CandyRetriever /iStock via Getty Images

A Quick Take On SolarBank

SolarBank Corporation (SLRB:CA) has filed to raise $1.9 million in a Canadian IPO of its common shares, according to a SEDAR registration statement.

The firm acquires, develops and operates solar energy properties in the Ontario, Canada, province and in the United States.

I’m on Hold for the SolarBank Corporation IPO, as I’m not a fan of small companies operating at thin margins.

SolarBank Overview

Toronto, Canada-based SolarBank was founded to develop and operate solar energy projects in Canada and the United States.

Management is headed by President and Chief Executive Officer Dr. Richard Lu, who has been with the firm since August, 2014 and was previously Managing Director of Sky Solar Holdings and Chief Conservation Officer and VP of Toronto Hydro Corporation.

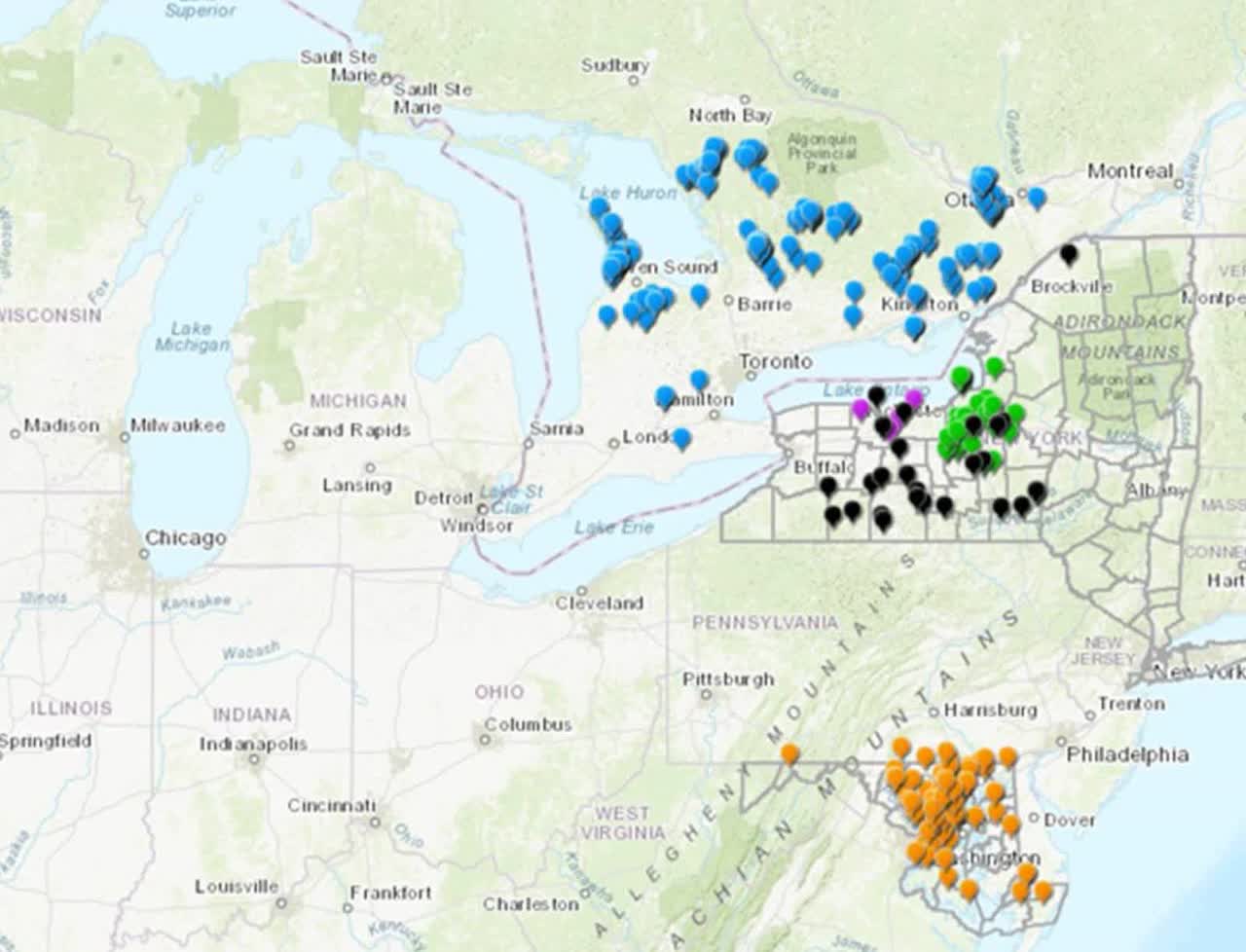

The firm has completed solar project construction for numerous projects, as shown on the map below:

