bgwalker/iStock Unreleased via Getty Images

Getting into a cab in Central London a couple of months ago, I passed by a homeless man sleeping on the sidewalk behind a pair of matching Ferraris. He had all of his possessions laid out beside him, while a valet kept a watchful eye over the cars. The scene stuck with me. Large differences in wealth and well-being are nothing new, but what struck me as peculiar about this is that a man who owns two Ferraris lives 100 feet from a man who sleeps on the street. Experiences like these make me wonder whether the global economy is really as healthy as it looks on the surface.

I have nothing personal against Ferrari (NYSE:RACE) – it’s the ultimate status symbol and an expression for many people of having “made it” in life. I can’t afford one and probably won’t buy one if and when I can. I had the pleasure of taking a Ferrari for a test drive last autumn – it was a blast. But as the most discretionary purchase that most buyers will ever make, I have serious doubts about the company to match analyst earnings estimates with recession warnings piling up and stocks in a bear market. With a crash in tech stocks, crypto, and possibly luxury housing, I just can’t see demand holding up at the current pace.

What I do see is an increasingly challenging political and economic reality for the middle class as prices rise beyond their ability to demand wage increases. 2021 was an aberration from this–on the heels of $10,000-plus per family government stimulus last year, a lot of customers who might have been Walmart (WMT) shoppers last year became Target (TGT) shoppers. But when it comes time to pay the piper, I think a lot of Walmart shoppers will be pulled into being Dollar General (NYSE:DG) shoppers, pinched between skyrocketing gasoline and electricity prices, the rising cost of food, and lagging wages.

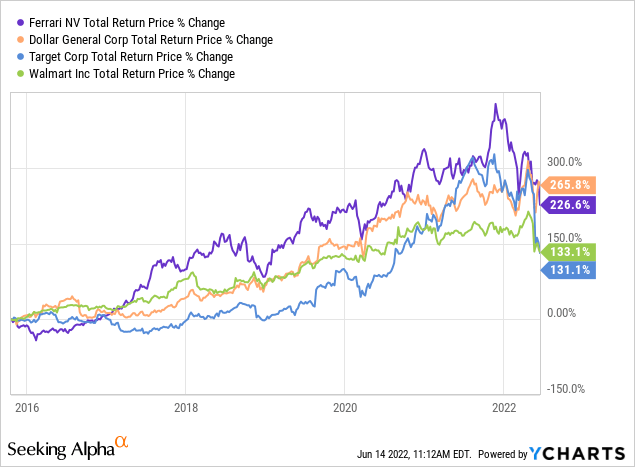

These four companies roughly correspond to each socioeconomic segment in society. Ferrari represents the upper class, Target the upper-middle, Walmart the middle class, and Dollar General the working class and those on fixed income. For a simple (if naive) test of which businesses are getting bigger over time, take a look at which of their stocks have done the best over the past few years.

Are we surprised? Ferrari and Dollar General are the best-performing stocks of the four, while Walmart and Target have performed worse. What does this say about the size of the middle class over the last few years?

Sell Ferrari

Ferraris are interesting because they’re the ultimate luxury good in the eyes of many consumers. They’re goods, but they’re also investments. There was a huge bubble in Ferrari prices during the Japanese asset price bubble in the 1980s, a smaller one in the late 1990s when Ferraris were snapped up by tech workers in the Bay Area and Seattle, and a surprisingly shallow bust after the 2008 financial crisis.

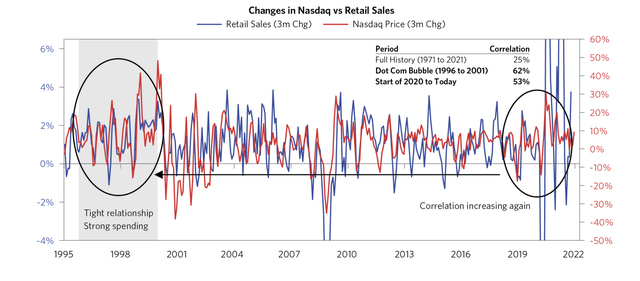

I think it goes without saying that the crypto boom and Nasdaq (QQQ) surge led to an increase in Ferrari sales as well. A lot of crypto millionaires bought Ferraris, and a lot bought Lamborghinis as well. There’s a well-known crypto meme called “When Lambo?” and people even made online calculators for what the price of Bitcoin would need to be before they could cash out and buy exotic cars. The calculators are a throwback to the old calculators Microsoft employees had back in the 1990s.

Here’s even some direct statistical evidence that the bull market in the Nasdaq (and crypto) was driving retail sales.

Do Bull Markets Drive Retail Sales? (Bridgewater)

If stocks fall, are a lot of these instant millionaires from sketchy crypto projects and meme stocks going to be selling their Ferraris, crushing RACE’s ability to sell units at high gross margins? I could certainly see it.

