for which the company has $292.5 million remaining on its revolving credit facility to cover.

Street analysts have stuck with Solo through the decline, featuring three buy and four outperform ratings. After the more conservative outlook from management, they were forced to sharpen their pencils, lowering their FY22 consensus forecast from $1.28 a share (non-GAAP) on revenue of $548.8 million to $0.97 a share (non-GAAP) on revenue of $504.5 million, followed by $0.95 a share on revenue of $590.2 million in FY23.

Despite her downward FY22 revisions, newly installed CFO Somer Webb is bullish on the company’s future, using the weakness in price as an opportunity to scoop up 45,000 shares at $4.10 on September 1, 2022.

Verdict:

She probably likes the fact that her company is forecasted to earn $1.92 a share in FY22 and FY23 combined yet is trading at two times that two year forecast. The economic outlook is uncertain and many of the outdoor products Solo sells are the definition of the word discretionary, but trading at under four times FY23E earnings and just over 0.6 times FY23E net sales would seem to represent an excellent entry point into Solo.

When you surround an army, leave an outlet free. Do not press a desperate foe too hard.” ― Sun Tzu, The Art of War

Be the first to comment