Company Project History (SEDAR)

As of June 30, 2022, SolarBank has booked fair market value investment of $1.3 million from investors.

SolarBank – Client Acquisition

The firm markets its various services to corporate entities, electric utilities, co-operatives and municipal agencies in Canada and the U.S. via its direct sales and marketing efforts.

The company’s management team has built over 600 C&I projects in Ontario, Minnesota and New York.

Salary & Wages expense as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

|

Salary & Wages |

Expenses vs. Revenue |

|

Period |

Percentage |

|

FYE June 30, 2022 |

17.4% |

|

FYE June 30, 2021 |

26.4% |

(Source – SEDAR.)

The Salary & Wages efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of spend, was 1.6x in the most recent reporting period. (Source – SEDAR.)

SolarBank’s Market & Competition

According to a market research report by Expert Market Research, more than 2,455 gigawatts of renewable energy production were installed in 2021.

This represents a forecast CAGR of 7.6% from 2022 to 2027.

The main drivers for this expected growth are a desire by governments, companies and individuals to decarbonize the production of energy for a wide variety of uses.

Solar power is expected to be a large contributor to this growth, due to increasing uptake in countries such as India and China, who are making major investments in solar energy infrastructure. Additionally, falling prices and advances in technology are helping to drive the growth of the solar energy market.

Also, the solar industry is considered the third largest source of renewable energy, behind hydropower and onshore wind sources.

Major competitive or other industry participants include:

-

Swinerton Renewable Energy

-

Cypress Creek Renewables

-

Mortenson

-

Arraycon

-

Helix Electric

-

Rosendin Electric

-

Signal Energy

-

Black & Veatch

-

HCS Renewable Energy

SolarBank’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Reduced gross profit and gross margin

-

A swing to operating loss

-

Positive cash flow from operations in FYE 2022

Below are relevant financial results derived from the firm’s registration statement (in U.S. dollars):

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

FYE June 30, 2022 |

$ 7,546,238 |

38.8% |

|

FYE June 30, 2021 |

$ 5,436,470 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

FYE June 30, 2022 |

$ 1,454,946 |

-22.4% |

|

FYE June 30, 2021 |

$ 1,874,003 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

FYE June 30, 2022 |

19.28% |

|

|

FYE June 30, 2021 |

34.47% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

FYE June 30, 2022 |

$ (266,804) |

-3.5% |

|

FYE June 30, 2021 |

$ 101,252 |

1.9% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

FYE June 30, 2022 |

$ 23,172 |

0.3% |

|

FYE June 30, 2021 |

$ (147,939) |

-2.0% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

FYE June 30, 2022 |

$ 126,697 |

|

|

FYE June 30, 2021 |

$ (1,986,796) |

|

As of June 30, 2022, SolarBank had $689,663 in cash and $6.5 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2022, was $118,579.

SolarBank IPO Details

SolarBank intends to raise $1.9 million in gross proceeds from a Canadian IPO of its common shares, offering 3.4 million shares at a proposed price of $0.56 per share.

The IPO is not being marketed to investors outside of Canada. No U.S. SEC filings have been made.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $11.1 million, excluding the effects of agent over-allotment options.

The float to outstanding shares ratio (excluding agent over-allotments) will be approximately 15.2%. A figure under 10% is generally considered a “low float” stock which can be subject to significant price volatility.