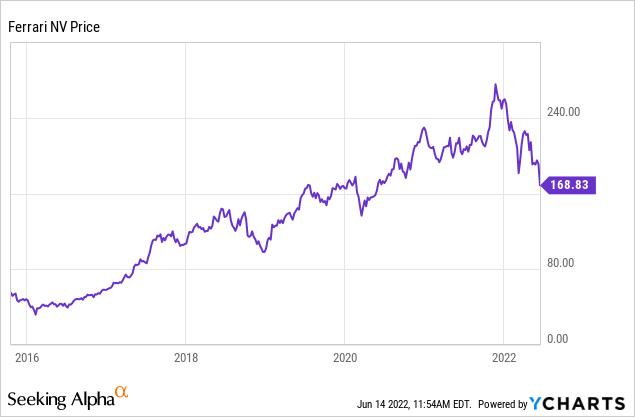

Glancing at Ferrari’s income statement shows that their earnings popped about 25% since the pandemic. This isn’t a red flag in itself as it’s actually about in line with the market average. Ferrari is a well-run business, but it’s very expensive for an automaker, trading for roughly 34x 2022 earnings estimates. Earnings need to come down for the market at large, but I would expect Ferrari’s earnings to come down more than average due to the highly discretionary nature of the business. And when you see homeless people on the street sleeping next to someone’s Ferrari collection in high-income places like the US and UK, the idea that taxes on high earners are likely to go down is not realistic. The only real question is how much income and sales/VAT taxes will have to go up.

Ferrari runs their business well, but the two main issues with the stock are the valuation still being high and the cyclical downturn in earnings that’s likely to come. Research into the financial markets shows that there’s a popularity bias in stocks. Investors are more likely to invest in stocks that are popular, well-known, or exciting, and less likely to invest in boring businesses. Ferrari is about as exciting as it gets for a business, and the stock trades for a very high multiple on earnings that were driven in large part by the stimulus economy of 2021.

In economic terms, Ferraris are considered “Veblen goods.” This is the economics profession’s attempt to explain why people want to spend money on conspicuous consumption and goods that are overpriced by conventional standards. I think most economists would rather buy a Porsche and call it a day. Many Ferrari owners would laugh at this.

However, I think the economists actually have a point here. A lot of people may have tricked themselves into eating their seed corn from the huge bull market. Spending 5%-10% of your assets per year on toys might not seem like a big deal if stocks go up 20% per year, but if stocks round-trip back to where they started the bull market at, you’re significantly poorer, having effectively embezzled a bunch of money from yourself. Ferrari is going to continue to sell cars, but I don’t think they’ll be able to sell as many going forward as they have during the long-running bull market.

Buy Dollar General

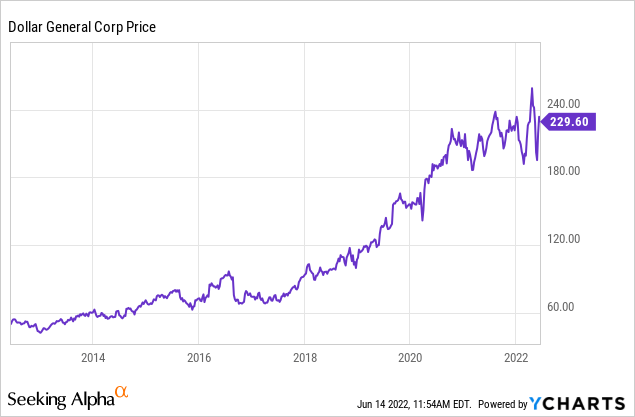

Dollar General is everything Ferrari isn’t. Ferrari is exciting, headline-grabbing, and sexy. Dollar General is austere and boring. But Dollar General has been a better investment, and it likely will continue to be going forward.

Dollar General trades for approximately 20x current-year earnings estimates. Unlike Ferrari, I think they’re good for every penny that analysts expect. Analysts expect roughly 10% per year earnings growth going forward, which I believe that Dollar General can deliver through a mix of opening new stores and an increased customer base at their existing stores.

Dollar General products are considered by economists as “inferior goods.” This isn’t a slam on Dollar General, rather it means that demand rises when consumer incomes fall. If consumers were buying steak and lobster during the boom, they’re buying more beans and rice in a recession. Another way of saying this is that I think Dollar General’s earnings estimates are far more solid than consumer discretionary stocks. Dollar General’s financial statements are among the best I’ve seen in my entire career, and if analyst estimates are to be believed, I think the company will continue to be a great investment over the next 10 years.

The vast majority of items are priced at $5 or less at Dollar General, and the company has alternately drawn praise for shrinking “food deserts” and criticism for creating them. The company has plans to sell more fresh food, which would improve the product mix and potentially widen its customer base. Unlike a company like Target, Dollar General gets only a small percentage of its revenue from household items like furniture. They sell necessities, and consumers aren’t going to cut back on necessities.

The way I see things playing out in the future is that more customers become Dollar General customers over time. By and large, middle class consumers did not save money for retirement, with many households having zero retirement savings in their 50s and 60s. As they age out of the workforce over the next 10 years, many of these consumers will find themselves living 100% on modest Social Security benefits. Fixed-income customers are a core demographic for Dollar General, and the group will be growing fast in the next decade.

Like any company with employees, real estate, and inventory, there’s operational risk, but I think that the current demographic and economic situation are going to give Dollar General a softball pitch for the next decade.

Bottom Line

Consumers are going to keep buying necessities. I don’t think they’re going to keep buying luxuries at the same pace with the stock market falling, the crypto winter, and skyrocketing prices for necessities. Ferrari represents the ultimate in luxury, while Dollar General represents the ultimate in austerity. Dollar General is less popular, more profitable, and has the benefit of demographics firmly behind it. For these reasons, I think that buying Dollar General and selling Ferrari stock makes a lot of sense. Feel free to check back a few years from now and see if this was the right call!

Be the first to comment