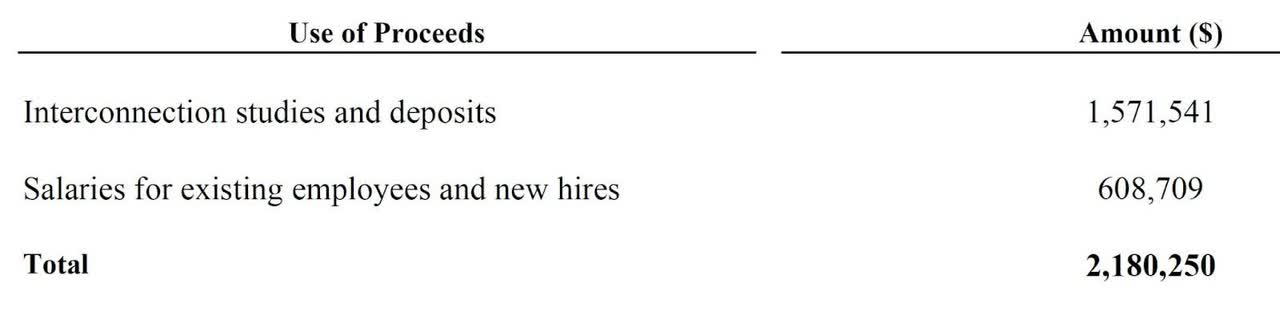

Management says it will use the net proceeds from the IPO as follows (in Canadian dollars):

Proposed Use Of IPO Proceeds (SEDAR)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, the company has filed statements of claims against the Ontario Ministry of Energy, IESO, and others in the amount of $500 million in lost profits, plus development costs and punitive damages.

The claims are for “misfeasance of public office, breach of contract, inducing the breach of contract, breach of the duty of good faith and fair dealing, and conspiracy resulting in the wrongful termination of’ numerous contracts.”

The listed agent of the IPO is Research Capital Corporation.

Valuation Metrics For SolarBank

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$12,437,550 |

|

Enterprise Value |

$11,146,317 |

|

Price / Sales |

1.65 |

|

EV / Revenue |

1.48 |

|

EV / EBITDA |

-41.78 |

|

Earnings Per Share |

$0.00 |

|

Operating Margin |

-3.54% |

|

Net Margin |

0.31% |

|

Float To Outstanding Shares Ratio |

15.17% |

|

Proposed IPO Midpoint Price per Share |

$0.56 |

|

Net Free Cash Flow |

$118,579 |

|

Free Cash Flow Yield Per Share |

0.95% |

|

Debt / EBITDA Multiple |

-3.72 |

|

CapEx Ratio |

15.61 |

|

Revenue Growth Rate |

38.81% |

(Source – SEDAR.)

Commentary About SolarBank’s IPO

SolarBank Corporation is seeking Canadian public capital market investment to continue its growth and expansion initiatives.

The company’s financials have produced increasing topline revenue, lowered gross profit and gross margin, a swing to operating loss but positive cash flow from operations in FYE 2022.

Free cash flow for the twelve months ended June 30, 2022, was $118,579.

Salary & Wages expenses as a percentage of total revenue have fallen as revenue has increased; its Salary & Wages efficiency multiple was 1.6x in the most recent fiscal year.

The firm currently plans to pay no dividends and to retain any future earnings for reinvestment back into the company’s growth initiatives.

SolarBank’s trailing twelve-month CapEx Ratio was 15.6x, which indicates it has spent very little on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing solar power project construction and management is large and expected to grow in the coming years, as the U.S. and Canada seek to reduce their carbon footprint and move toward greater use of renewable energy sources.

The primary risk to the company’s outlook is its tiny size and undifferentiated offering.

However, the firm is suing the Ontario Ministry of Energy and others for over $500 million, so the outcome of those legal processes is a real wild card.

As for valuation, SolarBank Corporation management is asking investors to pay an EV/Revenue multiple of approximately 1.5x on a relatively high growth rate from a small revenue base.

SolarBank is a small company operating in an industry with a number of large players and it produces very thin margins at its current size.

I’m on Hold for the SolarBank Corporation IPO as I don’t prefer small companies operating at thin margins.

Expected IPO Pricing Date: To be announced.

Be the first to comment